Mounting Debt, Shrinking Public Trust

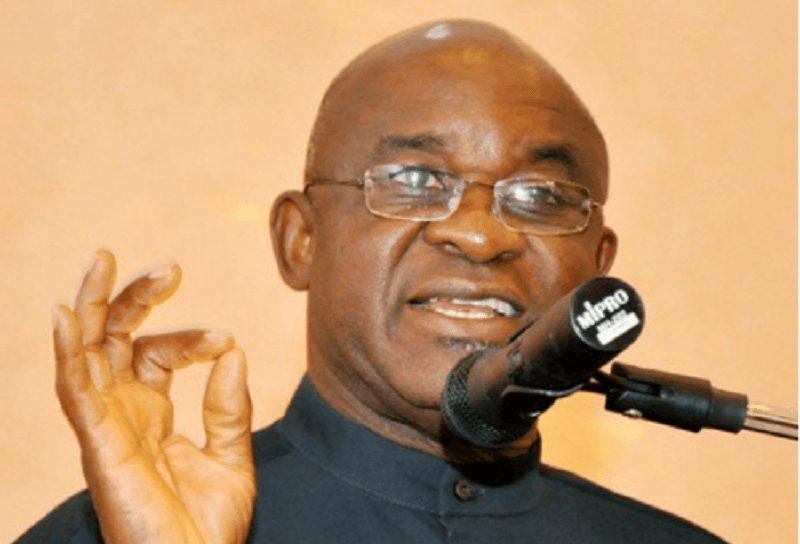

READING THE TEA LEAVES By Obinna Chima [email protected] 08152447875 (SmS only)

This week, President Bola Tinubu set tongues wagging when he formally requested the approval of the National Assembly to secure a new wave of multi-currency loans amounting to approximately $23.5 billion, €2.265 billion, ¥15 billion, and N757.9 billion, as part of the country’s 2025-2026 external borrowing plan.

Already, a lot of citizens have expressed concerns that the country may be heading towards a debt trap, a situation in which its debt is difficult or impossible to repay, almost two decades after it achieved debt forgiveness from the Paris Club.

More worrying with this development is the fact that, at a time when the Central Bank of Nigeria’s (CBN) Governor, Olayemi Cardoso and his team are aggressively pursuing a tight monetary policy regime aimed at curbing inflation and stabilising the naira, the federal government’s push for fresh borrowing appears to contradict this policy direction. Such a move risks undermining the effectiveness of monetary tightening by injecting more liquidity into the economy through increased public spending, potentially fueling inflationary pressures, distorting market signals, and eroding investor confidence in the government’s fiscal discipline.

Precisely, the fresh proposed borrowing plan, spanning multiple international lenders and development institutions, marks one of the most ambitious external financing proposals of this administration to date and will certainly elevate the country’s existing debt stock.

As at December 31, 2024, Nigeria’s total public debt stood at N144.67 trillion, according to data from the Debt Management Office. This was a 48.58 per cent rise from the N97.34 trillion recorded by the country as at the end of 2023.

However, the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has dismissed widespread claims suggesting that the country plans to borrow $25 billion within one to two years, calling such impressions as totally erroneous and misleading. He explained that the actual borrowing plan for 2025 is $1.2 billion through the DMO and up to $2 billion via the multilateral borrowing programme. These, he said, are tied to specific projects and would be disbursed over time, not in a lump sum.

“The actual borrowing for each year is contained in the annual budget. In 2025, the external borrowing component is $1.23 billion, and it has not yet been drawn. This is planned for the second half of 2025. Also, the plan is for both the federal and several state governments across numerous geopolitical zones, including Abia, Bauchi, Borno, Gombe, Kaduna, Lagos, Niger, Oyo, Sokoto, and Yobe States.

“Importantly, it should be noted that the borrowing rolling plan does not equate to an automatic increase in the nation’s debt burden. The nature of the rolling plan means that borrowings are split over the period of the projects. For example, a large proportion of projects in the 2024 – 2026 rolling plan have multi-year draw downs of between five to seven years, which are project-tied loans,” the minister stated.

Despite Edun’s clarification, the general concern is that Nigeria’s debt profile has been rising at an alarming pace. While borrowing is not inherently bad, as many nations leverage debt to fund growth, what distinguishes Nigeria’s case is the absence of a clear, measurable impact over the years, which has heightened distrust between the citizens and public office holders.

Public trust is the currency of governance. When leaders borrow in the name of national development, the people expect transparency, accountability, and results. This erosion of public trust is multifaceted, stemming from a combination of perceived corruption, lack of transparency in governance, inconsistent policy implementation, and a general feeling among citizens that their welfare is not the primary focus of leadership.

When citizens witness vast sums being borrowed with little to show for it in terms of improved public services or economic opportunities, skepticism naturally takes root. The opaqueness surrounding how loans are secured, how funds are disbursed, and the accountability mechanisms in place further fuels this distrust.

For instance, a recent revelation by civic tech organisation, BudgIT Nigeria, that it uncovered over 11,000 projects worth N6.93 trillion inserted by the National Assembly in the 2025 budget underscores growing concerns about transparency and fiscal discipline.

BudgIT had described the development as a deeply entrenched culture of exploitation and abuse, led by top-ranking members of the National Assembly, which is another means of frittering borrowed public funds meant to support national development.

This lack of transparency creates a chasm between the government and the governed, making it increasingly difficult for authorities to garner public support for necessary, albeit sometimes painful, economic reforms.

Indeed, Nigeria is not the first nation to borrow, and won’t be the last. But what distinguishes successful economies is not the size of their debt, but the clarity of their vision and the trust of their people.

This, however, is the time for other civil society groups, just like BudgIT, and indeed the citizens, to wake up, stay vigilant, and demand full accountability from those in power. We must ask the right questions about public finance, scrutinise every line of the budget, and track every amount borrowed to support governance. If we fail to act now, these massive loans meant to improve lives as had been reported in the past, could quietly vanish into private pockets, fueling corruption instead of development.

By prioritising fiscal discipline, fostering transparency, and actively working to restore the faith of its citizens, Nigeria can unlock its immense potential and build a more prosperous and equitable future for its citizens.

In the absence of trust, even the most well-intentioned policies will be met with suspicion. Therefore, as the government considers another round of massive borrowing, it must also begin the hard work of rebuilding its trust deficit.