From retail trading to private wealth: Inside Moomoo's plans to reshape Singapore's investment landscape

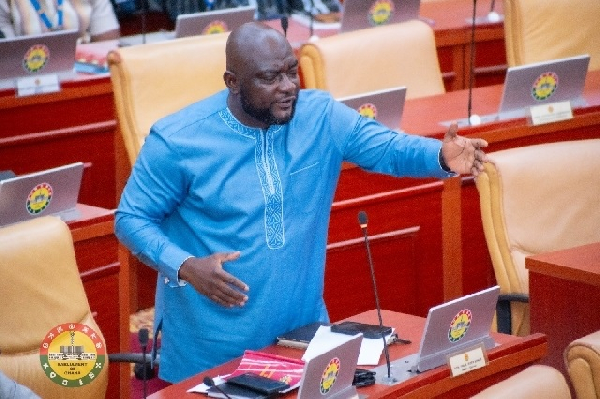

At first glance, an HDB flat in Toa Payoh seems an unlikely birthplace for a company looking to disrupt Singapore’s private banking sector. But that is exactly where Moomoo Singapore’s story began, with chief executive officer Gavin Chia fielding customer service calls on his personal mobile phone during the height of the pandemic in 2020.

“I remember taking calls at midnight from traders watching the US market,” Chia says. “Sometimes they would ask about their accounts, other times they just wanted to discuss investment strategies over coffee. Every call was an opportunity to understand what investors really needed.”

This hands-on approach helped Moomoo transform Singapore’s retail trading landscape. Now, with over a million users on its platform, the company is setting its sights on a bigger prize: the highly competitive private wealth management market dominated by private banks.

“The wealthy investors of today are different. They’re tech-savvy, they want transparency, and they’re questioning the traditional private banking model. We’re building something that combines the best of both worlds: cutting-edge technology with personalised service, but without the traditional constraints and costs,” says Chia.

Moomoo formally launched its platform in Singapore in March 2021, targeting retail investors by letting them trade Singapore, Hong Kong and US-listed stocks by paying just a fraction of the fees charged by traditional brokers.

Since its launch in March 2021, Chia says Moomoo has experienced impressive growth in Singapore which includes its one million users. “Achieving this within just three years highlights the platform’s strong appeal to the country’s digitally savvy investors,” he adds.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“Everything we’ve achieved came from listening to our users,” Chia reflects. “After reaching our milestone of one million users, we asked ourselves, ‘what’s next?’. Our clients’ wealth has grown alongside us and they’re seeking more sophisticated investment solutions.

“That’s why we launched Moomoo Private Wealth, to provide comprehensive wealth management services without the traditional banking overhead. It’s the natural evolution of our platform, built on the same principle of responding to what our community needs,” he adds.

Moomoo Private Wealth caters to clients with more than US$1 million in investments by providing them with access to a wider range of investment products that combine technology with the human touch to help investors grow and protect their wealth. These investors also enjoy bespoke services such as the help of a relationship manager and professional trading team.

“We wanted to apply the same principle of making investing more accessible, utilising our tech-enabled platform to complement the personalised service that high-net-worth individuals have come to expect,” Chia says.

High-net-worth individuals are not just ready for digital solutions – they are actively seeking them out, according to a study commissioned by Moomoo earlier this year. The study so noted that contrary to conventional wisdom, wealthier clients are more receptive to automated solutions compared to investors with fewer assets.

Other key trends the study revealed include high-net-worth individuals’ interest in advanced portfolio tracking and performance analysis tools – emphasising the need for comprehensive solutions that offer a complete financial overview – and a preference for seamless integration with existing financial accounts and platforms.

This created opportunities for digital platforms like Moomoo in the private banking space as a new generation of investment and tech savvy clients seek hybrid solutions that combine technology with personal advice.

The report by Ben Charoenwong, an Insead academic who was then an associate professor with the National University of Singapore, and Alan Kwan, an associate professor at the University of Hong Kong, notes that while traditional financial institutions have made significant strides in digital transformation, “their efforts often fall short of revolutionising wealth management”.

“A fundamental challenge lies in the inherent conflict of interest in many incumbent banks’ business models. These institutions may prioritise channeling clients towards their own proprietary products, which may not always align with the client’s best interests or offer the most appropriate solutions for their unique financial situations,” the two finance professors wrote in the report.

Explaining how Moomoo intends to target the high-net-worth space, Chia says many family offices are sophisticated investors with their own research staff. “So how Moomoo comes in is as a neutral party. They will use our platform because of the convenience in terms of research and the fundamental and technical analysis.”

Despite this push into the high-net-worth space, Chia says that Moomoo has not forgotten its roots. While clients can no longer reach him on his personal phone, he remains accessible through events like the annual MooFest, where investors of all levels can interact with Moomoo executives and fund managers.

“We’ve come a long way, but our mission hasn’t changed,” he says. “Whether you’re making your first trade or managing generational wealth, we’re here to make investing more accessible, more transparent, and more efficient. The future of wealth management isn’t about choosing between human touch and technology – it’s about combining both in ways that truly serve investors’ needs.

“It’s been an incredible privilege to witness our growth in Singapore — from starting as the sole employee working out of my mother’s home to now leading a team of nearly 100 in the heart of the central business district… but our mission is far from over. There’s so much more to do as we continue to elevate the investing experience, and I’m excited to write the next chapter of our story together.”

Read Moomoo’s private wealth report for more information on their private wealth offerings.