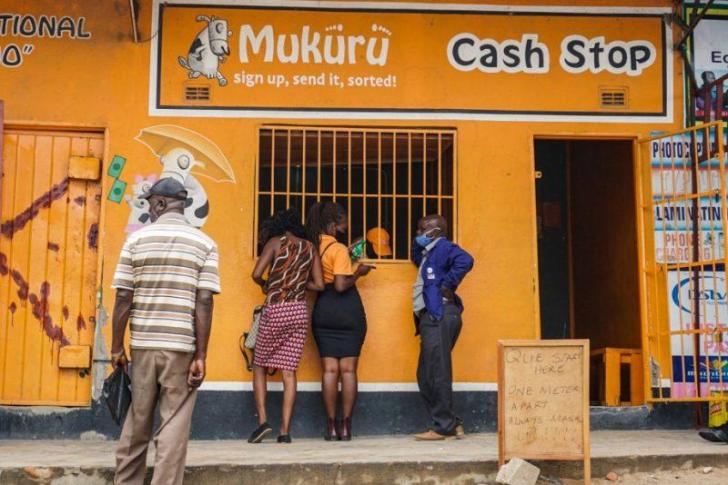

Mukuru, a prominent next-generation financial services platform in Southern Africa, has undergone a remarkable transformation since its inception in 2004, when it initially focused on selling international airtime. Today, the company plays a pivotal role in the region’s financial landscape, facilitating annual payment flows between $3.5 billion and $4 billion. This positions Mukuru at the core of Africa’s rapidly expanding digital financial ecosystem.

In a recent interview with Bloomberg, Mukuru’s CEO, Andy Jury, emphasized the company’s rapid growth, stating, “We are scaling up rapidly.” He noted a significant shift in customer behavior, with users becoming increasingly comfortable with digital means, networks, and infrastructure for their financial transactions. Mukuru’s expansion is closely aligned with Africa’s broader digital transformation. The continent has emerged as a global leader in mobile banking, with Sub-Saharan Africa accounting for nearly 50% of the world’s mobile money accounts and processing an impressive $2.5 billion in daily transactions.

This surge in digital financial activity is largely driven by a young, tech-savvy population that often faces limited access to traditional banking services. For example, Ghana has seen a staggering 51.76% increase in electronic transfers, reaching $196.7 billion in 2024. Digital transactions now represent two-thirds of Mukuru’s payments, a significant increase from just 40% four years ago, indicating a clear trend towards virtual money replacing cash and checks in everyday financial activities.

In response to this shift, Mukuru has broadened its wallet services. In January 2025, the company launched a digital wallet in Zimbabwe, which offers local and international money transfers, free cashouts, and basic payment services. This initiative follows the successful rollout of similar services in Malawi, where over 12 million people already utilize mobile money to manage their finances.

Fintech platforms like Mukuru have become essential components of the financial infrastructure in regions where traditional banks often struggle to establish a presence. They support critical functions such as remittances, payments, and access to credit, thereby enhancing financial inclusion for underserved populations.

However, despite Mukuru’s impressive growth trajectory, the fintech sector faces significant challenges. One of the primary obstacles is the lack of a unified regulatory framework across African nations, which complicates operations for companies like Mukuru. Navigating the diverse regulations across 54 different countries can be time-consuming and hinders the ability to achieve economies of scale. Jury highlighted this complexity, emphasizing the need to “knit together the puzzle pieces of 54 nation-states” to streamline operations.

Interoperability among mobile money platforms also remains a critical issue. Experts advocate for seamless transactions between various mobile wallets and bank accounts to reduce the notably high remittance costs in Africa. As of 2023, the global average cost for sending $200 was 6.3%, while in Africa, it soared to as high as 27%. This fragmented landscape not only slows the pace of expansion for companies like Mukuru but also limits the potential benefits for consumers.

Despite these challenges, Mukuru has made significant strides, now holding licenses to operate in 50 territories—a feat that took nearly two decades to accomplish. The opportunity for Mukuru lies not only in capturing a growing market but also in shaping the future of financial services for underserved populations across the continent.

As Africa’s mobile-first economy continues to evolve, Mukuru’s expansion efforts reflect both the vast opportunities available and the complex realities of conducting business in a diverse and dynamic environment. The company’s journey illustrates the potential for fintech to transform financial access and inclusion in Southern Africa and beyond.