Just Listed: Dolly Varden Silver (NYSE: DVS) Hits Our Radar For Tomorrow Morning

*Sponsored

Market Crux Announces Coverage On Dolly Varden Silver (NYSE: DVS)

Consider Starting Your Own Research On (DVS) Before Tomorrow Morning.

Here’s What We Can Tell You—Right Now…

(DVS) is Newly Listed On NYSE American As Of April 21, 2025, Expanding Visibility To A Wider U.S. Audience

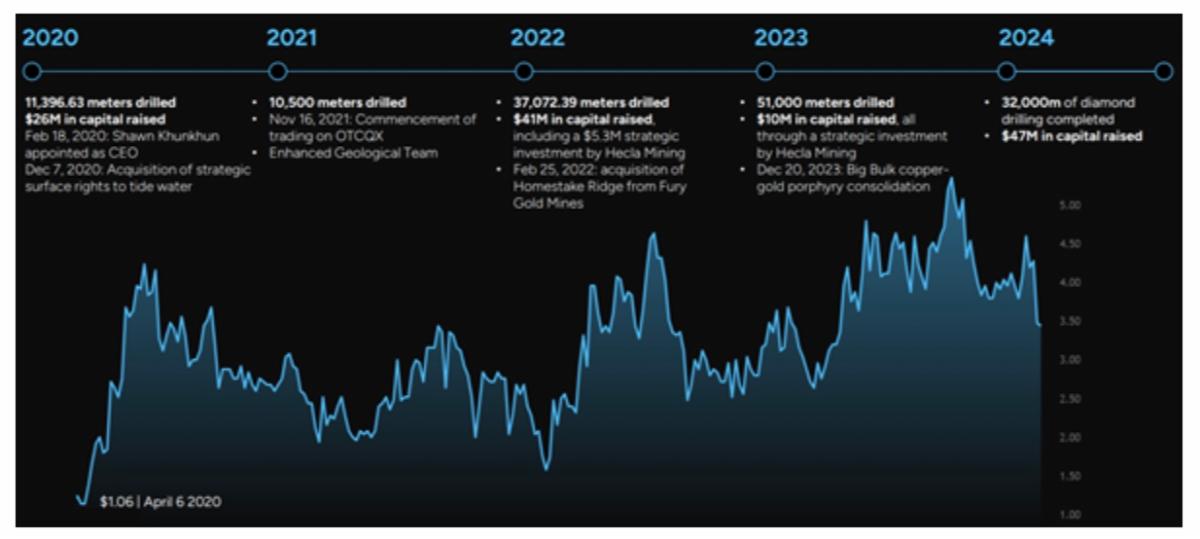

(DVS)’s Valuation Climbed Approximately 1,400% From $20M In 2020 To Over $300M Today, Backed By Technical And Strategic Execution

Kitsault Valley Project Now Spans Seven Deposits Across Fifteen Kilometers, Balanced Between Silver And Gold

Analysts From Haywood, Raymond James, And Research Capital Are Covering The Company With Detailed Technical Models

We Will Have All Eyes On Dolly Varden Silver (NYSE: DVS) Tomorrow…

April 22, 2025

Dear Reader,

Not every company is born from headlines.

Some quietly shape their path—drilling deep, consolidating ground, and revealing their potential core by core.

That’s what we’re seeing right now with Dolly Varden Silver (NYSE: DVS).

Tucked into British Columbia’s Golden Triangle, this company controls one of the largest high-grade, undeveloped silver assets in North America—and its story is starting to turn heads for a reason.

Just this week, Dolly Varden was officially listed on the NYSE American, a move that now puts the company on the radar of a much broader U.S. audience.

While still under the radar for most, the listing marks a meaningful step forward—aligning its market visibility with the scale of the asset it’s continuing to build.

Since 2020, Dolly Varden has quietly executed a methodical growth strategy.

Over that time, its valuation has increased from $20M to over $300M—a move of roughly 1,400%—fueled by:

It’s not just the scale—it’s the consistency. From 11k drilled in 2020 to over 32k meters completed in 2024, the pace hasn’t let up.

But growth like this doesn’t just show up on a chart—it has to be earned.

Over the last five years, Dolly Varden has quietly stacked milestone after milestone.

Some came with headlines… others didn’t. But together, they laid the groundwork for what’s unfolding now.

From leadership changes and key surface rights…

To major asset acquisitions, deep drilling campaigns, and strategic capital infusions…

The timeline above captures a rare stretch of consistent execution—one that built this foundation year by year.

This is the kind of groundwork that takes years to build… and only moments for the broader market to finally notice.

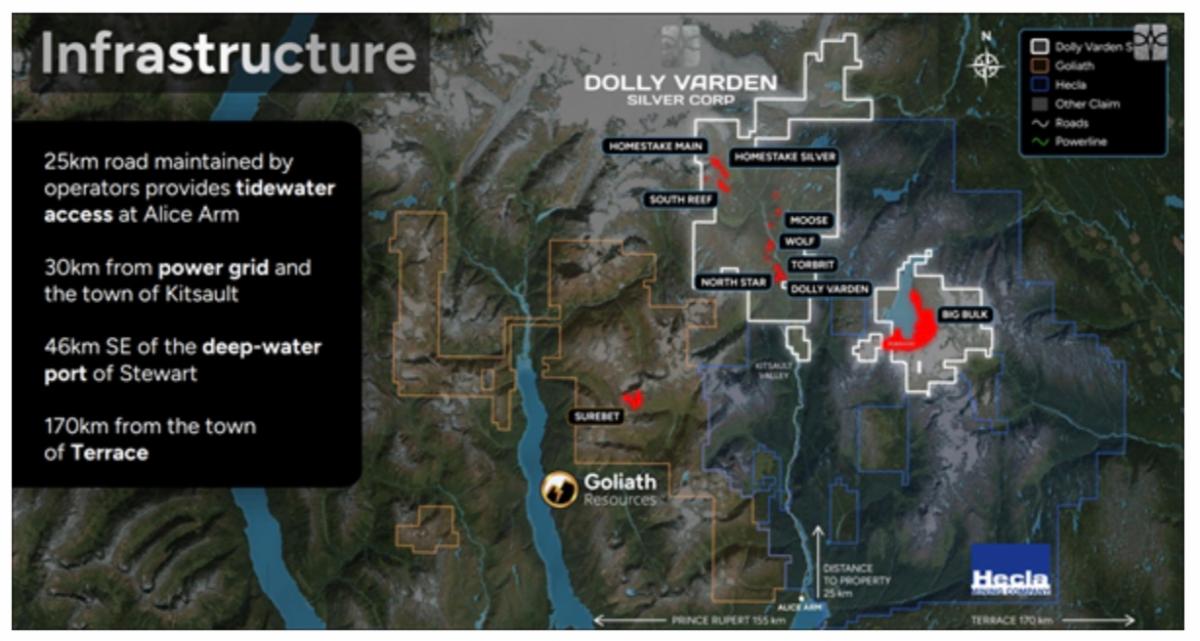

In 2022, Dolly Varden Silver Corporation consolidated its flagship Dolly Varden Project with the adjacent Homestake Ridge Project, forming the expansive Kitsault Valley Project.

This 163 square kilometer property, located in the southern tip of British Columbia's Golden Triangle, is now 100% owned by Dolly Varden and encompasses a 15-kilometer mineralized trend.

The project hosts seven known precious metal deposits:

This consolidation has transformed the company's resource profile, balancing its assets to approximately 50% silver and 50% gold by value.

The strategic merger not only increased the project's economic viability but also provided economies of scale in exploration, permitting, and development.

The Kitsault Valley Project is situated within the same structural and stratigraphic belts that host other significant high-grade deposits like Eskay Creek and Brucejack, indicating a strong potential for further precious metal discoveries.

During recent updates, CEO Shawn Khunkhun has emphasized that Dolly Varden is now executing on a multi-year blueprint: systematically expanding known zones, tightening infrastructure plans, and preparing the ground for future scalability.

What’s especially notable: one-third of the exploration team is from the Nisga’a Nation, and the company maintains active, transparent relationships with Indigenous communities—a key differentiator when it comes to operational readiness in northern Canada.

The Homestake Silver zone, Wolf, and new Moose/Chance targets are all being tested in tandem—revealing a pipeline of potential across the Kitsault Valley trend that may still be early in its full definition.

The company’s 2024 efforts have centered on extending known zones and exploring potential structural links beneath the sedimentary layers—a shift that could redefine the scale and continuity of the system.

From pure silver production roots to the addition of gold-rich zones at Homestake Ridge, this isn’t just about growing ounces—it’s about transforming the profile of the entire project.

As that evolution continues, here are five company highlights that help explain why Dolly Varden is now being tracked more closely:

While the broader market may just be catching on, seasoned analysts have been following the story for some time.

Dolly Varden Silver Corporation is currently covered by analysts from several respected institutions, including:

- Craig Stanley – Raymond James

Recent analysis from Research Capital Corporation has specifically highlighted Dolly Varden’s high-grade silver-bearing veins and applied valuation metrics based on in situ silver and gold resources across the Kitsault Valley Project.

Combined with strategic backing from names like Hecla Mining, Fidelity, and Sprott, this foundation of formal analyst coverage suggests the story is already resonating with professionals who specialize in high-grade, late-stage assets.

With its NYSE American listing now live and exploration activity continuing across multiple zones, Dolly Varden may soon find itself under an even wider lens.

1. Newly Listed on the NYSE American: As of April 21, 2025, Dolly Varden Silver (NYSE: DVS) was officially listed on the NYSE America — significantly increasing its visibility to U.S. institutions and retail platforms.

2. Multi-Year VMove of Approx. 1,400%: From $20M in 2020 to over $300M today, Dolly Varden Silver (NYSE: DVS)’s move into the spotlight has been powered by consistent exploration, acquisitions, and technical success—not hype.

3. Consolidated High-Grade Project With Dual Metal Exposure: Its 100%-owned Kitsault Valley Project now spans 7 deposits over a 15-kilometer mineralized trend and is balanced roughly 50/50 between silver and gold by value.

4. Institutional Coverage: Analysts from Haywood, Raymond James, and Research Capital are watching. Coverage from multiple institutions confirms professional interest is already building—backed by detailed technical assessments and valuation models.

Dolly Varden Silver (NYSE: DVS) has spent the past five years building, consolidating, and drilling—with results that are now difficult to ignore.

From the formation of its Kitsault Valley Project to its expanding resource base and recent listing on the NYSE American, this is a company that has moved with intention—and is now positioned to be seen on a much broader stage.

Its silver-gold balance, consistent technical execution, and growing institutional attention are all signals that something more substantial may be unfolding beneath the surface.

We will have all eyes on (DVS) tomorrow morning.

Consider taking a look at (DVS) and doing your own research before the bell rings.

Also, keep a look out for my next update—coming early tomorrow morning.

Have a good night.

Sincerely,

Gary Silver

Managing Editor,

MarketCrux

MarketCrux.com (“MarketCrux” or “MC” ) is owned by Headline Media LLC, a multi member limited liability company. Data is provided from third-party sources and MarketCrux is not responsible for its accuracy. Make sure to always do your own research and due diligence on any day and swing profile MC brings to your attention. Any emojis used do not have a specific defined meaning, and may be used inconsistently. We do not provide personalized in.vest.ment advice, are not in.vest.ment advisors, and any profiles we mention are not suitable for all in.vest.ors.

The owners of Headline Media LLC own and operate marketcrux . com (“MC”). From time to time, MC will publicly disseminate information about a company via website, email, SMS and other points of media.

*Pursuant to an agreement between Headline Media LLC and TD Media LLC, Headline Media LLC has been hired for a period beginning on 04/22/2025 and ending on 04/23/2025 to publicly disseminate information about (DVS:US) via digital communications. Under this agreement, Headline Media LLC has been paid seven thousand five hundred USD (“Funds”). These Funds were part of the funds that TD Media LLC received from a third party who did receive the Funds directly or indirectly from the Issuer and does not own stock in the Issuer but the reader should assume that the clients of the third party own shares in the Issuer, which they will liquidate at or near the time you receive this communication and has the potential to hurt share prices. Neither Headline Media LLC, TD Media LLC and their member own shares of (DVS:US). Please see important disclosure information here: https://marketcrux.com/disclosure/dvs/#details