Judicial Restraint and Policy Volatility: Navigating Legal Risks in U.S. Immigration Markets

Clyde MorganSaturday, Jun 28, 2025 12:58 am ET

![]() 32min read

32min read

The U.S. Supreme Court's June 2025 ruling in Trump v. CASA has upended the legal framework governing nationwide injunctions, introducing a new era of uncertainty for immigration policy stability. By curtailing federal courts' ability to issue broad halts to executive actions, the decision has reshaped how policies are challenged, enforced, and perceived by stakeholders. For investors, this shift amplifies risks in sectors reliant on labor mobility, regulatory predictability, and cross-border commerce. Below, we dissect the implications for markets and offer actionable insights.

The Court's 6-3 decision, authored by Justice Amy Coney Barrett, declared that nationwide injunctions “exceed equitable authority” and must be restricted to the parties directly involved in litigation. This overturns a decades-old tool used to block policies like the Trump administration's birthright citizenship ban or Biden's asylum restrictions, which had been frozen nationwide by district courts.

The ruling's immediate impact is twofold:

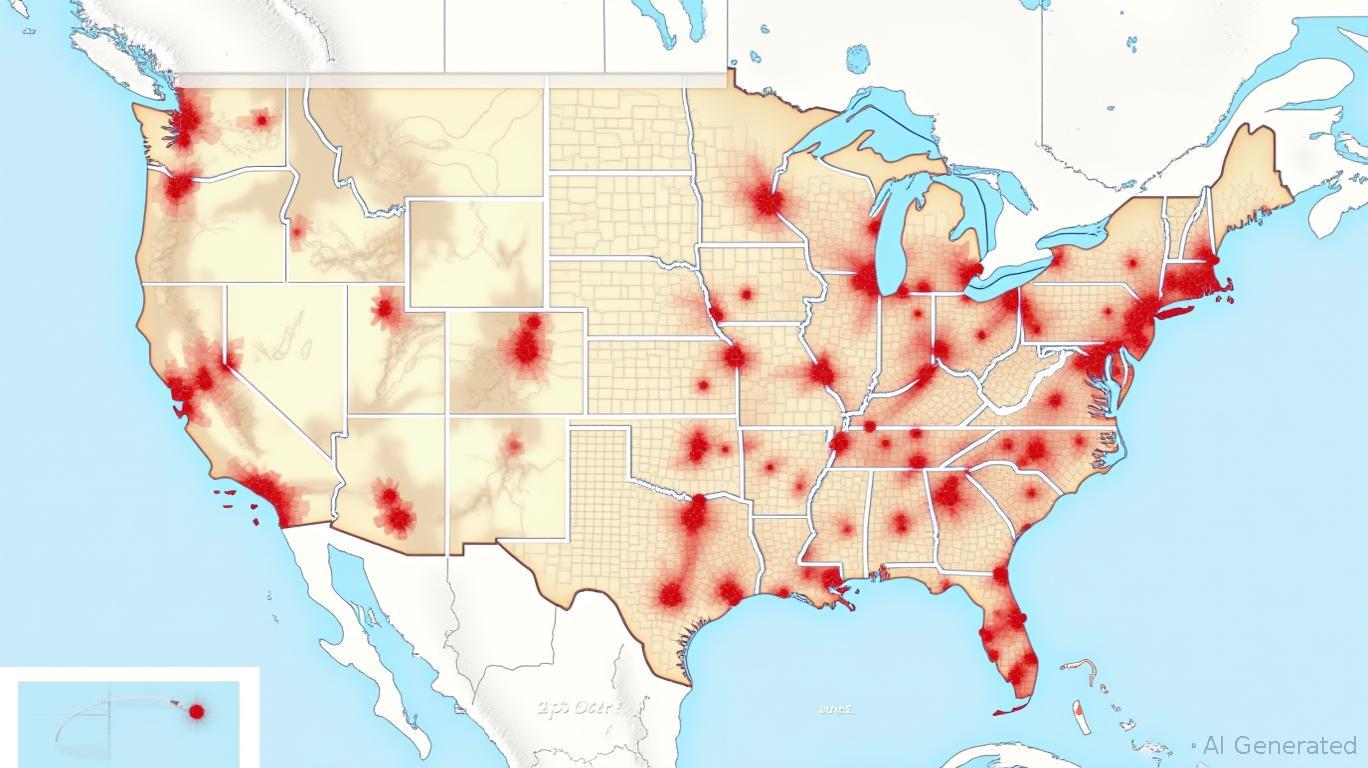

1. : Federal policies will now take effect in states not party to lawsuits, creating a “patchwork” of enforcement. For example, President Trump's birthright citizenship ban could apply in 28 states while being blocked in 22, depending on litigation outcomes.

2. : Plaintiffs must now litigate on a state-by-state or individual basis, increasing legal costs and delaying resolutions. This favors entities with deep pockets or institutionalized legal teams.

1. Agriculture and Labor-Dependent Industries

Firms reliant on immigrant labor, such as agriculture and food production, face heightened operational risks. A disjointed enforcement of visa policies or workplace raids could disrupt supply chains and labor availability.

Investors should favor companies with diversified labor sourcing or operations in states with stable immigration policies (e.g., California, New York). Conversely, firms in states like Texas or Florida—where stricter enforcement may dominate—could face compliance costs or labor shortages.

2. Healthcare and Hospitality

Healthcare systems and hospitality businesses, which employ large immigrant workforces, must adapt to inconsistent policy enforcement. For instance, hospitals relying on J-1 visa holders may face staffing gaps if states block visa programs.

3. Legal and Compliance Services

The rise in fragmented litigation will boost demand for legal expertise in immigration law. Firms specializing in regulatory compliance or class-action litigation may see revenue growth.

While the CASA decision prioritizes judicial restraint, it risks emboldening future administrations to enact contentious policies without broad judicial checks. This could lead to prolonged legal battles over foundational issues like birthright citizenship or asylum rights, further destabilizing markets.

Investors should monitor:

- : Any legislative efforts to codify immigration policies (e.g., birthright citizenship) to reduce judicial dependency.

- : Track which states are filing suits and the pace of rulings.

- : The Biden administration's response to the ruling, such as recalibrating enforcement priorities or pushing for legislative fixes.

Conclusion

The Supreme Court's curtailment of nationwide injunctions has transformed immigration policy into a high-stakes game of state-level litigation. For investors, this means heightened volatility in sectors tied to labor mobility and regulatory stability. Prioritize firms with geographic or operational flexibility, and be prepared to capitalize on—or hedge against—the resulting fragmentation. The era of broad judicial pauses is over; the next chapter belongs to those navigating the maze of legal and political uncertainty.