Japanese Government Bond Yields Reach New Highs

Key Points:

Japan’s 20-year government bond yields soared to 2.528%, while 30-year yields reached 3.103% on May 20, 2025. This marks their highest levels since their respective issuance dates.

Market participants monitor this bond yield jump for broader economic signals. Although no direct crypto impact is currently noted, changes in traditional markets could eventually influence digital asset trading patterns.

Japan’s bond market experienced as the Ministry of Finance announced a dramatic rise in the 20-year JGB yield to 2.528%. The 30-year bond also climbed to 3.103%, record numbers since its inception in 1999. These auction details for Japanese government bonds are attributed to influenced by MOF and BOJ activities, as reflected in their official reports. Observers highlight that macroeconomic factors could drive investor behavior, though specific crypto responses remain speculative.

As for immediate repercussions, are documented. Analysts suggest that while risk-off sentiment from traditional markets may not immediately affect digital assets, they remain cautious of future cascading effects. Institutional commentary and detailed analyses of potential long-term consequences are sparse, yet global financial markets watch closely for developments. The absence of official statements intensifies the speculative atmosphere, leaving financial experts to conjecture on the implications of this yield surge.

“20-year JGBs to be issued in May will be a reopening issue of the April 2025 issue.” – Ministry of Finance, Japan

The last time Japan’s 20-year government bond yield was this high, in 2000, it signaled a significant recalibration in global financial strategies, paralleling today’s market shifts.

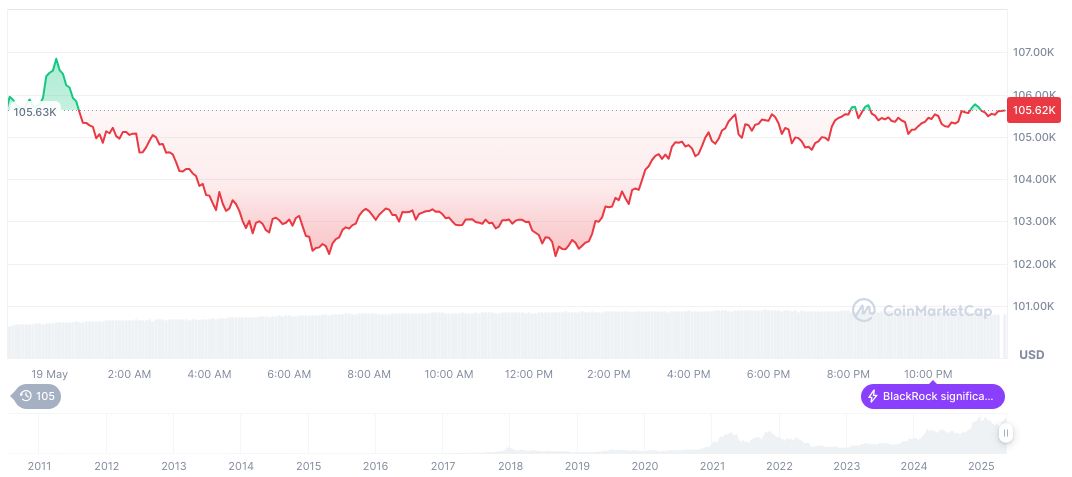

According to CoinMarketCap, , with a 2.69% 24-hour increase. Its market cap stands at approximately $2.10 trillion, while a 24-hour trading volume shows a slight decline. Recent trends include a notable 24.12% rise over 30 days. Fueled by such figures, Coincu’s research team emphasizes that repeated yield spikes could initiate shifts in investor sentiment towards conventional assets, eventually impacting risk-seeking behaviors in crypto markets. However, no immediate regulatory changes have been announced in tandem with this event. The list of Japanese government bonds issued in May 2025 provides further context to these market movements.

Analysts continue to monitor the situation closely, as the interplay between traditional bond yields and cryptocurrency markets remains uncertain. The potential for future shifts in investor behavior is a key focus for market participants.