Nvidia (NVDA) Reduces Stake in Chipmaker Arm Holdings | Markets Insider

Regulatory filings show that Nvidia (NVDA) has reduced its investment in British chipmaker Arm Holdings (ARM) by about 44%.

Silicon Valley-based Nvidia cut its stake in Arm by 43.8% to 1.1 million shares, valuing its remaining investment at $181 million. Arm, whose stock is down about 3% on news of the share sale, supplies the intellectual property that firms such as Nvidia and Apple (AAPL) license to create their microchips and processors.

Investors carefully parse Nvidia’s investment moves for insights into the company’s strategy and direction, particularly in the area of artificial intelligence (AI). Nvidia isn’t the only company to sell down its stake in Arm Holdings. Intel (INTC) recently sold off its entire stake in Arm amid that company’s current restructuring.

Beyond Arm Holdings, Nvidia exited its entire stake in SoundHound AI (SOUN) in the fourth quarter of last year, according to filings with the U.S. Securities and Exchange Commission (SEC). Nvidia also dissolved its holding in Israel-based medtech company Nano-X Imaging Ltd.

In terms of new positions, Nvidia purchased 1.7 million shares in China’s self-driving startup WeRide in the final months of 2024. WeRide uses Nvidia’s processors and AI software to power its vehicles. Nvidia’s own stock has risen 91% over the last 12 months.

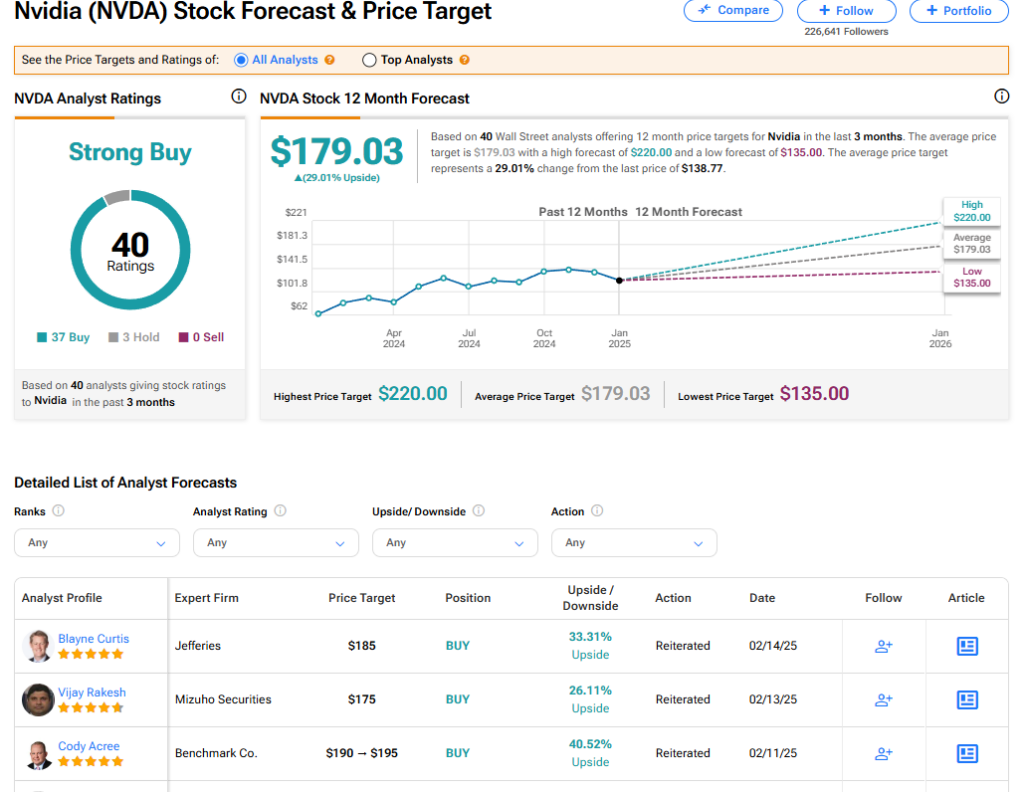

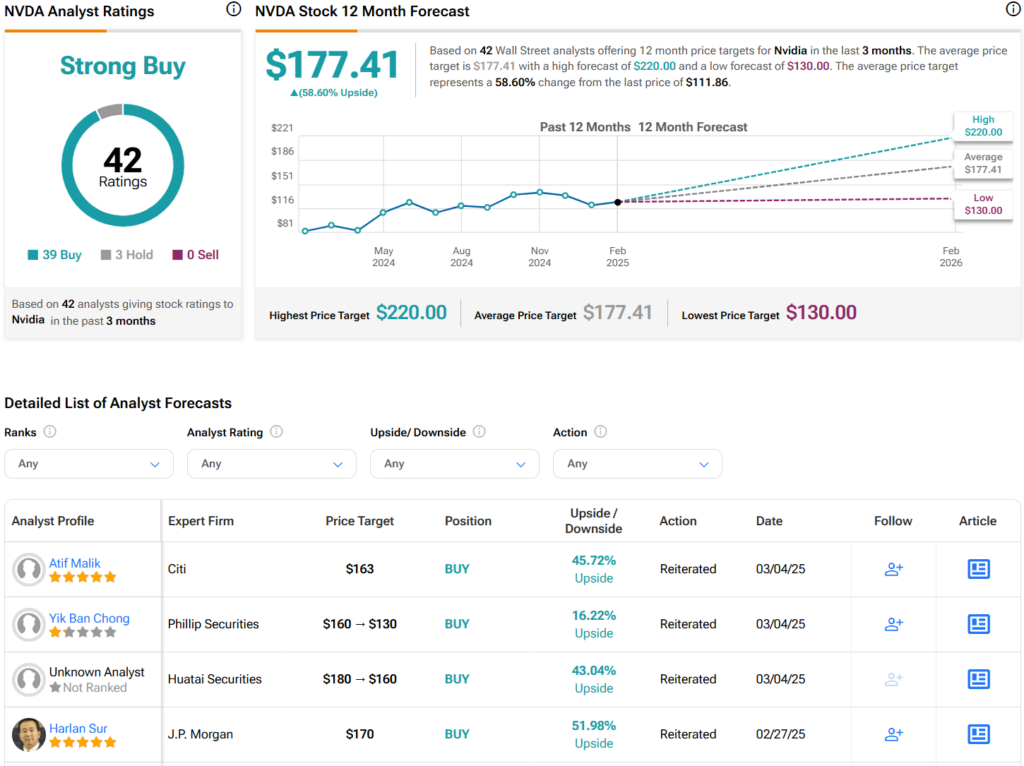

Nvidia’s stock currently has a consensus Strong Buy rating among 40 Wall Street analysts. That rating is based on 37 Buy and three Hold recommendations assigned in the last three months. The average NVDA price target of $179.03 implies 29.01% upside from current levels.