Finance Committee Rejects KRA's Push to Monitor Taxpayers' Bank and Mobile Transactions

The National Assembly’s Finance Committee has urged Parliament to delete a controversial provision in the 2025 Finance Bill that would have allowed the Kenya Revenue Authority (KRA) to access taxpayers’ personal and financial information without court approval.

The National Assembly’s Finance Committee has urged Parliament to delete a controversial provision in the 2025 Finance Bill that would have allowed the Kenya Revenue Authority (KRA) to access taxpayers’ personal and financial information without court approval.

At the heart of the dispute is Clause 52, which proposes to repeal Section 59A(1B) of the Tax Procedures Act. This section currently protects businesses from being compelled to share their customers’ personal data with tax authorities.

If passed, the change would give KRA unchecked access to sensitive data, such as mobile money transactions, bank details, and even trade secrets, all in the name of fighting tax evasion.

The proposal has ignited public concern, with critics warning that such a move could erode privacy rights, encourage government surveillance, and open the door to misuse of confidential information.

In its official report on the Finance Bill, the committee led by Molo MP Kuria Kimani concluded that Clause 52 does not meet the constitutional standards laid out in Article 31(c) and (d), which guarantee every Kenyan the right to privacy.

“The Committee also referenced Section 51 of the Data Protection Act, which outlines specific conditions under which exemptions to data protection may be permitted,” the report noted, underscoring the legal boundaries that should govern data access.

Committee members stressed that KRA already has the authority to obtain relevant taxpayer information as long as it follows due process and obtains a court-issued warrant. They emphasized the importance of judicial oversight in tax enforcement, saying it protects citizens from potential abuse while still allowing the government to carry out its mandate.

“Protecting personal privacy and adhering to judicial oversight not only reinforces public trust but also aligns Kenya’s approach with international best practices in data protection,” the MPs added.

A number of professional bodies have also voiced strong opposition to the proposal. The Law Society of Kenya (LSK) and audit firm KPMG East Africa were among those who submitted memoranda warning that the clause, if enacted, would weaken legal safeguards and compromise taxpayers’ rights to due process and fair adjudication.

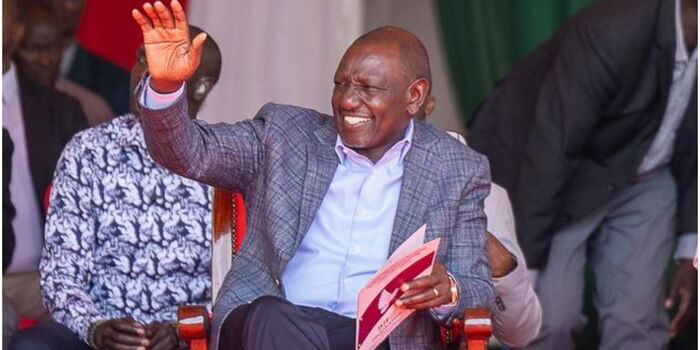

Despite the widespread criticism, KRA Chairperson Ndiritu Muriithi stood firm in support of the proposal. Speaking at a panel discussion last week, Muriithi defended the move as a necessary step to improve tax compliance and seal loopholes in revenue collection.

He pointed out that although 20 million Kenyans are registered with KRA, only about 10 million file their tax returns. Of those, a significant portion, around six million, submit nil returns, raising questions about their actual economic activity.

“The question is, where are these 16 million Kenyans? Are they truly outside economic activities, and how then can we bring them to participate in financing the state?” he asked.

Muriithi also questioned why tax collection isn’t integrated with real-time transactions, especially through mobile money.

“When you go to a restaurant and pay for the bill will mobile money, it shows how much is VAT and so on. Why is it not possible to have tax payment at that point of transaction; why is it that you have to pay the restaurant first, then (KRA) has to chase the restaurant around next month, in today’s technology?” he posed.