Bank of Japan upbeat on wages despite US tariffs, sees scope to resume rate hikes - The Business Times

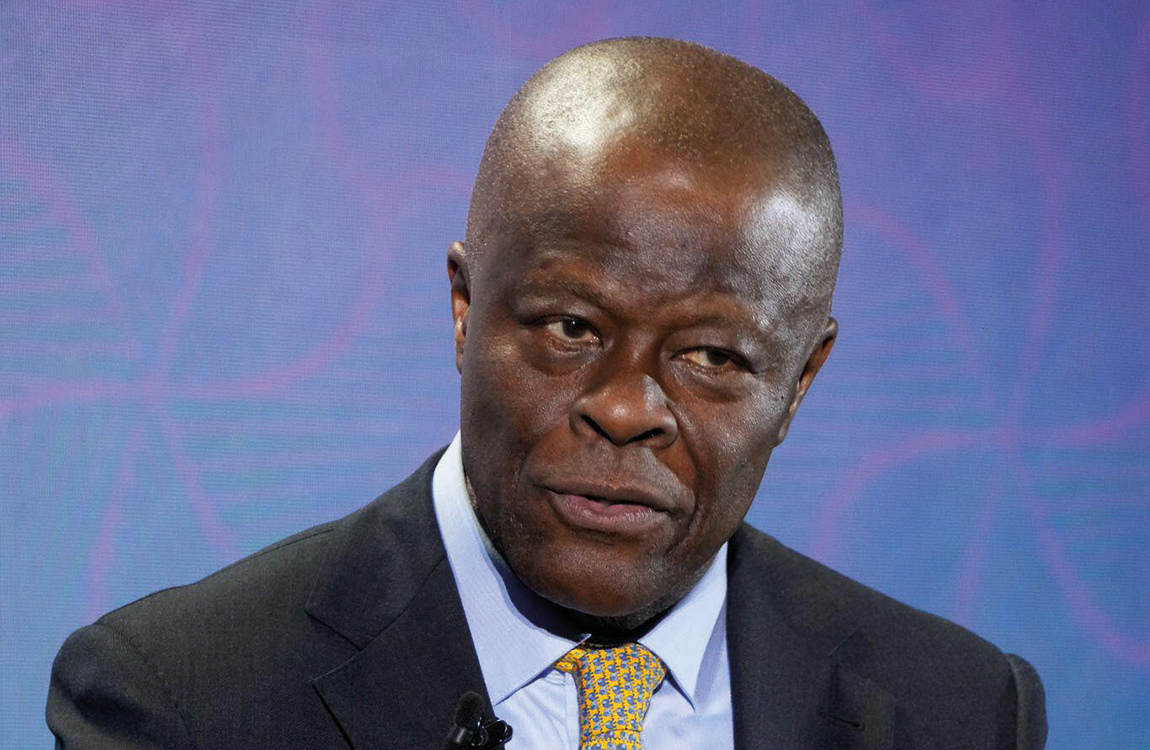

[TOKYO] The Bank of Japan expects wages and prices to keep rising even as the uncertainty over US tariff policy weighs on the economy, its deputy governor Shinichi Uchida said on Tuesday, signalling the bank’s resolve to maintain its rate-hike stance.

While US tariffs are likely to hurt Japan’s economic growth, the BOJ will continue to raise interest rates if the economy and prices improve after a period of stagnation, as the board projects, Uchida told parliament.

“Japan’s underlying inflation, and medium- to long-term inflation expectations, are likely to temporarily stagnate. But even during that period, wages are expected to continue rising as Japan’s job market is very tight,” Uchida said.

“Companies are also expected to keep passing on rising labour and transportation costs by increasing prices,” he said.

The BOJ will scrutinise the economic fallout from US trade policy “without pre-conception” as uncertainty surrounding the outlook was extremely high, Uchida added.

The remarks underscore the challenge BOJ policymakers face in balancing headwinds to growth from President Donald Trump’s tariff policy, and domestic inflationary pressures from a tight job market and rising raw material costs.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

At its April 30-May 1 meeting, the BOJ kept interest rates steady at 0.5 per cent and sharply cut its growth forecasts, suggesting the uncertainty surrounding US tariffs and the hit to exports could keep policy in a holding pattern for some time.

Scope to resume

But some BOJ board members saw scope to resume rate hikes after a temporary pause if developments over US tariffs stabilise, a summary of opinions at the meeting released on Tuesday showed.

While the board generally saw US tariffs hurting Japan’s economy, some said the damage was unlikely to derail the path toward sustainably achieving the BOJ’s 2 per cent inflation target, the summary showed.

“The BOJ will enter a temporary pause in rate hikes due to slowing US growth. But it shouldn’t be too pessimistic, and must conduct monetary policy in a nimble and flexible manner such as by resuming rate hikes in response to changes in US policy,” one member was quoted as saying in the summary.

Another opinion said the BOJ’s policy path “may change at any time” because the outlook for Japan’s economy and prices could quickly turn positive or negative depending on developments surrounding US tariffs.

“There’s no change to the BOJ’s rate-hike stance as our projection shows inflation achieving our 2 per cent target and real interest rates are deeply negative,” a third opinion showed.

The BOJ’s rate review was held at a time when policymakers focused on global recession fears from Trump’s tariffs. But global stock markets surged on Monday after the US and China agreed to slash steep tariffs for at least 90 days, de-escalating a potentially damaging trade war between the world’s two biggest economies.

The BOJ’s growth and price projections are only provisional and could be revised considerably in the future as how US tariff policy unfolds, and how firms would respond, were both fluid, one member was quoted as saying at the May meeting.

The board also discussed an upcoming review in the BOJ’s bond taper plan, with one member calling for the need to scrutinise liquidity conditions for each maturity given recent “significant” rises in super-long yields, the summary showed.

At its next policy meeting in June, the BOJ will review its existing bond-taper plan that runs through March 2026, and come up with a taper plan for fiscal 2026 onward. REUTERS