IPO Watch: Fibromat ups capacity to gain more ground with ACE Market transfer

This article first appeared in Capital, The Edge Malaysia Weekly on May 5, 2025 - May 11, 2025

GEOTECHNICAL solutions specialist Fibromat (M) Bhd (KL:FIBRO) is not exactly dancing in the rain but sees a silver lining in the heightened awareness of the need to ensure soil stability because of increasingly unpredictable rainfall, landslides and flash floods caused by climate change.

“We strive to restore the environment as naturally as possible,” says executive director Wallace Ng Chun Hou, the eldest son of managing director and CEO Danny Ng Kian Boon.

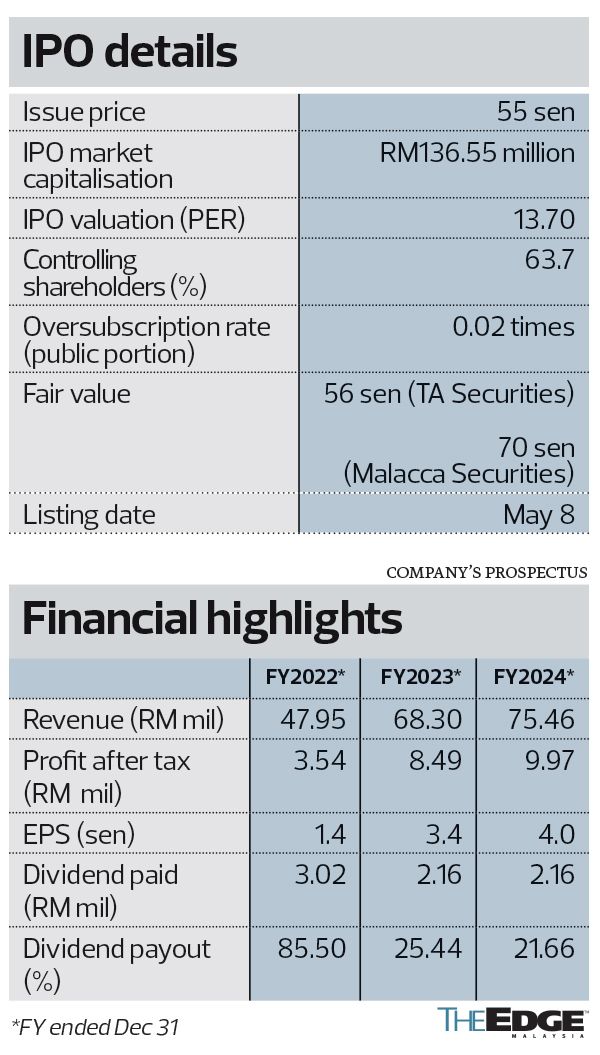

Danny will still control 63.7% of the company after new shares are issued in conjunction with its initial public offering (IPO)-cum-transfer of listing to the ACE Market from the LEAP Market on May 8, though his shareholding will be down from 84.7%.

Established in 1999 as a manufacturer of geosynthetics and erosion control products, Fibromat is positioning itself to capture growing demand with increasing urbanisation, having evolved into a comprehensive service provider, offering end-to-end solutions from design to installation.

In Malaysia, only a handful of companies specialise in geosynthetics, with Fibromat representing a home-grown option alongside Dutch-based TenCate.

Soft erosion control techniques utilise natural or biodegradable materials to stabilise soil, prevent erosion and minimise ecological impact, while maintaining natural aesthetics. These methods, which often mimic natural processes for sustainable land management, include planting vegetation, utilising erosion control blankets and implementing beach nourishment.

Fibromat’s solutions encompass slope stabilisation, river embankment protection, retaining walls, liquid and wastewater containment, ground enhancement and sediment control.

Of the RM17.8 million gross IPO proceeds raised from selling 32.3 million new shares at 55 sen each, some 42.6% or RM7.56 million has been earmarked for machinery purchases, with 37.8% or RM6.71 million left for working capital after deducting listing expenses of RM3.48 million (19.6%).

Specifically, Fibromat plans to invest RM3.96 million in two new stitching machines, enabling it to more than double its production capacity to 101,340 rolls of erosion-control blankets annually. These machines, equipped with jute netting manufacturing capabilities, will allow the company to expand its product offerings by introducing fully biodegradable erosion-control blankets.

According to Danny, in addition to addressing the rising demand for domestic projects, the fully biodegradable blankets present an opportunity to tap the export market, particularly in developed countries where there is greater receptiveness to such environmentally friendly solutions.

For reference, such products are comparable to the Coir Geotextiles product line developed by Sri Lankan Hayleys Fibre, a division of the publicly listed conglomerate Hayleys PLC, which is recognised for its expertise in sustainable erosion control solutions.

Meanwhile, RM3.19 million has been earmarked for the acquisition of hydraulic excavators, enabling Fibromat to integrate the installation of prefabricated vertical drains (PVD) into its in-house operations, reducing its reliance on subcontractors. The integration of in-house PVD installation alongside its geotextiles strengthens Fibromat’s position in securing higher-value projects.

According to Danny, this advancement also allows the company to climb the contractor hierarchy, moving from levels 3 and 4 to levels 2 and 1.

Additionally, as urbanisation progresses, suitable land is becoming increasingly scarce.

“For any housing development on soft and wet ground, the land must be treated before construction can begin, and PVD is considered one of the most effective and cost-efficient methods,” he says.

PVDs are vertically embedded into the soil, serving as drainage channels for pore water (water that fills the empty spaces in a porous material like soil or rock). This technique is widely utilised in embankments and land reclamation projects, especially in low-permeability, saturated, fine-grained soil such as clay and silt.

Given the critical role of ground stability, lab testing is essential to validate its effectiveness. With its ISO 17025-accredited laboratory, Fibromat can provide testing results across a range of parameters, customised to meet customer requirements.

According to Danny, the most promising opportunity currently lies in Sabah and Sarawak, particularly in Sabah Pan Borneo Highway Phase 1B, which has numerous hilly sections, and Sarawak–Sabah Link Road Phase 2.

Specifically, Sabah’s requirement to complete the Pan Borneo project by 2029 suggests an accelerated timeline for progress. To accommodate the expected demand, the company has established three distribution centres in Sabah and plans to set up a manufacturing plant in the state.

As for Fibromat’s Pan Borneo project bids, Danny expresses confidence in securing more than half of the 19 available packages.

Additionally, the company is positioning itself to secure opportunities from the implementation of 33 high-priority flood mitigation projects in the country, with the government allocating RM11.8 billion in Budget 2024.

Other potential infrastructure projects that could provide growth include the Gombak-Karak Highway extension, the North-South Expressway expansion in Johor, developments in Penang’s Batu Ferringhi, the Kuala Linggi International Port project in Melaka, as well as planned upgrades at Westport, Klang.

Fibromat’s projects are generally short term and typically end within six months. They are carried out on a call-out basis, contingent on the progress of the overall project.

The absence of long-term customer and supplier agreements may result in earnings volatility and operational uncertainty, particularly when government allocations are reduced.

While between 94.8% and 96.5% of its revenue from FY2021 to FY2024 came from Malaysia, over the past four years, the company has secured 249 contracts and expanded its reach by exporting products to Singapore, South Korea, India and the UK. In FY2024, overseas revenue of RM2.83 million made up 3.8% of total revenue.

Among Fibromat’s exports is the silt curtain, a key product that is sold to Singapore. Danny adds that the city state has adopted erosion control blankets on flat ground as an effective sediment control measure.

Fibromat has remained profitable since its LEAP Market listing in May 2019. Despite the challenges brought by the Covid-19 pandemic, the company reported a net profit of RM5.75 million on revenue of RM45.78 million in the financial year ended Dec 31, 2021 (FY2021). Net profit fell to RM3.54 million on revenue of RM47.95 million in FY2022 but post-pandemic, Fibromat recorded a strong recovery, posting a net profit of RM8.49 million in FY2023 and RM9.97 million in FY2024. During the same period, its revenue grew to RM68.3 million in FY2023 and RM75.46 million in FY2024.

While the company has not established a formal dividend policy, Danny intends to reward shareholders whenever feasible. Fibromat has consistently paid dividends since 2020, with the latest payout ratio at 21.7%, amounting to RM2.16 million in dividends declared, for FY2024.

Currently, two brokerage houses — Malacca Securities and TA Securities — cover Fibromat. Malacca Securities has set a target price of 70 sen, based on a forward price-earnings ratio (PER) of 15 times. TA Securities, meanwhile, is less sanguine, seeing just a one sen upside from its IPO price with a target price of 56 sen, which reflects 10 times forward earnings.

In terms of earnings per share growth projections for 2025, TA Securities estimates a 5.7% increase, whereas Malacca Securities foresees a more optimistic growth rate of 11.7%.

M&A Securities Sdn Bhd is the adviser, sponsor, underwriter and placement agent for the IPO.

Save by subscribing to us for your print and/or digital copy.