The Big Beautiful Turd in the Renewable Energy Pool

The IRA passed by the thinnest possible margin in the Senate and in the House of Representatives. Across both chambers, all 270 Democrats (and Independents caucusing with them) voted for the legislation, and all 257 Republicans voted against it, something that would surely be remembered if and when the political pendulum swung.

As the old adage goes, “payback is hell,” and last week Democrats got theirs when the Republican controlled U.S. House of Representatives passed the “One Big Beautiful Bill Act” (1BBB) by exactly one vote (215-214) along party lines much like the IRA (even without five Republicans, including two who voted against it). Numerous sections in the bill (Energy, Environment, Taxes) effectively destroy the economic case for wind and solar. After passing the Green New Deal IRA in 2022 only by VP Harris’ tie-breaking vote, Democrats entire forced “energy transition” to wind and solar now hangs in the balance of the 1BBB and a Senate controlled by Republicans.

The bill douses the “renewable energy transition” witch with water. How bad did wind and solar energy get hammered, and what does the bill do for natural gas and nuclear energy? What would the bill’s passage mean for states with time-dated commitments to “net zero” electricity? Let’s take a closer look at how the bill ruins “renewables” and puts the brakes on overbuilding wind and solar “capacity.”

We begin our story by happily reporting that under Title IV “Energy and Commerce” the 1BBB hammers or eliminates the key federal tax incentives that have underpinned wind and solar energy for too long, primarily by targeting “clean energy” tax credits, accelerating their expiration and imposing strict new eligibility requirements. The bill’s changes to Investment Tax Credits (ITC) and Production Tax Credits (PTC) are key.

In one vote, “renewable energy” advocates magic bridge to the forced “energy transition” future was destroyed by nothing more than words on paper (ironically, in the same manner it was created). The chart below summarizes these key changes.

Here’s a bit more detail on each:

Current Law: The “tech-neutral” credits were to be available through at least 2032, with a gradual phase-down afterward.

Bill Change: The bill accelerates the expiration date to 2028 for most clean electricity projects, including wind and solar.

Impact: Projects not started within this window lose eligibility,

Current Law: Homeowners could claim a 30% tax credit on solar installations through 2032, with a phase-down to 26% in 2033, 22% in 2034, and expiration after 2034.

Bill Change: The bill nearly a decade ahead of schedule, .

Impact: Homeowners installing solar after December 31, 2025 would not be eligible for the federal tax credit. Won’t stop wealthy green virtue signalers in tony neighborhoods, but will stop most everyone else.

Change: The bill prohibits companies from claiming the commercial solar tax credit . Only direct purchases (not leases or PPAs) would qualify in 2025.

Impact: The change effectively crushes the business model for companies that lease solar systems to homeowners, removing a compelling reason (the tax benefit) for those installations.

Change: The bill eliminates the ability .

Impact: This hammers financial models for wind and solar developers and will dramatically impact their ability to raise capital for new projects. Add higher interest rates after Covid-19(84) and the model effectively self-combusts.

Change: Starting January 1, 2026, clean power projects cannot use components from "foreign entities of concern" .

Impact: Because so much of the wind and solar supply chain relies on Chinese components, these restrictions will wipe out many if not most project’s eligibility for tax credits. (And U.S.-manufactured wind and solar kit won’t pencil financially for domestic projects. Tragic, really.)

While wind and solar got hammered, the 1BBB makes it clear that Republicans see natural gas and nuclear energy as key to U.S. economic competitiveness and energy affordability, reliability, and security. The "One Big Beautiful Bill" treats natural gas—and the broader oil and gas sector—as the bedrock of energy that it actually is compared to wind and solar.

The key provisions affecting natural gas include:

: Repeals the methane emissions fee imposed by the Biden administration on the oil and gas sector.

: Unlocks more oil and gas development on federal lands and aims to remove regulatory barriers that have limited new projects.

: Maintains tax policies that benefit the oil and natural gas industry.

: Or phase-outs for natural gas incentives. Instead, the bill rolls back climate-related regulations and maintains or enhances the sector’s tax advantages.

The 1BBB also favors nuclear energy. While it accelerates the expiration of most clean electricity tax credits (such as those for wind and solar) to 2028 and imposes strict new deadlines, it makes a clear exception for nuclear projects (with a deadline hitch):

: Advanced nuclear facilities (or expansions of existing nuclear plants) remain eligible for the tech-neutral Clean Electricity PTC (Section 45Y) and ITC (Section 48E) as long as construction begins before December 31, 2028. While this gives nuclear projects an extra year compared to other technologies (which must begin construction within 60 days of the bill’s enactment to qualify), practically the end of 2028 deadline is a disappointment (one the Senate can still fix).

: The bill also preserves the ability to transfer (sell) tax credits for nuclear projects for the duration those credits are available, even as it eliminates transferability for most other clean energy credits after 2027.

The dire threat to American “renewable” energy interests was quickly reflected in wind and solar equities. The image below shows some of those stocks at the market close on the day that the House of Representatives passed the bill. The three highlighted solar stocks were the biggest losers of the group.

The screams and howls of climate Armageddon, job losses, higher electricity costs for consumers and other pablum immediately reached a fevered pitch among “renewable energy” company CEOs, industry associations, EcoStatists™, Charlaticians™, and talking heads. A few included shameless whoppers that inverted reality so badly we included them for entertainment value.

The Solar Energy Industries Association (SEIA) issued a statement claiming (emphasis ours):

“This unworkable legislation is willfully ignorant of the U.S. power grid can meet the demand of American consumers, businesses and innovation.”

SEIA President and CEO, Abigail Ross Hopper, stated that the bill would "slam the brakes on solar and storage investments" at a time when energy demand is surging, particularly due to AI and data center growth. Her comment belies the fact that solar energy is as useful to electricity-gobbling AI as cars are to fish.

Heather O’Neill, President & CEO of Advanced Energy United called the bill a “meat clever,” adding that it (emphasis ours):

“...abruptly dismantles bipartisan, long-standing tax policy that has catalyzed billions in private investment for . If enacted as written, this bill will and , and .”

“Clean energy” is the opposite of “affordable, reliable energy.” It did not spark “a rebirth of manufacturing across America” and has weakened our electricity grid. The only “energy dominance” the U.S. ceded were wind and solar which it helped subsidize into existence (with Europe). China used its cheap (sometimes slave) labor, coal-fired power, and pipes to rivers as their industrial wastewater treatment plants to gain a cost advantage to make solar panels and Spinning Green Crucifixes™ in a Green Cold War the west created but could never win.

If the American Petroleum Institute had said exactly what O’Neill did about a bill that constrained oil and gas development, they would be correct while Ms. O’Neill and regressive progressive Democrats would accuse them of lying. Do not expect Ms. Hopper and Ms. O’Neill to see that irony.

In a statement posted on X,The American Clean Power Association highlighted that the bill "immediately ends the clean energy tax incentives that provide , , and to millions of Americans." (Try not to laugh.)

Not satisfied that his party’s 1BBB sufficiently stomped the life out of wind and solar projects in the U.S., the very next day President issued four Executive Orders (EOs) aimed at advancing nuclear energy, backing the truck over the wicked witch of “renewable energy” just in case the House’s dousing with the firehouse didn’t melt her completely. The four EO’s attempt to boost nuclear power generation by (links live to each):

·

·

·

·

The EO’s include long-overdue calls for science-based radiation limits and reconsidering the linear no-threshold (LNT) model, creating a domestic nuclear fuel supply chain and workforce, and expanding fuel cycles to produce HALEU (high-assay low-enriched uranium) fuel for advanced reactor designs among many other exciting changes. None of the above will be quick or easy.

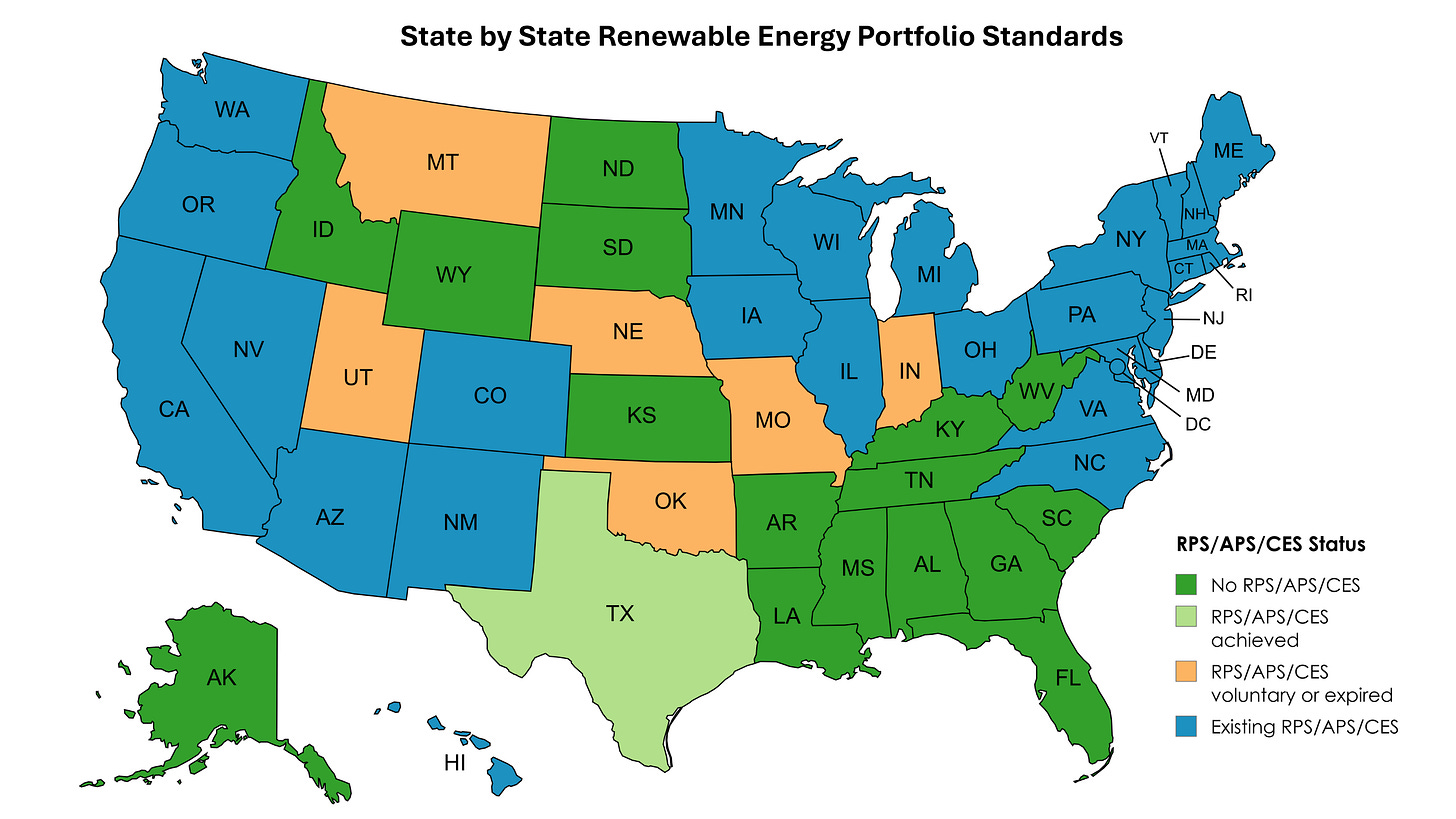

As written, the 1BBB creates an irreconcilable dilemma for more than half of U.S. states. We mapped the states with “Renewable Portfolio Standards” for electricity generation (i.e., “RPS”, “Alternative Energy Portfolio Standards” (APS), or “Clean Energy Standards” (CES).

In the map below, the green states are analogous to Toyota, the smartest people in the room when it came to electric vehicles (EVs). While many other manufacturers went all in, Toyota made only one hybrid-electric model (Prius) while their engineers carefully studied battery EVs.

The blue states (nearly exclusively Democrat-controlled) went all in on “renewables” and tried to out-pledge each other’s “net zero by X” commitments like European nations.

As our map shows, nearly 30 U.S. states plus the District of Columbia (DC) and Puerto Rico (PR) have established “clean energy” or “renewable energy” RPS, APS or CES goals. Eleven states (California, Connecticut, Hawaii, Michigan, Minnesota, New Mexico, New York, Oregon, Rhode Island, Vermont, Washington) and DC have set their 100% “net zero” target dates before 2050. The three most ignorant/insane aggressively optimistic have target dates before 2040 (District of Columbia – 2032, Rhode Island – 2033, Vermont – 2035, including 2030 for the state’s largest utility).

The 1BBB puts the states committed to this cosplay in an impossible situation. If the federal government pulls the plug on the incentives for the forms of energy to which these states have committed (most by law), how will they meet their goals?

The 1BBB requires that, to be eligible for the remaining credits, projects must commence within 60 days of the legislation’s enactment and be completed before 2029. Permitting and approvals take months, and depending on whether wind or solar resources and the size of the installation (capacity in megawatts), site work and construction can take months to years. And the bill’s new credit conditions restricting components sourced from China effectively means few (if any) new projects will be able to meet the schedule with source-compliant components.

It will be politically hard (if not impossible) for many of these (blue) states to embrace nuclear power to fill the gap. About a dozen have legislation in place banning or restricting new nuclear power plant construction that would need to be repealed or amended.

As a practical matter, the chance these states achieved their “net zero” aspirations by 2040 or 2050 was always Slim and None, and Slim was already on the 4:05 Greyhound to El Paso. If the 1BBB becomes law as written, Slim expires on that bus.

The 1BBB attempts to stop the runaway wind and solar “installed capacity” train that has the U.S. electricity grid headed for a cliff. The bill attempts to derail that train in more ways than space permits complete examination.

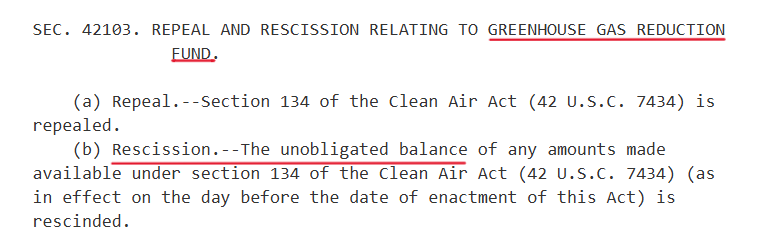

One section targets a program we noted in our February post Sunlight is the Best Disinfectant. The IRA added a section (Section 134) to the Clean Air Act, which established the Greenhouse Gas Reduction Fund (GGRF). U.S. Environmental Protection Agency (EPA) provides grants and other financial assistance via the GGRF “to reduce greenhouse gas emissions and promote zero-emission technologies.” The IRA allocated $27 billion for the GGRF, including $7 billion for direct grants and $20 billion for grants to non-profits, including $8 billion for low-income and disadvantaged communities, much of it for solar projects.

Remember when EPA staffer Brent Efron said the quiet part out loud in this Project Veritas video weeks after the 2024 election?

GGRF is the golden goose that laid those gold bars. Remember when EPA Director Lee Zeldin proclaimed his department was going to try to recover them? Absent removal by the Senate, that goose just got shot, and any golden eggs yet to be distributed (the “unobligated balance”) will be melted and returned to the Treasury thanks to the rescission language highlighted below.

Setting wind and solar ITC and PTC subsidies on fire stands to save U.S. taxpayers hundreds of billions of dollars over the next decade. The ~$367 billion acknowledged “climate”-related IRA spending did include the cost of uncapped wind and solar ITCs and PTCs that could have run into the trillions over time. The 1BBB forecloses that possibility.

Resources for the Future estimated the effect of eliminating these (Section 45Y and 48E) credits at $227–$315 billion over ten years (2025-2034). The Bipartisan Policy Center put the figure at $559 billion over the same period. Other estimates find a similar range.

We close with a dose of reality despite the good intentions of the 1BBB and Trump’s EO’s on nuclear energy. Several of the provisions are at cross purposes with the President’s and Republican’s agenda, including nuclear energy. For example, while the bill preserves the Department of Energy Loan Program Office (LPO), it rescinds unused IRA LPO credit subsidy funding that could be used to provide new loans to nuclear power plants. By limiting the applicability of the ITC and PTC for nuclear projects that commence construction after 2028, the bill effectively eliminates their ability to help finance and de-risk projects given the pace of nuclear construction. These examples just skim the surface.

Advancing nuclear power on federal lands in conjunction with the Department of Defense is an interesting idea, but clearing the National Environmental Policy Act (NEPA) process hurdle before any site civil work can begin averages 3-4 years. Reforming the NRC is sorely needed, as is the bewildering application of Linear No Threshold (LNT) risk assessment models for nuclear power plants, but these won’t be quick or easy, and both stand in the way of any major nuclear renaissance in America. Trump’s EO merely orders the NRC to “reconsider reliance on” LNT, something likely to make the NEPA process seem swift by comparison.

Trump could not resist attempting to one up Biden’s “plan” to triple nuclear power generation (to 300 gigawatts) by 2050, so his EO reforming the NRC ups the ante to 400 Gw by 2050. Admirable to be sure, but for perspective, the construction of the two new reactor units at Plant Vogtle in Georgia took about 15 years, and combined they generate 2.2 Gw. Robert Bryce’s recent Substack post examines the sobering reality of both President’s aspirations.

Some of these contradictions may be reconciled in the Senate’s final version. But lobbyists will be working overtime on members of the Senate as the bill proceeds to that chamber. A handful of Republicans realize the bill’s fate rests in their hands. Smoky backroom politics could water down the House’s version. “Renewable energy” lobbyists furiously attempting to break off half a dozen of the 53 Republicans in the majority could succeed, and the final 1BBB could give a life preserver to wind and solar. That would come at continued great expense to the American taxpayer and further threaten the reliability of the U.S. electric grid.

Finally, as fiscal conservatives we abhor the likelihood that (according to a CBO’s analysis) the 1BBB will add ~$2.3 trillion to the national debt over the next 10 fiscal years. The U.S. government has to learn to live within its means. The GOP cannot pretend perennial deficits and spiraling debt are solely a 21st century Democrat problem.

House Republicans’ Big Beautiful Turd in the “renewable energy” pool stands to finally stop the insane obsession with wind and solar “installed capacity”. Our advice for Senate Republicans: carpe diem, scream “Doodie!” and drain the pool.

“Like” this post or be forced to clean the pool.

Leave us a comment. We read every one and respond to most. Refuels the tank here.

Subscribe to environMENTAL for free below.

Share this post. Helps us grow. We’re grateful for the assist.