JM Financial Plans Growth in Four Key Business Areas

JM Financial is concentrating on four primary business segments to foster expansion: affordable housing, private credit, wealth and asset management, and corporate advisory. According to Nishit Shah, Group CFO, JM Financial, the company aims to strategically grow its balance sheet, primarily focusing on the affordable housing sector, which has demonstrated strong performance. They've broadened their reach to 128 branches, managing an AUM of Rs 2,800 crore, reflecting a 26% year-over-year increase. The balance sheet strategy is increasingly centered on home loans, with a broader approach to originate, invest, and syndicate transactions.

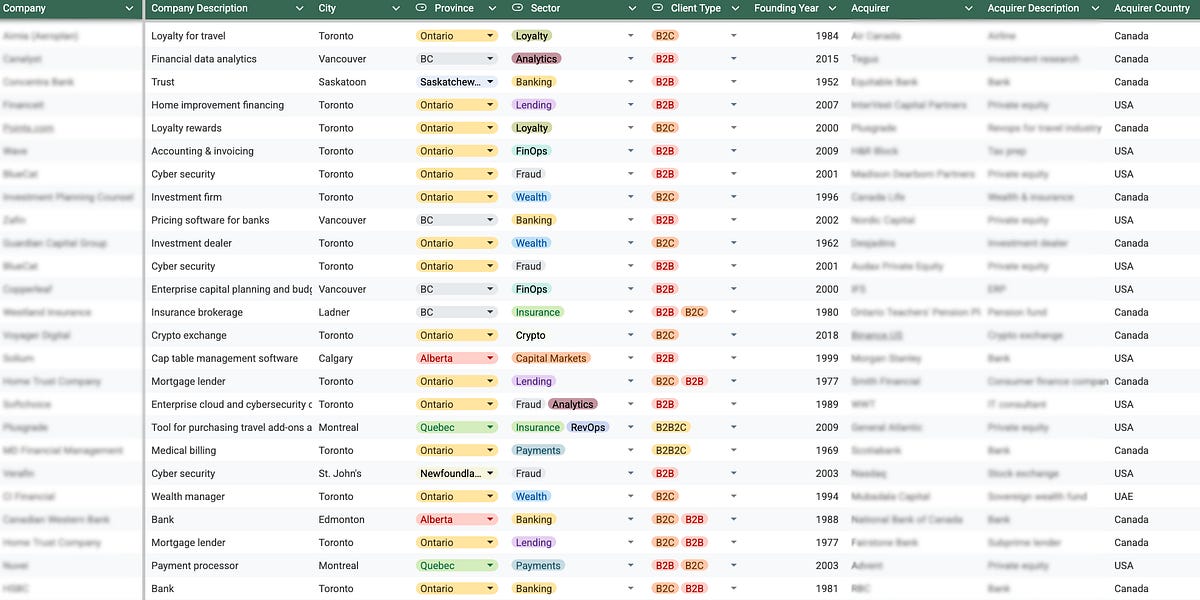

JM Financial has pinpointed four key businesses for future growth: corporate advisory and capital markets, wealth and asset management, private credit, and affordable housing. Despite a slowdown in ECM activity in the March quarter, the company's profits in this segment remained strong, driven by M&A transactions. The company has been recognized as the best investment bank on the M&A side. The fees and brokerage have increased 22% quarter-on-quarter. JM Financial acquired an additional stake in JM Financial Credit Solutions, raising its ownership from 47% to 97%.

Instead of focusing on extensive on-balance sheet lending, JM Financial is shifting towards its private credit business. The company aims to originate, invest, and syndicate transactions to achieve better risk-adjusted returns. The provisioning numbers are as low as 7 crores. Consolidating JM Financial Credit Solutions aims to improve capital allocation, streamline the group structure, and facilitate value unlocking. The book value has increased by Rs 6 this quarter due to the transaction, bringing it to Rs 101 per share. The company is adequately capitalized for its growth needs without needing external equity raises.

JM Financial manages approximately Rs 1,10,000 crore in assets under management (AUM) within its wealth business. The company is strategically growing recurring AUM and investing heavily in digital and physical infrastructure. These investments are expected to drive substantial growth in the wealth management business over the next two years. The company sees the Indian capital markets and wealth management businesses as multi-decadal opportunities. The brand recall is strong, with the mutual fund business increasing its AUM to Rs 13,000 crore in just a couple of years.

JM Financial is focused on growing four core businesses: corporate advisory and capital markets, wealth and asset management, private credit, and affordable housing. Investments in the affordable housing segment are now yielding results, with AUM up to 2800 and expansion to 128 locations across eight states.