AGM Alts Weekly | 6.22.25: The DNA - and why it matters

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC. I’ve just returned from a three-week trip to Europe, which spanned Berlin for SuperReturn, London for podcast recordings and meetings, and Stockholm for podcast recordings and to attend the EQT Annual Investor Meeting.

The trip was punctuated by a three-day visit to Stockholm right before Midsummer.

The days were long — and the nights were even longer (since it doesn’t get dark in the summer apparently, as the below picture from 3:30 am shows).

People can learn a lot about an investment firm by listening to what they say.

That’s what I did in Stockholm this past week.

I sat down with nine EQT executives for one-hour conversations with each of them.

Each executive came from different parts of the firm — and different parts of the world. Each had fascinating backgrounds and stories about how they ended up in private markets and working to build EQT.

But there was a single through line threaded throughout all of the discussions: the consistency and frequency that each executive talked about the firm’s mission, vision, culture, and values.

The conversations offered an opportunity to peer through window of how EQT operates.

The story starts with Conni Jonsson and the Wallenberg family, a prominent Swedish family of bankers, industrialists, politicians, and diplomats that have owned or been part of many companies that have shaped Sweden and beyond: EQT, Ericsson, Electrolux, ABB, SAS Group, Atlas Copco, Saab AB, Investor AB, and many more.

In 1993, Conni was an Executive Vice President at Investor AB, an investment firm owned by the Wallenberg family. According to the story on EQT’s website, the idea for building a private equity firm “rooted in the Wallenberg family’s traditions of responsible ownership” came to life during a dinner in Stockholm’s Old Town between Conni and Claes Dahlbäck, the CEO of Investor AB.

And so EQT was born. In 1994, Conni received backing from the board of Investor AB to establish EQT, with AEA Investors and SEB committing to EQT along with Investor AB.

The firm’s Nordic heritage and the DNA of the Wallenberg family appear to be omnipresent.

In the various conversations I had, I would hear the same sayings echoed organically — and repeatedly:

“More than capital.”

“Locals with locals.”

“Active ownership.”

“Future-proofing companies.”

“Long-term ownership.”

“Values-based culture.”

“Transparency.”

The sayings themselves represent — and operationalize — the values that EQT have as a firm. These values guide the way that they invest in and build companies, as displayed in the slide below from the firm’s recent Capital Markets Day.

EQT seems like a firm that really knows who they are.

Perhaps that’s why former CEO Christian Sinding described the 2020 sale of EQT’s credit business to PEI — at a time when the private credit space was heating up — as “one of the best decisions” the firm has ever made.

Sinding said, “we were subscale in that business and didn’t think we could be one of the long-term winners in that space. Therefore, we divested and that enabled us to be laser-focused on active ownership.”

Sinding continued, saying “all [of EQT’s equity] strategies have to do with owning, developing, and adding value to a company … and driving changes with the capabilities that we have.”

The focus on the wealth channel for many asset managers is not just about an evolution happening within the industry.

It’s also forcing investment firms to define who they are and how they tell the story of who they want to be.

Working with the wealth channel is different.

How firms productize, market, brand, and distribute the investment products and capabilities is a departure from how they have historically worked with institutional LPs.

To know how to work the wealth channel means first understanding what the wealth channel is.

What is the wealth channel?

The wealth channel is not monolithic.

The wealth channel is a disaggregated set of investors who require different service models and products based on the investor type.

It’s important to unpack the definitions of wealth and retail — both for the purposes of product creation and product distribution.

Creating proper definitions and categorizations helps to move the space forward. It enables firms to figure out where they want to strategically position themselves, where and how they want to build product, where they want to spend meaningful time, resources and dollars on marketing and distribution, and where they want to acquire firms.

I broke down the different channels within wealth in the 10.13.24 AGM Alts Weekly, so I won’t go into as much detail here.

But I will cover how different sub-channels within wealth prefer and demand different types of products.

Wealth channel product creation is not one-size-fits-all. Some within the wealth channel will prioritize closed-end fund structures, while others will prefer evergreens.

Is an investment firm equipped to handle the diverse needs of different wealth channel investors?

That’s where breaking down the wealth channel by investor type can help inform an investment firm as to where they should focus within the wealth channel.

UHNW and family offices

The saying goes, “when you know one family office, you know one family office.” That makes the family office channel arguably the most difficult channel within wealth to cover because it can be hard to predict sales cycles and optimal product structures.

Many UHNW and family offices already allocate to private markets — some with upwards 20-30% allocation to private markets.

Does this mean that family offices and UHNWs might want to add exposure to certain private markets strategies before the next vintage of a closed-end fund comes to market? Perhaps.

Some family offices and UHNWs might want evergreen funds, in part because it can offer the ability for capital to be put to work right away. Others might want to stick with closed-end funds, in most cases by going directly into the fund at or above the fund’s stated minimum investment amount.

With this category, there’s no one right answer. Some firms have launched dedicated family office coverage groups. Other firms will look to cover this market through the private bank relationships they possess.

The family office market is meaningful in size — Deloitte estimated in 2024 that total family office AUM was $3.1T. If family office allocations to private markets are 30-40% (J.P. Morgan’s 2024 Family Office Survey found that those surveyed had a 45% allocation to private markets) then that’s at least $1T in AUM allocated to private markets. This figure would represent a meaningfully sized portion of the $22T of current private markets AUM ($22T, as estimated by a recent McKinsey report), making family offices an important part of the wealth channel ecosystem.

The family office channel, while diverse in client size and client type, is probably the one channel within wealth where a distribution approach more akin to institutional LPs can be applied. Unlike with private banks, wirehouses, and RIA platforms, significant boots on the ground is not always required.

Building brand, community, and networks that add value to these investors, however, is important and can be a leveraged way to reach many family offices and UHNWs.

Many UHNWs and family offices have generated their wealth through either a wealth creation event as an entrepreneur or a multi-generational family business. Therefore, investment firms that are able to lean into a family business heritage or a business-building mindset should be able to resonate with this channel.

The next generation within a family office or family business might want to build and develop a network of peers and investors that can help them build their own business in the future or continue the legacy of a family business.

Many of the private banks have leaned into creating Next Gen networks and peer-to-peer learning for their clients. Perhaps alternative asset managers can do the same.

The family businesses that last for centuries are able to tell the stories of who they are to continue the family’s legacy. Asset managers have the opportunity to do the same — and that becomes a brand-building tool and a way to create and foster an engaged community.

New Mountain Capital’s Founder and CEO Steve Klinsky referenced this concept on his recent Alt Goes Mainstream podcast. He discussed how coming from a family business himself means that he considers both New Mountain and the entrepreneurs that they work with as part of the family business. That mindset has permeated how the firm hires and retains talent and informs how they work with entrepreneurs and executives to translate into investment performance. This type of mindset should resonate with LPs in the wealth channel.

Steve said on his Alt Goes Mainstream podcast:

[00:08:24] One thing that's important in my background is I grew up in a family business in Michigan, so my grandfather and grandmother had a store that sold coats for 30 years. My dad and uncle built into a chain of stores. And a lot of people in my firm come from small family businesses, so we say we don't have portfolio theory; we have family business theory. When we invest in a company in private equity, we treat it like the new family business. I'm proud to say we've never had a bankruptcy. We've never missed an interest payment in the history of our private equity effort. And have had $87 billion of enterprise value gains. So that kind of respectful idea also applies to how we treat people. We include every associate in the investment committee meetings. Everyone in the firm gets carry and every deal from the receptionist on up. And so we just try to get the best people working together.

Another example of a firm knowing who they are and figuring out how to work with the wealth channel is Hg. Their evergreen fund structure, Fusion, was initially supported by a number of Hg’s network of founders, as well as private investors, family offices, and a global partnership with UBS, along with a number of regional private banks. The fact that Hg’s wealth-focused offering was able to resonate with founders within their network illustrates that the firm understood who they wanted to work with and how to express their values and investment proposition to the UHNW and family office segments.

As a recent April 2025 update from Hg noted, the firm saw “strong demand from private investors, family offices and Hg's network of founders, [which] propelled the Fund beyond the $1 billion [NAV] milestone in Q1 2025.”

Private banks and wirehouses

Private banks also vary in terms of their resources and sophistication level in private markets. Some of the largest private banks have made concerted efforts — offering large menus of products — for their HNW and UHNW clients to access alternative asset managers.

But while even the most active private banks are allocators to the industry’s largest funds, sometimes to the tune of raising billions of dollars for a single fund in a relatively short period of time, even they are under-penetrated when it comes to advisor adoption of private markets products amongst the majority of their advisor population.

Do private banks prefer evergreens over closed-end funds? Some certainly do, from conversations I’ve had. The features that evergreens offer can make sense for private bank clients, particularly the vintage diversification and immediate investment and compounding.

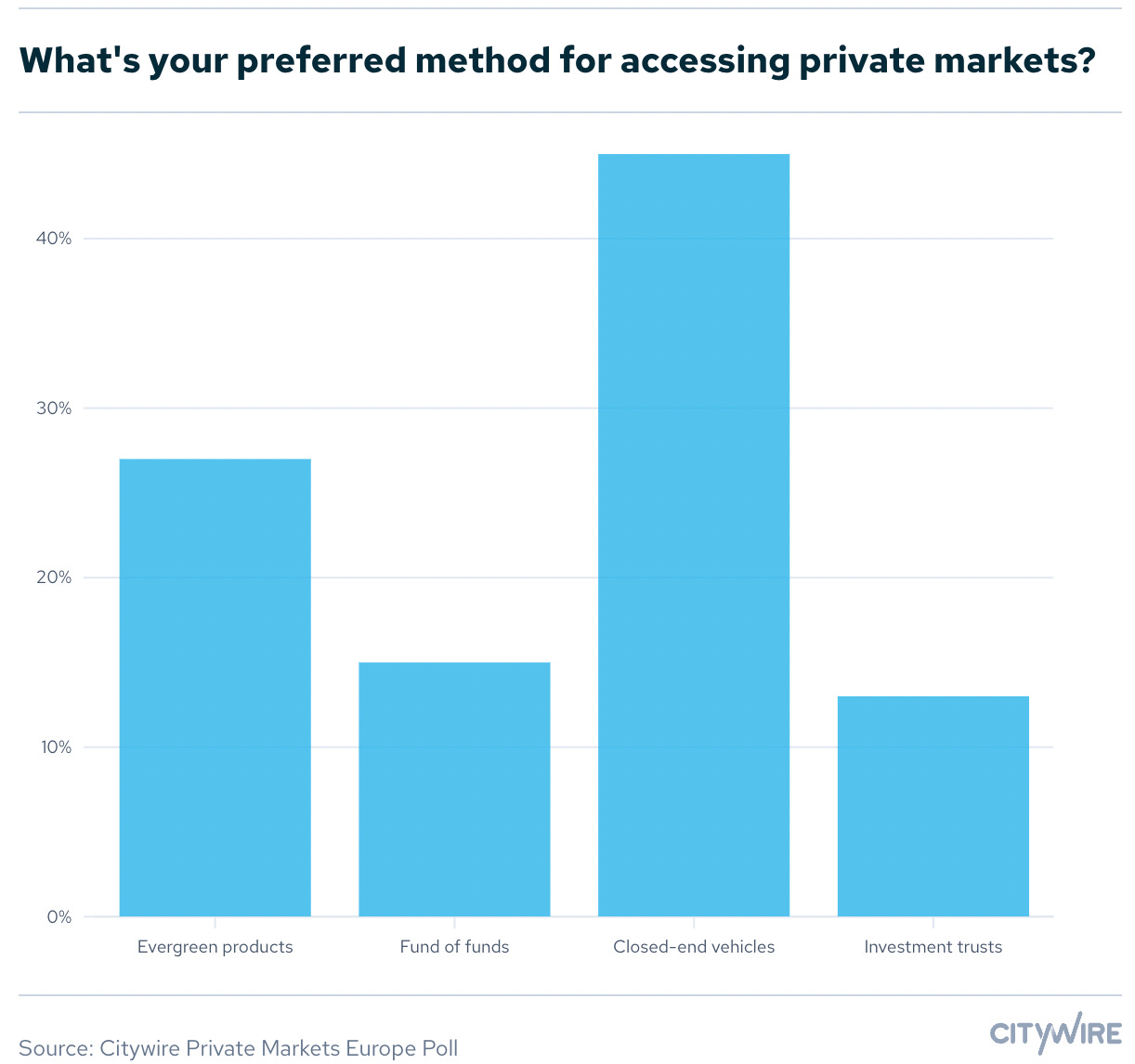

But, not all private banks and clients prefer evergreen funds. Interestingly, a poll conducted during Citywire’s Private Markets Europe event in February 2025, with more than 60 fund selectors, found that 45% of those surveyed said closed-end vehicles were their preferred method for accessing private markets.

Evergreen products were the second most popular product for those surveyed at the Citywire event.

Anecdotally, it does appear that wirehouse and private bank menus are becoming stocked with evergreen fund structures.

A recent McKinsey report noted the increase in “alternative forms of capital” in recent years.

Evergreen products look to be increasingly popular with many in the private bank and wealth channel, more broadly.

Some fund selectors, such as HSBC’s Global Head and APAC Regional Head of Alternatives Mathieu Forcioli, see evergreen funds as the product structure of choice. Forcioli told Citywire, “Open-ended funds have been a game-changer for us. At the beginning it was all about the liquidity advantages for clients. Now they’re mostly popular due to convenience.”

A recent iCapital survey of over 600 advisors found that many respondents anticipate that there will be increased adoption of evergreen strategies.

As the chart illustrates below, 77% of survey respondents said that evergreens will make up at least 10% of client portfolios within the next two years.

Evergreen funds have exhibited rapid growth in recent years. Hamilton Lane’s 2025 Market Overview noted that 415 new evergreen funds were launched between 2017 and 2023.

There’s a lot to play for with wirehouse and private bank channels — they are a large addressable market segment within the wealth channel, and they are structured in a way where firms that are able to make it onto wirehouse menus can achieve scale in a fundraise.

I wrote in the 3.3.24 AGM Alts Weekly that “the wires are plugged in.” Literally — and figuratively.

Wirehouses will continue to provide the lion’s share of asset flows into alternative asset managers. Structural reasons persist. Alternatives are still very much sold rather than bought — and the structure that wirehouses have to diligence, onboard, approve, offer, and distribute private markets products through their advisor channels is much more uniform and structured than it is in many parts of the independent RIA channel. A September 2023 whitepaper and survey on advisor adoption of alternatives by Invesco, Cerulli Associates, and IWI highlight that the majority of branch network advisors are more likely to have access to an alternative investments portal (54% of advisors) than are independent advisors (21%).

Structural differences like the ones above illustrate that it’s easier for alternatives products to be distributed through wirehouse / private bank channels.

It also shouldn’t be lost on advisors (and those selling to advisors) the power of a “recommended list.” Many advisors want to make fewer choices, not more. And, they also have to spend a large portion of their time focused on other activities that grow or maintain their business, like new client development, client service, and managing entire investment portfolios that span both public and private markets investments. Many independent advisor practices, particularly those that are smaller independent firms and even larger practices that may only have a few resources dedicated to manager research or private markets, aren’t equipped to handle the breadth and depth of the alternatives space across managers and strategies. Wirehouses and private banks certainly make it easier for advisors to find, evaluate, and allocate to alternatives products by providing a recommended list of curated products, education, research and diligence support, and an investment portal. Sure, there are good arguments as to why an advisor would choose to go independent and why a client would want to work with an independent advisor. But in terms of alternatives distribution, wirehouses are plugged into all the right pieces of the alternatives puzzle to unlock flows into private markets products.

Yet, despite the structures in place for wirehouses and private banks, there’s still an 80/20 (or perhaps even 90/10) phenomenon that’s occurring within this channel. Private markets distribution to the wealth channel is still very much in its early days — so much so that I’d venture to say that at many private banks and wirehouses 80-90% of the flows into private markets products come from 10-20% of the advisor teams.

But are investment firms equipped enough to cover the private bank and wirehouse channels with enough distribution boots on the ground to service advisor teams nationally and globally? After all, wealth distribution is very much a contact sport.

RIAs and wealth managers

The aforementioned structural considerations can make it harder for alternative asset managers to cover the RIA channel. That’s, in part, why the biggest and most well-resourced alternative asset managers have focused their efforts on the private bank and wirehouse channels with much success.

But it doesn’t mean that the RIA channel won’t feature prominently going forward.

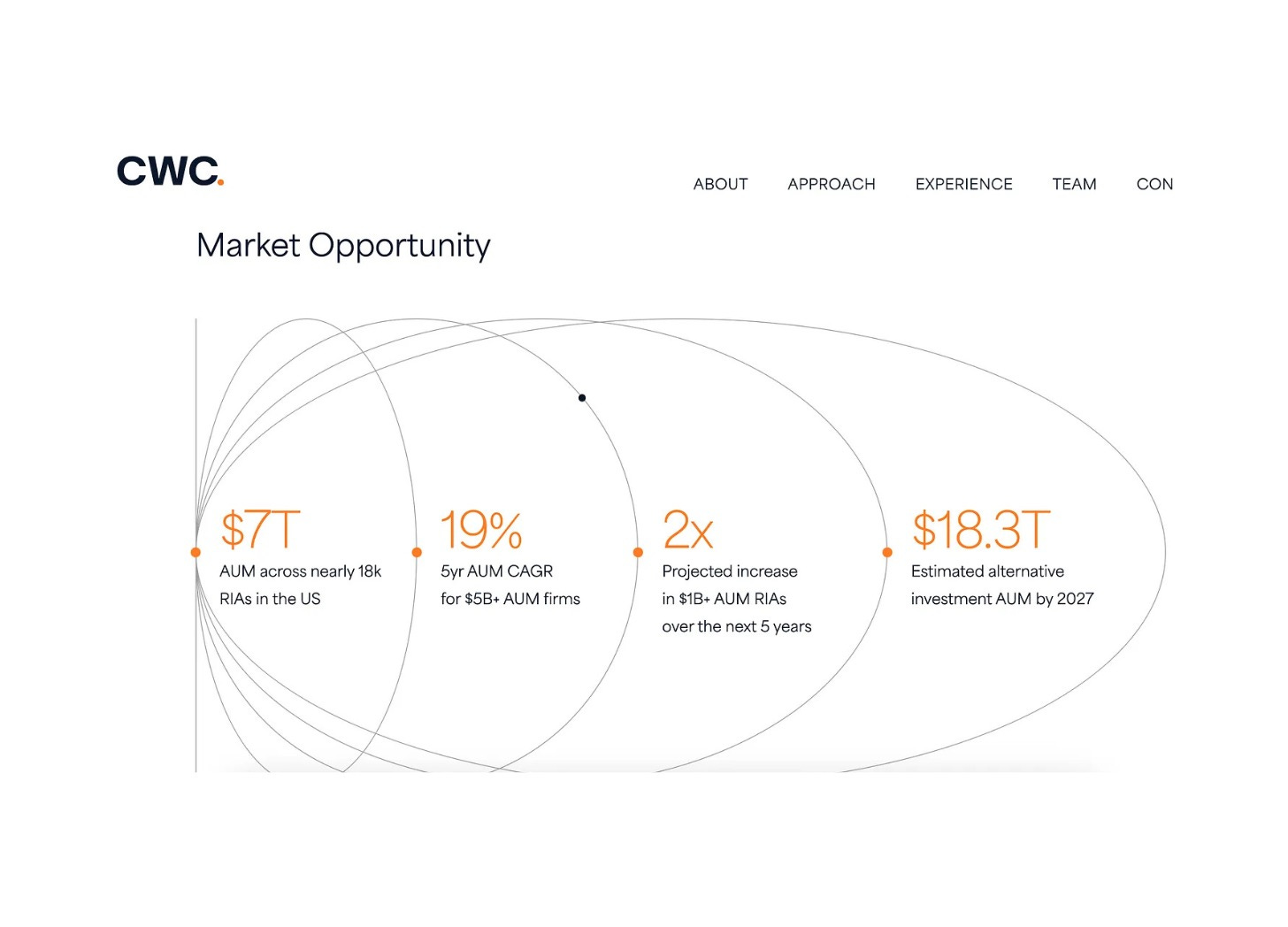

The RIA market is large, growing, and consolidating. Cerulli estimates that there’s over $8T (as of 2021) residing in RIAs. This figure should only continue to grow as the independent wealth space continues on its upward trajectory.

And, wealth could consolidate within the upper end of the RIA market, as a chart from Constellation Wealth Capital illustrates.

A 19% AUM CAGR is projected for $5B+ AUM RIAs and a 2x increase in $1B+ AUM RIAs is expected over the next five years.

With a flight to quality and scale within the wealth channel (yes, we could see a $1T RIA in the coming years, as I wrote in the 2.23.25 AGM Alts Weekly), the large RIAs are starting to build out capabilities that institutionalize, centralize, and mechanize their private markets diligence processes and menus.

The addition of OCIOs being consolidated into scaled RIAs, as Cerity Partners did with OCIO Agility, Hightower did with NEPC, and Pathstone did with Hall Capital Partners, will make these firms even more institutionalized when it comes to how they prosecute private markets investments.

This subset of RIAs, the large platforms, will likely require a sales and marketing process that resembles what is used by the private banks.

But, just as EQT leads with a “locals with locals” model on the investment side so that investment teams understand cultural differences and nuances within a particular locale, investment firms might do well to employ a similar mindset when deciding to work with the RIA channel.

RIAs are different than wirehouses and private banks in terms of how they want to interact with funds and how they want to be sold, so investment firms need to think about having dedicated RIA coverage teams that understand the nuances of RIAs in order to develop a deep understanding of their needs and how to best partner with them.

This point is particularly important as many RIAs are looking to figure out how to differentiate and deliver unique offerings to clients, as I wrote in the 5.11.25 AGM Alts Weekly, so investment firms that have the ability to help create bespoke product offerings or bring in large RIA platforms to help seed new product launches at attractive economics might be able to develop long-term relationships with certain RIA platforms.

Affluent and mass affluent … and the brokerages

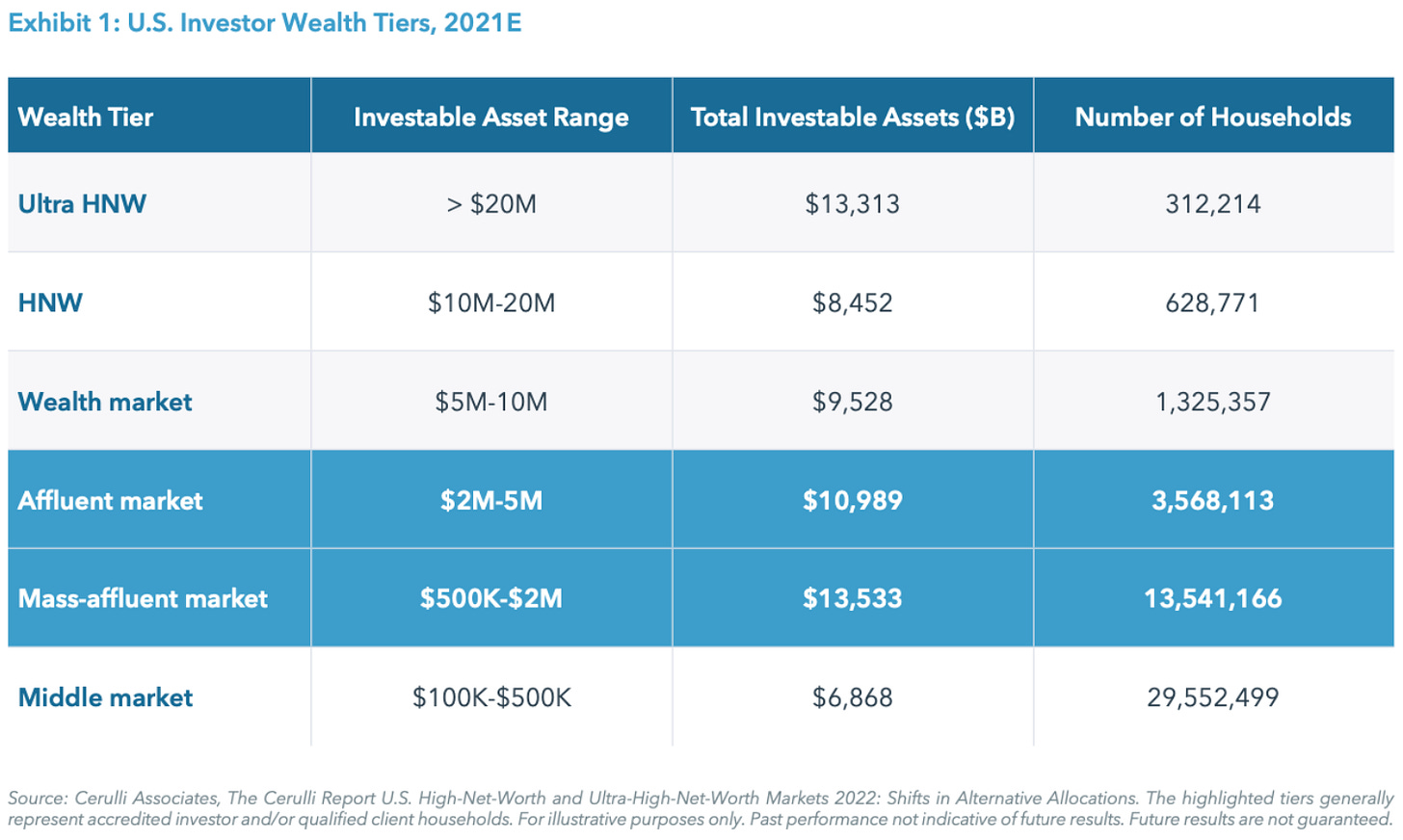

The affluent and mass-affluent market is one of the biggest opportunities for alternative asset managers but also one of the hardest to crack.

This market overlaps with the RIA / wealth channel. Some, if not many, in the affluent market ($2-5M in investable assets) and some in the mass-affluent market ($500K-2M in investable assets) will have advisors, and their investment decisions and asset allocation will be advisor-directed. Others, increasingly so, particularly younger cohorts, might look to their brokerage platforms like Fidelity or Schwab or digital neo-brokers / neo-banks like SoFi, Revolut, and others to gain access to private markets products.

The challenge for alternative asset managers is that they need to have the resources and scale to invest in product innovation and distribution. This channel will likely access private markets through evergreen funds. Building, productizing, and distributing these products requires a serious lift of both distribution and marketing / branding efforts. Again, the benefits of scale mean that the largest funds will likely have the most success here, particularly those that are publicly traded, as they will have the brand that will resonate with the mass-affluent investor and the currency to invest in distribution resources.

There’s a lot to play for. $24.5T across 17M households in the US alone, according to iCapital and Hamilton Lane, as they wrote in their paper, The Future is Evergreen.

The affluent and mass-affluent market is where wealth and retail intersect.

This part of the wealth channel covers both “wealth” and “retail” in terms of how this part of the market needs to be served.

Alternative asset managers will need to cover the wealth managers that cater to this affluent and mass-affluent client population. But for much of this channel, they will also need to invest to build their brand with the end client, almost thinking of this as a “consumer” or “retail” sales effort from a marketing perspective.

Building a brand requires its own focus and upskilling effort. This initiative won’t be for every alternative asset manager — and that’s fine. It will likely reside in the domain of the largest alternative asset managers that have chosen to go public or have grown so big in AUM as a privately held firm that they have built a recognizable brand.

Traditional asset managers could also have an edge here. They’ve spent decades, in many cases, building a brand with the wealth and retail channels. That investment and effort may bear fruit in the coming years as the lines between private and public become more blurred.

How can investment firms effectively work with the wealth channel?

The first step is knowing who you are, so you can figure out what part of the wealth channel makes sense for you to work with.

That means harmonizing every aspect across the firm.

Given that the wealth channel is not monolithic, investment firms might have to think hard about the brand and educational delivery model for different types of wealth channel investors. Within specific segments of the wealth channel, firms might have to amplify different parts of their brand and values in order to resonate.

In “Distribution Dilemmas,” I wrote on 7.28.24 that developing a channel strategy is core to successful selling into the wealth space. Different investors in the wealth channel have varying needs — and, therefore, require specific mechanics when it comes to pre- and post-investment needs across the spectrum of fees, capital calls, liquidity / illiquidity, cash management, investor reporting, and more.

The first step in the fundraising playbook (see here for the 6.30.24 AGM Alts Weekly on the fundraising playbook for asset managers)?

Devising a strategy.

In the 7.14.24 AGM Alts Weekly, Pantheon Partner Susan Long McAndrews stressed the importance of knowing and focusing on the right strategy:

How to build successful distribution starts with strategy. Step back and be honest about where you have a competitive advantage across geography and channel due to brand, investment performance or relationship hustle. Where are you fighting an uphill battle because of a bad fund, a late entry or the wrong hire — it happens! Spend your distribution resources in the right places for your firm — not what the herd is doing. Pick your bets and then hire the best troops you can find.

What does looking within mean?

First, it means knowing who you are.

Then, it means refining the story and the brand. Firms arguably need to invest as much time and effort in marketing and branding as much as they do in distribution.

Then, it’s about devising the right product for the right sub-channels within wealth.

Product-market fit here is not just one-dimensional; it’s two-dimensional.

Creating evergreen structures is not just about productizing for the wealth channel. It’s also about productizing for yourself.

But what does it all come back to?

One of the most valuable assets that a firm can have in today’s world of asset management? Brand equity.

It all comes back to the DNA.

The firms that know who they are will know who to be.

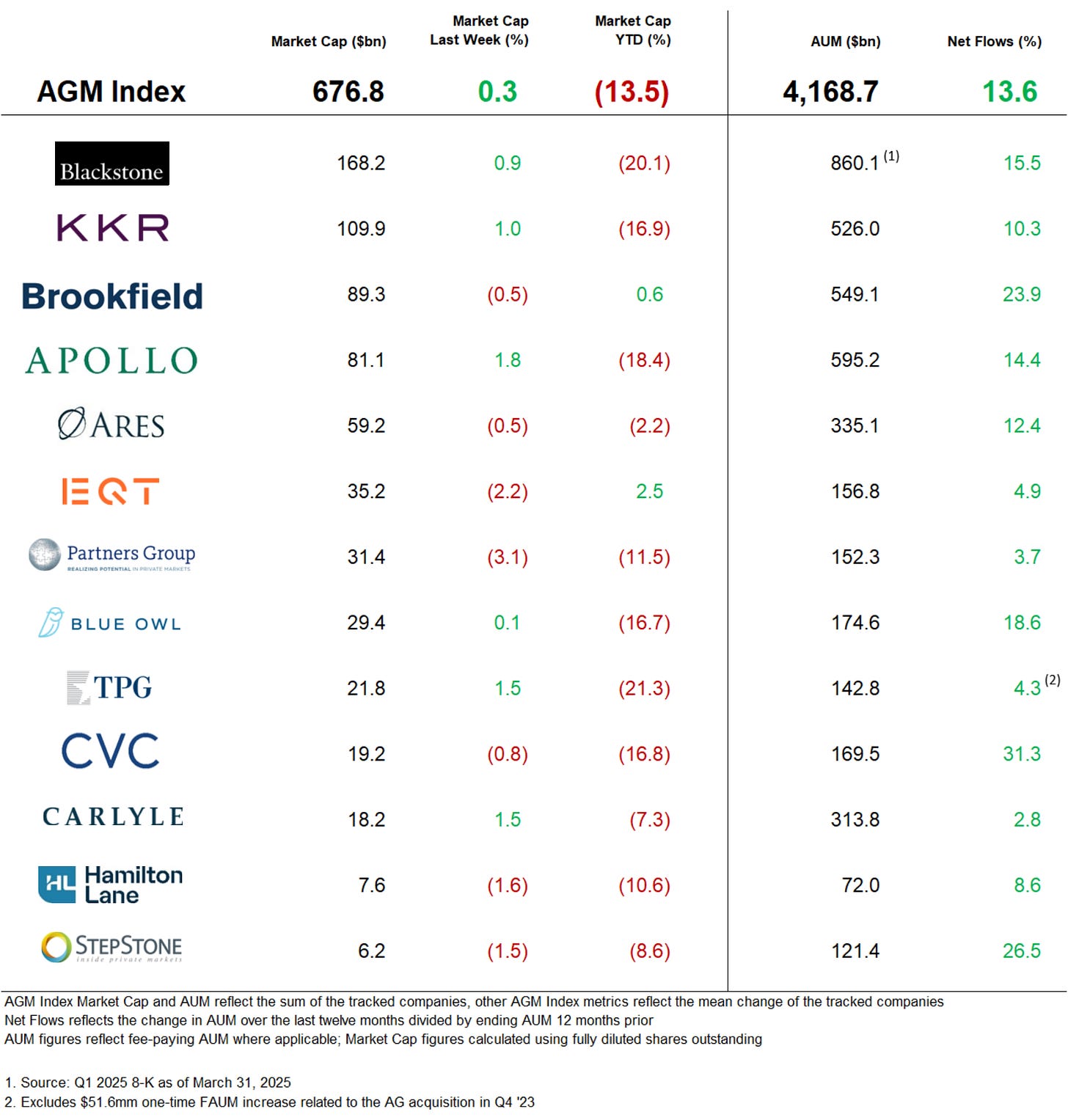

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

CIO Aneet Deshpande of $47B AUM RIA Clearstead discussed the importance of manager selection as more evergreen fund products come to market. Dispersion of returns is not just prevalent in closed-end funds. It’s also prevalent in evergreen fund returns.

📝

💡 Thoma Bravo Partner and head of the firm’s European operations Irina Hemmers wrote an op-ed in the Financial Times about the investment opportunity in the European software landscape. Hemmers wrote: “Many global software investors are still treating Europe as an afterthought to their core strategies. I believe this represents a significant misallocation of investment attention.”

Hemmers lays out a thesis for why Europe should be seen as an attractive investment opportunity:

Why is Hemmers bullish on the European software ecosystem? In her view, there are tailwinds that represent a structural opportunity.

According to McKinsey estimates, 68% of European organizations still run less than half their workloads in the cloud. Hemmers notes that migration to cloud is picking up steam. Germany is cited as an example of increasing cloud adoption: 46.5% of businesses currently use cloud technology, with an additional 11.1% planning to integrate it into their business, according to Inkwood research. Structural shifts like this should add tens of billions in software spending.

Hemmers also references geopolitical shifts changing how companies spend on software. Companies are “increasingly favour[ing] regional software providers that can navigate local regulations, provide in-country data hosting, and offer proximity for critical business applications,” Hemmers writes.

Hemmers also views the way in which European software companies grew within the constraints of the market as an opportunity. She writes: “[Europe’s] software companies spent decades building robust businesses under constraint, learning to be profitable earlier and to focus on sustainable growth rather than pursuing scale at any cost. Now they need capital to accelerate organic growth and facilitate mergers and acquisitions.”

Hemmers concludes her argument by saying that European software offers an opportunity for what institutional investors need: “profitable, growing companies with proven business models and clear scaling paths.” She calls Europe a “must-have growth engine,” not just a “nice-to-have diversification play anymore.”

💸 AGM’s 2/20: Hemmers shares a number of compelling reasons as to why European software buyouts could be fertile ground for investors. One statistic from Hemmers’ article stood out — the continued migration to cloud by European companies. The fact that a majority of European companies run less than half of their workloads in the cloud represents a major opportunity for software companies to grow and scale their customer base. There’s an even bigger opportunity for local software businesses now — it appears that European companies want to work with “regional software providers,” as Hemmers notes. Some of the biggest investors in software PE see Europe as an opportunity. In February 2025, Thoma Bravo closed its first European-focused mid-market buyout fund at €1.8B in commitments. Thoma Bravo Founder and Managing Partner Orlando Bravo called it a “significant milestone for [the] firm.” He said that they “see an enormous opportunity to back Europe’s technology innovators and help them scale.” Thoma Bravo has been investing in Europe for almost a decade and a half, deploying €14B of capital across 16 transactions in the region. Vista Equity Partners has also expanded its footprint in Europe, growing its private wealth solutions team and launching its evergreen structure, VistaOne, for European investors recently, according to an article in Citywire by Selin Bucak. US firms Thoma Bravo and Vista join an existing set of European heritage firms, including EQT, CVC, Hg, and Permira, amongst others, that have been investing in the European software buyout sector for years. Who will win in Europe? Last week’s piece on AGM dove into the European investment opportunity as firms turn an increased focused to the region.

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

- Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

- Vice President, Strategy & Innovation – Model Portfolios and Annuity Solutions. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Strategy & Corporate Development Associate. Click here to learn more.

- Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

Global Head of Product Strategy, Private Market Solutions - Managing Director. Click here to learn more.

SVP - GCG Head of Content Strategy. Click here to learn more.

- RIA, Family Office Business Development - Vice President. Click here to learn more.

- SVP Business Development, Private Markets. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

- SVP, Business Development. Click here to learn more.

- Alternative Investment Sales Specialist Account Executive. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch ’s MD, Head of Alternative Credit unpack private credit and why ABF has become a prominent part of the private credit ecosystem. Watch here.

📝 Read The AGM Op-Ed with Head of Alternative Credit on why “asset-based finance today mirrors the evolution of corporate direct lending from over a decade ago.” Read here.

🎥 Watch ’s EVP and CIO discuss the role of insurance companies in private markets as he discusses how he manages a portfolio of $300B in assets. Watch here.

🎥 Watch ’s Partner and CIO discuss how an RIA can chart a growth path by building out its private markets capabilities. Watch here.

🎥 Watch ’s Founder & Chief Executive Officer discuss how $55B AUM New Mountain has built a business that builds businesses. Watch here.

🎥 Watch ’s Private Markets Head discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch President & COO and SVP, Partnerships discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Managing Director, Global Head of Alternatives, Third Party Wealth discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Managing Director & Co-Head of Private Wealth Solutions discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch President & Managing Partner on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to , Founder of , and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a mini-series on Private Wealth. Listen here.

🎥 Watch Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business and Chairman & CEO discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Partner & Head of Private Wealth Americas discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Co-Founder and Managing Partner in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Private Markets Head on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch ’s Head of the Americas Client Business , Head of Product for US Wealth & Head of Alts to Wealth , and 's Co-Head of Private Wealth discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.