BFSI's big AI turn to move the business needle for slump-hit IT firms - The Economic Times

Banking, financial services and insurance (BFSI), the biggest sectoral purchaser of Indian technology solutions for decades, is expected to provide the much-needed ballast to a $280-billion industry that has recently struggled to boost its topline in a business climate rocked by AI-induced layoffs, towering tariff hurdles, and potentially inflationary geopolitical challenges.

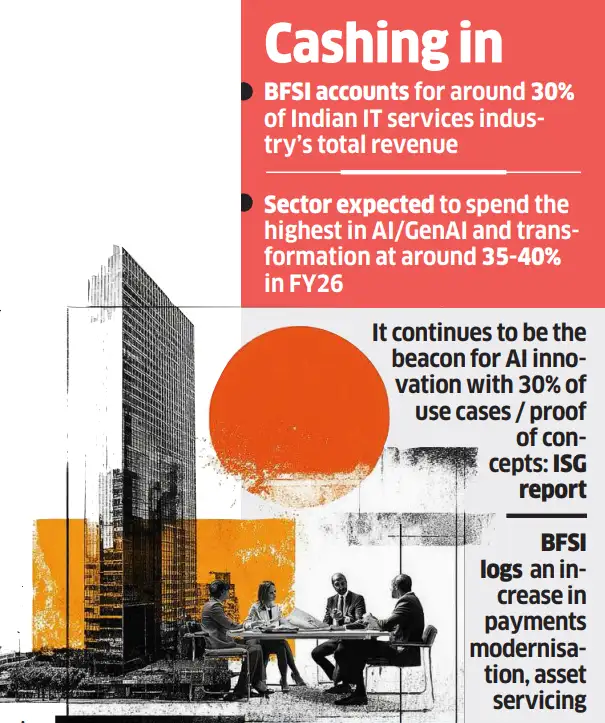

In this backdrop, Wall Street and London City banks have fared relatively better. With banks and financiers of all description taking to AI, the sector is witnessing an increase in payments modernization, asset servicing, and platform consolidation, boosting the demand for technology inputs, said experts.

“The BFSI vertical continues to be a strategic growth driver for Infosys. We’re seeing strong client interest in areas like payments modernization, asset servicing, and platform consolidation, especially as financial institutions look to simplify operations, enhance customer experience while also delivering on new experiences,” said Dennis Gada, executive vice president and global head of BFS at Infosys.

The macroeconomic environment is playing a significant role in shaping demand. With ongoing inflationary pressures, interest rate fluctuations, and geopolitical uncertainties, BFSI clients are more focused on balancing innovation with cost efficiency. This is leading to a shift from discretionary digital projects to more integrated cost takeout programs that deliver broader and measurable business outcomes, Gada added.

ETtech

ETtech

Presently, BFSI accounts for around 30% of the more than $280 billion Indian IT services industry's total revenue, as per industry body Nasscom and analysts.

Early adopters of technology, the sector is expected to spend the highest in AI/GenAI and transformation at around 35-40% at $270-290 billion, followed by healthcare at 25-30% in FY26, data from technology-focused platform UnearthInsight data showed.

Data from a BNP Paribas deal momentum report also highlighted that BFSI had cut most deals in May 2024 with six wins of the 17 large deals bagged by major IT firms.

Additionally, the latest third quarter from March to May financial numbers of Accenture, globally largest IT giant, were indicative of the strong momentum trend continuing in the BFSI vertical, which grew the highest at 13% from a year ago.

A Nomura report cited similar optimism for Indian IT services with healthy demand in the BFSI vertical, aided by strong results from global banks and no significant impact (unlike core manufacturing sectors) from ongoing tariff issues. “Demand conditions have largely remained stable given the 90-day pause in tariffs by the US administration in early May. Deals are more centered around cost take-out and vendor consolidation as clients continue to prioritise cost savings. We think a benign tariff outlook may lead to an improvement in discretionary spend in the short term (read 2QFY26F),” the report said.

Most industry experts have seen select green shoots in BFSI to have persisted, especially in areas of digital banking and regulatory technology.

A June report on State of the agentic AI market from technology research and advisory firm ISG stated that BFSI continues to be the beacon for AI innovation with 30% of use cases / POCs (proof of concepts). “This is driven by the industry’s rich structured and unstructured data, which is the first step to successful adoption of agentic AI in critical workflows…As agentic AI picked up pace over the past two quarters, about 70% of agentic AI use cases are concentrated in just three industries: BFSI, retail, and manufacturing.”

Bengaluru-headquartered India’s second largest IT major Infosys, which has a 28.4% share of BFSI revenue, is working with clients to modernize their technology foundations and transform their core operations and processes.

“We are seeing strong momentum in areas like payments, where cloud-native platforms are enabling real-time processing, faster settlement, and improved efficiencies in the cost to deliver and serve. In core banking, many institutions are adopting an approach to progressively modernize their systems by using API architectural solutions with their legacy platforms while gradually migrating key modules, like lending and deposits, to fully digital modern environments. This allows them to deliver operational, and experience benefits progressively as they undertake their modernization programs,” Gada pointed out.

According to him, regulatory shifts, competitive pressures, increasing costs, customer expectations and the market level focus to launch AI-enabled services are pressing financial institutions to act with urgency.

“It’s no longer just a technology upgrade or a digital program – it’s a strategic imperative to adopt AI for immediate and long-term business benefits. AI and cloud are being adopted, not as isolated tools, but as integrated levers to transform end-to-end processes and deliver business outcomes at scale.”