Nvidia Reclaims Title as World's Most Valuable Company

Nvidia has officially reclaimed its position as the world's most valuable company, achieving a monumental $3.77 trillion market capitalization on June 26, 2025. This significant milestone sees the AI chip giant surpass both Microsoft and Apple, underscoring its unparalleled dominance in the rapidly expanding artificial intelligence sector. This achievement reflects an astonishing journey for Nvidia, which had a market value of just under $3 billion a mere 25 years ago, growing from approximately $2.4 billion in 2000 and $3.7 billion by 2003 to its current valuation, an explosion of over 100,000%.

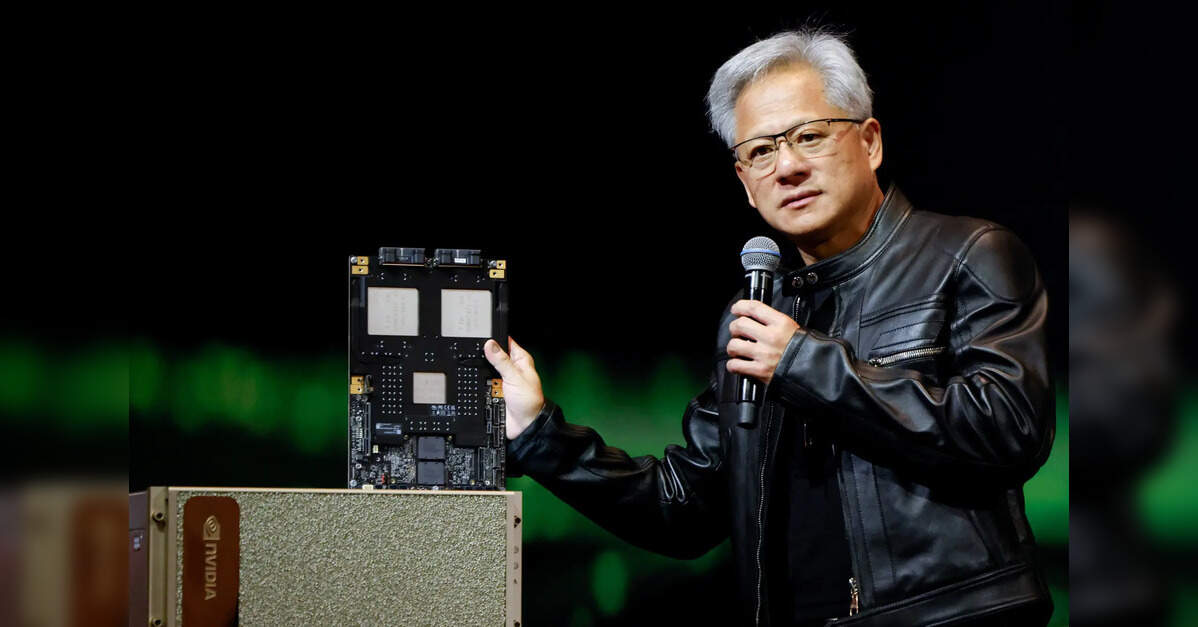

The primary catalyst behind Nvidia's explosive growth is its unmatched leadership in the AI chip market. Its Graphics Processing Units (GPUs) have become the industry standard, powering artificial intelligence applications across diverse sectors, from training large language models to enabling AI in robotics. A critical component of this success is the Blackwell AI chip platform, which serves as the backbone for cloud data centers and cutting-edge generative AI tools. Furthermore, Nvidia has strategically secured all of Wistron’s server manufacturing capacity in Taiwan through 2026, a move reported by CNBC that significantly limits competitors' ability to catch up and effectively locks in Nvidia's dominant position for the foreseeable future by controlling vital supply lines.

Nvidia's stock performance has been nothing short of staggering. The company's shares closed at $155.02 on June 26, 2025, after a remarkable surge. In 2024 alone, Nvidia's stock was up 170%, and it added over $500 billion in market value in just the past month, with a 36% increase in the last three months. Wall Street analysts are closely monitoring this trajectory; Loop Capital, for instance, has raised its price target to $250, suggesting that Nvidia could potentially become the world's first $6 trillion company if the current demand continues. Analysts also believe that despite these massive gains, Nvidia still possesses substantial room for further growth as AI adoption expands into new frontiers such as robotics, self-driving cars, healthcare, and edge computing.

The future growth potential for Nvidia remains exceptionally strong due to the expanding global AI market, which is projected to grow from $235 billion in 2024 to over $630 billion by 2028. Major cloud service providers like Microsoft, Amazon, and Google are heavily reliant on Nvidia's GPUs for their AI infrastructure. Nvidia CEO Jensen Huang has also articulated plans for expansion into emerging markets like robotics and autonomous vehicles, areas that represent massive untapped potential. Coupled with its ongoing strategy of securing exclusive production agreements with key manufacturers, Nvidia is not only leading in technological innovation but also effectively dominating the entire supply chain.

Looking ahead, Nvidia is evolving beyond a mere chipmaker to become the fundamental backbone of the global AI revolution. As industries ranging from finance to defense increasingly integrate AI into their operations, the demand for Nvidia's products is set to escalate. Analysts contend that Nvidia's comprehensive control over both its advanced technology and manufacturing processes makes it one of the most defensible companies in the tech landscape. Unlike many previous tech booms, Nvidia's current surge is underpinned by tangible demand, robust profits, and widespread global adoption. With its current momentum and a strong pipeline of innovations, including its advanced Blackwell chips, Nvidia is poised to maintain its leadership position for an extended period, fundamentally shaping the future of technology.