Nigeria open for business, says Shettima at 2025 PPP summit

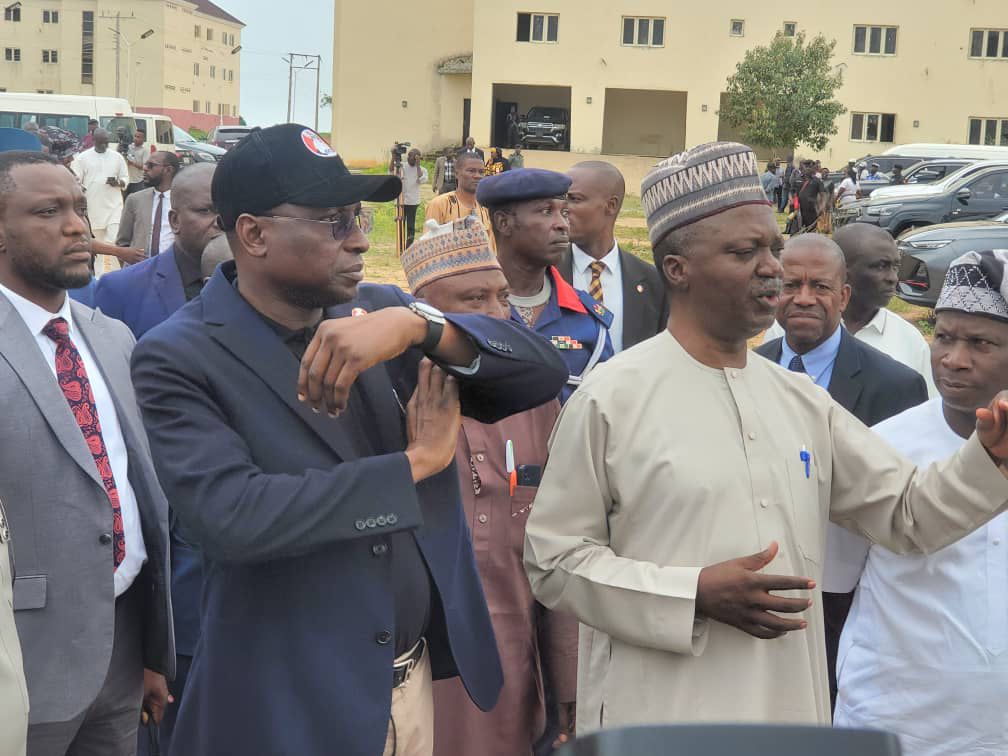

Vice President Kashim Shettima on Tuesday declared Nigeria ready and open for business as he officially opened the Nigeria 2025 Public-Private Partnership Summit at the State House, Abuja.

The event, organised by the Infrastructure Concession Regulatory Commission, brought together stakeholders from government and the private sector to explore strategies for closing Nigeria’s $2.3 trillion infrastructure gap.

Delivering his remarks on behalf of President Bola Tinubu, Shettima stated, “We are not seeking investors to carry burdens; we are opening opportunities to create value. We want long-term partners ready to bridge our infrastructure gap with purpose, precision, and integrity.”

He underscored that Nigeria can no longer build a modern economy on outdated infrastructure, adding that exclusive reliance on government funding for capital projects was unsustainable.

Highlighting the government’s reform efforts, Shettima said the Tinubu administration had liberalised the foreign exchange market, removed fuel subsidies, and strengthened the ICRC in a bid to attract investment.

“Policies alone don’t generate megawatts or build roads. What we need is collective action,” he said.

The Vice President noted that the goal, guided by the National Integrated Infrastructure Master Plan (2020–2043), is to raise infrastructure stock from 30–35% of GDP to at least 70% by 2043.

Citing Nigeria’s demographic strength—over 230 million people, projected to reach 440 million by 2050—Shettima stressed the country’s unmatched market potential.

“One out of every four Black people is a Nigerian. There is no African market like this,” he said.

He urged investors to focus on long-term value and impact.

“Let this summit not be remembered for kind speeches; we’ve had those for decades, but for bankable projects, signed deals, and enduring progress,” Shettima added.

In his welcome address, ICRC Director General Jobson Ewalefoh reaffirmed the government’s resolve to close the infrastructure deficit through strategic PPPs.

Speaking on the summit’s theme, “Unlocking Nigeria’s Potential: The Role of PPPs in Delivering the Renewed Hope Agenda,” Ewalefoh said PPPs are critical to achieving sustainable development.

He cited projects such as the Highway Development and Management Initiative, the Egini Medical Infrastructure Scheme, and the Dasin Hausa Dam as examples of ongoing progress.

“ICRC is committed to ensuring that all PPP projects are legally compliant, economically viable, and socially impactful,” the DG said.

Ewalefoh also commended Tinubu and Shettima for prioritising infrastructure and fostering private-sector-led growth. He acknowledged the support of development partners, including AfDB, NESG, Afreximbank, IFC, and Africa50.

Judicial delays raising Nigeria’s financial risk profile – UBA GMD

Meanwhile, the Group Managing Director of United Bank for Africa Plc, Oliver Alawuba, has said that persistent judicial delays and inefficiencies are heightening the financial risk profile of Nigeria and undermining confidence in the banking sector.

Alawuba stated this on Tuesday during the 23rd National Seminar on Banking and Allied Matters for Judges, held at the National Judicial Institute, Abuja.

The two-day event was jointly organised by the Chartered Institute of Bankers of Nigeria and the National Judicial Institute.

Speaking on the theme, ‘Justice and Finance in Partnership: Enabling Trust, Security and Nigeria’s Economic Growth’, Alawuba, who also serves as Chairman of the Body of Bank Chief Executive Officers, stressed the need for greater synergy between the judiciary and the financial services sector.

He said, “In Nigeria, however, judicial delays, overlapping jurisdictions, and enforcement challenges continue to increase the risk profile of financial transactions.”

Alawuba cited data published in April 2025 showing that non-performing loans in the Nigerian banking sector had risen to over N1.57 trillion, partly due to sluggish legal processes in contract enforcement and debt recovery.

“Prolonged litigation and enforcement bottlenecks are not mere technicalities – they impede credit access, raise the cost of capital, and limit the capacity of banks to support SMEs and job creation,” he added.

He explained that the effectiveness of Nigeria’s financial system depends largely on a fair, efficient and predictable judiciary, adding that the current state of delays contributes to the rising level of non-performing loans in the industry.

He stated, “No economy can flourish without the enabling guardrails of justice – an impartial judiciary, rule of law, and a predictable legal environment that inspires trust.”

Alawuba called for urgent reforms, including the digitisation of judicial processes, the establishment of specialised financial courts, and harmonised legal frameworks across jurisdictions.

“Our partnership is not one of convenience, but of necessity. Without a strong, efficient judiciary, banks will struggle to extend credit with confidence.

“Without a sound financial system, government revenues, public investments, and judicial infrastructure cannot be sustainably financed,” he added.

In her remarks, the Chief Justice of Nigeria, Justice Kudirat Kekere-Ekun, who declared the seminar open, described judicial predictability as an important factor in economic development.

She also stressed the judiciary’s role in strengthening financial confidence and legal certainty.

“Judicial predictability is not just a legal virtue; it is an economic asset. It enhances market efficiency, lowers risk premiums, and unlocks capital for business and infrastructure development.

“In contrast, perceptions of delay, unpredictability, or opacity in dispute resolution erode investor confidence, deter growth, and can lead to systemic distrust,” she said.

Kekere-Ekun added that the judiciary must continuously adapt to evolving financial innovations, especially in areas such as fintech, digital banking and cybercrime.

“Our courts must possess the capacity to interpret complex transactions and assess novel financial arrangements within the framework of existing laws, while also contributing meaningfully to the development of jurisprudence that supports economic innovation without compromising legal safeguards,” she noted.

Kekere-Ekun also advocated continuous judicial education, particularly in areas such as digital finance, cybercrime and fintech, noting that Nigerian courts must be equipped to interpret complex financial transactions within existing legal frameworks.

The President and Chairman of the Council of the Chartered Institute of Bankers of Nigeria, Prof. Pius Olanrewaju, emphasised the strategic importance of deepening collaboration between the judiciary, the banking industry, and law enforcement agencies to strengthen Nigeria’s financial ecosystem.

He noted that the seminar serves as a critical platform for addressing long-standing legal and operational issues affecting the banking sector.

He pointed out that the CIBN had constituted a high-level organising committee made up of representatives from key institutions, including the Central Bank of Nigeria, Nigeria Inter-Bank Settlement System, the Nigerian Bar Association, and the Body of Bank CEOs, among others.

A survey conducted by the committee revealed several challenges requiring urgent attention, such as the need to improve judicial enforcement mechanisms, address inappropriate garnishee and Post No Debit orders, and build judicial capacity to handle cybercrime and complex financial disputes.

Olanrewaju also highlighted the need for the judiciary to adapt to the rapid changes in the financial landscape, especially with the rise of fintech, artificial intelligence, digital currencies, and open banking.

He stated that these developments demand a legal system that is not only informed but also responsive to emerging risks and innovations.

He reaffirmed CIBN’s commitment to promoting ethical conduct and professionalism in the banking industry through its alternative dispute resolution efforts, which have led to significant financial recoveries.

The Administrator of the National Judicial Institute, Justice Salisu Abdullahi, described the forum as a vital platform for equipping judges with the knowledge required to navigate complex financial cases.

He stressed that the judiciary plays a central role in promoting investor confidence by ensuring fairness, predictability, and the consistent enforcement of financial laws.

Abdullahi further noted that a competent and independent judiciary is essential for fostering innovation, protecting capital, and creating the stability needed for businesses to thrive.