Advanced Micro Devices (AMD) may no longer be categorized as a traditional value investment; however, it remains a compelling high-growth opportunity within the AI sector, with strong return potential over the next year. Moreover, demand for AI products is mushrooming across all industries and geographies as companies seek to leverage AI to enhance their operations. As a supplier of AI-driven technology, AMD is well-positioned to capitalize on the growing demand.

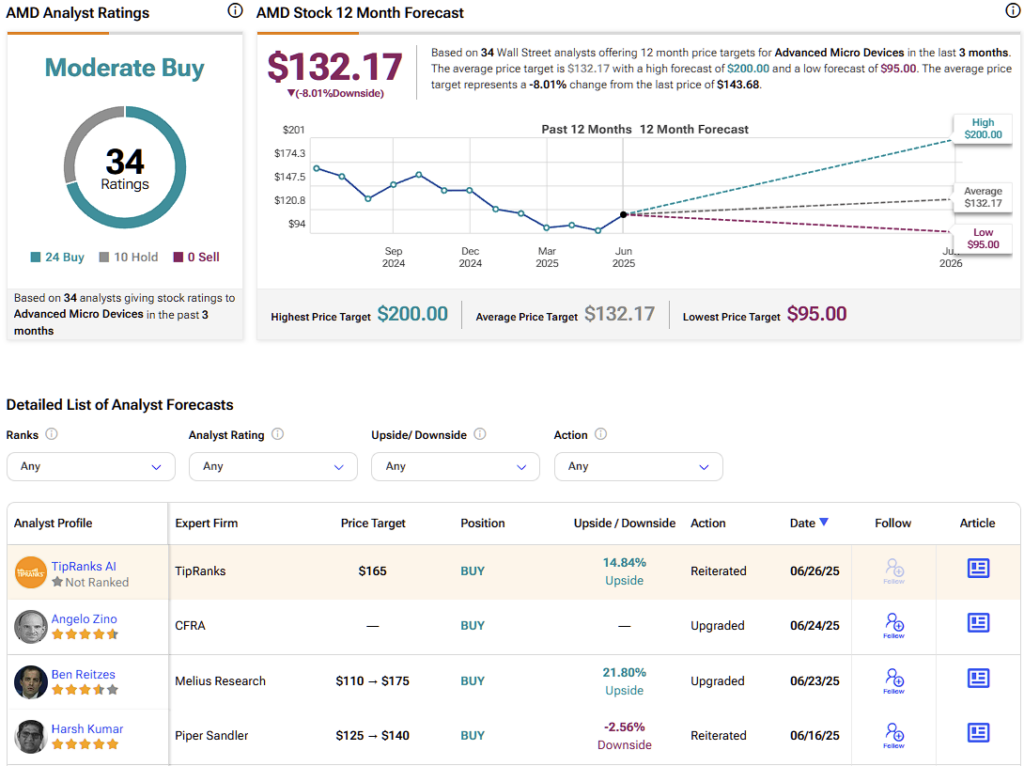

As a confident shareholder, I have set a 12-month price target of approximately $175, representing an estimated 30% upside. However, Wall Street analysts are not quite as bullish despite the stock’s 19% climb year-to-date.

Should a $175 target be achieved, I intend to strategically reduce my position and reallocate capital toward attractively valued equities with longer-term growth prospects. From a macroeconomic standpoint, several supportive factors continue to strengthen the bullish outlook for AMD.

AMD is now trading above the 50-week moving average, with the 14-week Relative Strength Index (RSI) at 65. This indicates that the stock is being driven by the bulls again, and it warrants more cautious buying behavior despite a strong return horizon ahead. Investors who are ahead of the game would have bought this stock earlier in the year.

Bullish sentiment for AMD stock is understandable. AMD’s forward non-GAAP earnings per share (EPS) growth rate is nearly 30%, compared to just 10% for the sector. Also, the trailing 12-month non-GAAP price-to-earnings (P/E) ratio is 37, compared to 23 for the industry. That indicates a stark difference in growth and a very fair valuation compared to the broader industry.

This robust growth is primarily fueled by accelerating demand in the artificial intelligence sector, where AMD plays a key role through its involvement in data center infrastructure, particularly with its graphics and central processing units.

Management has identified 2026 as a pivotal year for profit realization, following years of strong AI-related revenue expansion. While much of this anticipated growth may now be reflected in the stock’s valuation, shares do not appear overvalued, making AMD an attractive candidate for a long-term buy-and-hold strategy with the potential for sustained AI-driven returns.

A key near-term catalyst for AMD’s continued growth is the potential for interest rate cuts by the Federal Reserve. However, I recognize that an overly aggressive easing cycle could contribute to broader market overvaluation in 2026. Should a significant bull market materialize next year—as I believe is likely—I plan to actively manage my exposure by trimming positions. I may also consider entirely exiting my AMD holdings if the stock appears to have fully priced in several years of anticipated growth.

Furthermore, China remains a significant risk. While I’m confident that U.S. diplomacy will prevail over escalations in trade tensions or hot wars evolving, any conflict in Taiwan could disrupt AMD’s return horizon (and that of every tech stock) for some time. That’s why a cash position to protect from geopolitically induced volatility is so important right now. As TipRanks data shows, AMD’s cash position is robust with ~$3 billion in operating cash flow and ~$2 billion in free cash.

However, management has also been making the business more resilient, and Taiwan Semiconductor Manufacturing Company (TSM) is diversifying aggressively into the U.S. to mitigate the risk of being threatened by China. That significantly enhances AMD’s supply chain security.

Hopefully, China will play a diplomatic role. We have AMD’s diversification into the EU to look forward to in the near term, as well as burgeoning opportunities in the Middle East with a new $10 billion arrangement with Saudi Arabia’s HUMAIN. Looking longer-term, the Global South appears to be a promising growth climate, with India likely taking center stage.

On Wall Street, AMD stock has a consensus Moderate Buy rating based on 24 Buys, 10 Holds, and zero Sell ratings. AMD’s average stock price target is $132.17, indicating an 8% downside potential over the next 12 months.

Given the macroeconomic factors and the strong demand for AI, I don’t think this is the end of AMD’s near-term, elite return horizon. The company has also been buying back stock aggressively, with $2.24 billion worth repurchased in the last 12 months; this significantly improves shareholder value and shows management’s conscientiousness.

At the same time, $2.44 billion in total debt was issued over the same period, suggesting that management is likely trying to boost short-term sentiment to improve stock returns. That’s a clever strategy, if you ask me.

When a stock transitions from being undervalued to fairly valued, the instinct may be to exit the position. However, as Charlie Munger—one of the most respected investors of our time—has noted, even modest overvaluation is not necessarily a reason to sell shares of an exceptional company. Long-term success often comes from weathering volatility while remaining focused on the broader upward trajectory.

This perspective applies well to AMD. The AI boom continues to gain momentum, and AMD remains a central player in this transformative shift. A 12-month price target of $175 appears not only reasonable but also aligned with what could be considered fair value based on the company’s medium-term growth outlook.