AGM Alts Weekly | 3.30.25: The business of storytelling is evergreen

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC.

Last week, over 800 people in the private markets and wealth management industries descended on Phoenix.

It wasn’t just to enjoy the warm, inviting desert air and play golf (although that did happen).

It was to come together to discuss trends and topics that were top of mind at the intersection of private markets and wealth management.

iCapital’s Connect conference artfully captured the pulse of the industry. At a time when complexity only seems to be increasing — whether geopolitical or with product innovation — speakers and attendees managed to balance optimism and excitement about the future of the industry with practical and tactical advice for how to navigate uncertain times and markets.

Undoubtedly, there’s an excitement about private markets that is undergoing a rapid evolution. But that evolution comes with uncertainty, as asset managers and wealth managers are searching for who they want to be as they grow their respective businesses.

Private markets have hit a new frontier. And central to the next wave of growth is wealth.

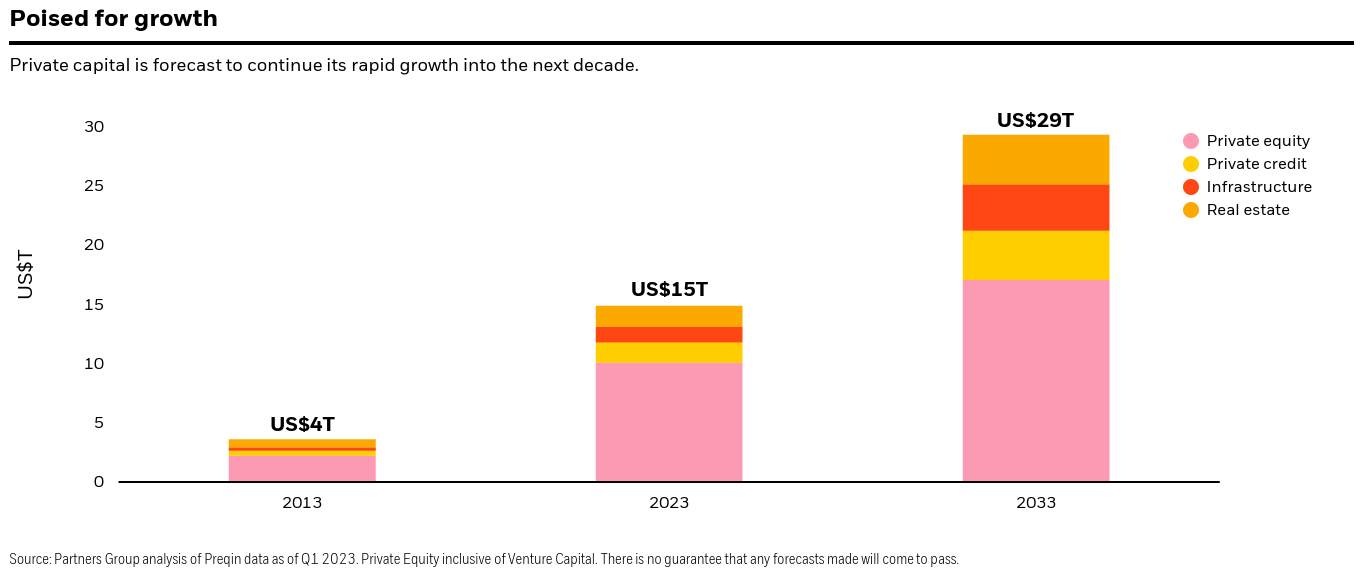

A chart from a recent BlackRock report on private markets (2025 Private Markets Outlook) highlights the projected growth in the industry, which is expected to nearly double asset growth from 2023-2033.

As BlackRock notes, there is complexity with this industry evolution:

This democratization comes with challenges. These emerging vehicles require new processes. Ensuring that private markets are effective within the portfolios of these new investors calls for portfolio construction expertise to build diversification, while providing a degree of liquidity.

Solving these challenges requires a broad suite of tools. Modeling is essential to predict cashflows, manage liquidity and optimize holdings. Equally important is finding the right mix with public-market assets to provide liquidity and mitigate the J-curve often seen in private markets.

We are still in the early stages of this new phase in the private markets, with rapid developments in product design, regulatory frameworks, as well as the tools and solutions for clients.

How does the industry make sense of all of this?

On one hand, iCapital Connect is just one conference organized by one company for its clients.

But, if one takes a step back and examines the conference, the programming, and the attendees, a bigger picture emerges.

As I thought about the conference and what it encapsulates about the state of the industry, these seven “C’s” came to mind: complexity, customization, collaboration, content, connections, community, and caring.

Private markets are in the midst of a number of seismic shifts.

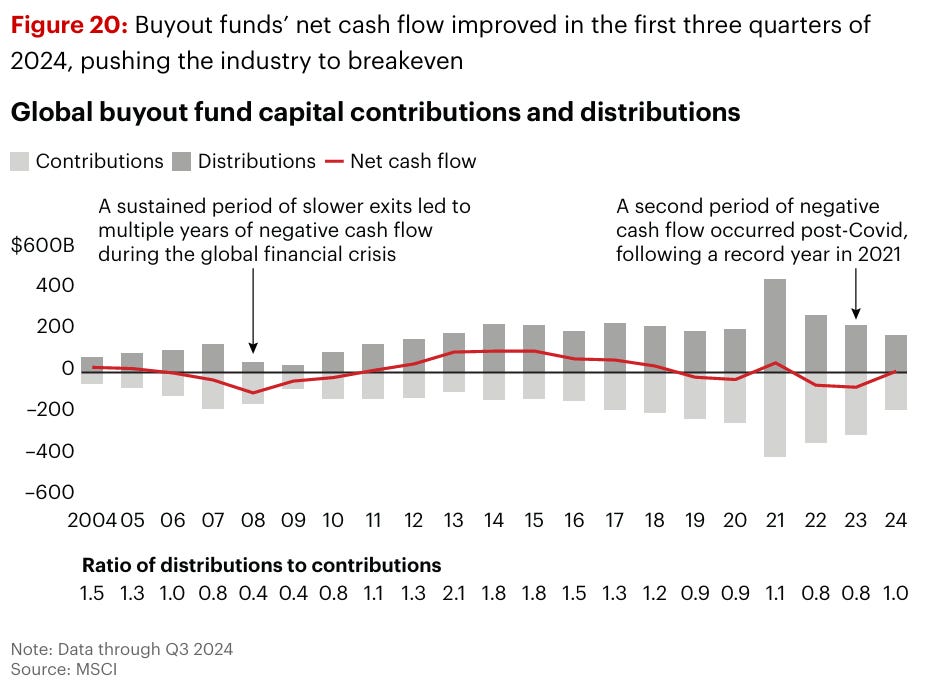

The slowed state of distributions has made it hard for institutional investors to continue their investment pace in private markets. The below chart from Bain & Company’s 2025 Global Private Equity Report highlights the declining rate of distributions in recent years to buyout funds, putting pressure on a $4T part of the private markets industry.

The wealth channel was already the next frontier of growth for asset managers, but a more challenging fundraising environment has intensified efforts to work with wealth.

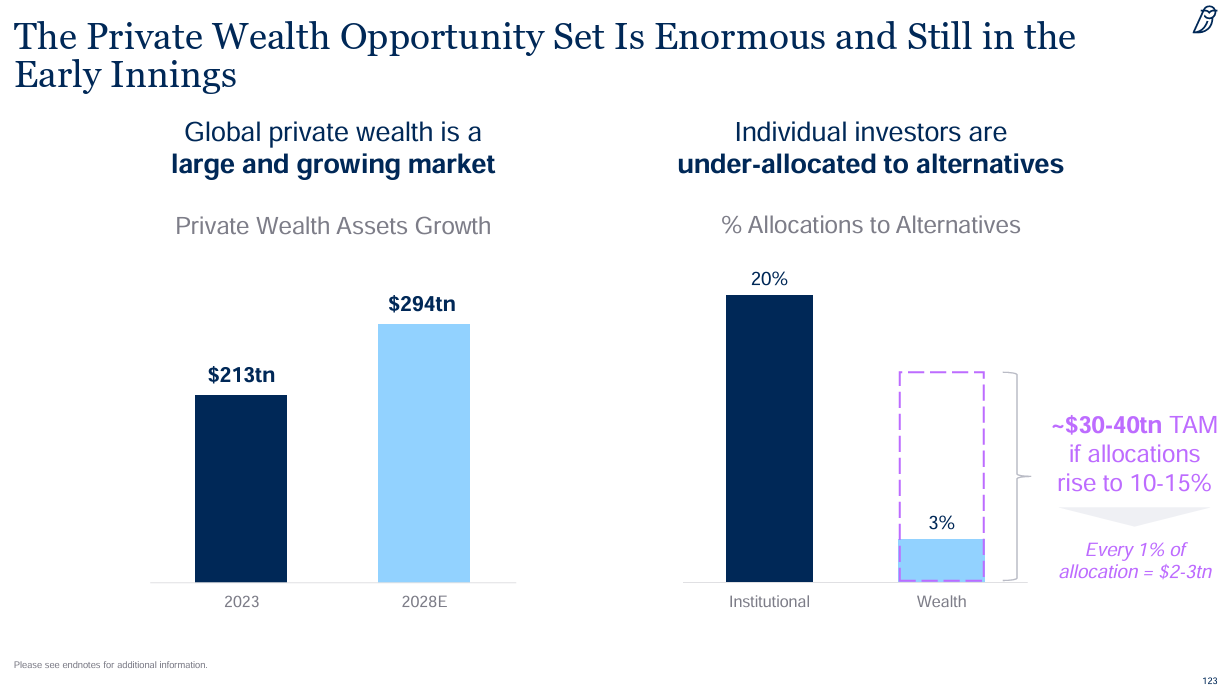

And the opportunity is massive.

Blue Owl’s Investor Day presentation lays out the size and scale of the opportunity: $30-40T could be at stake by 2028 (assuming $294T of private wealth assets) if private wealth allocations rise to 10-15%.

The focus on the wealth channel has meant a Cambrian explosion of product innovation.

Efforts to provide access to a growing population of investors have resulted in a golden age of product innovation combined with a distribution deluge.

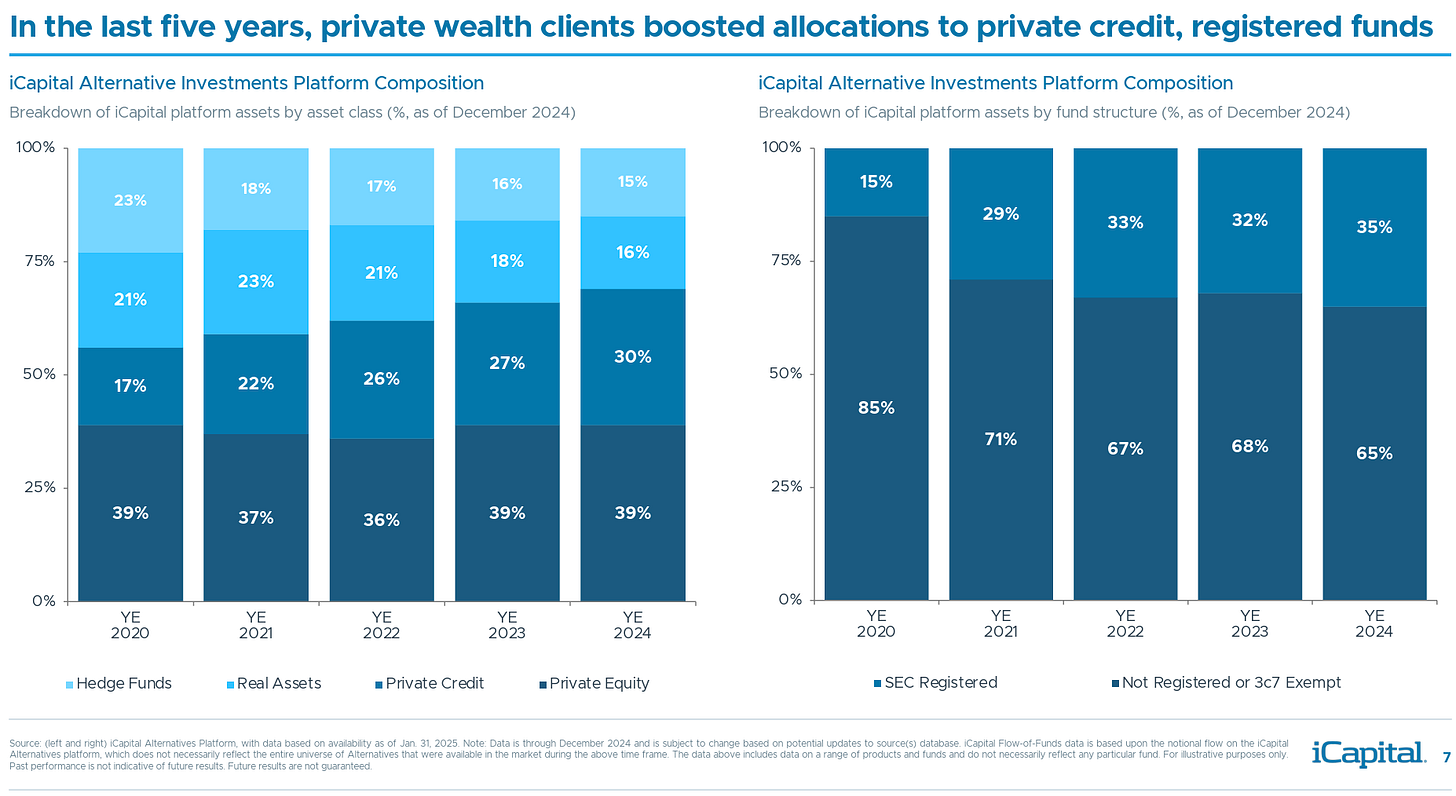

The rise in evergreen and registered fund structures is encapsulated in iCapital’s Alternatives Decoded chartbook, which illustrates the marked growth in allocations to SEC-registered funds over the past five years.

This week’s news took product innovation a step further. Bloomberg’s Allison McNeely reported that KKR is planning to grow its Strategic Holdings unit, long-term investments made from its balance sheet, into what Co-CEO Joe Bae recently called a “mini-Berkshire Hathaway.”

KKR has already innovated with its Conglomerate structure, an operating company structure that makes long-term investments across its platform available to the wealth channel (and institutional LPs, if they wish) in an evergreen fund structure. The intensifying focus on its Strategic Holdings unit, which the firm projects to generate $1.1B in operating earnings by 2030, illustrates that firms are focused on other ways to enable investors to access private markets, this time through owning the firm’s stock. Now, it’s worth noting that KKR’s Strategic Holdings is only one part of the firm’s operations and revenue stream, so it is not identical to Berkshire Hathaway. But, by growing this structure, it certainly could be an incentive for investors in public markets to think about gaining exposure to KKR’s stock since it would offer exposure to the dividends and cashflows from the Strategic Holdings group.

Another groundbreaking product innovation was announced at iCapital’s conference: the launch of a UMA (unified managed account) that includes a private markets allocation.

Which brings me to the next themes that were prevalent in many conversations at the conference …

Private markets is balancing two major — and somewhat competing — forces: customization and scale.

Wealth managers are looking to find ways to provide differentiated service and customization to clients, but do so in a way that enables them to scale their practice.

Asset managers understand the importance of meeting advisors where they are in terms of how they adopt private markets — and enable them to serve more clients.

This week’s announcement of the first-of-its-kind model portfolio that includes both public and private markets strategies is a major milestone for the industry.

Product innovation was needed to enable the inclusion of private markets strategies in a model portfolio. Technology infrastructure — from pre- to post-investment — needed to be built to streamline the process of investing in private markets. The ability to capture and track private markets performance so that valuations are readily available needed to be purpose-built to serve evergreen structures.

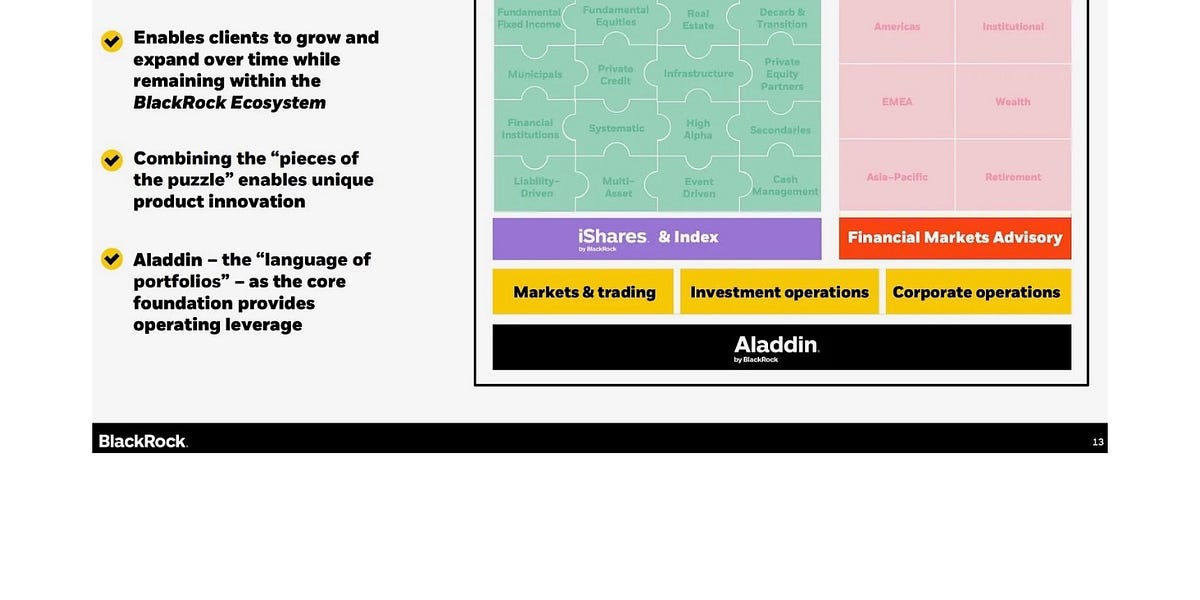

All of these features are now a part of private markets. And they’ve culminated in a partnership between BlackRock, iCapital, and GeoWealth, where models that include both public and private markets exposure through a UMA are now available to advisors.

The models, which were released on Wednesday, will initially include BlackRock’s own funds — a Private Credit Fund with $1.1B AUM and its Private Investments Fund with $300M in private equity assets. Over time, it’s likely that the models will include exposure to funds managed by BlackRock’s newly acquired businesses in credit (HPS) and infrastructure (GIP).

Private markets has often been thought of as part of asset allocation where funds are sold, not bought.

There’s not yet a “buy” button in private markets, but it’s possible that model portfolios could turn into that feature for the wealth channel.

In an interview with WealthManagement.com when the partnership was announced last October, BlackRock’s MD, Co-Head of US Wealth Business Jaime Magyera said: “Part of this is bringing together a platform that helps an advisor personalize and customize a portfolio across public and private markets and then easily, conveniently implement that through a platform. And that’s what we are doing through this partnership. Today, there are probably $4 trillion to $5 trillion sitting in model portfolios. We think in the next few years, it will double. That space — model portfolios, custom portfolios — is going to be the future of the wealth industry. But it has to be easy; it has to be implemented in a very convenient way.”

Private markets model portfolios and UMAs that include private markets exposure are in their infancy. The next stage will include further customization of these models, where allocators can choose which managers and strategies they would like to include in their models. Taking that a step further, wealth managers will likely be able to choose managers and strategies in customizable fashion by client.

This innovation has meaningful implications for alternative asset managers. Fund managers who have the ability to responsibly create and manage evergreen funds could become fits for model portfolios. Firms that lack the size and scale of the largest managers that have distribution teams armed with requisite boots on the ground to properly cover wirehouse, IBD, and independent wealth channels could have the chance to punch above their weight in asset gathering if they find ways into models. Certain firms will have the ability to build their own firmwide models, but customization will be a defining feature of the wealth channel’s adoption of private markets going forward, so I anticipate that we’ll see managers join forces to create “best-of-breed” models.

After all, as one of my interview guests said at iCapital’s conference, “it’s difficult to be all things to all people.”

Certainly, the BlackRock, iCapital, GeoWealth partnership is big news.

But all of this ability for customization would not be possible without collaboration.

A unified managed that includes private markets exposure couldn’t work without the infrastructure and rails, or the “chassis that [they] are able to deliver the entirety of BlackRock’s private markets capabilities and the entirety of BlackRock’s public markets capabilities through this one portfolio,” as BlackRock’s Magyera said to Bloomberg.

iCapital’s end-to-end infrastructure for workflows in a private markets investment process and GeoWealth’s TAMP, which allows for “seamless delivery of both advisor-managed and third-party model portfolios,” are the enablers of this innovation.

The history of capital markets infrastructure is defined by examples of industry collaboration that has propelled the creation of industry giants to make markets function better.

Markit, Tradeweb, MarketAxess are just a few examples of this phenomenon that has shaped market structure.

Industry collaboration is also critical if the wealth channel is to adopt private markets in a meaningful way.

Education is a key part of the collaboration between asset managers and the wealth channel. The alternative asset managers present at the conference made an effort to engage and educate. Wealth managers were there to build and deepen relationships and learn about private markets and the firms in the industry.

Education is an area of private markets where meaningful and thoughtful investment from all firms benefits everyone involved. The more work asset managers do to deliver high-quality content on private markets to the wealth channel, the more they will be able to deepen and grow their connections. After all, these investments are long-lived so building strong connections is critical to gaining trust within the wealth channel even if it takes years before a wealth manager allocates to a fund.

Content is critical to educating and driving engagement. Asset managers cannot do distribution well without the constant aerial support of marketing to supplement their boots on the ground distribution teams.

A key ingredient in the equation? Advisor and client education.

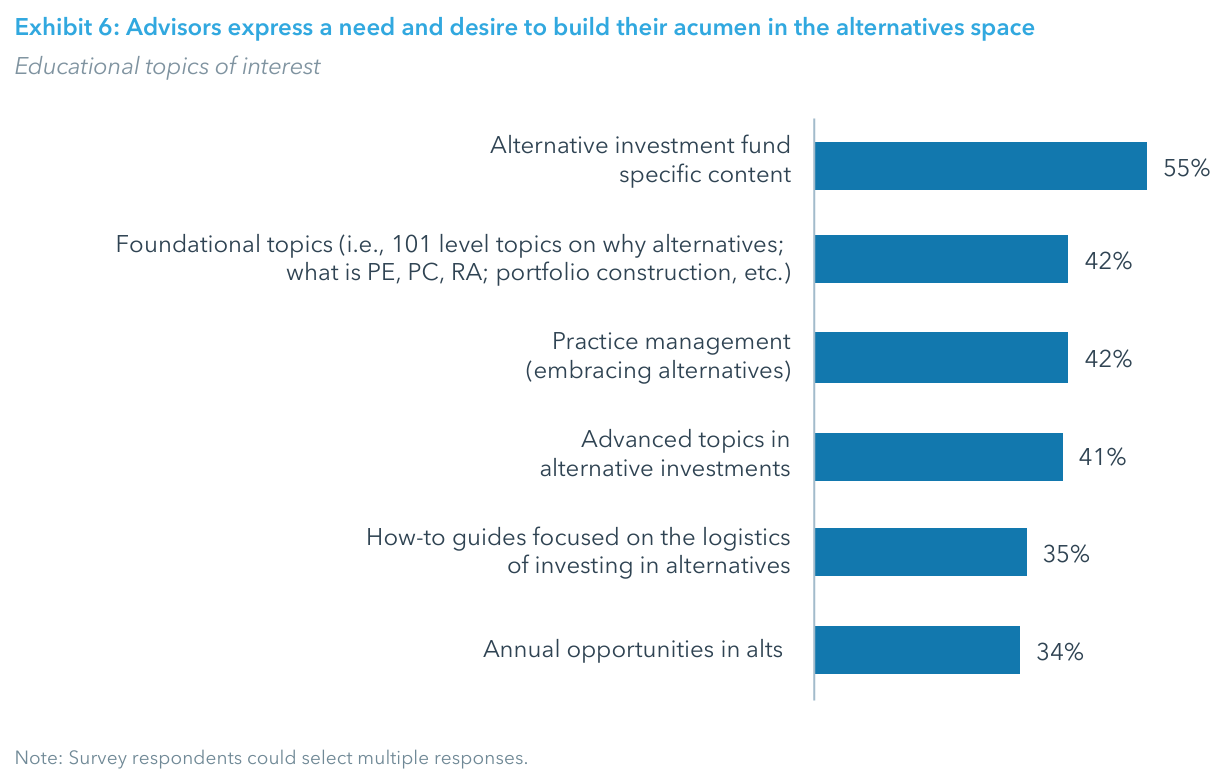

iCapital’s 2023 Financial Advisor Survey found that 95% of participating US financial advisors expressed a desire for educational content on private markets.

Fund specific content and foundational topics were most important to advisors in 2023.

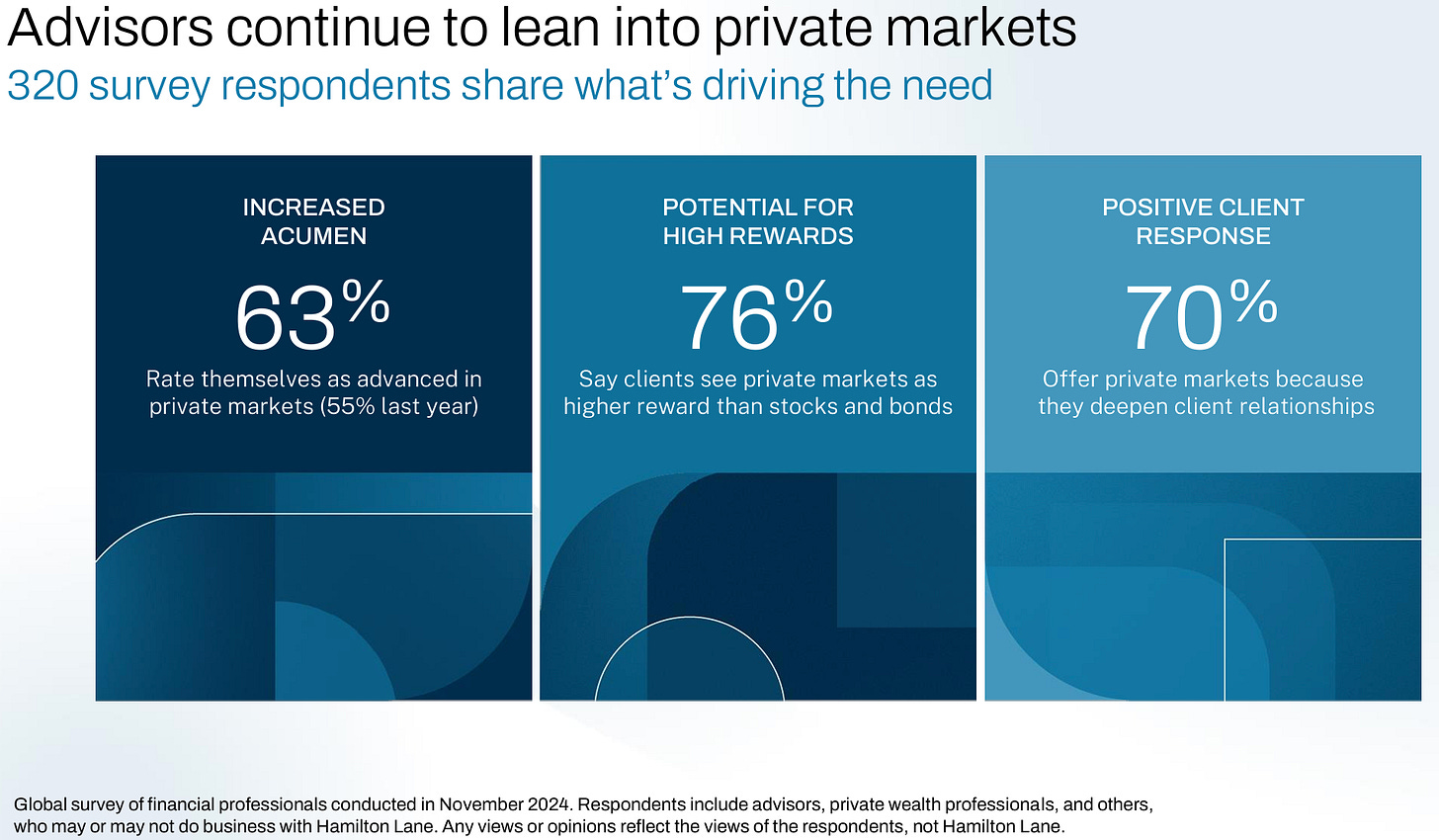

Two years later, the discourse is likely more advanced. Hamilton Lane’s 2025 Annual Global Private Wealth Survey is case in point.

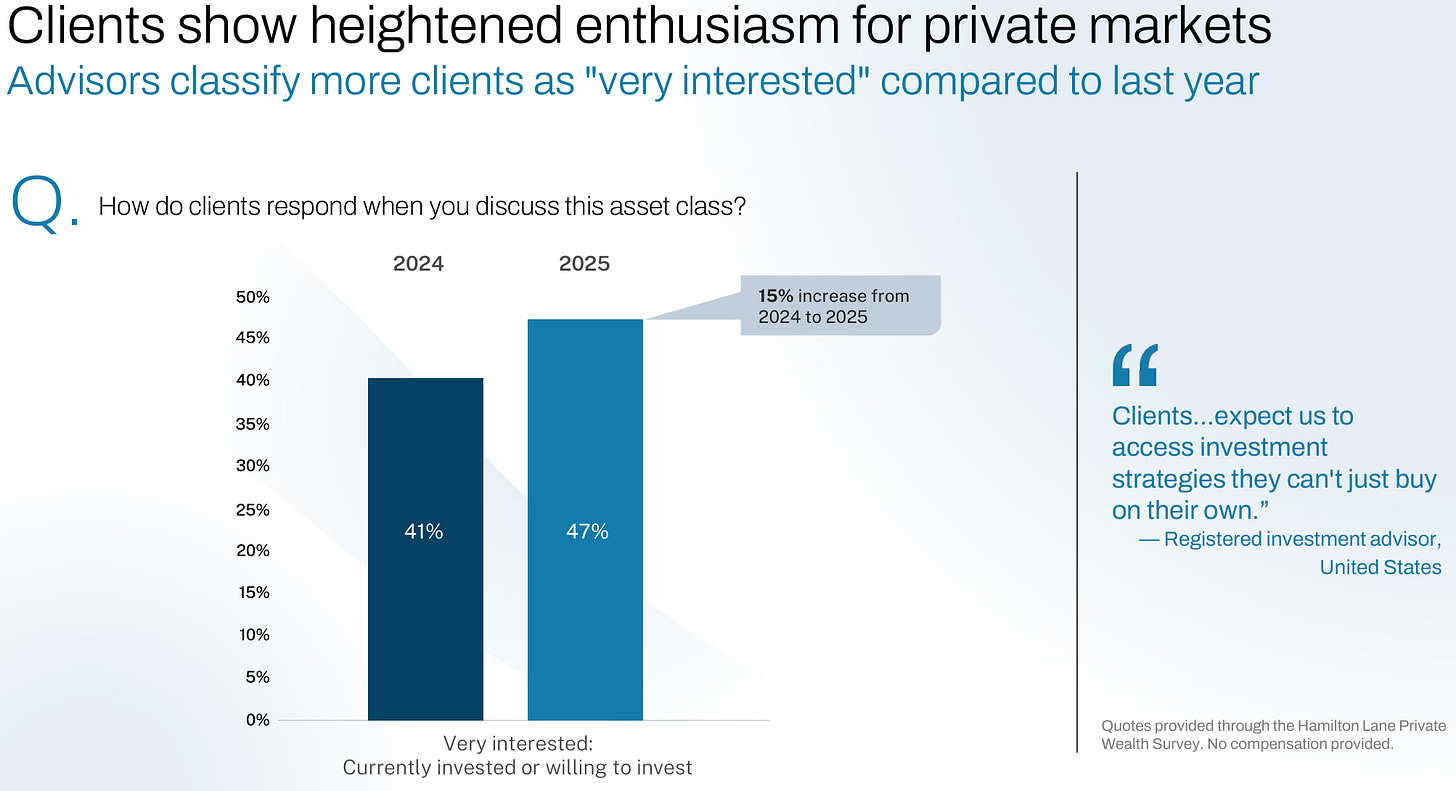

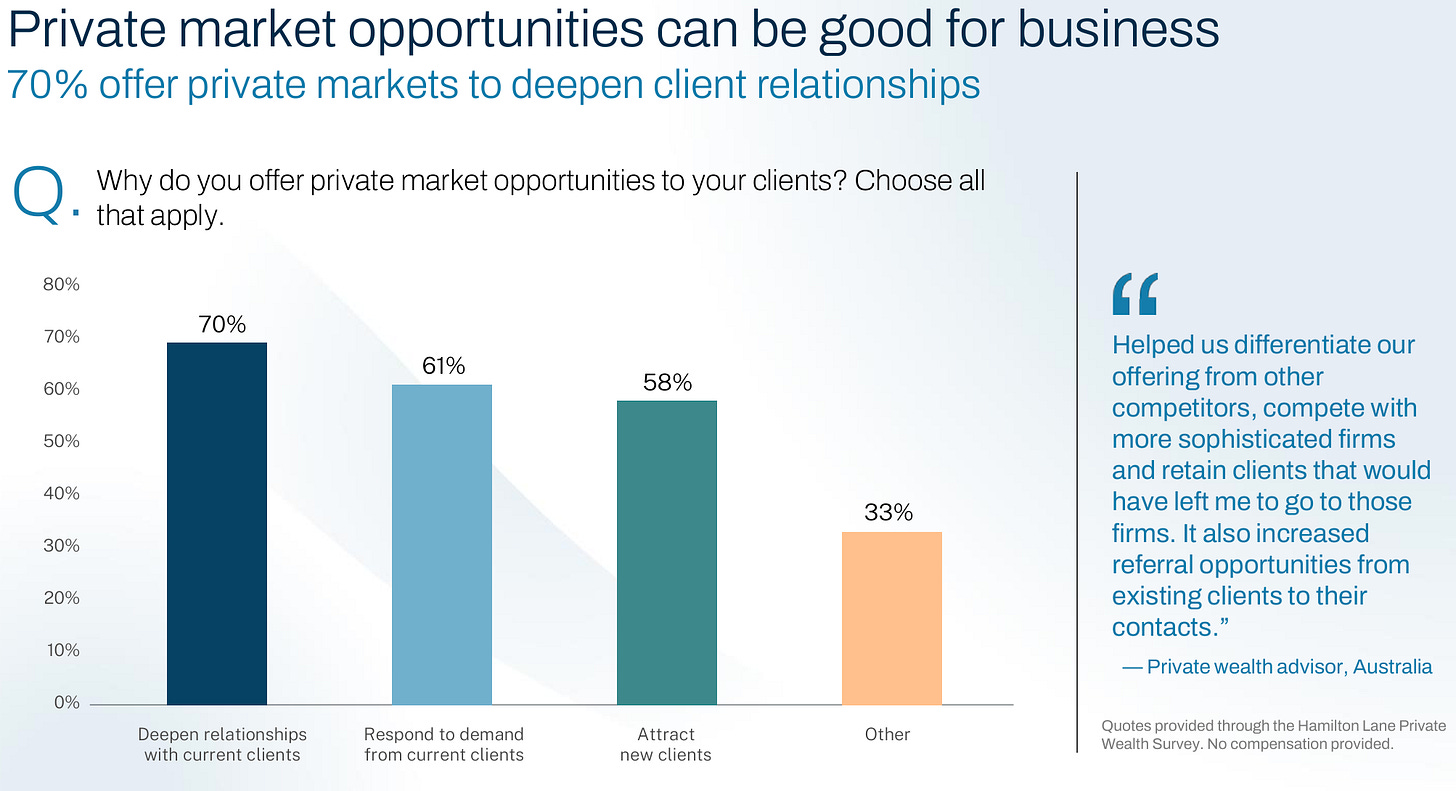

Clients appear to be responding positively when advisors discuss private markets with them, with Hamilton Lane noting a 15% increase in clients’ enthusiasm when discussing private markets compared to last year.

Many advisors understand the importance of private markets access as a differentiator for their practice.

Some advisors and wealth management practices have even gone as far as building their business around helping clients navigate private markets baked into the core of their offering.

A number of highly sophisticated wealth management practices have focused on private markets access and customization. Recent business combinations like Cerity and Agility, Hightower and NEPC, and Pathstone and Hall Capital Partners punctuate this phenomenon, highlighting that many of the scaled wealth management practices understand the importance of providing clients with access to private markets in a customized and differentiated manner.

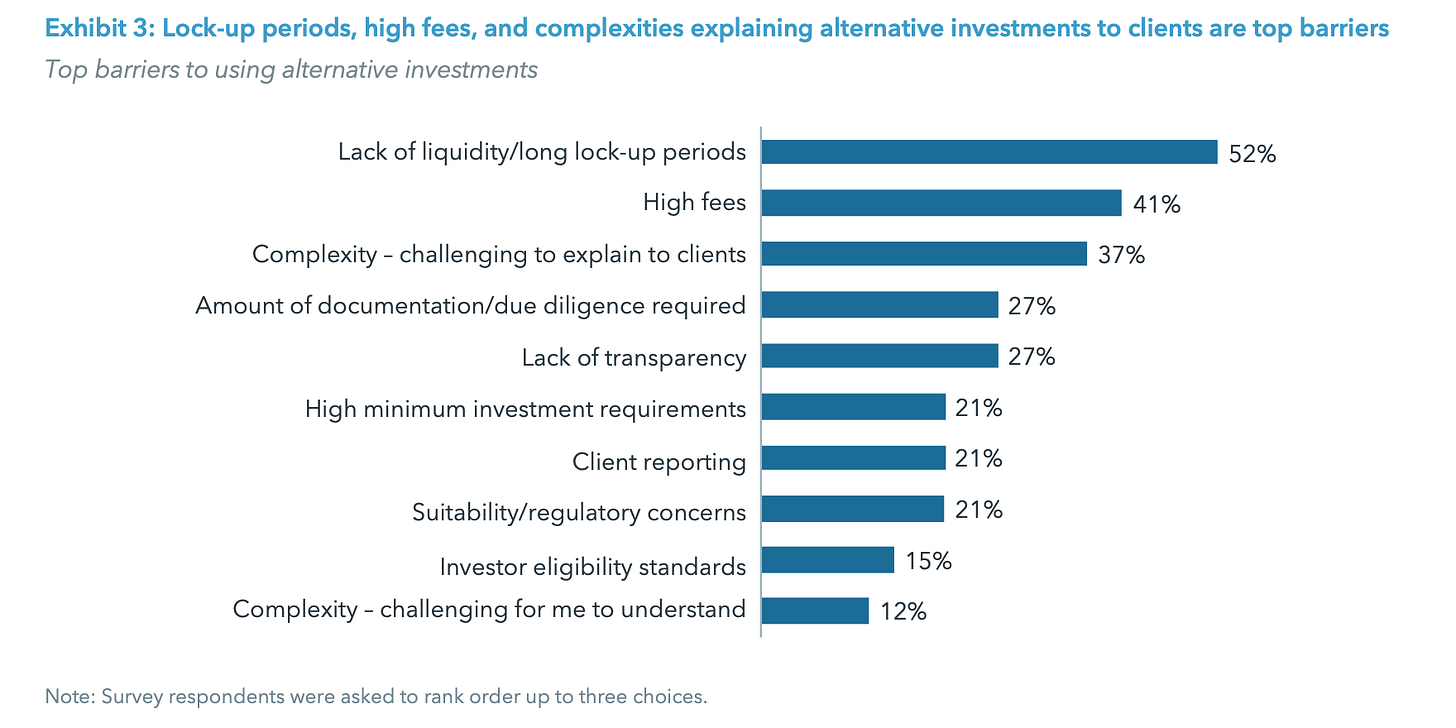

In 2023, iCapital found that there was still a complexity challenge. Advisors cited difficulty explaining private markets investments to clients.

Cerulli’s survey echoed that sentiment: 67% of alternative asset managers noted advisor education as a top challenge for their firm’s success working with the wealth channel.

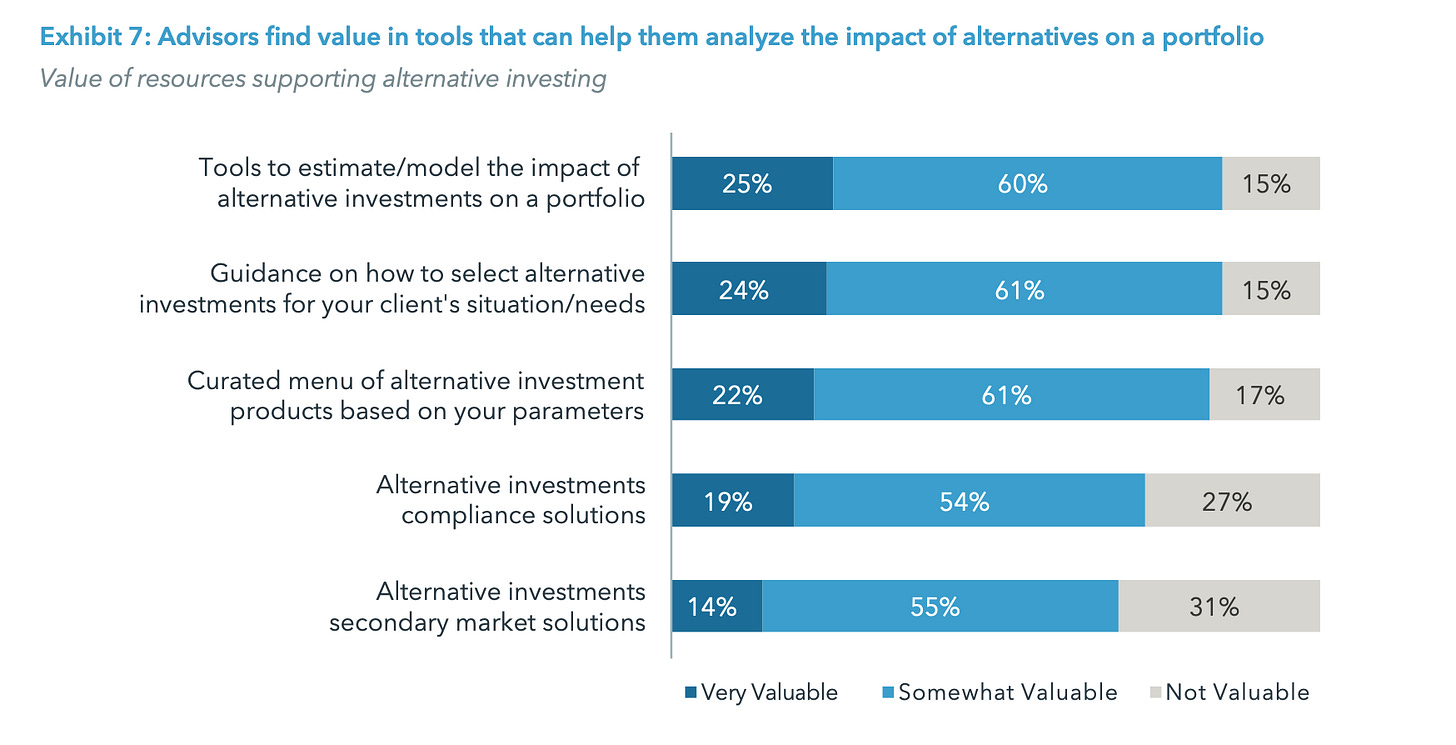

Advisors want to be armed with information that can help them understand private markets strategies and products — and tools that provide them with the ability to better understand the impact of private markets strategies on a client’s portfolio. That was evident in iCapitals 2023 survey.

The industry has been hard at work to build solutions that help advisors better understand how private markets products fit into an asset allocation framework.

This week’s announcement about adding private markets into the UMA was further evidence that the industry is collectively figuring out solutions to help meet advisor demands on how to both select private markets products customized to a client’s needs and arm advisors with the tools to estimate and model the impact of private markets exposure on a portfolio.

A number of conversations this week centered around how sophisticated advisors think about helping clients access private markets. An interesting theme? Advisors focusing on a client’s balance sheet and how private markets fits into the liquidity and tax management framework of managing a client’s portfolio.

Education will continue to play a major role in helping clients understand why private markets matters and how it can play a role in a client’s portfolio.

Another important aspect of education? Connecting private markets to the real world.

That was a topic that came up in conversations with some of the largest infrastructure investors in the world. The airports that we walk through every day are financed by infrastructure investors. The ability to search ChatGPT on our phone is enabled by a data center that has been financed by infrastructure investors.

Perhaps there was nothing that brought the concept of connecting investing to the real world more than the closing talk at the conference.

iCapital’s Managing Director, Chief Investment Strategist Anastasia Amoroso interviewed actor, producer, businessman, and sports team owner Ryan Reynolds.

His message provided a fitting end to the event — and one that should resonate with asset managers.

Reynolds’ favorite investment? Entertainment.

Why? He weaved in stories of acting, commercials, production, and his ownership of Wrexham AFC, the Welsh football club that has climbed its way up the English football pyramid, to illustrate the power of storytelling.

Storytelling is powerful. It can create an emotional investment — and, at times, a feeling of connection to a community — that is hard to replicate.

The business of storytelling is evergreen.

Reynolds noted that consumers want to know why they are being marketed to and what they should care about. Entertainment and building a brand can provide a connection to an investment or a product that is unique and powerful.

Asset managers have come to understand the power of storytelling. That’s why we’ve seen holiday videos and an intensified focus on brand-building.

If there’s a lesson to learn from Reynolds’ success with Wrexham AFC off the pitch (which has very likely galvanized the team’s success on the pitch), it’s that he, his co-owner Rob McElhenney, Chairman of the Board Shaun Harvey, and team have helped humanize the Wrexham story and the town through their captivating storytelling, creating a connection to the town and club and building community in a way so effective that they’ve created a movement that extends far beyond the town limits of Wrexham itself.

Much of that has come down to something so simple and so human: they really care about the town and people of Wrexham.

One thing is evident in this space: it is about meeting the client where they are and caring about their success. Private markets, done right, can help real people with real money generate income for retirement.

Speaking of stories, iCapital’s story started in earnest in a cramped, shared office at 441 Lexington Avenue over 11 years ago. The team was small, but driven, possessing experience in financial services, but facing a long journey ahead of educating the wealth channel about the merits of private markets and building a platform to connect the industry.

It was surreal walking into the opening night dinner on the lawn under the clear desert sky at the Arizona Biltmore seeing 800 people from the industry.

It was exciting to be part of something in 2014 when we were trying to launch our first feeder fund and provide access for the wealth channel to invest into top-tier private equity firms. But to see 800 people from many of the largest asset managers, wealth managers, and private banks coming together as iCapital has crossed over $220B of assets on its platform — that really hit home.

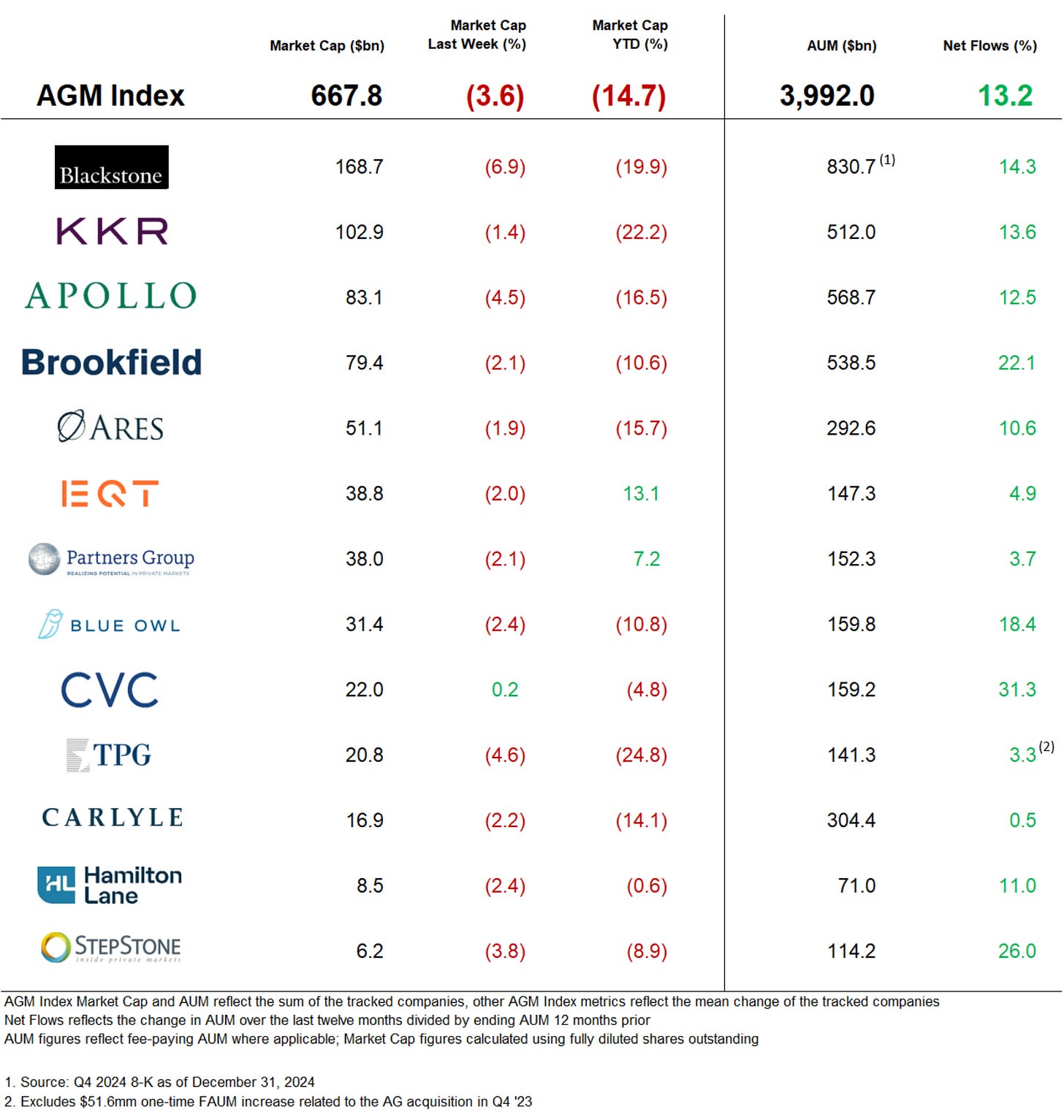

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

BlackRock’s Global Chief Investment Strategies Wei Li recently shared three investment themes from the firm’s 2025 Global Outlook.

💡Financial Times’ Antoine Gara reports that former Morgan Stanley CEO James Gorman is joining General Atlantic as an adviser as the firm continues to chart its growth path. General Atlantic, at over $100B AUM, is one of the industry’s larger firms that has yet to go public. General Atlantic confidentially filed with the SEC for a public listing, as the FT reported in 2023, and has diversified its investment platform in advance of a public offering. Gorman said General Atlantic is a “firm with momentum.” He sees the industry undergoing consolidation, saying that GA is “going to be a winner in what is a very rapidly consolidating, changing industry.” Gorman, who helped lead the revival of Morgan Stanley after the 2008 financial crisis, will advise General Atlantic’s leadership on strategy, growth plans, and future acquisitions. GA’s roots started in growth equity investments, including investments in category leaders and category creators Alibaba, ByteDance, Facebook, and Mercado Libre. GA’s IPO could come by the end of this year, said people briefed on the matter. In advance of a possible IPO, GA has built out its investment platform across private credit, infrastructure, climate, and secondaries, acquiring Actis to provide them with scale and capabilities to invest into sustainable infrastructure and acquiring Iron Park Capital Partners to form GA Credit. GA CEO Bill Ford said that Gorman would advise the firm on evaluating acquisitions. “James can help us a lot as we start to sort through [acquisition] opportunities, which ones are right for us and our strategy and which ones are not.” Gorman, an Australian banker who is also Chair of Walt Disney, is also expected to help GA manage its growth in both assets and headcount. The firm has around 1,000 employees but could expand as it continues to launch new funds and strategies and builds a bigger team to serve its growing client base, which includes the wealth channel.

💸 AGM’s 2/20: GA’s CEO Bill Ford said it well in the aforementioned article: private equity “is changing significantly, and we know that our strategy is going to need to evolve to ensure that we are a leader far into the future.” GA is amongst the largest firms in the industry that understand that the industry is changing and that they need to continue to grow and expand the firm to serve a changing customer — both on the investment side and on the capital partner side. It’s notable that GA brought in a banker who led one of the industry’s largest firms in Morgan Stanley — and one that made a big bet on wealth management. With Gorman at the helm, Morgan Stanley focused on growing its wealth management business to steady the ship. That bet paid off. Wealth management was a driving force behind Morgan Stanley’s success in recent years. A 2023 Euromoney article highlighted how the firm’s intense focus on wealth management drove revenues and profitability for the bank: for the full year in 2022, wealth management produced pre-tax profit of $6.6B, on revenues of $24.4B, both of which were record figures. It should perhaps come as no surprise that Gorman’s expertise in building and growing a wealth management business comes at a time when firms like General Atlantic are increasing their focus on the wealth channel. Gorman’s appointment comes a year after GA brought in Chris Kojima, former Goldman Sachs Partner and Global Head of the Client Solutions Group and Co-Head of Alternative Capital Markets & Strategy. Kojima joined GA as Global Head of Capital Solutions, responsible for building GA’s client franchise globally and across both institutional and individual client channels.

Firms that are on the growth path have to think about how they want to grow. That often includes building out a bigger presence in the wealth channel and looking to acquire specialist managers to add to a platform that can serve LPs in a differentiated way. An industry in transition means that consolidation has come into focus. General Atlantic should be familiar with the theme of consolidation. They are an investor in an adjacent industry, wealth management, through their ownership of Creative Planning. They’ve helped the $300B AUM firm complete a number of acquisitions as the wealth management space has undergone a wave of consolidation in its own right.

GA looks to be one of the next firms in line to either go public or be acquired by a larger asset management platform. Last year, AGM highlighted a number of firms (a non-exhaustive list) of private alternative asset managers that could be in the crosshairs of a larger platform or a public listing.

GA appears to be on the path to IPO. Who is next?

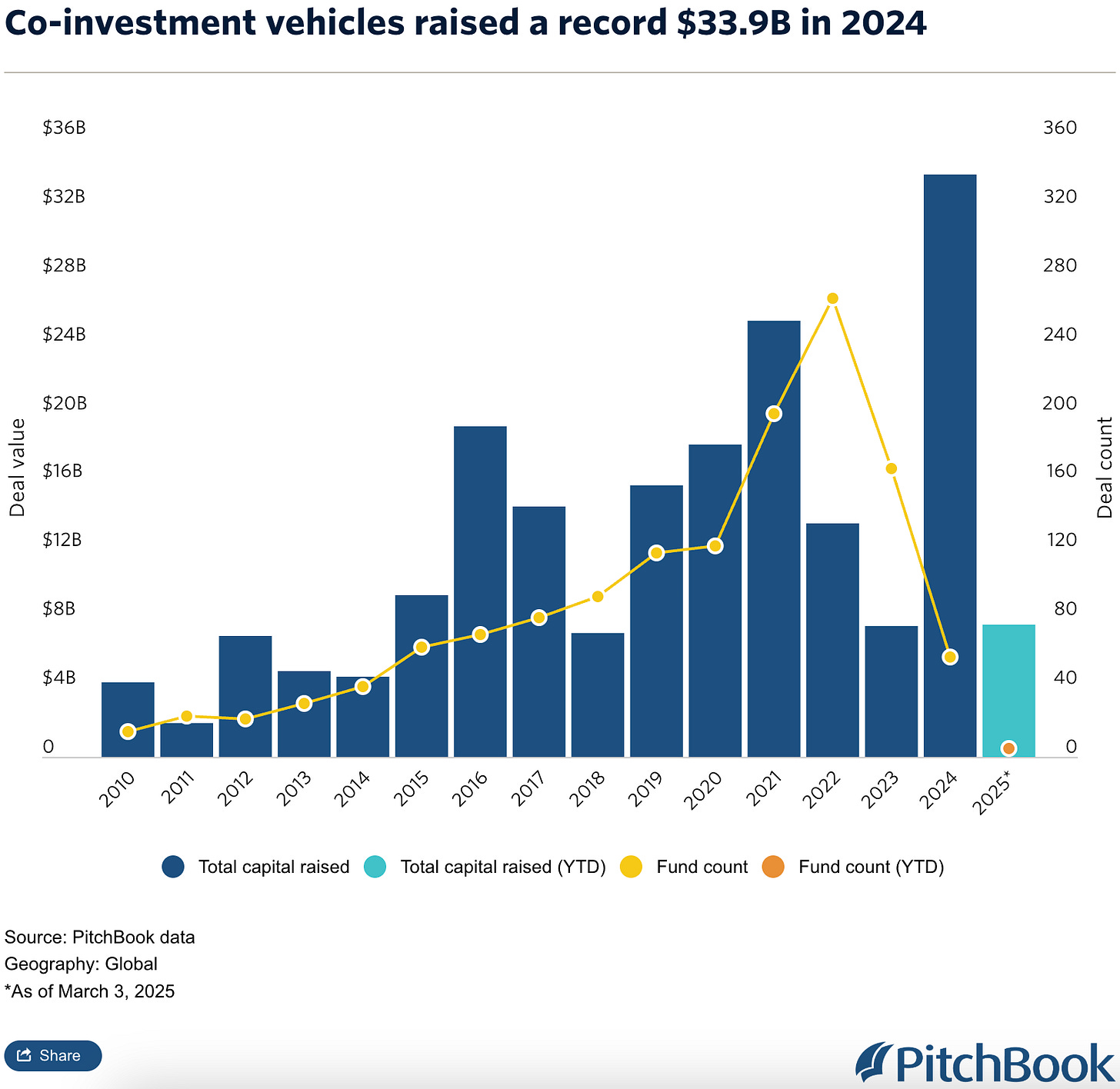

💡PitchBook’s Jessica Hamlin reports that Liberty Mutual’s $100B investment arm is intensifying its focus on direct and co-investments. Liberty Mutual’s focus on going direct highlights the changing nature of GP / LP relationships in an industry in transition. At the SuperReturn conference in Miami last week, David Ott, Head of Relationship Management at Liberty Mutual Investments, said “We want to be the first call [for deal flow] today.” Ott’s comments come at a time when co-investments have gained momentum. With distributions on the decline, GPs have been forced to be creative in how they partner with institutional LPs. That has brought co-investments to the forefront of the conversation. Liberty Mutual has had a history of making direct investments. One notable direct investment made by Liberty Mutual was the investment into the Owl Rock and Dyal $1.8B combination to create publicly-traded alternative asset manager Blue Owl. Since 2020, the insurance company has built out a direct and co-investing team to almost 500 employees, with 150 investors that focus on increasing direct deal flow. Liberty Mutual has joined up with firms such as Imperial Capital, a middle-market PE firm, on a growth investment into Certus Pest Control, and with CPP Investments and CalSTRS on a $255M funding round for geothermal systems power plant developer Fervo Energy. Liberty Mutual is not the only institutional investor that’s looking to reduce its commitments to funds and increase its co-investing activities. Pensions and sovereign funds are increasingly becoming co-investment partners to GPs. And this shift is something that has registered with GPs. “Today, it feels like co-investments are table stakes,” said Natasha Siegal, Head of Investor Relations at Veritas Capital, on a panel at last week’s conference. “For us lately, it’s been almost a one-to-one ratio of fund commitments to co-investments.” The question is whether or not institutional LPs are structured to move quickly on co-investment deals. “If an LP can move quickly, they’re more likely to get in on a co-investment deal,” Siegal said.

💸 AGM’s 2/20: Liberty Mutual’s increased focus on co-investments is emblematic of the changing nature of the institutional LP and GP relationship. As insurers aim to ramp up their private markets allocations, they are looking at the different ways that they can be partners to alternative asset managers. One way to do so while blending down fees? Co-investments.

Co-investment vehicles raised a record $33.9B in 2024, according to PitchBook data. Interestingly, co-investment fund vehicles were lower than prior years, yet co-investment dollars deployed reached new highs. That likely means large LPs were looking to deploy co-investment dollars to blend down fees into funds and allocate capital to less, higher-quality deals.

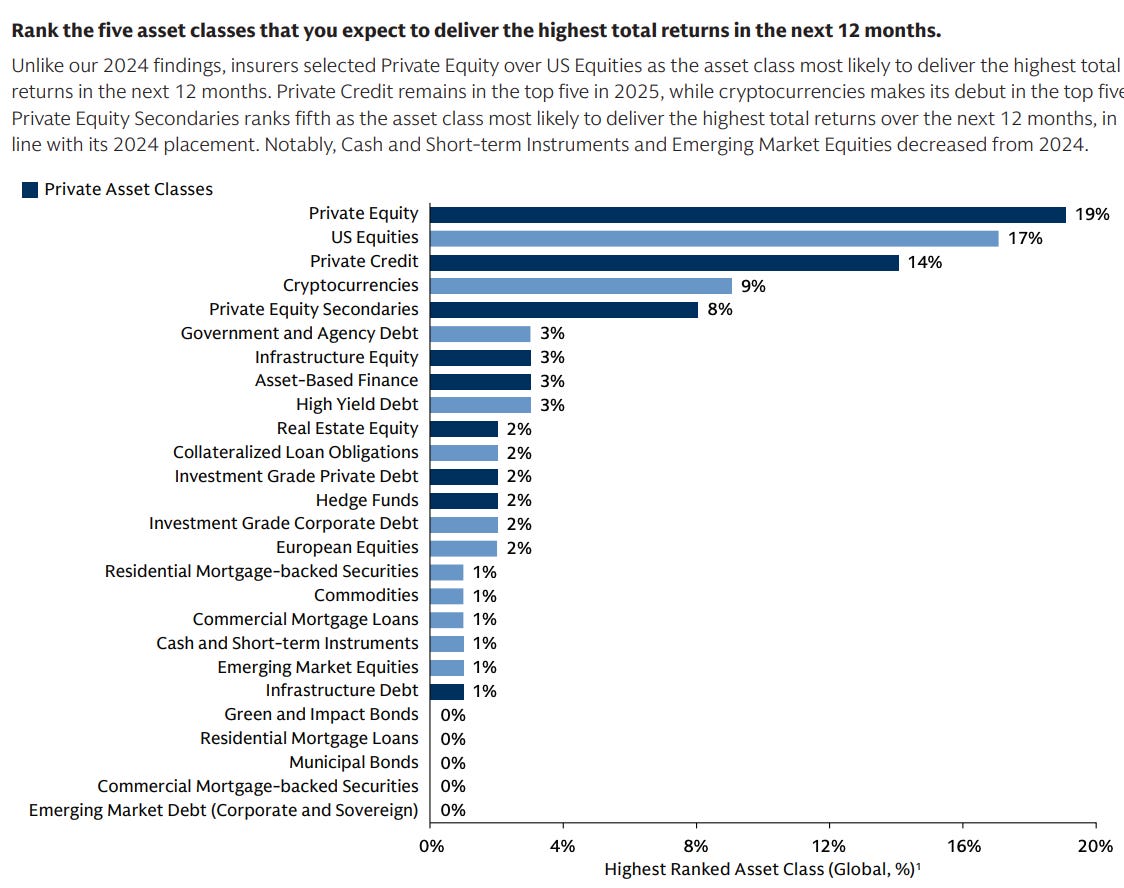

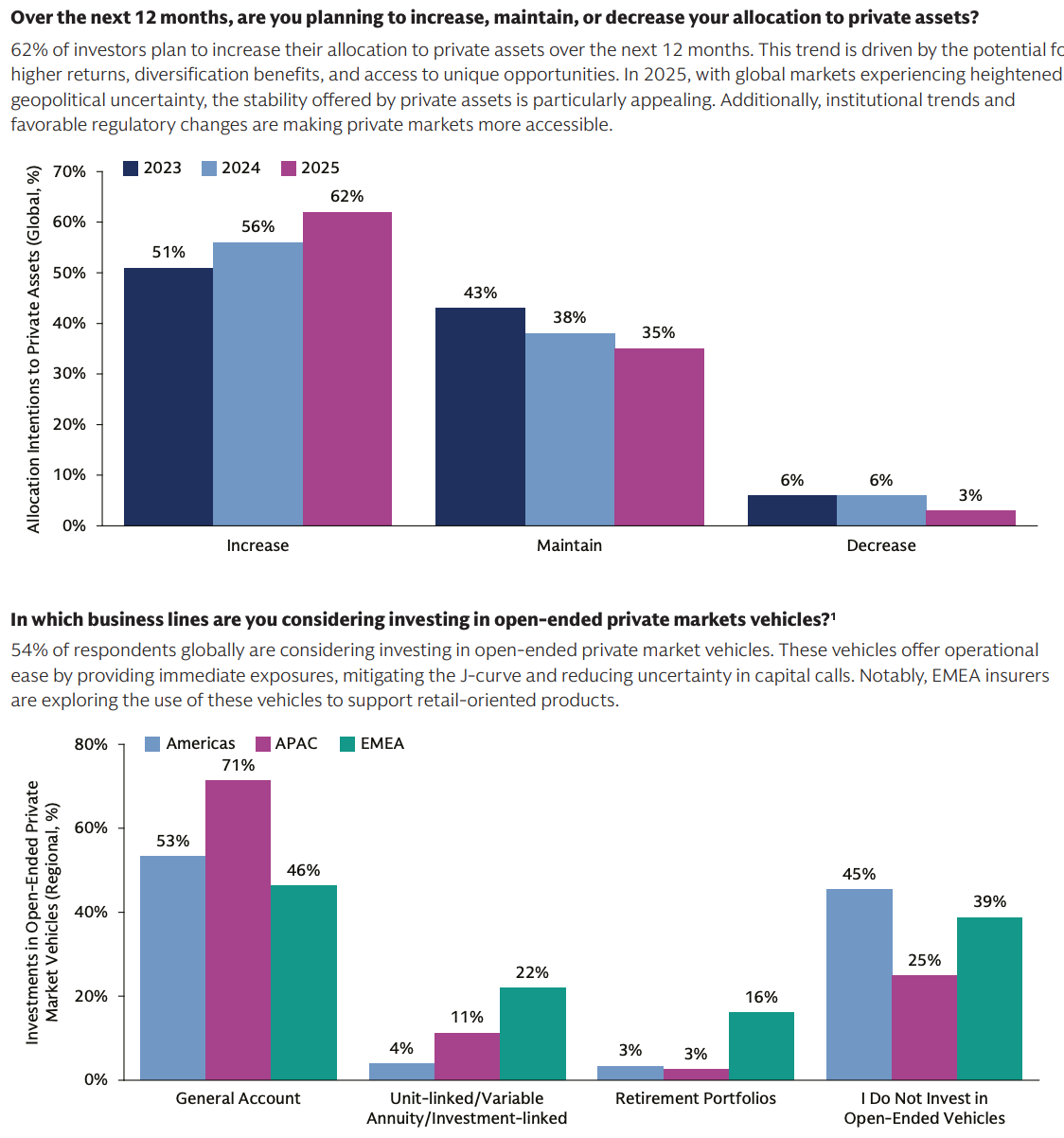

These datapoints come at a time when insurers are increasingly focused on private markets. The 14th annual Global Insurance Survey from Goldman Sachs Asset Management found that 62% of the 405 CIOs and CFOs representing over $14T in balance sheet assets at insurers plan to increase their allocation to private assets within the next year.

Based on the survey response, perhaps it shouldn’t come as a surprise that many insurers are looking to private equity direct and co-investments to drive returns. Goldman’s survey finds that insurers expect private equity to deliver the highest total returns over the next 12 months.

Many insurers are planning to increase their allocations to private markets — and a number of them are looking to do so out of the General Account.

It’s both interesting and notable to see insurers show an increased interest in investing in open-ended private markets vehicles. This datapoint highlights that the evergreen product structure innovation is not just for the wealth channel.

But the rise in demand for co-investments by insurers does bring a major question to a head for any head of distribution or IR at an alternative asset manager: how should alternative asset managers balance out their focus on the wealth channel LP with their service of institutional LPs?

The co-investment question is caught in the crosshairs of this industry evolution. As evergreens become more popular investment vehicles — which, by the way, alternative asset managers get paid fees and carry on — how do institutional investors maintain co-investment relationships with GPs as they look to blend down their fees between fund commitments and co-investment activity? There’s no easy answer to this question. Alternative asset managers are going to have to figure out how to navigate a growing — and necessary — focus on serving the wealth channel with balancing the desires and demands of institutional investors, many of whom have been long-time capital partners and will continue to be big allocators to private markets.

Where can alternative asset managers start? By harmonizing their investor relations efforts across institutional and wealth market channels to make sure that both institutional investor relations teams and wealth distribution teams are in sync as it comes to serving client needs and figuring out product innovation. There’s no one right answer to this question. Certain asset managers will prioritize the institutional channel and other asset managers will focus on the wealth channel. But both client types have their needs and asset managers would do well to continue to figure out how to serve both client types.

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Private Wealth Solutions - Investor Services Onboarding, Vice President. Click here to learn more.

- Investor Relations Professional. Click here to learn more.

- Global Wealth Solutions - Investor Relations - Principal - Japan. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

- Credit Executive Office, Senior Associate / Associate. Click here to learn more.

VP, Private Markets Products. Click hear to learn more.

- Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click hear to learn more.

- Vice President, Data Intelligence. Click here to learn more.

- Alternative Investment Specialist. Click here to learn more.

- Practice Marketing Director. Click here to learn more.

- Sr. Editor - Private Equity. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Global Head of Alternative Investments Product at live from Nuveen’s nPowered conference on structuring products for success for the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

🎥 Watch the second episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with ’s Global Head of Product in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear US Financial Intermediaries Leader and ’ MD and Head of Investments on following the fast river of alts. Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎙 Hear Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Boardshare the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎥 Watch internet pioneer , , share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.