AGM Alts Weekly | 4.6.25: The pieces of the puzzle

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good afternoon from Washington, DC.

Private markets are seemingly becoming more like public markets by the day (or with each successive announcement by BlackRock).

Product innovation is ushering in the convergence of public and private.

Traditional asset managers are converging on alternative asset managers’ territory with each successive acquisition, such as BlackRock’s landmark purchases of $100B AUM GIP to add infrastructure capabilities and $148B AUM HPS to add credit to the mix. Conversely, alternative asset managers are expanding into areas traditionally the domain of banks, like private credit, and finding ways to partner with traditional asset managers on public / private products, such as KKR and Capital Group and Apollo and State Street, respectively, have done as of late.

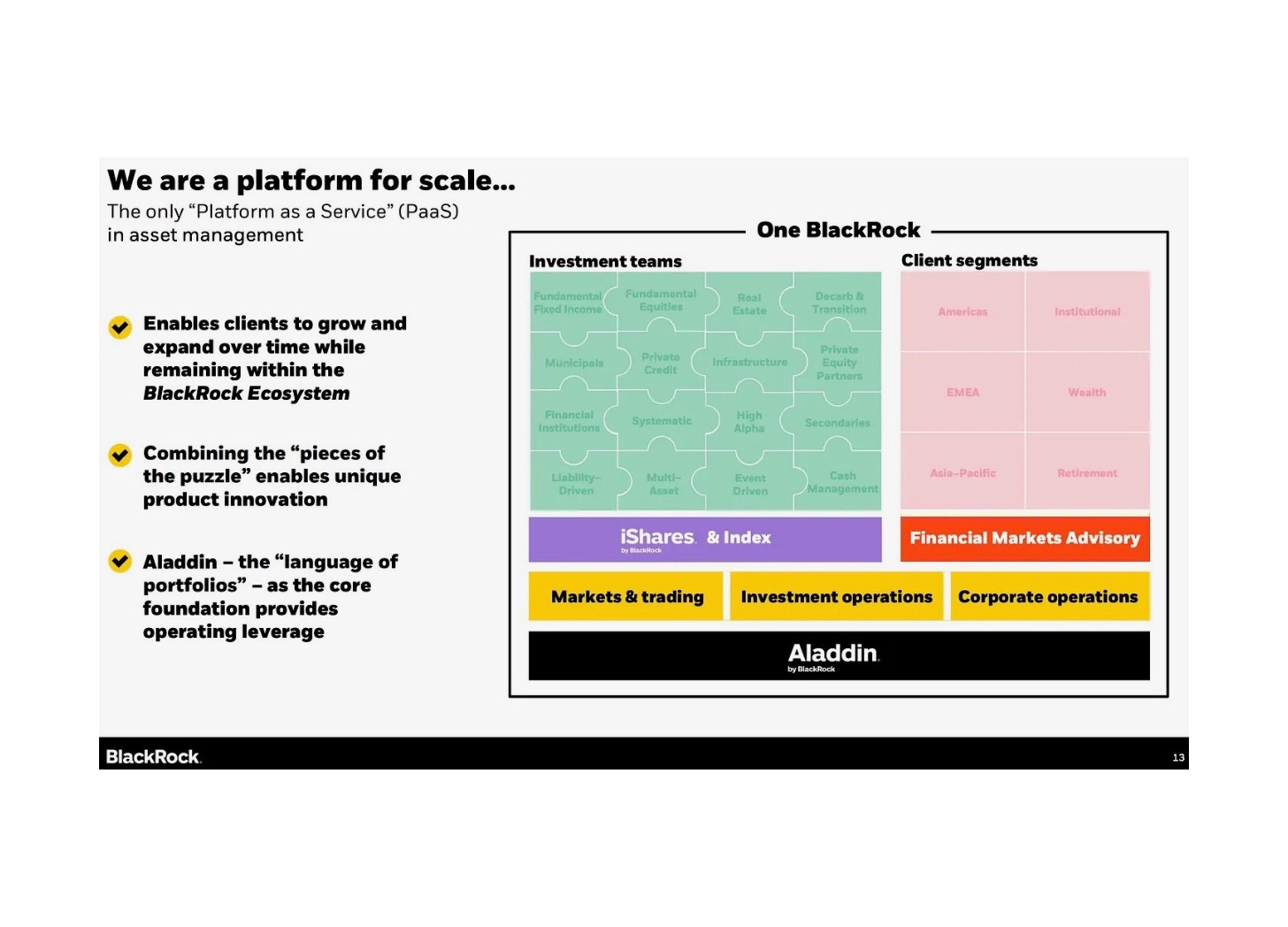

BlackRock has been hard at work trying to figure out how to bring together public and private markets (and technology) into “One BlackRock,” which they call the “only ‘Platform as a Service’ (PaaS) in asset management.”

A chart from their 2023 Investor Day presentation highlights how the firm has pieced together the puzzle — and that was before they went on a $27B acquisition spree to add GIP, HPS, and Preqin to the mix.

It certainly seems like BlackRock is going for blackjack, particularly when it comes to private markets, as I wrote in the 12.1.24 AGM Alts Weekly.

At the time, I wrote:

BlackRock’s innovation in private markets has no bounds. Their partnerships with Partners Group and iCapital follow three major acquisitions that put BlackRock’s stamp on private markets. eFront was BlackRock’s foray into private markets data and infrastructure (along with investing in iCapital in 2016). They followed up the eFront acquisition with the purchases of GIP and Preqin, paying a combined $15.7B for these respective firms.

This week’s Annual Chairman’s Letter to Investors, penned by BlackRock Chairman Larry Fink, took things a step further.

BlackRock’s moves in private markets throughout the years have signaled that private markets are an increasingly integral part of the future of the firm.

But his words this past week shook the earth.

The future is here.

He made it clear — in no uncertain terms — that BlackRock is no longer just a traditional asset manager:

BlackRock has always had a foot in private markets. But we’ve been—first and foremost—a traditional asset manager. That’s who we were at the start of 2024. But it’s not who we are anymore.

Who are they?

Following the acquisitions of HPS and GIP, BlackRock’s private markets franchise stands at over $600B in AUM, placing it amongst the top five managers of alternative assets by AUM. According to figures cited in Fink’s letter, the franchise generates over $3B in revenue.

BlackRock is certainly operating at the intersection of both public and private markets — and the firm is right in the middle of two industries that appear to be on a path of convergence.

The pieces of the puzzle across public and private markets are being put into place.

Private markets investing

GIP and HPS provide BlackRock with large and growing franchises to serve institutional and individual investors in categories that require a massive supply of capital to meet demand.

As Fink wrote, “there's between the demand for investment and the capital available from traditional sources.”

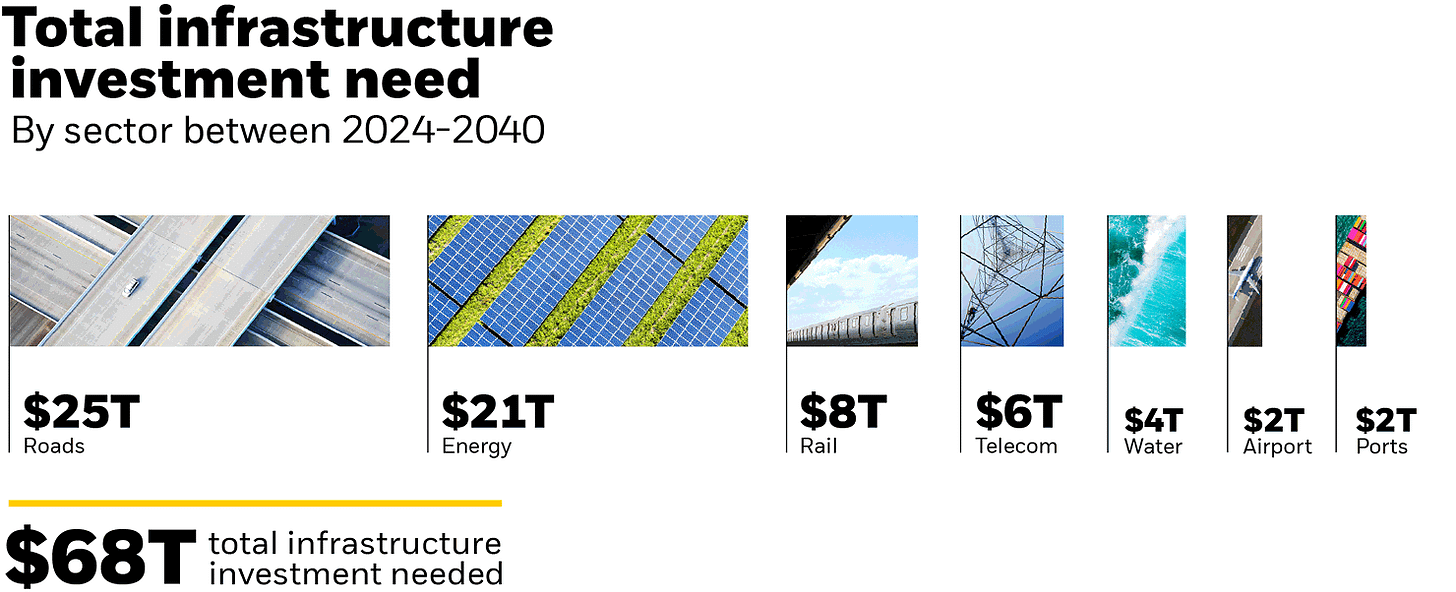

Infrastructure is one example cited by Fink. A $68T investment into critical infrastructure like roads, bridges, railways, energy, airports, water, and ports, is required by 2040.

Government debt and deficits have put countries in the difficult position of having to figure out how critical infrastructure — which helps the welfare and well-being of their populations — is financed.

Perhaps private markets can play a role in offloading some of the burden on governments and taxpayers to shoulder the costs of building new infrastructure.

And, as Fink notes, it’s not just governments that face these challenges. As many of the world’s largest tech companies race to build the scale and capabilities to handle the transformation to AI, large pools of capital will be required to finance data centers. It was quite eye-opening to read that Fink stated that a single AI data center can cost between $40 billion and $50 billion.

Public markets dominance

BlackRock has long figured out how to use size and scale to win and own markets.

They’ve found ways to build a large franchise across ETFs, active strategies, and index products on the traditional asset management side.

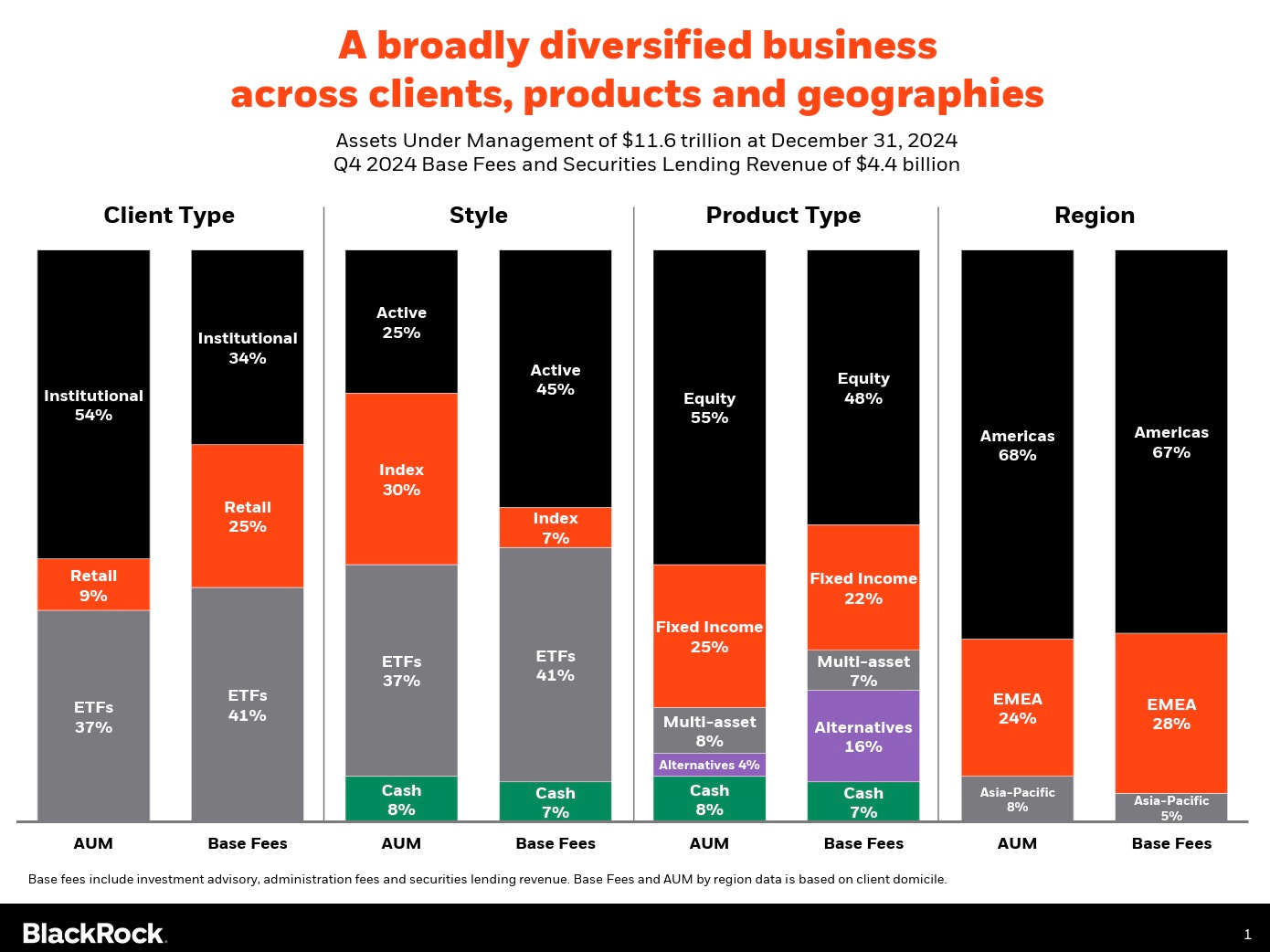

The firm’s focus — and strategic moves — have made them the market leader with over $11.6T in total AUM.

Innovations in product structure have also helped to assert market dominance. A focus on model portfolios, first in public markets and now in private markets, has made it easier for advisors to allocate to products and investment solutions.

But, with fee compression in public markets, it’s not hard to see why BlackRock has made such a big bet on private markets.

As the below chart from BlackRock’s Q4 2024 earnings call illustrates, private markets represent around 4% of BlackRock’s $11.6T AUM but 16% of the firm’s base fees. Public equity and fixed income are heading in the opposite direction. Equity represents 55% of BlackRock’s AUM but 48% of its base fees. Fixed income represents 25% of BlackRock’s AUM but 22% of its base fees.

But it’s not just the ability to manufacture and sell product that has given BlackRock such an advantage with growing inflows.

It’s also that the firm has managed to insert itself into the desktop real estate of the advisor with technology.

Desktop real estate

BlackRock’s Aladdin has been a masterstroke on many levels.

As Fink notes, the software solution generates $1.6B in annual software revenues for BlackRock.

But it’s more than just a revenue generating business unit. It’s the desktop real estate for many advisors and allocators who look to Aladdin to understand portfolio construction, risk, and rebalancing.

Fink said:

Aladdin is powering a whole portfolio ecosystem across public and private markets with eFront and our recent acquisition of Preqin. This growing platform changes the complexion of BlackRock — one that we feel delivers for client needs and results in over 20% of our revenue base in long-dated, less market-sensitive products and services. Our revenue mix will continue to shift organically as private markets, technology and customized solutions experience higher secular growth. We believe this will translate to higher and more durable organic growth, greater resilience through market cycles, and long-term value for shareholders.

Fink’s comments highlight the deliberate chess moves made by BlackRock to fit together pieces of the puzzle to provide a single solution — across public and private markets.

The acquisition of eFront brought private markets capabilities around portfolio management and risk monitoring to Aladdin’s public markets’ prowess.

The more recent acquisition of Preqin gives BlackRock the ability to do something even greater: create indices for private markets.

Will this be a promise that is realized? There are a number of questions as to how (and should) an index for private markets would be constructed.

But one thing is certain: Preqin’s data will provide BlackRock customers with vast amounts of performance data and information on over 190,000 private markets funds and 60,000 private markets managers.

Private markets is in the midst of a transformation — and one that is driving more transparency to the forefront as more investors access private markets via new products that are (in certain cases) marked more frequently.

More data and better data help to further the push to make private markets more public (we can debate whether making private markets more public is a good thing — and how it’s done, whether that’s a good thing — but that’s for another day).

When combined with BlackRock’s recent announcement about the creation of a private markets model portfolio with Partners Group and a unified managed account solution with iCapital and GeoWealth, the pieces of the puzzle start to fit together.

BlackRock is figuring out ways to provide total portfolio solutions by merging public and private, individual funds and models.

Fink noted that the firm did it before, breaking down the index vs. active barrier. And he said BlackRock has the opportunity to do it again with public vs. private.

To do this? Fink calls for the 50/30/20 portfolio rather than the 60/40.

That 20%?

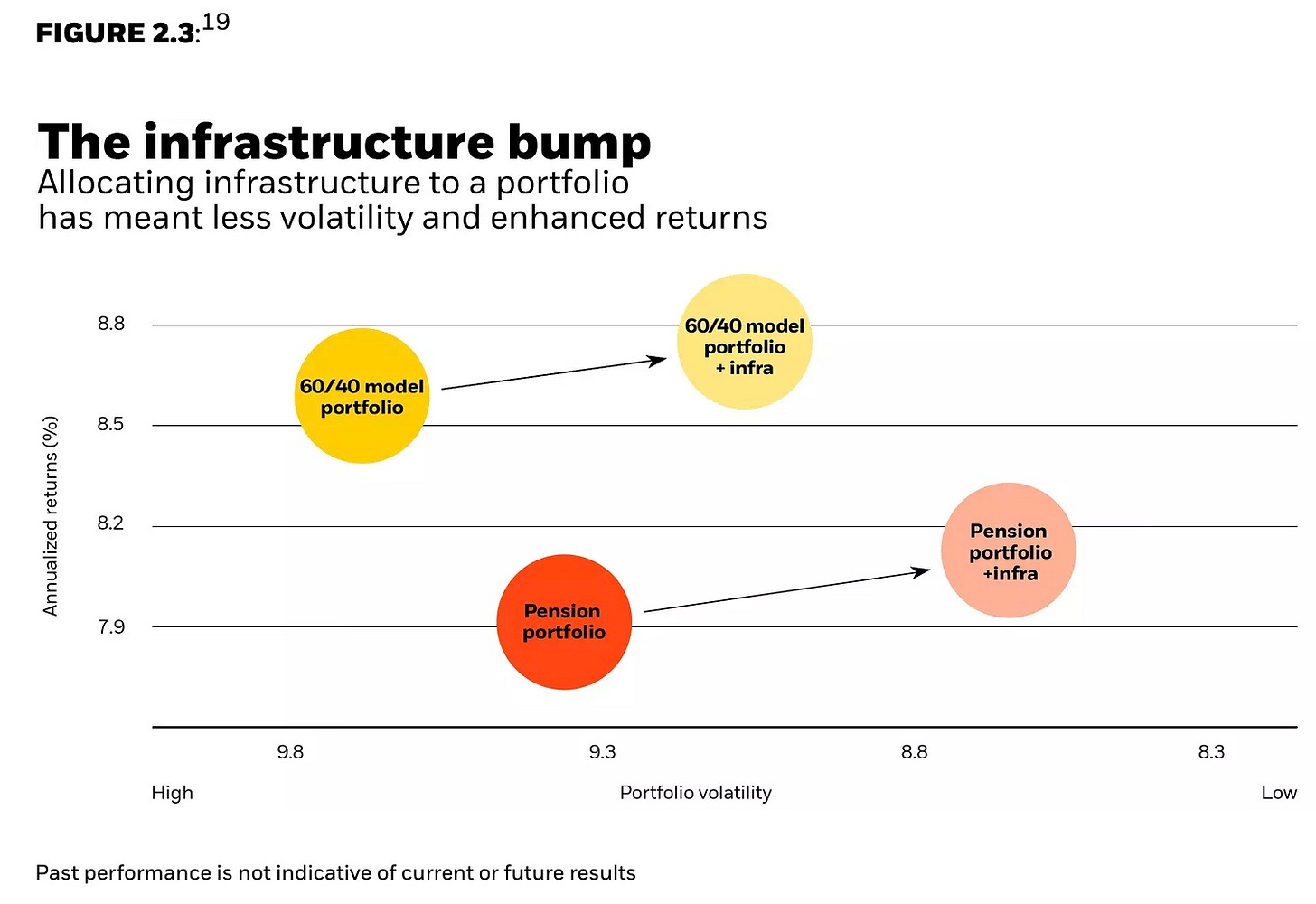

Private markets, with infrastructure and private credit amongst the top of the list. Fink makes the case for allocators to add infrastructure to a portfolio. As the chart below illustrates, infrastructure reduces portfolio volatility and increases annualized returns.

Fink’s letter was a fascinating window into how the leadership at the world’s largest asset manager is thinking about the evolving nature of investing — and why the convergence of public and private is a defining feature of the current market structure.

But it’s an equally interesting exercise to read between the lines of Fink’s words and consider what he and the firm could be thinking about for the future.

What other pieces of private markets are required for BlackRock to complete the puzzle?

In December, I wrote in the 12.8.24 AGM Alts Weekly that BlackRock would likely try to round out its private markets capabilities.

It would seemingly make sense for BlackRock to round out their private markets capabilities on the investment product side by fortifying other investment strategies, such as private equity, secondaries, venture, and possibly even a category like GP stakes or sports. There’s also reason to believe that they could continue to acquire their way into valuable software solutions that further the buildout of the Aladdin, eFront, and Preqin technology suites with either pre-investment workflows, distribution tools, or post-investment data and analytics that would add important features to the Aladdin toolkit.

How would BlackRock go about doing this?

Private equity would seemingly be next in line. Following landmark acquisitions of blue chip alternative asset managers in infrastructure (GIP) and private credit (HPS), respectively, private equity would be the next big swing for BlackRock to take.

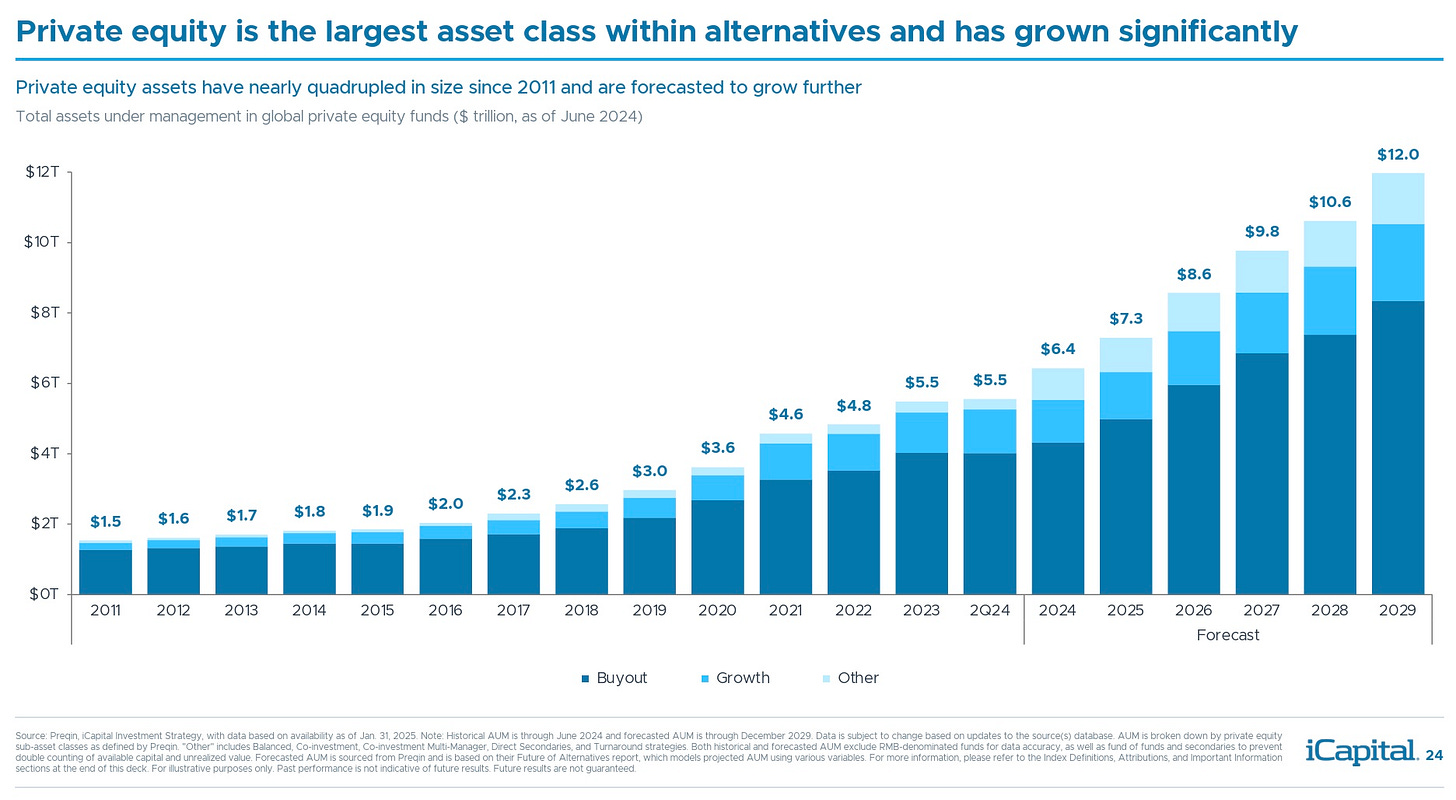

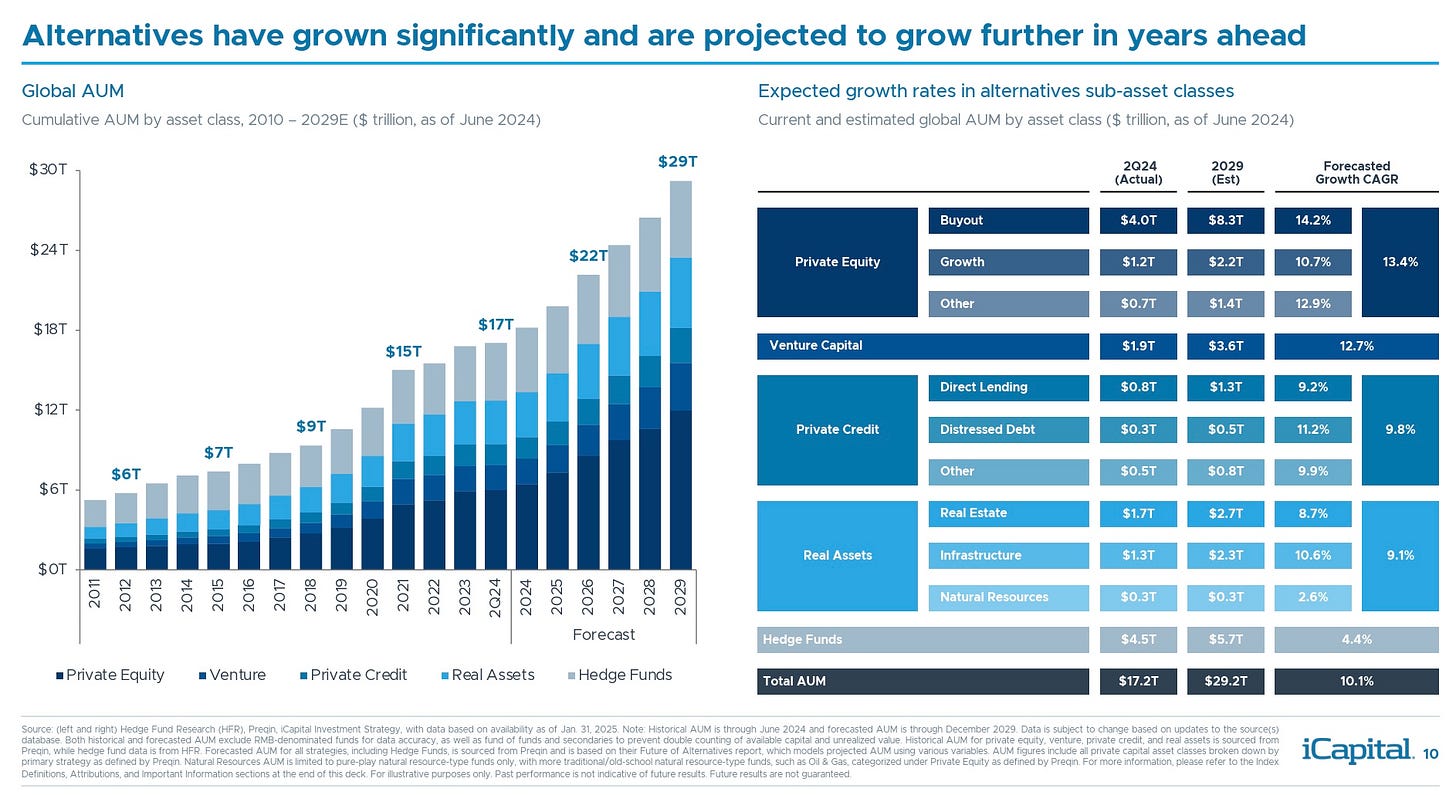

A chart from iCapital’s Alternatives Decoded chartbook illustrates private equity’s projected growth over the next five years (from 2024), which could double the size of the industry by 2029.

Private equity is projected to outpace other asset classes within private markets over the coming years, making it an attractive asset class that possesses market-leading capabilities.

BlackRock’s private equity ambitions are no secret.

In late 2023, BlackRock was reportedly looking to partner with Warburg Pincus to develop joint products. This apparently came after BlackRock wanted to buy a majority stake in independently owned Warburg Pincus.

That clearly would have been a transformative deal for BlackRock (and Warburg Pincus) if it had happened.

More recently, BlackRock built out a strategic partnership with $152B AUM and evergreen fund pioneer Partners Group to build out a “first-of-its-kind model portfolio solution streamlining retail wealth access to private equity, private credit, and real assets.”

Could this partnership be a foreshadowing of BlackRock making an even bigger move in private equity than a partnership, just as they’ve done in private credit and infrastructure by buying HPS and GIP, respectively?

It’s certainly possible.

Another area where BlackRock could make a big move is in secondaries.

The growing size and scale of the secondaries market combined with BlackRock’s push into private markets data — and product innovation that could come off the back of that — could make secondaries an attractive category for BlackRock to make its next big move.

Ardian’s record $30B fundraise in the firm’s latest flagship secondaries fund — coupled with industry dynamics of slowing distributions and the need for LPs to unlock liquidity — could be foreshadowing that secondaries funds could be the big AUM machines going forward.

BlackRock’s ~$127B market capitalization and its ~$6.6B in net income (in 2024) makes it possible for BlackRock to have the currency to make a number of moves that could continue to bolster its private markets franchise.

Acquisitions are far from easy in private markets. Culture and incentives for investment teams are paramount when it comes to consolidation, but if BlackRock proves that the blueprint can work with the successful consolidations of GIP and HPS, then perhaps a manager on AGM’s Next Wave could be next in line for BlackRock’s private equity ambitions.

If BlackRock wants to lean into secondaries? Perhaps Ardian or Coller Capital could be fits.

If BlackRock wants to add scaled specialist capabilities in areas like software investing expertise or another core competency? Vista, Thoma Bravo, Silver Lake, Veritas (for its focus on government, healthcare, and education) or Francisco Partners could all make sense.

If BlackRock wants to lean more heavily into making a bet on Europe (more on that later) and add a leading European software investor? Hg could make sense.

It will be interesting to see the sequence with which BlackRock strategically approaches the buildout of its private markets capabilities.

Fink mentioned the possibility of extending the vision of creating more transparency in private markets to something even more profound: indexation.

With clearer, more timely data, it becomes possible to index private markets just like we do now with the S&P 500. Once that happens, private markets will be accessible, simple markets. Easy to buy. Easy to track. And that means capital will flow more freely throughout the economy. The prosperity flywheel will spin faster, generating more growth—not just for the global economy or large institutional investors, but for investors of all sizes around the world.

BlackRock’s acquisition of Preqin gives BlackRock the ability to manage and track the performance of private markets funds. That’s a precursor to manufacturing products.

When it comes to indexing a market, I certainly wouldn’t bet against BlackRock.

I’ve called BlackRock an “index company” in the past. The scale and size that makes a firm like BlackRock a market leader means that it can serve as a relative proxy for a market.

To some extent, BlackRock has been an index company for public markets. The growth of BlackRock’s AUM and product suite in liquid markets has enabled more people to invest into public markets. Now, they appear poised to run a similar playbook in private markets.

I’ve written about Index Companies in the past — and believe that businesses that own both the infrastructure and distribution will be defining companies in private markets. The most successful public and private alts companies will own their customers and grow their AUM through product distribution and toll-taking infrastructure / rails that enable institutional investors, wealth managers, and individuals to access alternatives.

BlackRock has owned both infrastructure (ETF / Index product manufacturing, Aladdin) and distribution in liquid markets, despite being in a highly fragmented asset management world. Now, can BlackRock do the same in private markets?

What BlackRock did in public markets by owning both the infrastructure and distribution has put the firm at the epicenter of the action and the flows. It’s enabled BlackRock to manufacture products across ETFs and Index Funds off the back of data and intelligence.

Could BlackRock do the same in private markets now that the supply chain of financial technology infrastructure and portfolio management, product manufacturing, and distribution are all under one roof?

Perhaps. This point dovetails with another profound point made by Fink around unlocking access to new markets.

Fink discussed tokenization at length in his letter.

The creation of index products for private markets and tokenization are tied together by the same theme: unlocking access for more investors.

Fink believes that tokenization is a real possibility.

If they are, it will revolutionize investing. Markets wouldn't need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth.

He makes it clear that more time and innovation are required to re-architect the pipes and plumbing to enable tokenization, particularly as it relates to innovations with digital identity verification that can pave the way for tokenization.

But, tokenization has the potential to do something at the heart of Fink’s letter: democratize access.

Fink says that “tokenization makes investing much more democratic,” particularly as it relates to accessing private markets assets.

Tokenization allows for fractional ownership. That means assets could be sliced into infinitely small pieces. This lowers one of the barriers to investing in valuable, previously inaccessible assets like private real estate and private equity.

When you own a stock, you have a right to vote on the company’s shareholder proposals. Tokenization makes that easier because your ownership and voting rights are digitally tracked, allowing you to vote seamlessly and securely from anywhere.

Some investments produce much higher returns than others, but only big investors can get into them. One reason? Friction. Legal, operational, bureaucratic. Tokenization strips that away, allowing more people access to potentially higher returns.

Why is unlocking access to more investors so critical?

Because more people need the ability to save for retirement, particularly as innovations in healthcare means that people may live longer.

Fink rattles off some incredibly alarming stats, which is particularly relevant given that reportedly half of the $11.6T in AUM managed by BlackRock is retirement money.

A 2025 BlackRock survey found that 33% of Americans have no retirement savings. 51% of Americans are reportedly more worried about outliving their savings than of death itself.

What’s a number that would make people more comfortable in retirement?

BlackRock surveyed Americans, asking how much money they'd need to retire comfortably.

BlackRock found that “it was just over $2 million—$2,089,000, to be exact. That’s a lot. More than I was expecting,” wrote Fink. “And almost no one is close. Even Gen-Xers, the oldest of whom will start retiring in five years, are falling short. In fact, 62% have saved less than $150,000.”

Fink makes the case for adding private markets exposure to retirement accounts — and he chalks it up to returns:

We're going to need better ways to boost portfolios. As I wrote earlier, private assets like real estate and infrastructure can lift returns and protect investors during market downturns. Pension funds have invested in these assets for decades, but 401(k)s haven't. It’s one reason why pensions typically outperform 401(k)s by about 0.5% each year.40

Half a percent doesn't sound huge, but it adds up over time. BlackRock estimates that over 40 years, an extra 0.5% in annual returns results in 14.5% more money in your 401(k). It’s enough to fund nine more years of retirement, helping you stop working on your own terms. 41

Fink makes the important point that for private markets to be included in retirement accounts, more transparency and real-time data is required.

That’s a critical point — and one that’s a focal point of this private markets market structure evolution as we speak.

I wouldn’t be shocked to see BlackRock continue to build out its private markets data capabilities through the acquisition of other post-investment data and analytics businesses that are focused on portfolio monitoring, valuations, and fund administration. Businesses that drill down on asset level data and more real-time, accurate reporting of asset and fund performance are critical to functioning market structure.

Innovation in data and technology will be one part of the private markets puzzle for BlackRock to solve retirement savings challenges not only in the US, but also in other parts of the world.

Fink calls out Europe as a region on the rise.

It was BlackRock’s 2006 acquisition of Merrill Lynch’s asset management business, anchored in London, Fink notes, that “set [the firm] on the path to becoming the largest asset manager in the world.”

But I think Europe is waking up. The policymakers I talk to—and I talk to a lot—now see that the regulatory roadblocks aren’t going to remove themselves. They need to be addressed. And the upside is enormous. According to the IMF, reducing intra-EU trade barriers to the level between U.S. states could boost productivity by nearly 7%, adding an astounding $1.3 trillion to its economy—the equivalent of creating another Ireland and Sweden.53

And now BlackRock is playing a major role in shaping the growth of an investing culture in Europe, according to Fink.

Similarly, ETFs are facilitating growth of an investing culture in Europe. As first-time investors begin to enter the capital markets, it’s often through ETFs, and particularly iShares. Only one-third of European individuals have capital markets investments, compared to more than 60% of Americans. Not only are they not participating in the growth potential offered by the broader capital markets, but they’re also often losing out on a real return as low interest rates in bank savings accounts are outpaced by inflation. We’re working with established players plus several newer entrants in Europe, including Monzo, N26, Revolut, Scalable Capital, and Trade Republic, to lower the barriers to investing and build financial knowledge in local markets. With our now more than $1 trillion European ETF platform, which is larger than the next five issuers combined, we see a tremendous opportunity to grow our regional offerings and help more individuals reach their financial goals through the capital markets.

I certainly wouldn’t bet against Europe. It’s a hub of financial activity — and certainly, when it comes to capital markets innovation, London has been home to some of the market’s most important market infrastructure businesses.

It doesn’t sound like Fink would bet against Europe either, which makes it an interesting locale for continued innovation in private markets market infrastructure. Perhaps, it shouldn’t come as a surprise that BlackRock’s private markets technology acquisitions include eFront, a company with French origins, and Preqin, a company with English origins. What’s next?

Fink concludes his letter with a point quite profound: “Investing isn’t just an act of hope; investing is what makes our hopes, our reality.”

Private markets is just one piece of the puzzle. But the need to finance critical infrastructure and innovation can be filled in part by private markets.

And now individuals have increasing opportunities to participate in that capital markets activity, thanks, in part, to firms like BlackRock that are pushing the market structure forward yet again.

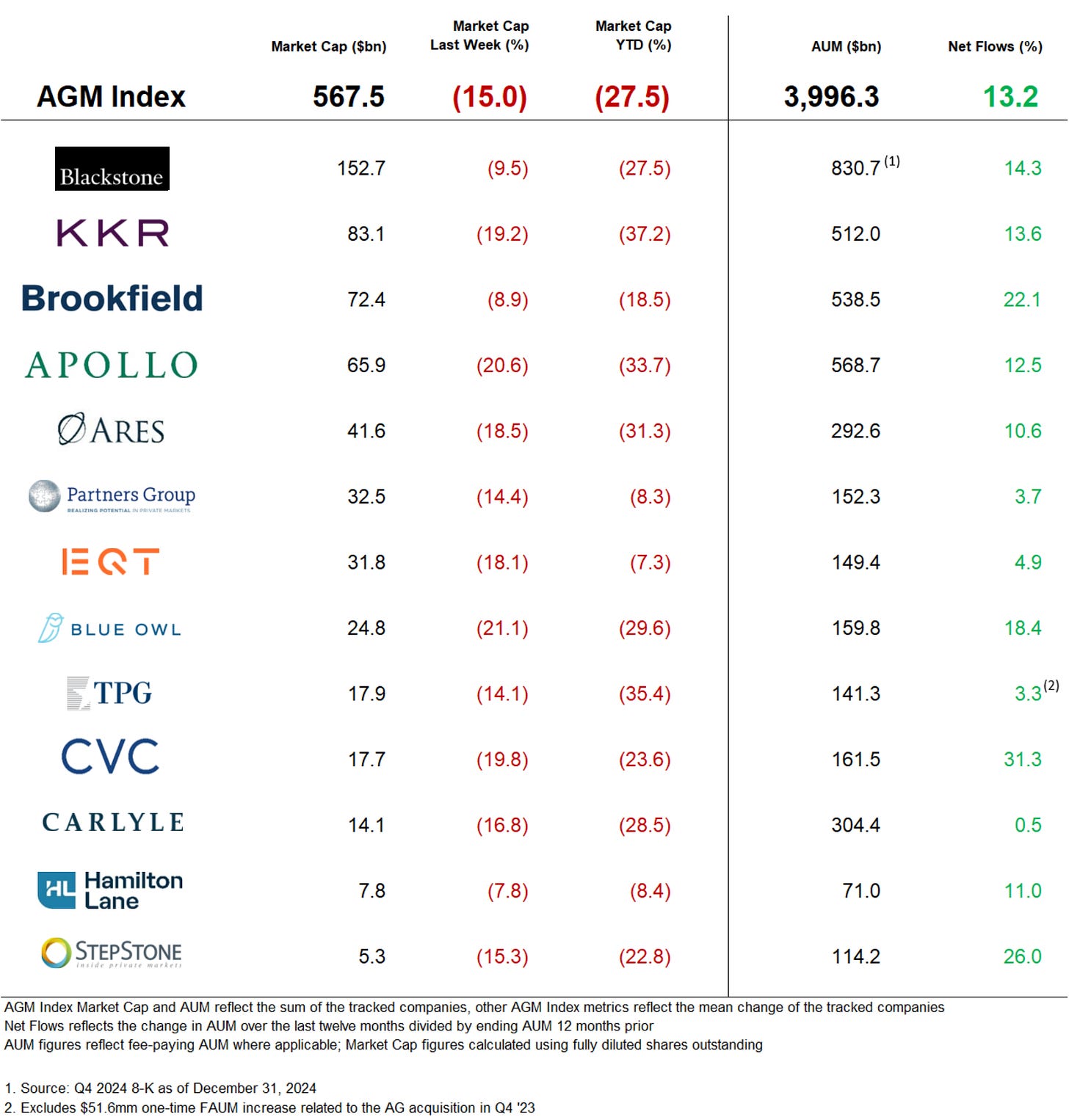

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

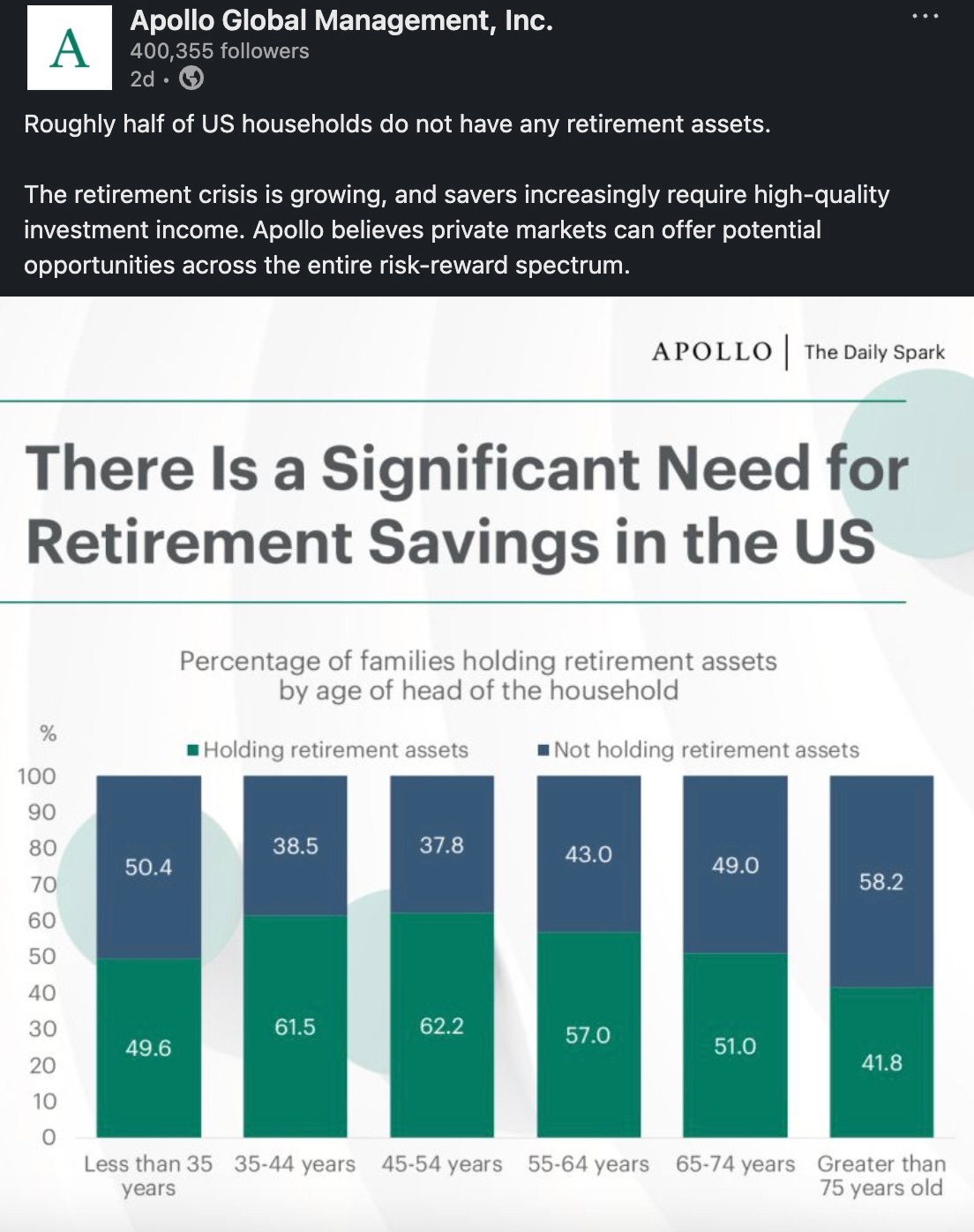

Apollo posted an alarming statistic on LinkedIn. Roughly half of US households do not have any retirement assets.

💡Financial Times’ Mary McDougall reports that the UK’s first commercial pension “superfund,” Clara Pensions, is planning to invest over £3B into private markets in the next three years. This mandate comes at a time when UK Chancellor Rachel Reeves has been calling for increased investment in the economy. Clara is collaborating with wealth manager Van Lanschot Kempen to expand its illiquid holdings from £150M as it takes over more schemes. Clara CEO Simon True said its expects to launch its private markets fund “in the next few weeks,” as the firm’s pipeline of £10B should have “30-35% [targeted] for private markets.” True also said that “up to half” of those assets would be invested in the UK. News of Clara investing into private markets comes at a time when ministers have been seeking to encourage pension funds to spend more in the UK. Funds such as Clara appear to stand to benefit from a push to allocate assets into private markets and in the UK. In January, PwC estimated that more than 200 defined benefit schemes, totaling around £150B of assets, could benefit from being transferred into a superfund such as Clara. Clara’s focus on private markets comes at a time when other pension schemes have also said they would increase investment activities into private markets. Earlier last week, the Pension Protection Fund, the UK’s pensions lifeboat, said it would increase its investments in UK infrastructure and fast-growing companies from 7.5% to 10% of the fund.

💸 AGM’s 2/20: News of Clara Pensions turning an increasing focus on private markets is emblematic of a bigger question: how can private markets become a part of retirement assets? There are a number of questions to solve, chief amongst them risk, illiquidity, and more real-time valuations of private markets assets, but it’s a worthy problem to solve. As BlackRock’s Larry Fink mentioned in his Annual Chairman’s letter, helping real money earn more as they save for retirement is a critical question that both capital markets participants and governments alike need to solve. Pension schemes can play an important role in ushering in the ability for individual investors to gain exposure to private markets in a thoughtful way. At a time when an increasing number of direct-to-consumer solutions are being built in the brokerage world (mainly for traditional, public markets assets), intermediaries and institutions that manage money on behalf of individuals have both a critical responsibility and a valuable position to provide thoughtful and institutional-quality access to private markets. This news comes months after Fidelity International announced that they will integrate private markets assets via a Long-Term Asset Fund (LTAF) into its £16.9B FutureWise default investment strategy for UK-based workplace pension schemes.

Pensions, in many cases, have the size and scale to invest into private markets in a way that enables access to some of the largest alternative asset managers at a size and scale that can benefit its members. Clara, for its part, has a partnership with Sixth Street, where Sixth Street has provided capital to Clara to allow for consolidation of pension liabilities in the UK. That was in 2018. It’s not a surprise that the industry has seen more collaboration between alternative asset managers and both pensions and insurers as private markets becomes an even more critical feature of ensuring that pensions and insurers meet return expectations for its members (provided that manager selection is robust and fees are appropriate).

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Legal & Compliance - Private Wealth Solutions - Core Compliance, AVP. Click here to learn more.

- Investor Relations Professional. Click here to learn more.

- Global Wealth Solutions - Investor Relations - Principal - Japan. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

- Credit Executive Office, Senior Associate / Associate. Click here to learn more.

VP, Private Markets Products. Click hear to learn more.

- Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click hear to learn more.

- Vice President, Data Intelligence. Click here to learn more.

- Alternative Investment Specialist. Click here to learn more.

- Merger & Acquisitions Associate. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch the third episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Global Head of Alternative Investments Product at live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with ’s Global Head of Product in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear US Financial Intermediaries Leader and ’ MD and Head of Investments on following the fast river of alts. Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Boardshare the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎥 Watch internet pioneer , , share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.