Every once in a while, I run across a bank bonus that I think everyone should get in on if they can, especially because the requirements to earn the bonus are so easy. In this case, I stumbled on a bank bonus from U.S. Bank for their “Smartly” Checking Account. If you’re eligible and able to meet the requirements for this bonus, I highly recommend going for it.

The requirements for the U.S. Bank Smartly Checking account are as follows:

What makes this bonus particularly good is that the direct deposit requirement isn’t hard to meet and based on my experience, most normal bank transfers will trigger the bonus.

In this post, we’ll go over exactly what you need to do to earn the U.S. Bank Smartly Checking account bonus, as well as how to avoid fees and what to do with the account after you earn your bonus.

Here is exactly what you need to do to earn this bonus:

The first thing you’ll need to do is to open a U.S. Bank Smartly Checking Account. You can do so at this link (not an affiliate link). There is a promo code that you have to enter with your application, but if you open your account using the link above, it’ll automatically include the promo code when you fill out the application.

Opening the account is straightforward and should only take you a few minutes. Note that the account requires a $25 minimum opening deposit. However, U.S. Bank allows you to fund the account with up to $250 using a credit card, so I recommend doing that if you can. I funded my account with $250 on an American Express Business Platinum card that I had recently opened for the signup bonus.

This requirement is self-explanatory and you’ll need to do it anyway, but make sure to set up your online account. I have my account set up on both the U.S. Bank app, as well as the website.

The most important step is to complete at least two direct deposits within 90 days of opening your account. The direct deposits need to total $8,000 or more.

There are two things about this direct deposit requirement that make it easy to meet. First, the direct deposit requirement doesn’t require a “real” payroll direct deposit. Instead, pretty much any ACH transfer into your U.S. Bank Smartly Checking account will trigger the direct deposit requirement. I did an ACH transfer from one of my Ally savings accounts into my U.S. Bank Smartly Checking account, which worked to trigger the bonus. Just remember to initiate the transfer from your external bank account, rather than from U.S. Bank.

Second, the $8,000 is a cumulative deposit requirement, which makes it a lot easier to meet if you don’t have a lot of extra cash to use. What this means is you can do multiple deposits of smaller amounts until you hit that $8,000 requirement. You can also deposit, withdraw, and redeposit the same money over and over, so even with a small amount of cash, it’s possible to meet the requirements for this bonus. When I did the bonus, I did two ACH transfers from my Ally account of $4,001 each. I had enough money on hand that I didn’t need to redeposit the same money, but I could have if I wanted to.

The great thing about the U.S Bank Smartly Checking account bonus is that the bonus posts a day or two after you meet the requirements. This means if you aren’t doing a “real” payroll direct deposit, you’ll at least know if your ACH transfer triggered the direct deposit requirement soon after you complete it.

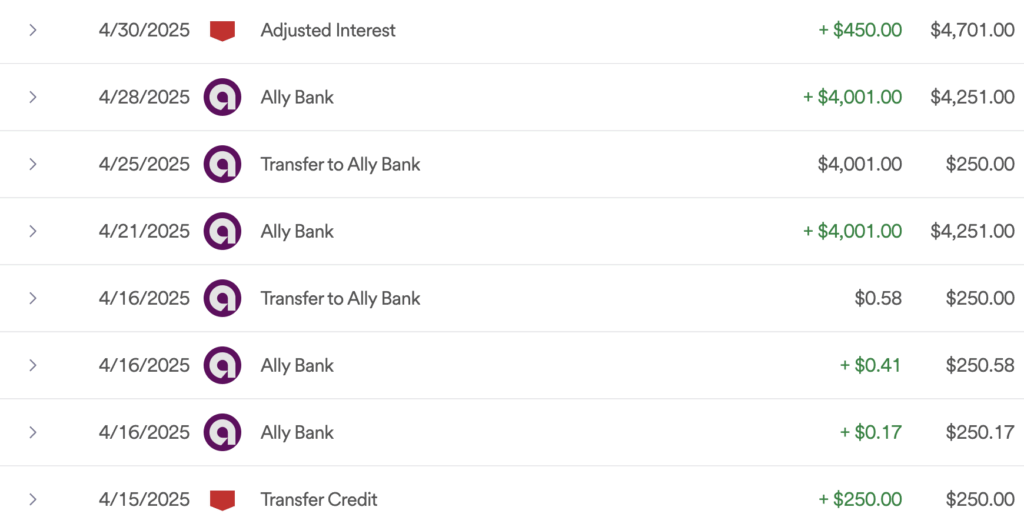

In the below screenshot, you can see that I initially funded my account with $250 using a credit card. I then linked my Ally account. To verify ownership of the account, Ally made two small deposits that I had to confirm in my Ally account. Interestingly enough, those two small verifying deposits counted towards the $8,000 total direct deposit requirement and counted as two separate direct deposits. You can also see that after making my two direct deposits of $4,001 each, the bonus was posted to my account just two days later.

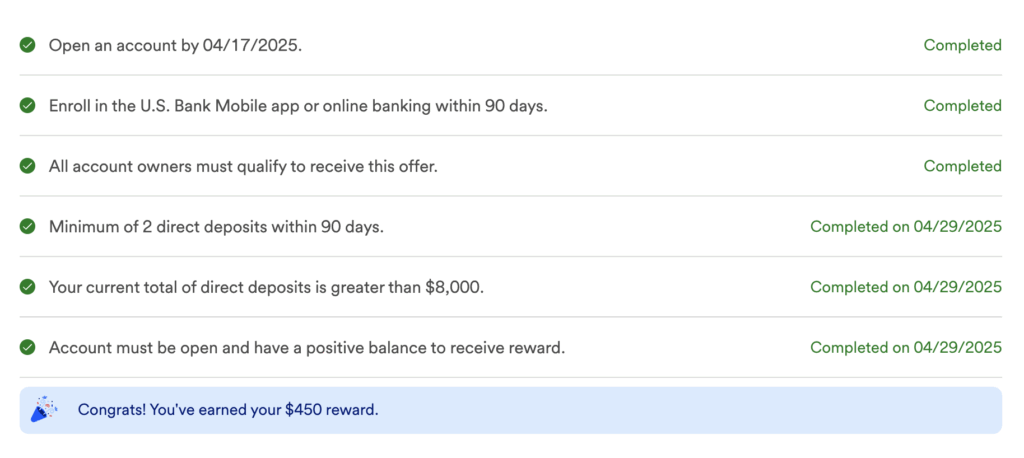

U.S. Bank also has a progress tracker so you can keep track of every step of getting your bonus. This is a great way to make sure you’re not forgetting anything.

There are a few things to note about the U.S. Bank Smartly Checking account. First, it has a monthly fee of $12 that is waived if you have a direct deposit of $1,500 or more each month or maintain a minimum balance of $1,500 or more (it looks like it used to be $6.95 per month and a $1,000 direct deposit to waive the monthly fee, but this was changed to the higher $12 and $1,500 per month).

Second, there is no minimum time you need to keep the account open after you earn your bonus, so technically, you could close your account immediately after getting your bonus. That being said, my advice is to not close the account right away, as it’s generally better practice to keep accounts open for at least a few months before closing so as not to make the bank angry.

Since the fee is easily waived with an ACH transfer of $1,500 each month, I recommend doing that for a few months before closing the account. For my U.S. Bank Smartly Checking account, I’ve set it up so that at the beginning of each month, I transfer $1,500 from my Ally account to my U.S. Bank Smartly Checking account. A week later, that $1,500 is automatically withdrawn back to my Ally account. I’ll do this for a few months before I close the account.

The U.S. Bank Smartly Checking account is a very easy bonus that most people should be able to get. The main reason it’s so easy is that the direct deposit can be met with an external ACH transfer from most bank accounts. The deposits can also be cumulative, so you don’t need a large amount of money to get the bonus. Finally, the bonus posts quickly, and U.S. Bank even has a progress tracker that you can use to make sure you’ve met all the requirements. The fact it’s so easy to do means this is a bonus everyone should go for.