AI deep dive: BIG spending, agentic intelligence and the race for global dominance - MoneyTalk

We have this new technology, where is it going to be five or ten years from now? We have to be ready to be surprised a lot. It's probably one year from now in which AI can write better code than almost all coders. If you look at three pure plays: Google, Microsoft, and Meta, this year they're going to spend over US$200 billion on capex. China now has more software engineers, has more AI patents, drones, robots, autonomous vehicles. This is why Trump says we need to win. But it's really we need to make sure we don't fall behind.

The MoneyTalk Podcast, brought to you by TD Wealth with Kim Parlee. Recorded on May 15th, 2025.

Hello everybody. I'm Kim Parlee and today we are talking about artificial intelligence, AI, the economics of AI, and what it can mean for investors. And I have a whole bunch of questions, part of which is how do you sift through everything and understand the big picture of what's going on right now, where we are, where are we going. This is a sector, according to one journalist I read in the FT that is radiating ambition and I love that phrase. It talks so much to what the future is going to be. But what's being overlooked? What's being mispriced? Where are there opportunities? Where is it going? These are all the questions that Kevin Hebner is going to answer over the next bit of time. Or so. He is, of course, Managing Director and Global Investment Strategist at TD Epoch. Nice to have you here.

Oh, thank you.

Can you answer all those questions?

I'll try.

Okay. I'm going to start with some easy questions. And my purpose of this conversation right now, and this is what I do on our other topics is you give me the big picture. So when I hear news and hear things come and go, oh, that's where that fits. Oh, that's where that fits. So no pressure, but I want it all. But let's start with something fun. How do you use AI or what are some of the fun ways people around you use AI?

So I use AI constantly, and I think that's where everyone's going to be in a year or two that it's something we don't we don't turn off. It's going to be like electricity. It's going to be everywhere around us. I think some of the interesting ways of using AI, I think of what my kids do. My son, who's an engineering school, he just had his calculus exam yesterday morning. So what he does is he takes old calculus questions, feeds into ChatGPT and says, please give me sample questions that are like this. And after a while, show me how to solve them. So he gets to try. And that's part of how he and his friends study for exams now, working very closely with ChatGPT. I have another child who's in law school. And in there, when they were starting classes in September, they were told explicitly, don't use ChatGPT because we want to teach you how to think as a lawyer. But once you get out and you're acting like a lawyer, it's very much like how translators are working now. Translators don't translate documents. What they do is get translated documents from ChatGPT and they proof them. They go over them. And I think that's what our lawyers will be doing. I have another daughter who works at a biotech firm, and during their training before they started working, just about all of it was about AI and how they can use AI tools for what they're doing. So I think regardless of what your profession is now or shortly, AI is going to be a critical part of what you're doing.

You sound like you have a very underachieving family, Kevin, I say that facetiously. Congratulations. They sound amazing. Can you talk to me about, before we get into some of the mechanics, because you've put something together to say, here's what I think about that is important for AI for 2025. But if we back up even further and I say, where are we in AI? I've heard things like first we have AI or machine learning, then we have AI, then AGI, then ASI, and then sentience. What does that mean from your perspective?

To some extent these words don't really mean anything. We don't know how to define them. But for example, on the betting sites, they have bets. By what year will we achieve AGI for example. And then they have to have a technical definition. So for example, what they'll do is they'll have ten cognitive tasks. So the task could be things like solving a chess problem or an SAT question or a biology or calculus question, something like that. And then the model has to do better than 90% of people. And they define that as having achieved AGI. ASI superintelligence is something beyond that. In sentience, my understanding is that's feeling pain. I'm not sure... Models, they're models. Maybe they pretend they can feel pain.

Say it's a mimicking pain or feeling pain.

But so I think that's a bit of a weird thing.

We'll bring in a philosopher on that one for the next conversation we have. That's a different one. I want to get into your 2025 themes. And when you talk about AI and again, I want people to think about this so they can understand again, from an investing standpoint, you've got three what you call vertical stacks. People need to think about. Just start with like, what do you mean by vertical stacks for someone who's not in that business, what does that mean?

So the first one is the big hyperscalers, the companies developing the foundational models. And I think what's important there is they view it as an existential task that they have now, is to make sure that they're at the leading edge with the view that if they fall a little bit behind, given the winner takes most nature of the technology, is that their competitors get all their business and then they fade and ultimately disappear. So, for example, if you look at three pure plays, so Google, Microsoft, and Meta, this year they're going to spend over US$200 billion on capex.

I was just going-- I actually heard a stat I want to give people context. I think for the chip act, I think in the States it was US$83 billion or something over three years. So I just want to give that context of how big this is.

Well, to give context, so they're scheduled to spend just over $200 billion. The Apollo Project in today's dollars, that was over a decade, that was US$160 billion. Manhattan was US$40 billion. So combined US$200 billion. So in one year, three companies are spending more than those enormous projects. So it's an unfathomable amount of money that they're spending this year. And then they will increase it again next year and so on. So it's a massive amount of money being spent on models, data centers and building all this out.

So those are the hyperscalers. And then you have a stack which you're calling infrastructure. Does that support the hyperscalers? Is that what goes into it?

And so with infrastructure we're thinking about one is just semiconductors. So the ability to actually make semiconductors and so that's a very big priority for the United States now is to reduce vulnerabilities and make sure there's production in the US. And investment in semiconductor manufacturing has gone up 12x in the last three years. So it's a big, big increase. Another part of that would be the generation of electricity and then the grid. So data centers, transformers, cooling systems, high voltage wires and everything like this, and then the last mile locally, that's another aspect of infrastructure. And people think that ultimately the cost of these models will be the marginal cost of the electricity. So that is important. And we have to make sure that we're building out the electrical grid in those capabilities faster than we're building the AI models. And I think with the infrastructure, the key thing is that it's extremely underdeveloped now in the same sense, if this was 1997, we'd say the internet infrastructure was extremely underdeveloped relative to what we'd need in 2010 or 2020 or today.

It's hard for me to fathom when you say that the infrastructure, I mean, infrastructure is a huge bucket. And you know, you talk about chips and electricity and the grid. Those types of things. I can see that. But when you think about chips and the run they've had and what's happened and you're saying to me you still think that's very underdeveloped, or am I misinterpreting that?

I think extremely underdeveloped.

Wow. Really? And is that just because it's the volume of what's needed to create for this... how much we're going to use, like electricity?

And so, for example, now a lot of what we use AI is just for prompts. We get text out. Text doesn't use actually very much computing or very much electricity.

I write limericks I know that doesn't take a whole lot right now.

We're going to go from text to images to video to all sorts of things that are much more complex, much more compute intensive, much more electricity intensive.

Can we talk a bit about, just to take a tangent on the electricity, because I remember reading about nuclear a very long time ago, and it's kind of in and out, but it seems to be steadily moving forward. We hear about small modular reactors coming to Canada. So is that... Like when you say electricity, what are the kinds of things that are going to continue to grow with it?

A little bit before I answer that, so the compute usage is going up five x per year. So it's a lot. And we're getting more efficient. So in some sense the cost of it is going up 2.5x a year. But it's very exponential. And so we're really underdeveloped in terms of electricity generation. So not just the grid but generation. So we will need a lot more. And we'd like that to be coming from solar and wind. But that doesn't happen fast enough. So it's easy to turn on an LNG generation plant. And then there's a lot of attention being paid to nuclear, which could be SMRs or other technologies, and it is a priority for the Trump administration to deregulate these sorts of areas. And so just that the generation, this is part of the Trump's message: It's time to build, we have to win. So we have to clear any hurdles which could be financial, could be electricity generation, could be construction of a semi fab, so we can be players in this space.

So we're going to delve into this a bit more too. So we talked about the hyperscalers. And then when you talked about the infrastructure to support that. And then you talk about different stack called "applications". Are these the ChatGPTs? Is that, or no?

Well ChatGPT would be in the foundational model. So this would be if you think of 1994-1995, we essentially got the internet through the first browsers mosaic and so forth. And then a couple of years later, we got things you could actually do with it. Amazon, and really, the only person in 1995 who saw the future, as far as I can tell, was Jeff Bezos. Nobody else really understood how it was going. Five years later, there were two PhD students at Stanford trying to find a thesis topic. Sergey Brin and Larry Page, and they invented Google. And that was really interesting. But that was five years later. Twelve years later, you had Facebook. After that, Uber, Airbnb and so forth. So all these applications of the underlying technology internet and clearly a lot of infrastructure there. And so the point here is we're going to have zillions of applications for AI across all different types of sectors, professions. So legal, education, finance, but it's going to take a long time to develop these apps. The product management aspect is bringing a product, developing a product, getting beta testing it and then bringing it to market and scaling it, this takes a lot longer than people expect. And people have the feeling, oh, we're going to have AI apps that are terrific in three months or six months from now. The historical experience is that it takes a long time and a lot longer than people expect.

I'm sure you think about how long Google has really been around or any of these ones too. And I should tell people, you and I were chatting before we started and I said: Who would be fun to talk to? And you said a product manager, someone who's actually developing these and bringing them to life. Going through some of your notes and some of the things that I should mention, that you're a prolific writer and you're publishing on a regular basis. You do talk about how digital tech in this environment you're talking about it's going to outperform margins, free cash flow, ROE because I'm assuming of all this, all the build.

So the center of innovation is still going to be digital tech and AI. So there's going to be other places where there's innovation. But that's a center part. And given the winner takes most nature and the scalability of these technologies, you end up with the ROE in tech is twice the ROE of the rest of the market. The margins in tech are three times the margins in the rest of the market. The free cash flow growth over the last 20 years in tech is six times free cash flow growth on the rest of the market. So this is where the innovation and the value creation is going to occur. The bulk of it, there'll still be other opportunities in equity markets. But I think investors want to make sure that they have exposure to tech.

And capex, you think it's going to continue? And I should ask you, because you actually have a line in here and you say: Boom or bubble, is it 1997 or 1999? Remind us, what's the difference between the two?

The internet really started in 1995. 1997, things were still really good. Lots of new companies, lots of capex. 1999, the cycle was getting old. And then 2000, a couple things happened. The Fed started to tighten, and then people realized that the companies were running out of cash, and it was going to take a lot longer to bring to market cash generative companies. And then we had the tech bubble collapsing. This time, the Fed isn't hiking. There's lots of liquidity. I think the big risk this time is that it takes a lot longer to get the killer apps than people are expecting. The reason to be on the more optimistic side is the big, at least the big hyperscalers are producing enormous amounts of free cash flow, and that's what allows them to invest so much. But for the VC companies, which are putting so much money into the new apps, at some point they might say: When are we getting our money? When are we able to cash out? And that might take longer than they expect.

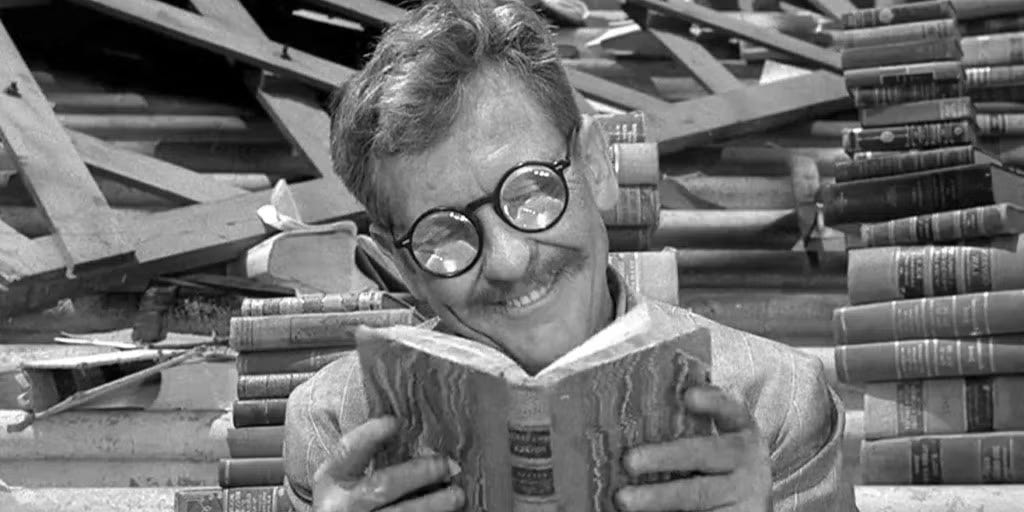

I'll encourage people who want... I know that you've published some work on this, and it's great to get into the detail, to understand where exactly is the opportunity. I want to touch on a couple other ones. You mentioned earlier some of the companies that were the big names in the beginning are no longer mosaic. We don't talk about mosaic much anymore. But you talk about, and you've got a chart here, you talk about how a lot of today's superstars are going to stumble and we don't know what's coming. Maybe just give some perspective on that and then how do you manage that? Because if you can't pick the superstars today, how do you stay invested and how do you think forward.

For example, if you look at the top 15 global tech companies in 2000, only one of those is still in the top 15, and that's Microsoft. So if you're trying to think, well, what is this list going to look like in 2035 or 2040? Are the current Titans still going to be there? History suggests no. Many of them are going to be gone. And you look at the current top companies Apple, Microsoft, Google, Meta and so on, Tesla, they all look like they're companies that are going to be there forever, but they're not. In particular, the Innovator's Dilemma. And this is a particular challenge, say, for Apple, where Apple is used to being so seamless, so perfect that they're not that willing to experiment with a new technology which is going to hallucinate and make mistakes, and it could damage the reputation. That's a classic innovator's problem. It hurt Blockbuster, it hurt Kodak, companies like this. You have a new technology coming up. Kodak invented digital technology, but they had a great product, their customers loved them. But digital technology was pretty terrible. But other companies came along. Digital technology, there were fast innovators, the people who liked the products, even if they're not great. But the technology gets better, the market widens. And then Kodak's left nowhere and they disappear. The Innovator's Dilemma happens not because the company is bad, but because it's good. It has great products, customers love it, but they can't pivot to the new technology which initially is inferior. And so that's what all of the companies have to worry about.

And it's hard to, I would think if you're a big company, you said good product. You're doing things right. You might be public, you might be big and you've got quarterly demands that doesn't really allow you to do those types of things too. I was reading that. I think Apple said that Google's search on Safari, I still use Safari. I like Safari, I'm probably the only one now. But they said that their searches have gone down consecutively for the last two months. That's the first time that's ever happened. That's pretty significant.

And Google challenged that. Google said that there still is increased traffic flow to their search engine. Google is by far the world leader in terms of pure research and AI. They have the best foundational model. And Google is really the first AI first company. That's how it's always been designed. But they always have a problem with product management. We were discussing it earlier. Bringing products to market, and maybe similar to the problem that Apple has. There are challenges to Google companies like Perplexity, which are now valued at about US$14 billion. So very a small fraction of what Google is valued at. We'll have to see. And actually, Google is the only Mag 7 company that's trading below the market multiple. So there is a real discount because people are worried about the Innovator's Dilemma and Google being displaced. I tend to think that Google, given the talent, the enormous talent they have, and they've got the best model that they're going to have to figure out a way to bring it to market and to be the leader. And I would be careful with taking bets against Google.

Noted. I want to talk about some of the exciting things I know that you're pretty interested in right now. And this one phrase I know you talked about. It's not yours. I think it came from the head of Nvidia, but the future of AI is physical AI. What is that?

At the March GTC, that's the GPU tech conference, the big one that Nvidia puts on Jensen Huang, the founder and CEO of Nvidia, he said the future of AI is physical AI. This was something that was echoed by other people. The head of AI at Meta, for example, Yann LeCun, who's a famous researcher. So this is what they believe the future of AI is physical AI. That is AI embedded in things like autonomous vehicles, drones, robots. And we are seeing acceleration in all of these areas. There's a number of problems with this. One is the current type of model people are using, large language models, which are sort of stochastic parrots, trying to predict what the next token is going to be. The next word is going to be. These aren't models that can understand the physical world. They're not 3D, they're not sensory. So we are going to need real innovation in the architecture of the models. That's something that, for example, Yann LeCun is very interested in doing. But we are seeing obviously with drones and all different types of drones, air drones, surveillance or weaponized drones, land drones, of which a tank is essentially a land drone. Autonomous vehicle is whether it's a car or a truck is a drone. And then there's marine either surface or subsurface marine drones.

Who would you say is furthest along on that physical AI journey, when I think about the Teslas of the world, they have been, ingesting data with the autonomous driving and picking everything up. So who should we be watching on that front?

The weird thing is, so if you think about being excellent at software, there's a number of... You can name a couple dozen companies that are excellent software. And then you think, well, which companies are excellent hardware? You could name a bunch of companies. If you try to name what companies are excellent at both hardware and software, it's a really short list. Tesla, Apple, maybe BYD in China. It's really hard to come up with names beyond that.

So it's that integration of understanding. So it sounds to me that that's something you think is going to be very important as you move forward.

I think that's absolutely critical going forward. And in the startup space a lot of the companies in this area that are doing autonomous cars or trucks that are doing drones or different types of things in robotics, they have to try to be doing this stuff. It's fiendishly difficult.

It's expensive, I'd expect. Software is cheaper to develop than hardware, is it?

Well, I think to be excellent at one takes a certain type of company, a certain type of way of thinking. To be excellent at hardware, different type and to try to mold it. I think this is part of the reason why the German automakers are so struggling with EVs and AVs, because these are internal combustion engine people and companies. This is the way they think. And an EV or an AV, it's a computer with wheels. It's a totally different thing. You need a 25 year old from Silicon Valley to do that. You don't need someone from Stuttgart who's been working with internal combustion engines for 30 years.

How far away are we from the robot? I know Tesla came out with a robot, the humanoid. Do you think this is just like all fiction? Do you think it's going to happen 15 years from now?

We've been talking about robots for a long time. And there's industrial robots, most of which are used for welding in auto plants or in warehouses, moving crates and things around. In terms of household robots, it's going to be a while. There will be particular tasks that robots can do. But if you think of some basic activities we do, folding laundry, emptying a dishwasher, making a sandwich, these are not things that robots can do. It's going to be a long time before robots can do these sorts of things.

There has to be an economic need, I guess, right? Things get built where there's a payback. And so that's probably not something where there's a payback.

There could be a commercial setting where you're loading and unloading dishwashers a lot.

Let's talk about China, because I know that again, from reading your work, that one of the interesting things about China, although I would say also maybe a bit about the States, too, is that there's this fusion of military and civil use. I was thinking about DARPA and the internet, way back kind of thing, and that's where innovation comes from. But in China, this is ongoing. So does this give them the lead they need to move forward on this front?

I think it's been underappreciated how advanced China is both in software and hardware.

DeepSeek came out and rattled that.

And I think that really made a big difference. So we understood that China was challenging the US in terms of economic growth and the size of the economy. But the technology and defense capabilities, I think, is something which has really come to the front burner just in the last couple of months. China now has more software engineers than the United States has more AI patents, has a lot more STEM PhD graduates than the United States. In terms of drones, they're way ahead of the United States. Robots, they're ahead, autonomous vehicles, they have lots of companies in this space. So there are lots of innovative companies in the US, and I think there is a real sense that we need to win, and a minimum we need to make sure that China doesn't get so far ahead of us that they could get tempted to make some risk in the Taiwan Straits or other places. This is why Trump says he views it as we need to win, but it's really we need to make sure we don't fall behind.

I kept waiting for you when you were listing all the ways that China's ahead to say: But... There's no but. Is it too late? Whit everything you list off, it sounds like it's an extraordinary lead.

I think they have a lot of momentum. Ultimately, though, it is a top down economy. Almost all these companies are terrible capital allocators. And there is something about the innovation that goes with the capitalism you have in Silicon Valley companies like Anduril, which is one of the really hot startup companies in the United States. You could never get a company like that in a place like China.

Why? Tell me. Just tease that out. You know, you do this all the time. Tell me why capital allocation is such a bad idea in a centralized command and control economy.

You get top down objectives of this is where we need to go and you need to make that happen. That's very different than the United States, where you have venture capital companies meeting with startups, saying: We'll give you this much series A funding and you go see what you need to do. But if you do well, we'll give you more, if you don't, sorry, you're out of luck. They're really incentivized. And then you get Palmer Luckey, the founder of Anduril, he also...

What is Anduril? I'm not familiar.

Anduril, it's a company that focuses on drones and also Battlefield Advanced Information systems. So the combat soldiers would wear HoloLens so they can see what's going on, and it's connected to all the other soldiers. So if a shot is fired or something happens to the left, everybody will know instantaneously what's happening.

It's the Borg, Kevin. But anyway, keep going.

It's an advanced information system.

That's pretty wild.

It is. Someone like Palmer Luckey. I think someone like him wouldn't do really well in Beijing.

Interesting. They still do have... I'm just looking at some of your notes here. The shipbuilding capacity and the China... Tell me, because it's a factor. so much greater than the States. Why does that matter to on top of all this?

Right now, the shipbuilding capacity in China, measured in tonnage, is 230 times that of the United States.

Jaw dropping.

Globally, China has a 54% share. The other major players are Japan and South Korea, which luckily our allies of the United States. But it means that if things happen and there was a conflict and US ships were sunk, they wouldn't have the capacity to replenish the fleet. That's a pretty big deal. The Chinese fleet is growing much more quickly than the US fleet. Ultimately, we're talking about the world of bits here, but we live in the world of atoms, and we have to have the capacity to make things like ships and drones and batteries and all these things. To some extent, the US made an explicit policy decision to outsource that to China and other places. Now, just during the last four years with the Biden and Trump administrations realizing we need to home share or friend share these capabilities to reduce vulnerabilities and risk.

That's partially why they were elected. And we'll talk about the policies in just a moment. Who are... Given the challenges, I would say that China has in terms of the type of economy they're in. But who would you say are the companies that we should be watching that are going to be building the future there?

There's a couple public companies that are terrific. BYD, which is dominant in electric vehicles and is doing very well, not just in China but in their sales globally. CATL, which is the dominant battery manufacturer. Then there's a host of private companies. Huawei, which is the world's number one telecoms equipment. Jensen Huang from Nvidia, he thinks it's the number one tech company in the world measured by the breadth of its products. He thinks it's a pretty impressive company. There's a number of other, DeepSeek would be an impressive Chinese company that's private. DJI with drones and so on. They have a very good deep ecosystem.

There's always been... You mentioned about the venture capital and the system that there is in Silicon Valley and those types of things. And always that a lot of the really interesting innovation happens in North America. But from what I've read over the past little while people I've talked to is like the innovation that's coming out of China is astounding.

They are fast followers. They do a lot of copying, but that lets you catch up. But to move ahead, obviously it has to be leading edge innovation and so that's where they are now.

You mentioned about President Trump and of course their move to trying to home shore bring things back. Tell me what you know. When you hear him speak, when you've heard the policies. What are the big focuses when you just they talk about flooding the zone, all the things that are coming out. Just push that all away. What should you focus on?

The sequencing of policies until next November I think is very clear. I think we have a lot of clarity about that. So clearly we've had tariffs and we're 95% of the way done through that. Now we're in trade deals. We have 15 trade deals, at least the contours of them, we've started that process. We have trade deals now with the UK and China. Next we'll get tax cuts. We should get that somewhere between July 4th and Labor Day. It's going to be big. It's going to be fiscal stimulus over the ten year window of $3.7 trillion. It'll add about 0.8 percentage points to GDP next year in the US. That's a big number. So tariffs, trade deal, tax cuts and then deregulation. Deregulation, we mentioned some of the areas earlier, to ensure you can construct semiconductors, nuclear generators build out the grid broadly construction but also finance energy broadly, including LNG. Hopefully not coal. But the idea that we do need to deregulate and we need to focus. It's time to build. We have to win with that focus.

Does that turbocharge your thesis? Is that built into your thesis? How do you think of it when you're looking at that? And I guess the other thing too is none of this is done. It's the plan. You talked about that. It's probably that his administration's optimistic scenario.

Yeah. This is very ambitious. You can see from what President Trump's been doing so far, he's really busy and we just got the contours of deals like the deal with China. We've got 90 days to fill in some of the details come up with a process. It probably looks a lot like the phase one trade deal that they negotiated in January of 2020, just before Covid broke out. It's a lot to do 15 trade deals in three to six months when the average trade deal takes 18 months to negotiate, longer to implement. We want to home shore the production of smartphones, laptops, video game consoles, all these things. We could do that over a five to seven year window. They want to do it in three to six months. That's pretty ambitious. They have to administer all these tariffs. The US has 2.6 million import categories. Who are the customs agents that are going to be monitoring this matrix of tariff rates we have? I think at some point state capacity and the competency to implement this stuff is going to be a real challenge.

Is that a challenge then to this whole thesis, because you say... But all the things you know, and I even think... you talk about trade deals, the time to do. How long does it take to build chips and all these things? These are multi-year decades sometimes initiatives.

TSMC which is the leading fab for making semiconductors. It was founded in 1986. Lots of subsidies from the Taiwanese government. It took a long time to build up the labor skills, the knowledge they have. It took 40 decades for TSMC to become TSMC. It can be done. It can be replicated. The TSMC facilities in the US look like they're equally efficient to the ones in Taiwan. Yet it takes a long time. It doesn't happen in market time doesn't happen a couple of months at minimum three to five years for it to play out.

Lots to watch there. I want to talk to you about Agentic AI and tell me what agentic AI is just for those who don't know and why you think it's a 2025 pay attention to this.

So it's a developing thing. Agentic AI as opposed to normal AI, it has two characteristics. One is multi-step reasoning. Lots of things we have to make decisions about, it takes a couple of steps. If you're writing a document or you're writing software code, or if you're shopping or traveling, you always have to go through multiple steps to get to where you want to do. The current LLMs, it's just you put in a prompt, you get an answer, that doesn't do it. The second part of Agentic AI is it actually takes an action for you. To give an example, with e-commerce, Walmart is pushing forward their Agentic AI website, so it will help you with decisions that you'd make with shopping. This is something that Walmart is putting out. The head of AI at Meta, Facebook, Yann LeCun, I mentioned him before. He's a professor at NYU. The example he gives, I think is an interesting one. He lives in New York now, but he's from Paris. He says that he wants to put in a prompt and say: In August, I'm going to Paris for a week, please arrange everything for me. So an Uber comes to pick you up. It puts you on a plane. It knows your preferences. What class you want to fly, whether you like seats or aisle or window seat. Once you get there, it gets you to your favorite hotel, the type of room you like. It knows the restaurants you prefer. It knows the type of activities. Do you like museums or do you like hiking? What it is you do, do you like nightclubs? And so books these things. It would go through this process. You can imagine there's a lot of steps to go through it. Then it would show you what it suggests and then you'd be able to make modifications to it. This sounds sort of science fiction, but it's probably two years from now.

Really.

It's probably one year from now in which AI can write better code than almost all coders. The 99% of coding. Then you have AI writing its own code and getting better on its own. That's sort of what a genetic AI implies. But there's the coding part. There's writing different types of documents. There's e-commerce. There's travel. There's quite a few different applications for AI. It's now in this stage where it's research, we're getting some beta good for Walmart. They're coming out with because there will be problems with the site.

I'm just trying to think about how that plays out, and who would use this stuff. If you're price insensitive you don't care. Just go figure out the trip to Paris and do the things. There's a whole lot of knock on effects of who can use it, who can't, and how it would work.

We're all going to be using it. If you want, you can tell it to be price sensitive, and you can tell it to give you a list of options. You get to click on them, which one you want. It'll be a tool I think we'll all be using extensively two years from now.

I've heard about open source versus proprietary and I've also heard about distributed. Maybe just put the dots together for me and just why that matters. So first, what is it and then why does it matter?

I'll say 18 months ago, everything in AI was proprietary. All the leading systems. Whether you were OpenAI or Google, whatever system you had is proprietary. You didn't share the architecture, the training data, the model structure, the model parameters or anything with other people. Then a couple companies came out and started making some of these elements public, particularly the parameters of the models. There can be billions of parameters there, like the weights that you put on different things. Meta has been very big on doing this. A French company called Mistral is doing it, the next OpenAI model, which will be due sometime in the next couple of months, and it'll be probably the second best AI model out there. It will be open source in terms of the weights. What that does is it lets people replicate the structure of the model, the weights, and then they can build on top of it. You end up with a lot more competition, a lot more players and hopefully a more innovative system. It should be good.

What's the motivation for someone to open it up. I understand the benefit that it provides. Why would you?

The idea, say if you're Meta, is that a lot of other people start using your model and then building on it, and then it becomes the standard, say in social media or your particular space. It expands your team, your addressable market. It helps you build your business.

I have a few more questions, and I know we're running up against the clock. When you think about the world in terms of AI, obviously China is going fast. The States going very fast. I was looking online and I saw some charts of who was doing what. I think Canada was the grandfather of AI actually came from Canada. We now have a new minister of AI. What do you think? What would you like to see from that standpoint? I don't know if it's even market relevant. This is more of an economic question for Canada.

At least in my list of the top 20 AI startups today, four of them are based in Canada, three are actually based in Toronto, just a couple of kilometers from where we're sitting now. They're terrific companies. You mentioned so-called godfathers of AI, Geoffrey Hinton, Yoshua Bengio. These are leaders and the level of training that's coming for AI out of U of T, McGill, Waterloo, UBC and so on. Canada's punching way above its weight in these matters. Unfortunately, one of Canada's biggest exports is young people who are trained at U of T, McGill and so forth going to Silicon Valley. It does feel sometimes when you go there, half of the programmers that you meet are Canadian from these schools. Instead of keeping them in Canada, developing Canadian businesses, we're exporting them. Hopefully part of the job of the AI czar or the cabinet minister in charge of this new important emerging industry will try to be incentivizing young talent and businesses to stay in Canada and also develop products that are Canadian, because if we're consuming big US products, whether it's from Google or Facebook, they do embed a lot of US culture, specific culture. There's not going to be Canadian. If these are big parts of our lives, it's going to be very difficult to differentiate us culturally from our big southern neighbors. There's a lot of aspects to it. Canada in some ways punches above its weight in IT, but only 20% of our exports are services, and that's way lower than the UK, which is over 50%, the US is 35%. So IT services we should be exporting, as well as financial services, marketing services and so on. Given the issues in the election that came to the fore in establishing a distinct Canadian identity and economic trajectory, how we're going to grow, I think this is pretty critical.

What about regulatory blowback for AI? I know one of the things going back to the States, the Trump administration is doing its best to make it easier. But are there things that could happen? I don't know what they are, but that could cause regulators to step in and say no too far too fast, we need to come back and do those things.

The history of new technologies is you have the new technology, something terrible happens, and then regulators step in and create a framework. Typically the lag time between when the technology is commercialized and you get the regulatory framework is 5 to 15 years, starting with railways just under 200 years ago. That's what normally happens. Biden had an executive order on AI to ensure safety so all these hurdles, the big models had to satisfy. Trump has discarded that executive order. JD Vance gave a big speech in Paris in February, in which he made clear to the EU and leaders globally that from the US perspective, it's all about innovation. It's not about safety. This is concerning because there will be problems, there will be issues. Maybe it won't be as bad as bioweapons or terrible things happening, but it's a new technology and there will be problems. The industry would probably be more sustainable if we did have a sensible regulatory framework. But it's very early in the days because ultimately you want to regulate uses and products and applications. We really don't know what those are.

I was thinking about is, are there any kind of wild card scenarios when you start thinking too... You mentioned all the things people can think about, but if there's a breakthrough in quantum and then that gets coupled to AI, if there's societal shifts and like there's just a lot of things that we just don't know what we don't know.

The head of AI at Google, he thinks one surprise could be five years from now. We've essentially cured all cancers. He got the Nobel Prize last year for some of the work that he's been doing at the molecular level. They're very busy in this area. There are some negative things that could happen.

That's not one.

There's some phenomenally positive ones. One of the arguments that if we do put too much regulation in front, we slow the pace of innovation. Then instead of getting in five years you get 10 or 15. That causes a lot of net loss of life.

Let me ask you two last questions. I promise I keep saying that, but for real, it's two last ones. What are you maybe unsure about as you look ahead? What are you maybe worried about as you look ahead?

In terms of unsure, I think I'm unsure about everything. Because I think there's a lot of similarities between where we are in AI now and where we were in the internet in saying 97 or 98. Almost nobody understood the future of the internet in 97 and where it was going. When you read what people were writing and saying at that time, the companies that were startup, people just didn't know. Jeff Bezos was in fact... He had special insights about where things were going. As a consequence, he's one of the richest people in the world. But that was very rare. Most of what people were thinking at that time, in retrospect, looks pretty ridiculous. I think now people are sort of cognizant, we have this new technology, it's developed so quickly over the last two and a half years. Where is it going to be five years or ten years from now? We have to be ready to be surprised a lot. Hopefully there will be real innovations that make life better for us and lots of different ways. Make new professions and create lots of value. I don't think we have to be careful about assuming we have real insights in the future where the history of innovation says you really don't, you never do.

I guess you sort of answered my next one, but I'll ask it anyway. What are you most excited about in terms of where this could go?

I think Demis Hassabis, the head of AI at Google, the scientific discoveries, the idea that you could come up with, you know, a vaccine isn't the right word, but that's the people use a vaccine cure for most cancers. This is pretty great. The fact it could have on the quality of life and longevity would be fantastic. That's certainly what he's most excited about.

Kevin, thanks so much.

Thank you lot.

Thanks for tuning in to this episode of the Moneytalk podcast, brought to you by TD Wealth.