Japanese Yen and Aussie Dollar News: AUD/USD Dips as CPI Data Fuels RBA Rate Cut Bets

Published: Feb 26, 2025, 00:52 GMT+00:00

On Wednesday, February 26, Japan’s Leading Economic Index will influence USD/JPY trends and market sentiment toward the Bank of Japan’s rate path.

According to the preliminary report, the Conference Board Leading Economic Index climbed to 108.9 in December, up from 107.8 in November. The Index reflects business and consumer sentiment, providing insights into business investment, job creation, and wage growth trends.

Increasing bets on a Bank of Japan rate hike expose the USD/JPY pair to revisions in the preliminary data. A higher reading could boost expectations for a more hawkish BoJ policy stance, potentially pulling the USD/JPY pair toward 148. Conversely, a downward revision may temper rate hike bets, driving the pair toward 153.

Beyond the FX market, traders should monitor Japanese Government Bond (JGB) yields. After January’s hotter-than-expected inflation numbers, Bank of Japan Governor Kazuo Ueda warned that the Bank could intervene if yields rise excessively, causing market irregularities.

Intervention threats could widen the US-Japan interest rate differential, favoring the US dollar. Conversely, a silent BoJ and a surge in JGB yields could trigger another Yen Carry Trade unwind, potentially causing market disruption.

The last major BoJ-driven Yen Carry Trade unwind pushed USD/JPY below 140 in September 2024.

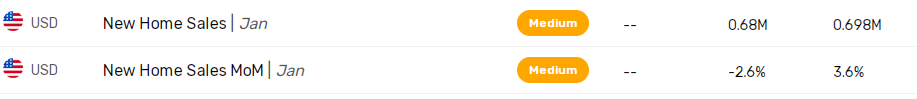

Shifting to the US session, housing sector data will influence US dollar demand. Falling new home sales could signal a deteriorating housing market and softer house prices on weaker demand.

With economists considering the housing sector a barometer for the US economy, lower house prices could affect consumer spending, softening the inflation outlook and the Fed rate path. Under this scenario, the USD/JPY pair could drop below 148.

In contrast, rising demand could fuel expectations of a higher-for-longer Fed rate path, potentially pushing the pair toward 153.

Explore in-depth USD/JPY trade setups and expert forecasts here.

On Wednesday, February 26, Aussie inflation figures influenced AUD/USD trends and RBA rate cut bets.

Australia’s Monthly CPI Indicator remained at 2.5% in January softer than expectations of a rise to 2.6%. According to the ABS, annual trimmed mean inflation rose from 2.7% in December to 2.8% in January. Notably, rental prices increased 5.8% in the 12 months to January, down from 6.2% in December, pressured by higher vacancy rates across most capital cities.

The release was closely watched after RBA Governor Michele Bullock referenced the CPI Indicator in last week’s RBA press conference. Governor Bullock highlighted factors that could support further rate cuts, stating:

“A slowdown in wage growth, disinflation in market services, a sustained decline in housing costs, and a partial recovery in supply-side conditions could support another rate cut.”

The AUD/USD pair dropped from $0.63523 to $0.63475 after the inflation report, signaling a more dovish RBA rate path. The RBA’s next interest rate decision will be on April 1

For a comprehensive analysis of AUD/USD trends and trade data insights, visit our detailed reports here.

In the US session, an unexpected rise in new home sales could reduce Fed rate cut bets. A widening in the US-Aussie interest rate differential, favoring the US dollar, may pull the AUD/USD pair below $0.63.

Conversely, a larger-than-expected fall in new home sales could raise concerns about the US economy, supporting a more dovish Fed rate path. Under this scenario, a narrowing rate differential could push the AUD/USD pair toward $0.64.

In addition to US housing sector data, traders should also track US tariff developments. Sweeping US tariffs could impact Aussie exports and weigh on the Aussie dollar given Australia’s trade-to-GDP ratio sits above 50%.

Key macroeconomic drivers influencing currency markets include:

Click here to read expert USD/JPY and AUD/USD forecasts for deeper insights.

Related Articles

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Editors’ Picks

Advertisement