The cost of health insurance for City employees is a significant hidden risk in the FY 2026 Budget and Financial Plan released on May 1st. This fiscal note addresses two issues:

The conclusions of the analysis are that the City is facing significant and unaddressed fiscal risks of at least $612 million in FY 2025 due to the exhaustion of HISF disposable balances. For the same reason, the City is paying for benefits previously funded by HISF ($53 million in FY 2025 as of April). The City and welfare funds that provide additional health benefits are also unlikely to receive recurring transfers that were part of previous labor agreements. Furthermore, the City is facing unbudgeted (despite being known since early 2025) increases in health insurance premiums in FY 2026 that will cost at least $500 million.

The City and the municipal unions are engaged in two major health care cost saving initiatives: the above-mentioned switch toward Medicare Advantage, and the procurement of a new contract for active employees and pre-Medicare retirees currently covered by GHI Comprehensive Benefit Plan. As the former remains under litigation and the latter has been ongoing for more than two years, it is unclear how the City will be able to offset the fiscal risks. Understanding the status of savings initiatives is further complicated by litigation between the City and the municipal unions.

The City contracts with EmblemHealth for the provision of health insurance plans that are free of contributions for its employees and retirees. EmblemHealth is a nonprofit health insurance company established in 2006 through the merger of two New York-based insurers: Group Health Incorporated (GHI), and the Health Insurance Plan of Greater New York (HIP).

Per its Administrative Code Section 12-126(b), the City is obligated to “pay the entire cost of health insurance coverage for City employees, City retirees, and their dependents, not to exceed one hundred percent of the full cost of HIP HMO on a category basis.”

In FY 2024, the City spent $8.3 billion on health insurance for its employees and retirees. The amount budgeted for FY 2025 is $9.0 billion. The two main plans offered free of premium coverage to active employees and pre-Medicare retirees are HIP-HMO Preferred and GHI Comprehensive Benefit Plan (GHI-CBP).[1] The two main plans offered free of premium coverage to Medicare-eligible retirees are HIP-HMO VIP Premier (a Medicare Advantage plan) and GHI Senior Care (a Medicare supplemental plan).[2] GHI-CBP and Senior Care represent the vast majority of membership in their respective categories. The full list of plans is available here.

There are two ongoing major cost reduction initiatives tied to a 2018 Health Benefit Agreement (HBA) between the City and the Municipal Labor Committee (MLC), a coalition of labor unions representing municipal workers:

The City noticed the procurement of the MA contract through Negotiated Acquisition (NA) in November 2020. In July 2021, the City announced an agreement with the Municipal Labor Committee to implement the NYC Medicare Advantage (MA) Plus Program. The program, which would not require retirees to pay premiums, was to be administered by an alliance between Empire BlueCross BlueShield and EmblemHealth, beginning January 1, 2022. It was projected that the program would result in approximately $600 million annually in health care cost savings.

The implementation of the program has been delayed due to ongoing litigation. In December 2024, the NYS Court of Appeals determined that the City could not pass off premiums to retirees but has an obligation to “pay the full cost, up to the statutory cap, of any plan it offers.” The statutory cap refers to the HIP-HMO premium. Plainly put, the Court held that Senior Care premiums must continue to be paid by the City and, consequently, that Senior Care enrollees would not switch to the MA plan. The Office of the Comptroller declined to register the MA contract in June of 2023 because of the uncertainty tied to the litigation, and expressed its opposition to it as a policy matter.

In a separate lawsuit before the Court of Appeals, the City is seeking to interrupt the provision of multiple plans to Medicare-eligible retirees and to offer only the MA plan. Oral arguments on this lawsuit were heard on May 15th and at the time of this writing a decision is still pending.

In 2021, the director of OLR testified before the NYC Council that the City and the MLC agreed that “the full amount of the MA savings would be redirected to support the benefits provided by the Health Insurance Stabilization Fund.” The next section explains this connection.

The City started offering GHI-CBP after a 1982 Municipal Coalition Economic Agreement (MCEA) that also provided for the “equalization” of employer’s costs with HIP-HMO. The agreement specified that the City would not bear costs exceeding those of the HIP-HMO plan. A subsequent 1985 MCEA created the Health Insurance Stabilization Fund “to provide sufficient reserve; to maintain to the extent possible the current level of health insurance benefits provided under the Blue Cross/GUICS plan; and, if sufficient funds are available, to fund new benefits.” In essence, this means that when GHI-CBP premiums are lower than HIP-HMO’s the City deposits the difference into HISF. Conversely, when GHI-CBP premiums exceed those of HIP-HMO, the difference is funded by HISF.

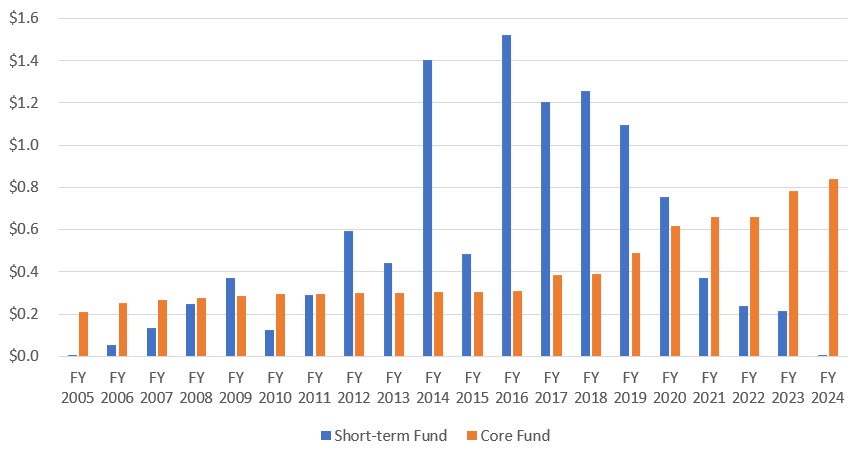

In a 1995 Memorandum of Agreement (MOA), the City transferred to HISF the reserve for claims incurred but not yet paid (formally, the Incurred But Not Reported – IBNR – reserve) by “GHI/CBP/Blue Cross Basic Plan, all optional rider coverage, the Blue Cross Supplemental Hospital Reserves, and the Blue Cross Hospital Advantage Payments.” This portion of HISF’s balance is non-disposable. In HISF financials, the non-disposable balance is referred to as “core fund” while the disposable balance is referred to as “short-term fund.” [4] Figure 1 shows the short-term and core fund cash balances at the end of the fiscal year in FY 2005-2024. The figure shows that the short-term fund balance fluctuated substantially over the years but was essentially depleted as of the end of FY 2024. To explain why, the rest of this section presents a chronology of labor agreements as they pertain to the revenues and expenses of HISF.

In the 2001 Health Benefits Agreement (HBA), the City and the unions agreed to transfer $95 million from HISF to the City’s General Fund, and to waive the City’s $35 million annual deposit for two years. The agreement also required HISF to fund Psychotropics, Injectables, Chemotherapy, and Asthma (PICA) medications as well as other health benefits. The funding of psychotropic and asthma medications was transferred back to the welfare funds in the 2005 HBA. Welfare funds are created and managed by the City’s municipal unions through collective bargaining to provide supplemental health benefits (for instance, prescription drugs, vision, dental) and non-health related benefits (for instance, life insurance, disability benefits, and legal services) to their members. Welfare funds are also funded by the City and provide benefits to both active employees and retirees. Our office published a comprehensive overview and audit of the funds as of FY 2020.

Figure 1. HISF Cash Balance

Source: Health Insurance Stabilization Fund.

In the 2009 HBA, the City and the unions agreed to transfer $121 million from HISF to the City’s general fund, plus $112 million annually going forward. HISF also contributed $117 million to the welfare funds to pay for benefits.

In the 2014 HBA, the City and the unions agreed to transfer $1 billion from HISF to fund the collective bargaining agreement. Furthermore, up to $150 million could be withdrawn from HISF over a four-year period for use by the welfare funds, followed by transfers of $60 million annually. The HBA also stipulated the achievement of substantial health care cost savings, which in part relied on the reduction of the HIP-HMO rate. This meant that inflows to HISF became smaller, and outflows larger.

In the 2018 HBA, the City and the unions set a target of recurring savings for $600 million annually. The agreement also stipulated $200 per member lump sum transfers over two years from HISF to the welfare funds. The HBA established the Tripartite Health Insurance Policy Committee (THIPC) to explore further health care cost savings by, among other things, exploring Medicare Advantage options for retirees and opening medical and hospital benefits for bidding. THIPC is comprised of the City, the unions, and the arbitrator Martin Scheinman.

GHI-CBP premiums have been consistently above HIP-HMO’s since FY 2017 for families and FY 2022 for individuals. This created a structural deficit for HISF. Furthermore, the delay in planned implementation of the MA contract meant that HISF had to suspend transfers to the welfare funds and to the City in FY 2023 and FY 2024.

At the end of FY 2024, the disposable balance of HISF was just $1 million. Nonetheless, the FY 2026 Executive Budget assumes that HISF restarts the $112 million transfer to the general fund in FY 2025. The financials through April 2025 show that the City transferred $53 million to HISF’s disposable balance, which mainly covered the cost of the PICA benefits still paid out of the fund.

Table 1 at the end of the fiscal note summarizes the above information and chronology.

In FY 2025, the HIP-HMO rate for individuals is $998.55 vs. GHI-CBP’s $1,072.33. The rates for families are $2,446.47 for HIP-HMO vs. GHI-CBP’s $2,818.15. Given the depletion of HISF’s disposable balance, it is not clear how the FY 2025 GHI-CBP/HIP-HMO’s cost differential, which we estimate to be at least $500 million, will be funded. This risk was not addressed in the FY 2026 Executive Budget.

EmblemHealth requested from the NY State Department of Financial Services (DFS) a 12.7% premium increase to take effect in FY 2026 (see Health Insurance Plan of Greater New York HPHP-134284248). In the comments submitted by the City’s Office of Labor Relations and the Mayor’s Office of Management and Budget, such a premium increase represents a cost of $650 million above budgeted costs. The NY State Department of Financial Services approved a 12.2% increase.

Therefore, HIP-HMO’s rate in FY 2026 is estimated to reach $1,120.14 for individuals, and $2,744.33 for families. This represents $600 million in additional overall cost given that the City estimated a growth rate of 5.5% rather than the approved 12.2%. The amount carried in the City’s operating budget (which excludes Health + Hospitals Corporation, CUNY Senior Colleges, the School Construction Authority, and other entities) would increase by $500 million. The additional cost is not reflected in the FY 2026 Executive Budget.

The large increase in HIP-HMO rate for FY 2026 could mean that the City may need to restart equalization payments to HISF, particularly if contract negotiations reduce the cost of GHI-CBP (or its successor) by the targeted 10%.

Conversely, if GHI-CBP’s rates in FY 2026 are higher than HIP-HMO’s, the City and unions would need to find a funding source for the difference. Should the MA contract be implemented, some or all the funding could come the savings deposited into HISF. However, it is unlikely that the recurring HISF transfers to the City and to welfare funds could restart in full.

This fiscal note provides a first look at the hidden health care risks in the City’s Financial Plan. The City is facing significant risks deriving from the depletion of HISF and from the increase in health care premia. To address these risks, the City and the municipal unions are procuring new health contracts for active employees and retirees. However, litigation from retiree groups has so far been able to stop the transition toward Medicare Advantage. On June 2nd, the Mayor announced that negotiations will proceed on a joint proposal from EmblemHealth and United Healthcare for a self-funded plan with projected savings of $1 billion per year that would keep the plan premium-free. In the meantime, the relationship between the City and the municipal unions appears to have become acrimonious after the City requested the start of arbitration proceedings related to the 2014 and 2018 HBAs and the unions petitioned the State Supreme Court against the request.

This fiscal note was prepared by Francesco Brindisi, Executive Deputy Comptroller for Budget and Finance, with the assistance of Elizabeth Brown, Director of Budget Oversight and Rosa Charles, Assistant Budget Bureau Chief. Archer Hutchinson, Creative Director, and Addison Magrath, Graphic Designer, led the report design and layout. The author is thankful for the comments received on earlier drafts and is responsible for any errors.

Table 1. History of the Health Insurance Stabilization Fund

Source: New York County Supreme Court #652652/2025, Office of the NYC Comptroller analysis. * The 2005 HBA starts at pdf page 77 of the linked document (Exhibit E). ** The first appearance of a $65 welfare fund payment reimbursement is HISF’s FY 2005 financials. In most years, the total amount paid by HISF is around $36 million, consistent with the recurring transfers to the City in the 2005 HBA. In FY 2016, a $25 reimbursement was added, followed by $150 in FY 2017, $75 in FY 2018, and $100 in FY 2019-2022. The total amount of HISF expenses tied to the “$100 reimbursement” generally follows the pattern established by the 2014 HBA and the additional lump sum amounts stipulated in the 2018 HBA. In FY 2023, the $100 reimbursement was suspended and the $65 reimbursement dropped to $18 million. In FY 2024, the $100 reimbursement (for both FY 2022 and FY 2023) was approximately $68 million, while the $65 reimbursement did not occur. Neither of the reimbursements took place in FY 2025 through April.

Endnotes

[1] The GHI plan offers hospital benefits through Empire Blue Cross Blue Shield (EBCBS). A full list of plans and premiums for employees as of October 2024 is available here.

[2] A full list of plans and premiums for retirees as of January 2025 is available here.

[3] Following a 1992 agreement, the procurement of contracts for collectively bargained health benefits is a process managed jointly by the City and the unions.

[4] The end of year balance (on accrual basis) is also reported in Schedule G7 of the City’s Annual Comprehensive Financial Report (ACFR). In the ACFR, the “core fund” is referred to as “Health Insurance Stabilization Fund” while the short-term fund is referred to as “Health Stabilization Reserve Short Term.”