Follow Only the Value Investors Who Actually Beat the Market-Here's the Shortcut - Finance Monthly | Personal Finance. Money. Investing

Want to Invest Like Buffett? How to Spot Undervalued Stocks in 2025 by Tracking Top Value Investors

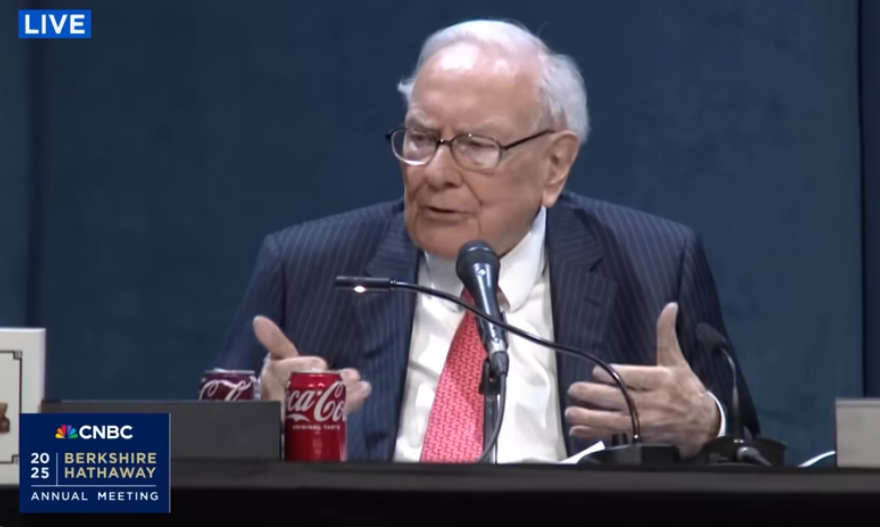

If you're searching for undervalued stocks in 2025, you're not alone. Many investors want to invest like Warren Buffett—buying great companies at a discount and holding them for long-term gains. The secret isn’t a crystal ball. It’s value investing—a proven strategy used by elite funds like Berkshire Hathaway, Fundsmith, and Cobas Asset Management.

Value investing means buying stocks for less than their intrinsic value. These are companies with strong fundamentals—like low price-to-earnings (P/E) ratios, healthy cash flow, and solid balance sheets—but whose stock prices haven’t yet caught up. In 2025, with markets shifting and new trends emerging, this strategy remains a powerful way to uncover overlooked investment opportunities.

Top value investors screen for bargains using key metrics:

They also use models to estimate intrinsic value—then aim to buy 30-40% below that estimate, creating a “margin of safety.”

The challenge? Finding these stocks requires hours of research. That’s where comes in.

This free stock alert service tracks the 13F filings of elite value investors like Warren Buffett, Terry Smith (Fundsmith), and Francisco García Paramés (Cobas AM). When these experts buy undervalued stocks, sends you a curated email with the stock pick—already screened for strong fundamentals.

In 2025, sectors like industrials, consumer goods, and tech-adjacent value plays are showing promise. Elite funds are moving quietly into these areas. But unless you’re watching closely, you’ll miss it.

By using tools like , you tap into millions of dollars’ worth of institutional research—without lifting a finger. It’s like having Warren Buffett’s team in your corner.

Finding undervalued stocks in 2025 doesn’t have to be hard. Whether you're new to value investing or looking to refine your strategy, tracking elite fund activity gives you a major edge. Combine their moves with your own research and patience—and you’re investing like a pro.

to start spotting 2025’s undervalued stock gems—before the rest of the market catches on.

:max_bytes(150000):strip_icc()/GettyImages-1358981804-c4b5feef12084ddaa875e73263027bf7.jpg)