The Lesaka story: Shaping the future of financial services in Southern Africa - TechCentral

catching up; it’s defining the future of fintech. With Boston Consulting Group forecasting that fintech revenues across the continent will grow 13-fold within the next decade, the momentum is real. A convergence of powerful trends drives this: a growing, youthful population, increasing digital penetration, and a deep desire for accessible and affordable financial services.

This transformation goes beyond technological – it’s deeply human. People choose solutions that are simple, trustworthy and genuinely useful. That’s why fintech is succeeding where legacy banks have struggled. It’s about more than digitising transactions – it’s about building ecosystems that reflect how Southern Africans actually live, earn and spend, now and in the future.

Four years ago, I left a large financial institution after 20 years’ service to help turn around a struggling fintech. I was sold on the vision of building a company with impact: a platform for financial and economic inclusion, helping underserved consumers and merchants fulfil their potential.

We boldly named this platform Lesaka – rooted in the Sotho and Tswana languages. Lesaka means “kraal”, a place of protection, belonging and order. For millions of people across Southern Africa, the kraal is where the community gathers, where resources are safeguarded and the future is planned.

This is a fitting metaphor for what we are building: a secure and inclusive financial ecosystem in which every participant – from the underserved consumer in an informal settlement to the village trader, the township merchant, the suburban restaurateur and the corporate enterprise – holds a rightful place and a clear pathway to grow.

Lesaka is a digital kraal for the modern economy.

Each day, our solutions drive the digitisation of everyday commerce:

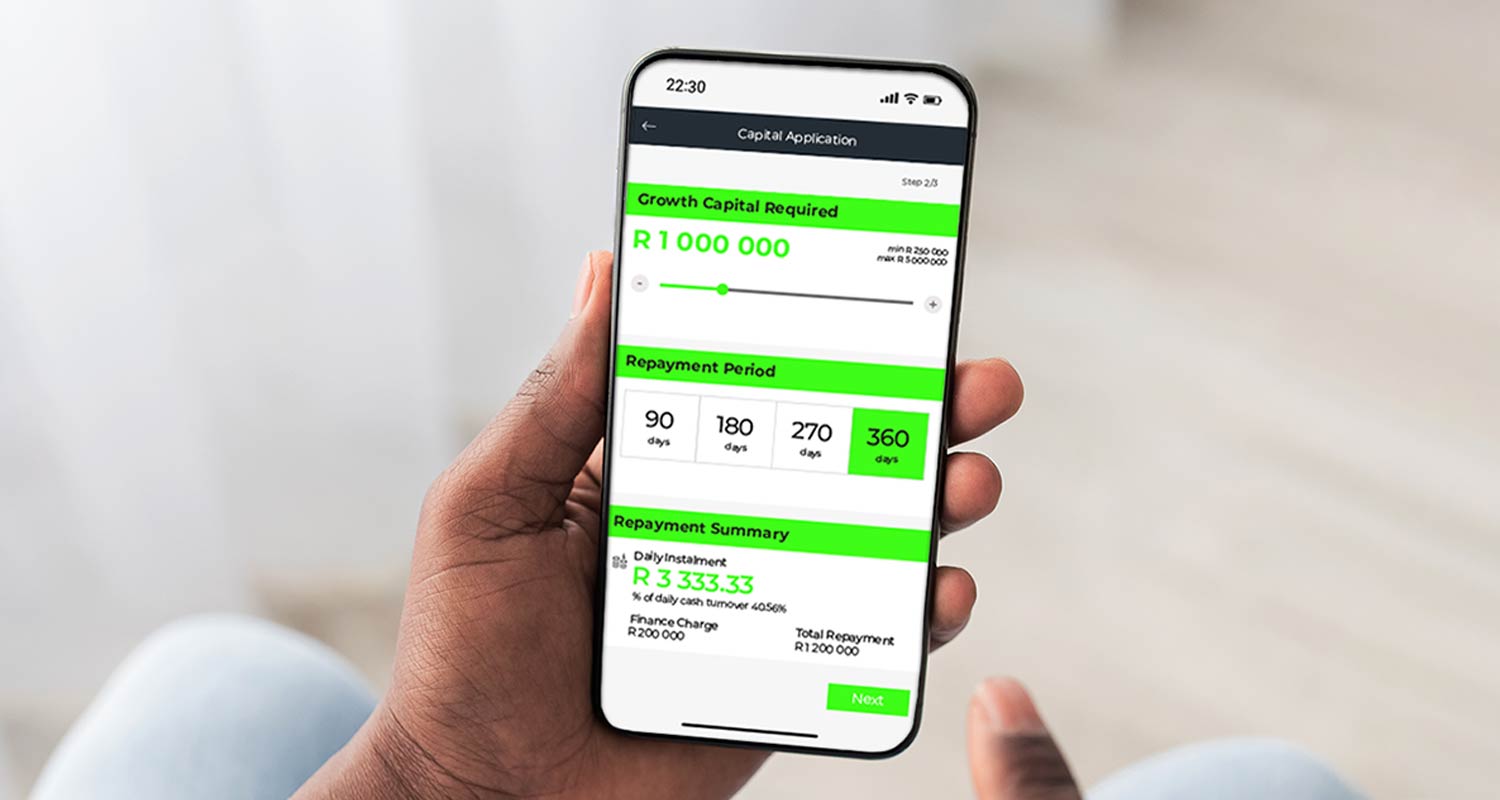

These are more than use cases. They are signals of an economic transformation for more than 120 000 merchants and 1.9 million consumers. Through our solutions, we have been able to integrate payments, lending, software and value-added services into a single experience, designed for scale and relevance for these underserved consumers and merchants. We are focusing on solving their pain points in a manner that enables them to grow and prosper.

Financial inclusion is not an act of charity – it’s sustainable business. Lesaka has just reported its third-quarter results, delivering R2.5-billion in revenue, R1.35-billion in net revenue and group adjusted Ebitda – or earnings before interest, tax, depreciation and amortisation – of R237-million.

We reaffirmed our financial year 2025 guidance of group adjusted Ebitda of R900-million to R1-billion and reaffirmed our FY2026 guidance of group adjusted Ebitda of R1.25-billion to R1.45-billion. At the mid-points, this represents a 40%-plus growth in group adjusted Ebitda next year.

We reaffirmed our financial year 2025 guidance of group adjusted Ebitda of R900-million to R1-billion and reaffirmed our FY2026 guidance of group adjusted Ebitda of R1.25-billion to R1.45-billion. At the mid-points, this represents a 40%-plus growth in group adjusted Ebitda next year.

Our financial success has allowed us to have a positive impact on our communities. Our brpad-based black economic empowerment rating has improved from level 8 in 2022 to level 2 today. As businesses grow and prosper, so, too, should the employees who are fundamental to their success.

This principle of shared ownership is what underpins our employee share ownership plan (ESOP). One of the distinctive aspects of Lesaka’s ESOP is our commitment to shared ownership with a broad range of our employees. At inception, all qualifying employees, regardless of seniority, salary, race or gender, will receive equal benefits under the plan. Senior executives are excluded.

As I reflect on what we have achieved, I am inspired by the fact that this is not our finish line; it’s our foundation. The Lesaka platform will keep evolving: embedding software into businesses, expanding digital payments and integrating financial tools, all while keeping the experience seamless for users.

And we are not doing this alone. Through the Association of South African Payments Providers, we are collaborating with regulators to modernise payments in an inclusive, agile and responsive way that benefits society. Fintech is no longer just about disruption; it is about co-creation and nation building.

I am heartened by the fact that we are attracting top talent motivated by purpose – people who want to do meaningful work, from builders to problem solvers and visionaries. At Lesaka, we hope that they find not just a job, but a mission: to shape the financial future of a continent.

As we do all this, fuelled by our entrepreneurial spirit, we are not chasing a race. We are building a new track where every participant, no matter their starting point, has a chance to win.

That’s the Lesaka story. That’s the future we are shaping. We stand ready to unleash the potential of our continent, one consumer and one merchant at a time.

We are at an early stage of our journey and the opportunity is vast. The Lesaka platform is designed to benefit from a broad range of fintech opportunities that we believe are going to compound for at least a generation or more across the African continent.

Lesaka Technologies is a South African fintech company driven by a purpose to provide financial services and software to Southern Africa’s underserviced consumers and merchants. By providing a full-service fintech platform in our connected ecosystem, we facilitate the digitisation of commerce in our markets. Lesaka has a primary listing on the Nasdaq (LSAK) and a secondary listing on the JSE (LSK).

Don’t miss: