The Wolf Den #1139 - Prepare For An Orange Wave

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Free. Yes, free! Last week Arch Public released an update to the Bitcoin Algorithm. It is now free.

The Bitcoin Algorithm Arbitrage Strategy remains extraordinarily powerful. How powerful you might ask:

You’re reading that correctly. FREE! Our Bitcoin Algorithm Arbitrage Strategy will generate cash flow, while also producing exceptional annual returns that are 4.5X buy and hold Bitcoin returns.

Most of you reading this believe in Bitcoin, and so do we. Employing a strategy that generates cash flow, protects downside risk, and aggressively buys dips (completely hands free!) is available to you; for FREE!

In This Issue:

The race among states to adopt Bitcoin is accelerating at an unprecedented pace.

When I first started tracking state-level Bitcoin bills, I thought we’d be lucky to see even ten take shape in 2025. As momentum built, I revised that estimate to half the U.S. by year’s end. Now, barely halfway through February, nearly half the map has already turned orange, forcing me to reconsider yet again. At this rate, multiple states are on track to pass Bitcoin legislation in the coming months if this trend holds.

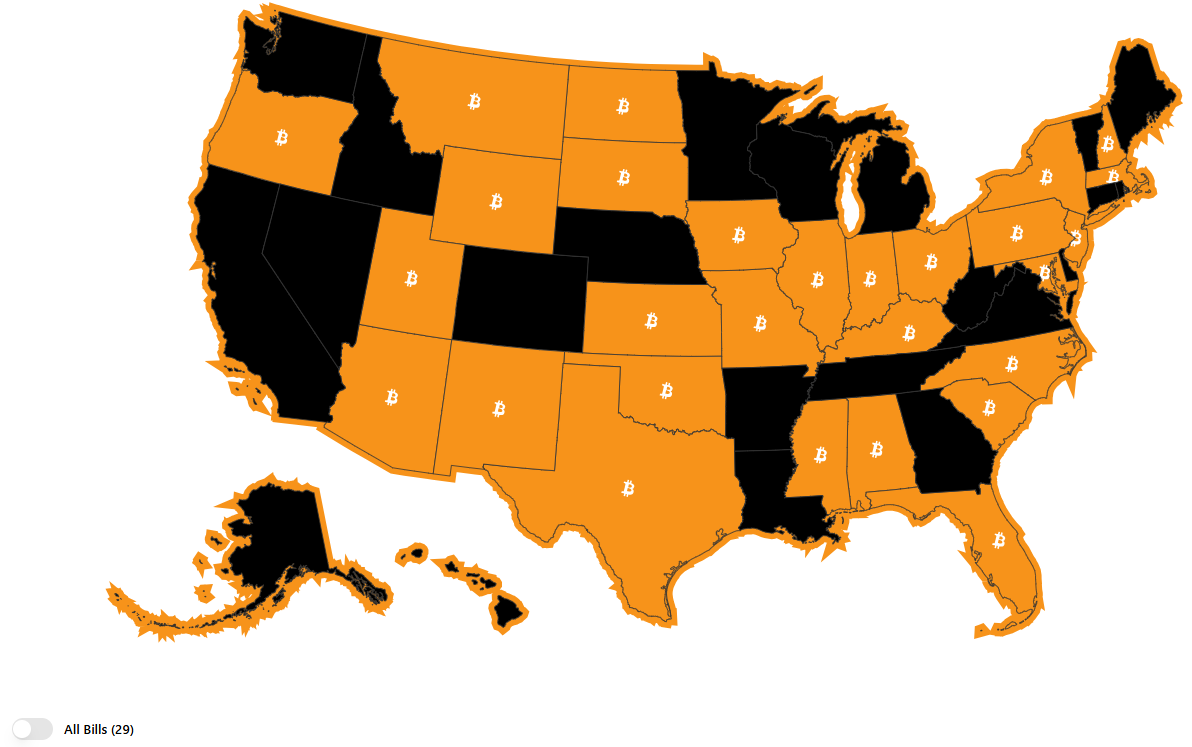

This is what the map looks like.

With so many states jumping in, there are bound to be plenty of failures along the way—but it only takes one state to show the other 49 how it’s done. Once that happens, we could see an epic Bitcoin domino effect.

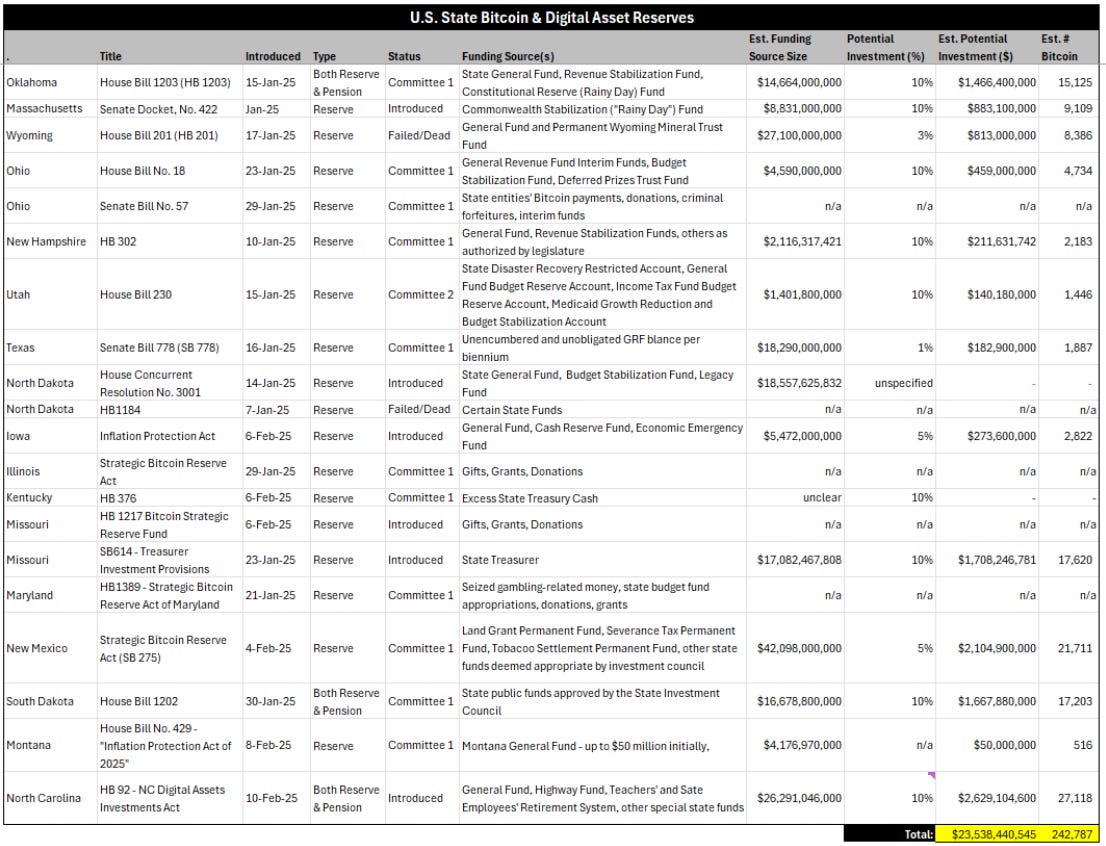

That said, it’s important to stay grounded. So far, three states have stumbled early in the process—North Dakota’s HB1184 failed a House vote, Wyoming’s HB201 died in committee, and Pennsylvania’s HB2664 also didn’t make it past committee. That doesn’t mean these bills are dead forever; they can be reworked and reintroduced to address sticking points.

Generally, state bills have about a 20% to 30% chance of passing, with that number rising to 50% if they have bipartisan support. Given that these are Bitcoin bills, we likely need to adjust those odds downward for now.

For those curious, here’s the process these bills must go through—just like any other piece of legislation:

The process is lengthy, but it’s important to note that if a Bitcoin bill fails at any stage, it can be sent back, amended, and reintroduced without having to start from scratch. A great example is what’s happening in Texas.

Texas state lawmakers have reintroduced a bill aimed at establishing a Strategic Bitcoin Reserve, now designated as SB 21, which was previously SB 778. The updated bill “broadens the scope to allow investments in crypto that have maintained a market capitalization of at least $500 billion over the past year.” Even more interesting, “SB 21 eliminates the previous annual buying limit of $500 million, allowing the legislature to appropriate funds as deemed necessary.”

Now, let’s get to the part I imagine all of you really want to hear.

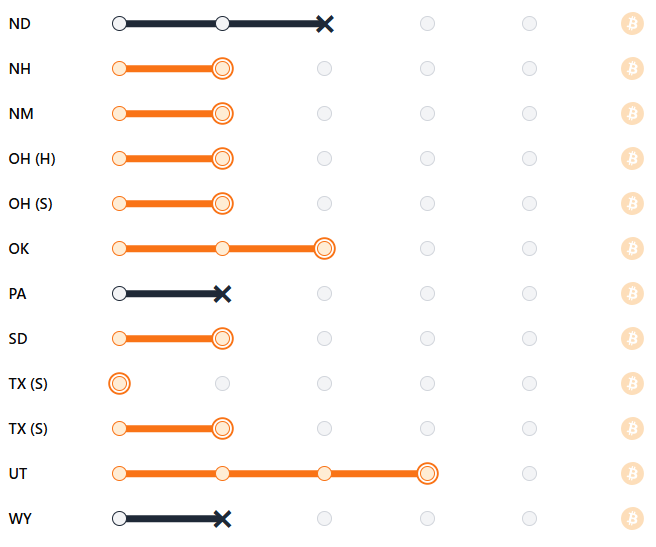

Crypto firm VanEck ran the numbers on the Bitcoin bills and came up with this:

Keep in mind, predicting the total impact of state-level Bitcoin adoption is a fast-moving target. Texas is a perfect example—its bill recently removed the buying limit, effectively raising the Bitcoin budget to whatever the state can afford or chooses to allocate.

I know it’s a bit hard to read, but the key numbers to focus on are the two yellow figures in the bottom right: $23.5 billion in estimated potential investment and 242,787 BTC.

At first glance, that number might not seem massive—it’s only half of what Strategy owns—but 242,787 BTC represents more than 1% of the total 21 million Bitcoin supply—1.18%, to be exact. And as more states get involved and bills evolve, this percentage will likely grow, potentially reaching around 3%, given that nearly half the map is already orange and state-level participation is more likely to increase than decline.

What isn’t priced in is that this race extends far beyond the few hundred thousand BTC states may buy. They aren’t just competing with the U.S. government but also with other nations, sovereign wealth funds, institutional players like banks, hedge funds, and pension funds, and, of course, retail investors—people like us. The number of entrants chasing Bitcoin will only grow, while the amount of available BTC at current prices will only shrink. And this isn’t a race with a finish line—it’s a contest to see who can accumulate the most, the fastest.

Now, let’s put this into perspective by revisiting Strategy. The states preparing for Bitcoin adoption help highlight just how massive Strategy’s holdings are. With 478,740 BTC, Strategy owns almost double the amount VanEck predicted for all U.S. states combined. While it may be difficult for states to catch up given Strategy’s lead, their impact on price will still be undeniable.

Another way to frame this is by comparing state-level Bitcoin purchases to the influence of spot ETFs. ETFs have already had a lasting effect on Bitcoin’s growth, with $40.21 billion in cumulative net inflows. VanEck estimates that the impact of just 20 states could be about half of what ETFs have achieved so far. If 40 or even 50 states join in, their collective impact could approach, or even rival, that of the spot ETFs.

States will certainly play a role, but they aren’t the endgame. Instead, they represent the initial spark—small but steady waves building momentum. As more states come aboard, these waves will converge, gaining strength until they ultimately pull entire nations into the current, reshaping the global Bitcoin landscape in ways we’ve only begun to imagine.

For those that don’t know, Aptos—one of the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s start with this announcement from Coinbase regarding USDC on Aptos!

Aptos-native USDC on Coinbase enables seamless fiat on-ramps, cross-chain interoperability, faster and more secure transactions, and lower costs—benefiting users in over 100 countries.

The Aptos stablecoin market cap hit an all-time high of $820m!

In other news, Aptos reposted me, which is always cool to see. If you didn’t already know, I interviewed Avery Chang about two weeks ago. In that episode I delve into Avery Ching’s transformative journey of as the co-founder and CTO of Aptos Labs. We also explore how his innovative work is shaping the future of blockchain technology and its real-world applications.

Last but not least, I want to end on some an Aptos ecosystem highlight.

Merkle Trade is redefining leveraged crypto trading, making it more accessible, intuitive and engaging for all.

Since its launch, Merkle has addressed key user painpoints surrounding the crypto derivatives market—having grown to more than $17 billion in trading volume and 170,000 users worldwide. By leveraging Aptos' tech stack, Merkle is removing critical barriers to redefine the trading experience for everyone. You can read more about Merkle Trade HERE.

That is all for this week, make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

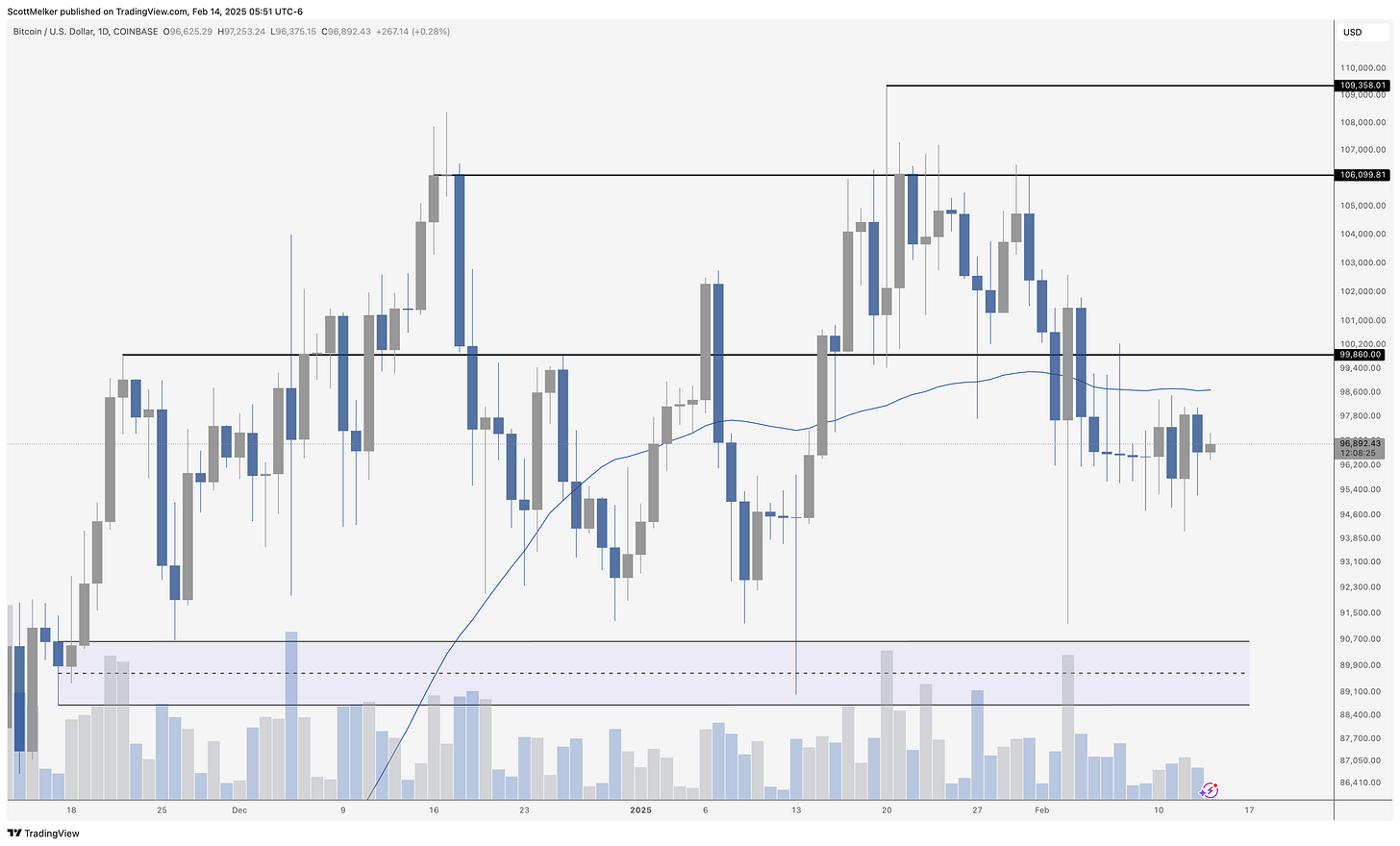

Bitcoin's daily chart remains range-bound, showing little directional momentum as price consolidates below key resistance at 99,860. The 50-day moving average continues to act as resistance, keeping Bitcoin suppressed below psychological levels. Volume has declined, indicating a lack of strong participation from buyers or sellers. Until a decisive move occurs above resistance or below recent lows near 95,000, the market is likely to remain choppy and indecisive. The overall structure suggests Bitcoin is still in a period of re-accumulation or distribution, awaiting a catalyst for its next move.

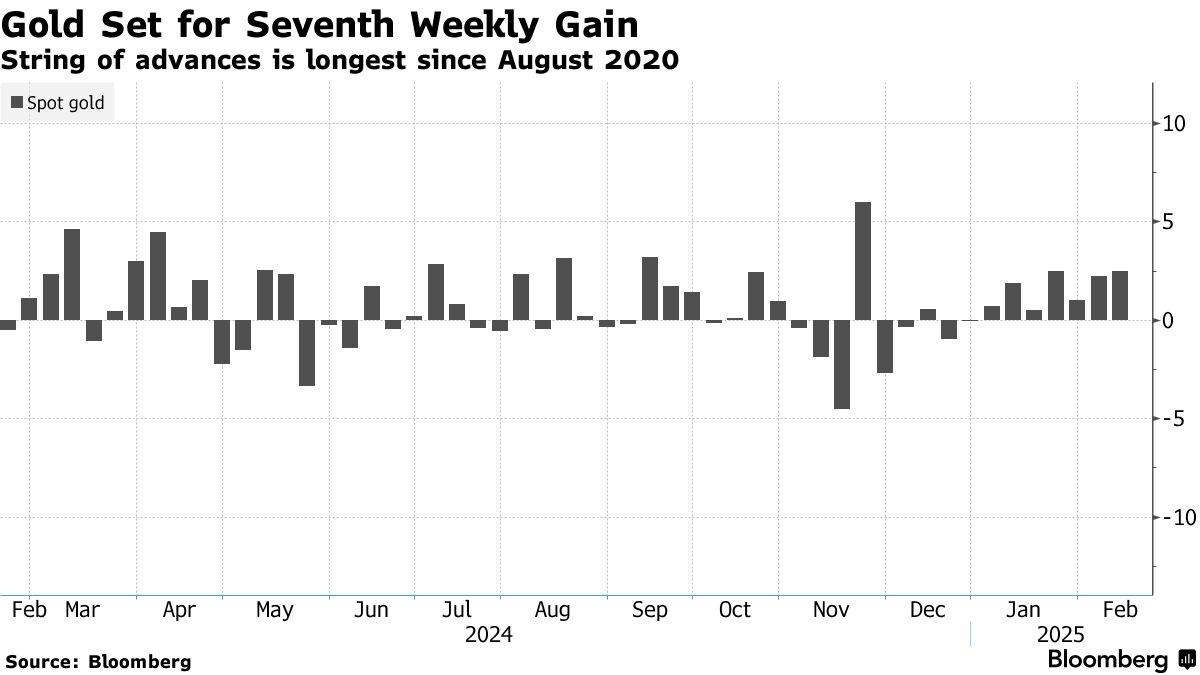

Some of the main moves in markets:

After what feels like forever of waiting, OpenSea, the world's first and leading NFT marketplace, has launched OS2, a complete rebuild of its platform along with confirmation of an airdrop. The update enhances every aspect of the marketplace, introducing new chains, improved search and exploration, marketplace aggregation, cross-chain purchasing, and lower fees. OS2 marks the most significant upgrade in OpenSea's history. Alongside the launch, the OpenSea Foundation has introduced $SEA, a token aimed at rewarding and engaging NFT users.

“This represents an expansion of OpenSea from an NFT marketplace to a much broader platform for trading all types of digital assets. We think tokens and NFTs belong together in a single, powerful, delightful experience,” said Devin Finzer, Co-founder and CEO of OpenSea.

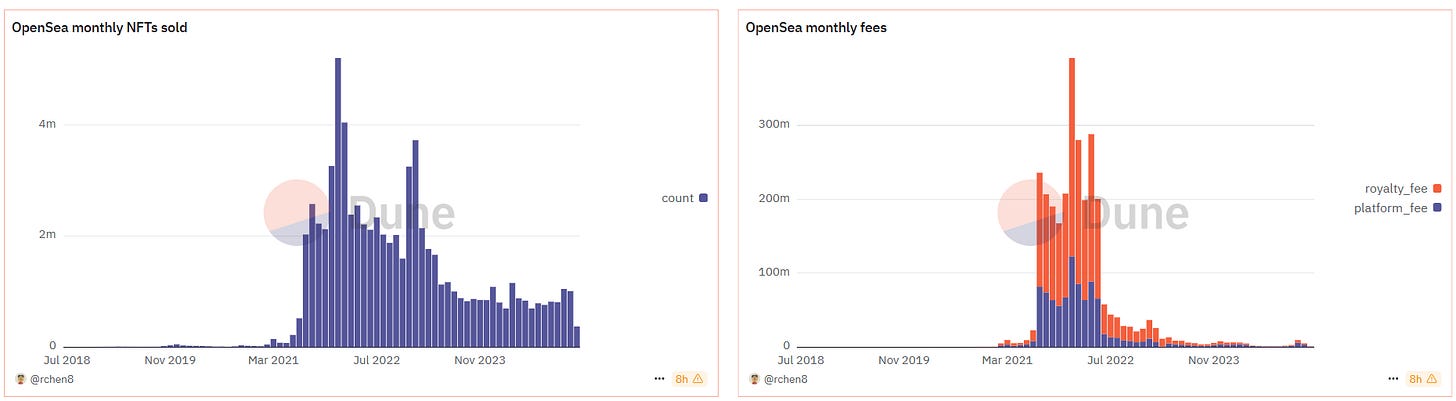

On all accounts, OpenSea is in desperate need of a revitalization. As you can see from the two images above, NFTs sold and monthly fees have respectively fallen off cliffs. Furthermore, OpenSea's monthly trading volume has dropped significantly from its $5 billion peak in early 2021, with $190 million in NFT trading last month. Its annualized revenue is currently $33 million, according to Dune Analytics.

According to a TechCrunch report, Coinbase has entered talks with India’s Financial Intelligence Unit (FIU) but has yet to receive formal registration. A company representative expressed excitement about the Indian market and reaffirmed Coinbase’s commitment to complying with local regulations. This comes as India’s stance on crypto is evolving—after banning offshore exchanges in late 2023 and issuing fines in May 2024, the FIU has since registered KuCoin and Binance, signaling a more open approach.

For those that don’t know, Coinbase launched in India in April 2022 but quickly ran into regulatory issues when the National Payment Corporation of India (NPCI) refused to recognize UPI transactions for crypto. Just three days later, Coinbase halted UPI services and, by September 2023, exited the market entirely. Despite this, the company has invested heavily in India’s crypto ecosystem, backing major exchanges like CoinSwitch Kuber and CoinDCX.

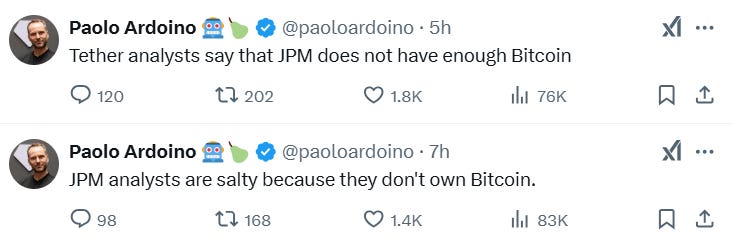

A JP Morgan analyst argues that Tether may need to sell its Bitcoin to comply with a proposed U.S. stablecoin bill. Currently, the bill’s language restricts stablecoin issuers to holding only insured deposits, U.S. Treasuries, short-term Treasury repos, and central bank reserves. However, another proposed bill takes a more lenient approach to reserve assets. There’s no cause for concern, though—even if Tether were to sell its Bitcoin, it would still maintain full reserves and holds over $20 billion in excess assets.

An unknown source from Tether said the following, “Those analysts at JPMorgan seem a bit jealous that they didn’t buy Bitcoin cheap, and it makes them salty. But clearly, they understand neither Bitcoin nor Tether. And they won’t have a cheap event to buy Bitcoin. No one feels sorry for them.”

GameStop's stock surged 18% in after-hours trading following reports that the company is considering investing in Bitcoin. CNBC, citing three anonymous sources, stated that GameStop is exploring alternative assets, including cryptocurrencies, but has not yet made a final decision.

After briefly hitting $31.30, GameStop’s stock settled at $28.36, maintaining a 7% after-hours gain. Speculation around this potential move was fueled by a Feb. 7 post from CEO Ryan Cohen featuring a photo with MicroStrategy’s Michael Saylor, though CNBC sources confirmed Saylor is not involved in any Bitcoin acquisition plans.

Additionally, a Solana-based memecoin named GameStop (GME) surged 45% to $0.0027 before retracting to $0.0025. The stock’s movement aligns with a broader trend of companies adding Bitcoin to their balance sheets, such as Japanese firms Gumi and Metaplanet, which recently expanded their BTC holdings.

GameStop has previously dabbled in crypto, launching an NFT marketplace and a crypto wallet, both of which were shut down due to regulatory concerns. The company became a meme stock sensation in 2021 after a historic short squeeze.

Join Edan Yago, Core Contributor of BitcoinOS, and Bill Barhydt, Founder and CEO of Abra, as they break down the latest Bitcoin and crypto news. In the second half, Dan from The Chart Guys shares his expert market analysis and key trade insights.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.