Tesla delays application as govt debates brownfield investment in EV policy

The Scheme for Promotion of Manufacturing of Electric Passenger Cars (SPMEPC) was notified last year and this scheme allowed those OEMs which were willing to establish a new manufacturing facility for making electric cars to import high value EVs at a concessional import duty rate of 15%. The SPMEPC was widely seen as a policy tailored to get US EV giant Tesla to make in India, since many provisions of the policy echoed Tesla’s specific demands.

But Tesla never arrived and in the interim, local OEMs began clamouring for inclusion in the policy, suggesting that brownfield investments–new manufacturing lines for electric passenger cars at existing plants--be included in the scope of the SPMEPC. The local industry wanted to test market their high-end cars in India by importing these at the concessional duty rates for three years.

It has been almost one year since the SPMEPC was notified but policy guidelines have not been issued, with government officials admitting that not a single applicant has shown interest in the scheme till date. In this one year, the government has been holding discussions with stakeholders, including representatives of global and local OEMs, which already make in India.

And a draft of the amended guidelines, framed after these deliberations, had been circulated last month. This draft allowed concessional import duties to be extended to OEMs making EVs at existing factories, subject to some local sourcing and mandatory investment conditions. Basically, the draft guidelines allowed brownfield investments too under the SPMEPC.

Now, a senior government official has told ETAuto that the draft is yet to be vetted by an inter-ministerial group and there is no guarantee that brownfield investments will eventually be allowed under the SPMEPC.

“These are just draft guidelines, nothing has been finalised till now. So how can we say whether brownfield investment will be allowed or not under SPMEPC? There has to be an inter-ministerial consultation first,” this official said.

The government departments which are expected to participate in this consultation include ministries of Road Transport and Highways, Finance, Petroleum and Natural Gas, Environment, Heavy Industries and Electronics, besides the Niti Ayog.

This means VinFast, the Vietnamese EV maker which had already established a manufacturing facility in India, will have to wait alongside local OEMs such as the Mahindra, Tatas, Toyota Kirloskar Motor, Hyundai Motor India and others for a decision on whether they will be allowed concessional import duty rates.

The official said the government has no information as yet on whether Tesla will set up a manufacturing facility in the country, since the company has participated in just one stakeholder meeting last year.

“We have held three such meetings, Tesla was part of just the first one and that too as an observer. The company may be setting up showrooms in India and importing high-end cars at full duty rates, just like Mercedes, BMW or others are importing cars. There is no word from Tesla on manufacturing in India till now,” this official said, adding the guidelines on SPMEPC could take another month or two to be finalised.

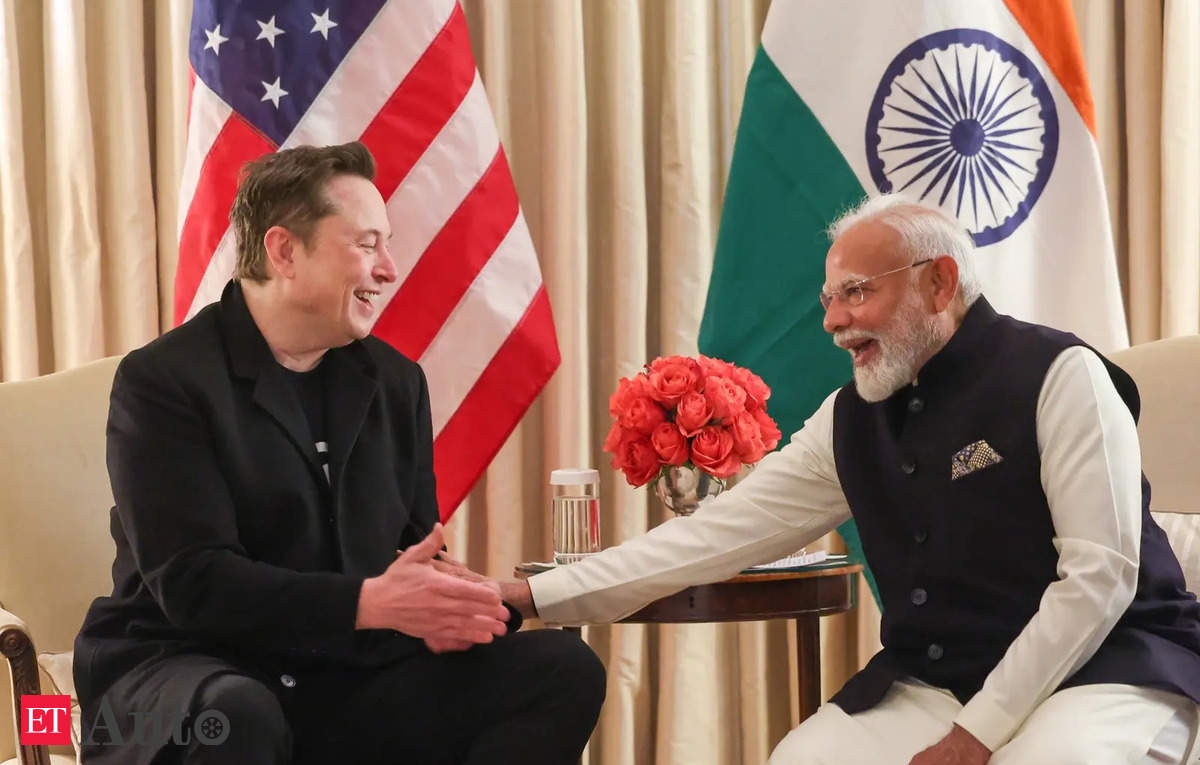

Meanwhile, Tesla is believed to be finalising showrooms locations across Delhi and Mumbai, just after Prime Minister Narendra Modi met Elon Musk during his recent visit to the United States. An industry representative had earlier said that the decision on whether to include brownfield investments is now pending approval of the Prime Minister’s Office. This person had also alluded to local OEMs being wary of the Chinese threat– well funded Chinese OEMs could apply for concessional import duty rates under SPEMPC, thwarting local OEMs’ investments.

SPMEPC draft guidelines

The policy allows import of cars with CIF (cost, insurance, and freight) value of $35000, which attract 70% duty currently at 15% duty as long as they set up a manufacturing facility in India within three years. Another stipulation is that such companies should achieve a localisation level of 50% by the fifth year. The annual imports of e-vehicles under this policy have been capped at 8000 units.

To qualify, an OEM should commit an investment of $500 million (Rs 4,150 crore), show localisation level of 25% within three years and 50% within five years. This will entitle the company to import e-vehicles of CIF value $35,000 (about Rs 29 lakh) and above at a concessional customs duty rate of 15% for five years.

Also, the total number of EVs which can be imported under the new policy would be determined by “the total duty foregone or investment made, whichever is lower, subject to a maximum of Rs 6,484 crore”. The investment commitment made by each player setting up a manufacturing facility would have to be backed by a bank guarantee, in lieu of the customs duty foregone.

Also, the draft guidelines circulated after stakeholder consultations make it clear that investment made by the applicant and capitalised in its books of accounts on or after the application approval date only will be considered under the scheme, ensuring that investments already made by OEMs are not used to seek concessional import duty rates. Also, the word ‘brownfield’ makes an appearance in the draft: “in case the investment under the Scheme is made on a brownfield project, a clear physical demarcation with the existing manufacturing facility(ies) should be made.”

Then, the draft guidelines allow operations to commence “ within 3 years from application approval date” and also have a provision for penalties in case minimum revenue has not been achieved. By the fourth year, minimum revenue which the OEM needs to show from the sale of products approved under SPMEPC is Rs 5,000 crore, which goes up to Rs 7,500 crore by the fifth year. If the revenue falls short in the fourth year by 75% or more, for example, the penalty payable is 3% of the amount of shortfall or 3% of Rs 3,750 crore which is Rs 112.5 crore.