Battle Royale in the paints industry: Is Asian Paints losing its sheen?

The Asian Paints stock delivered a Compound Annual Growth Rate (CAGR) of 22.6% (excluding dividends) between March 2013 and March 2021, while earnings increased only at 13.5% CAGR.

In the last three financial years ending March 2024, the profit growth was much higher – at 20% CAGR – but the stock is down an absolute 35% from September 2021 highs.

Source: http://www.tradingview.com / http://www.trendylyne.com

Source: http://www.tradingview.com / http://www.trendylyne.com

Strange though it might seem, this is not a new phenomenon, nor is it an isolated one.

Over the last three years, 15 of 50 of India’s largest companies have given a return of less than a Fixed Deposit (which I take to be 6.7%).

This list includes Banks & NBFC (HDFC Bank, Kotak Bank, IndusInd, Bajaj Finance), IT (TCS & Infosys, Tech Mahindra), Steel (Tata Steel, JSW Steel), Nestle India, Insurance (HDFC Life), and Reliance Industries etc.

Source: http://www.screener.in

Source: http://www.screener.in

Asian Paints tops this list with the worst relative performance versus NIFTY 50 in the last three years. Where once it captured the imagination of many BAAP (Buy At Any Price) investors, now it’s a blob on many investors’ portfolios.

Investors are confused. Should they hold or should they buy more? Is this a generational opportunity to own one of the best Indian businesses ever? Let’s find out.

Despite a 13.5% EPS growth in the 8 years leading to FY21, Asian Paints’ stock price increased 22.6% plus dividends. This meant about 9% CAGR was on account of valuation (PE Ratio) expansion.

PE Ratio expanded from 42 to around 95 in September 2021, the month the stock peaked.

The expansion was probably on account of narratives suggesting that buy at any price investing works and that great companies can sustain such valuations infinitely. It could’ve been a result of consistent performance versus the NIFTY 50 companies. Either way, the point is that investors flocked to the stock which resulted in super high valuations.

But narratives change.

The Indian paint industry has seen several new entrants challenging established players like Asian Paints and Berger Paints. These include:

According to a CRISIL note dated June 11 2024, the organised paints sector’s production capacity is set to nearly double to ~7.8 billion litre per annum (blip) between fiscals 2024 and 2027 with investments of ~Rs 19,000 crore lined up, including by one large entrant (Birla Opus).

Birla Opus (Grasim Industries) is possibly the most formidable of these latest entrants. It’s adding 40% to the industry’s total manufacturing capacity and aiming for a topline of Rs 10,000 crore (US$ 1.2 billion) in just three years. By the end of FY25, it will be the second largest player in the decorative paints market by capacity.

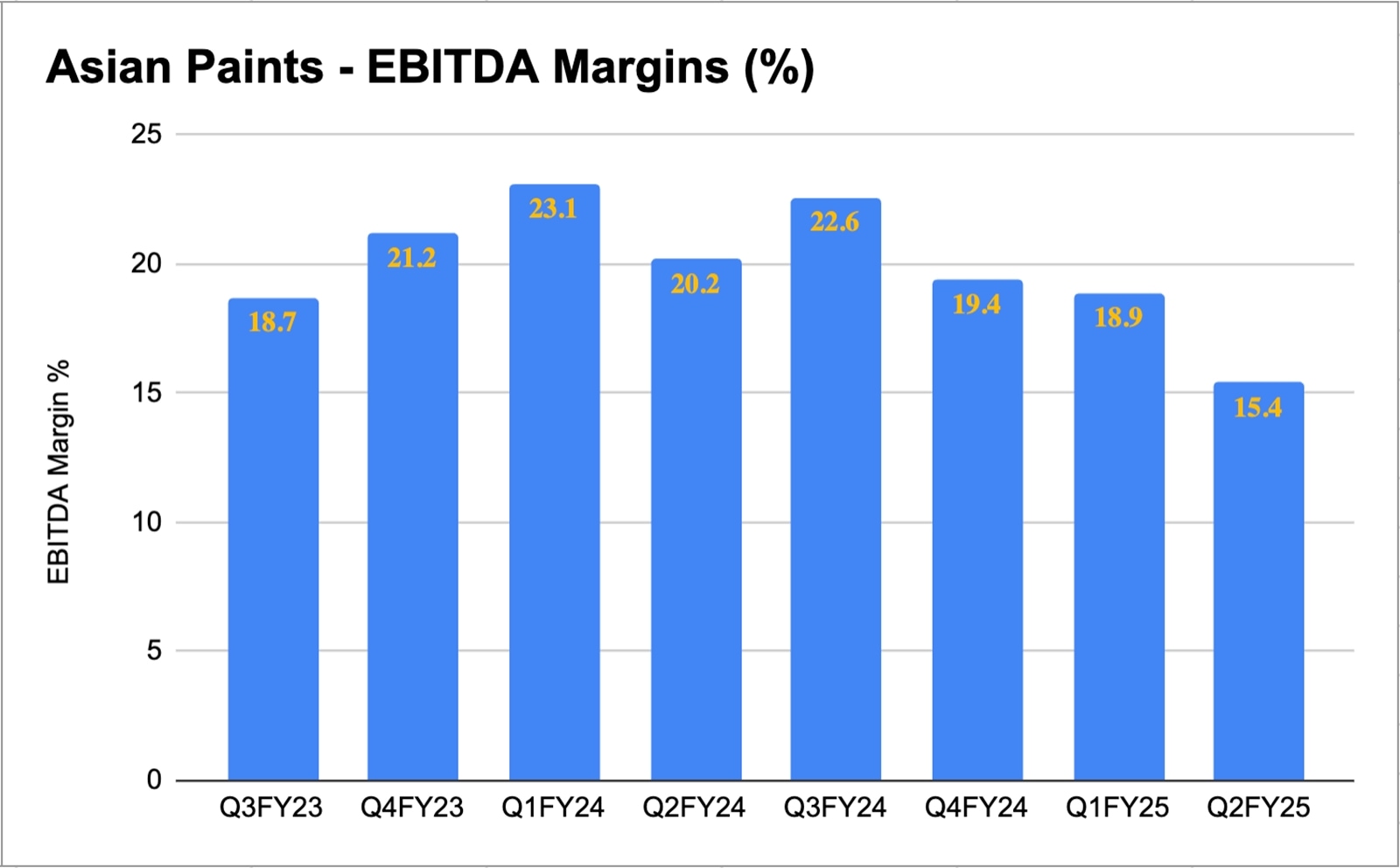

The above capacity additions have started showing signs of damage to existing players’ margins. It has led to price cuts, increased promotional schemes and higher spending on branding, impacting the profitability of the industry.

Credit rating agency CareEdge expects operating margins to fall sharply to around 14% by FY26, compared to the average of around 18% in the last five years.

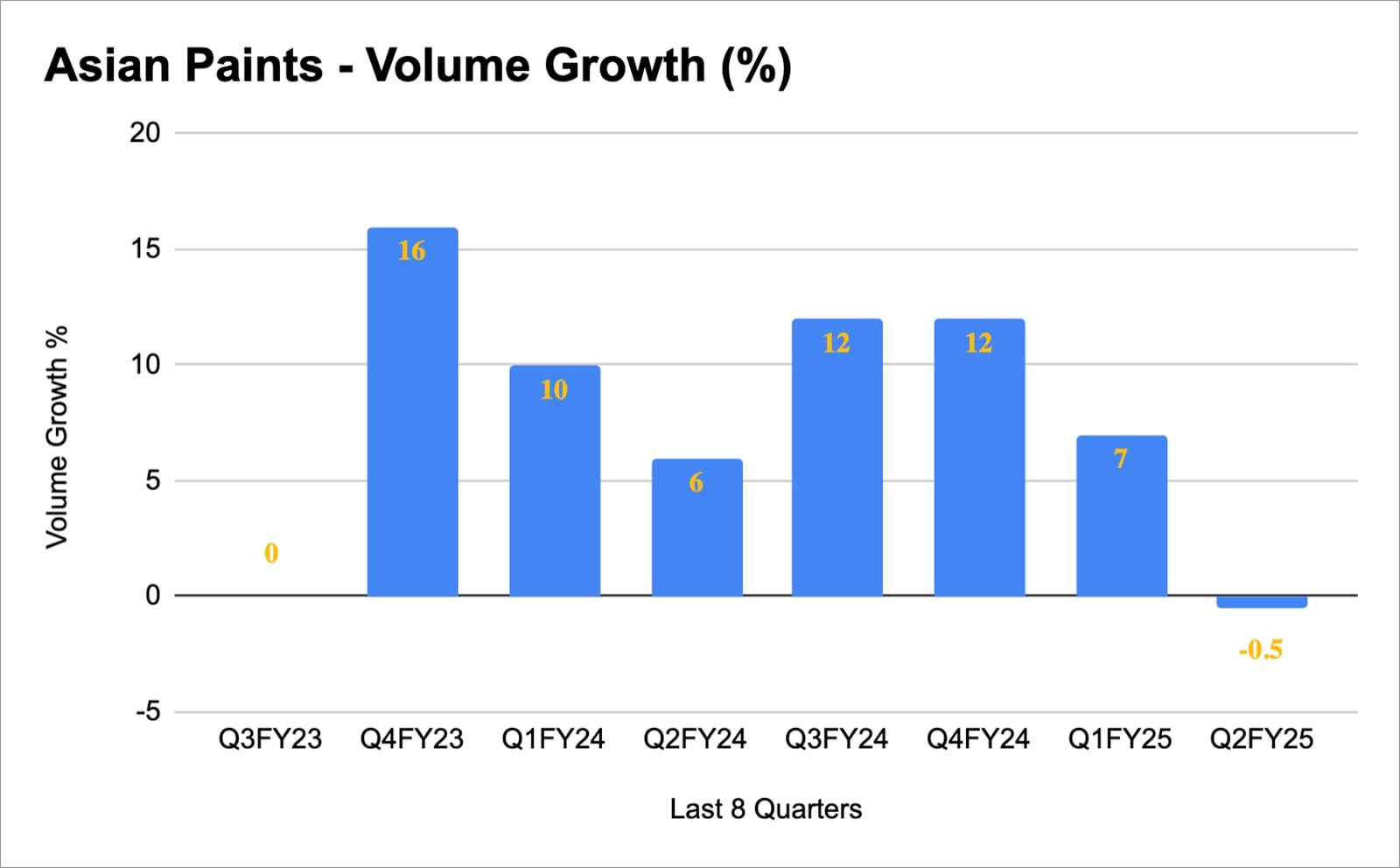

After showcasing significant revenue growth in FY22 and FY23 post-pandemic, the growth rate of Asian Paints moderated to mid-single digits in FY24 and slipped into a negative zone in H1FY25.

In Q2FY25, the company’s volume growth was -0.5% and top-line growth was -5.3%.

Source: Geojit Paribas Report on Asian Paints

Source: Geojit Paribas Report on Asian Paints

Even the EBITDA margins have come down.

Source: Geojit Paribas Report on Asian Paints

Source: Geojit Paribas Report on Asian Paints

While Asian Paints expects a rebound in revenue growth in H2FY25, the growth rate is expected to remain muted.

What next?

With capacities doubling in the next 3-4 years and demand expected to grow 8-10% annually, according to CareEdge, a case for oversupply looks highly likely.

Even if Asian Paints maintains its market share at the end of this battle royal, volume growth, margins and profitability are likely to come under pressure. If we use the Growth Investing metric – PEG (PE/Growth), at an EPS growth of 20%, which seems like a distant dream for now, a PEG of 1.5-2X would be rich. This would lead to a higher end PE of 40X versus the current 46-47X. If we go purely by these numbers, the stock still seems pricey. Or to put it another way, unless something changes dramatically in favour of industry dynamics, it may be tough for companies in this sector to justify premium valuations.

Having said that, the new competition in the decorative paints industry is still in its infancy and is already starting to cast a dark shadow on Asian Paints’ dominant market position. Whether the old stalwart can pull a rabbit out of its hat and protect its core paints market share without too much further damage remains to be seen.

Until then, it’s a wait and watch.

Note: We have relied on data from Screener and Tijori Finance throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Rahul Rao has worked at an AIF, focusing on small and mid-cap opportunities and helped conduct financial literacy programmes for over 1,50,000 investors.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

Discover the Benefits of Our Subscription!

Stay informed with access to our award-winning journalism.

Avoid misinformation with trusted, accurate reporting.

Make smarter decisions with insights that matter.

Choose your subscription package