Family of 3 Living on $144k in Washington, DC

Before I kick things off today, I just want to acknowledge that it’s yet another week where sending this email feels very weird because of the state of our world. I don’t really know what else to say other than hug your loved ones close, help your neighbors, and GO VOTE. Early voting for the mayoral primary (and many other local races) starts in New York City this weekend.

Today, I’m so excited to publish my 30th edition of Home Economics! Running this series is one of my favorite things—I love to talk to the women who write them, and I love to see how you readers respond to their stories in the comments.

When I sit down to choose an entry to feature, I think about a few things:

To date, 91 people have submitted Home Economics entries. Most are written by women, but there are a handful from men. (I haven’t yet published one from a man. TBD if I will.) The majority are based in the U.S., but I have gotten a couple from the U.K. and Canada, as well as one from Africa (though I’ve yet to publish an international edition). I would wager that two are fake. (Don’t ask me how I can tell; it’s just a hunch.)

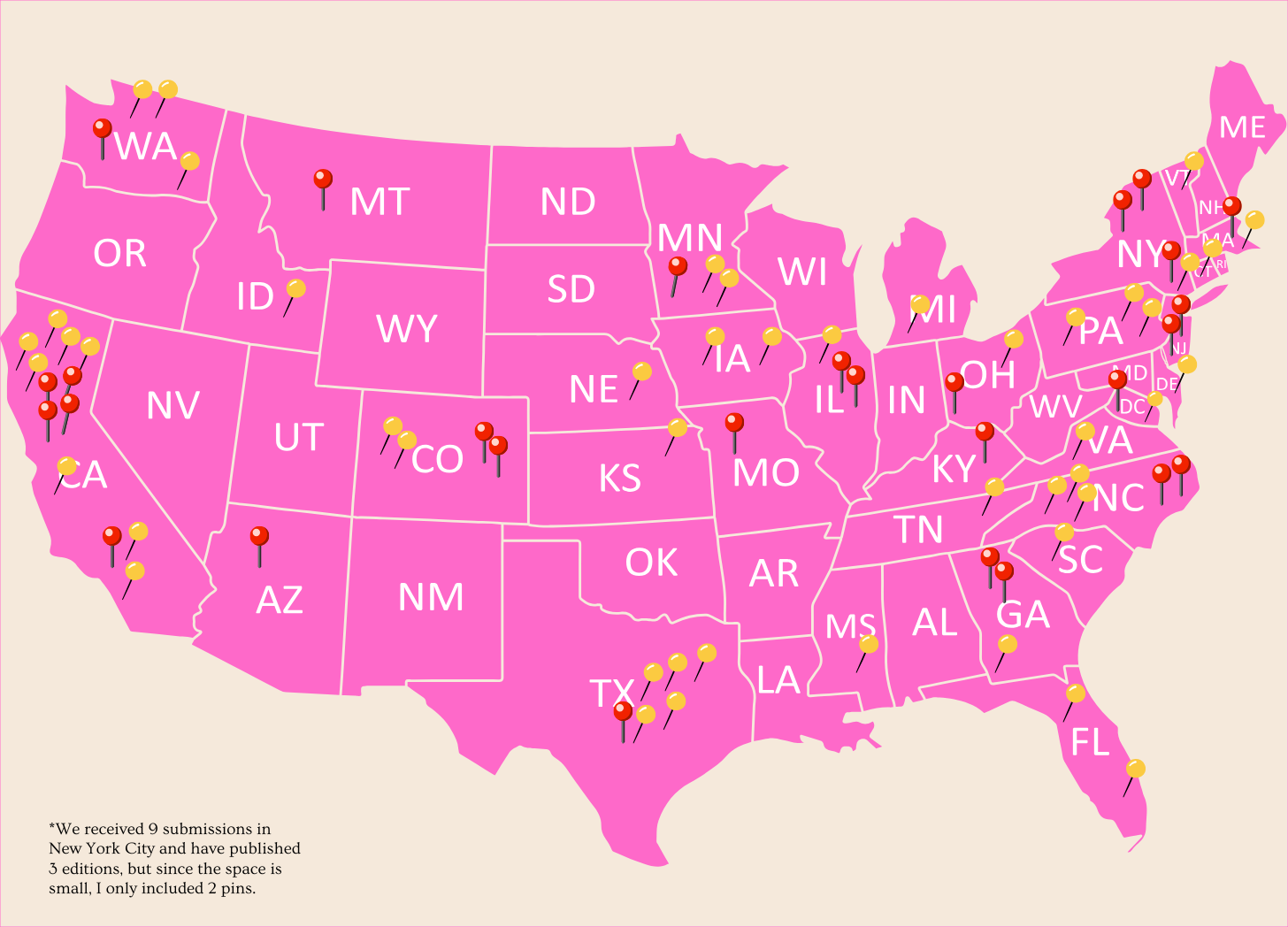

I was personally curious how many U.S. states are represented among the entries (published and submitted), so I spent an afternoon creating a map in Canva. (Yes, there are probably better ways I could have spent my time, but I have no regrets!) The red pins indicate there’s a published entry from that location, and the yellow pins indicate there’s a submission. Sorry that the map doesn’t include Hawaii or Alaska—I don’t have submissions from those states either!1

It’s not surprising that we overindex on the coasts, with many coming from New York City (three published entries and nine total submissions, plus an additional two from upstate) and the San Francisco Bay Area (four published entries and nine total submissions). But I was a little surprised that I’ve only received two entries from Florida (and also, one was written by a guy). And I haven’t received any entries from the following states:

This is all a long-winded way of saying I’d love to get more submissions so we could be closer to hitting all 50 states. I’m also always looking for diverse stories—interesting family situations, income ranges, and job titles. Really anything goes! And I *think* everyone who has participated has had a good experience.

You can fill out the form here. And feel free to reach out to me if you have any questions.

And now on to today’s Home Economics, which is our first from Washington, DC! You can quickly see why I related so much to this entry! I hope you enjoy it!

44

Washington, DC

Married

48

I’m a very typical white collar professional in her early 40s living in the Washington, DC, metro area. I’m married to a federal government employee (fun time to be that right now), and we have a tween daughter. After 20+ years of climbing the corporate (nonprofit management) ladder, I left the full-time workforce in 2024 due to severe burnout. I was the primary earner prior to my leaving, so for the past year we’ve been learning how to live on one (relatively modest for our area) income and figure out what’s next financially. My husband and I are both first-generation immigrants, and we define financial health very differently, so we’re really relearning everything we believe about money and financial health right now.

As of a year ago (mid 2024), we were fully debt-free except for our mortgage. I paid off nearly $100K in student loans (mine), we paid off two cars, and bought a house, and we never took on consumer debt. This made it easier for me to take the leap and leave my stressful job. And as we navigated this year on one income, we haven’t had to tap our emergency savings at all, which I’m very proud of.

Honestly, I don’t have any regrets about our spending. I’m very proud of my budgeting and how I’ve managed our finances, and the cuts we’ve made have been worthwhile. Nothing feels superfluous right now.

Takeout. I know this is the one place people always say to cut more, and we have quite a bit, and I do love to cook. But being able to grab our favorite pizza when we’re in between school and activities or a sandwich on a busy work day is sanity-saving.

It costs an absurd amount of money to cut my daughter’s hair, even though it’s a very simple haircut. She hates having her hair cut, but it needs to happen because it’s thick and long and gets very overwhelming. But because she’s a female—and even though it’s just her ends being trimmed—I still spend an absurd amount, and it makes me batty.

I spent my entire career working toward a career milestone, and when I reached it, it burned me to a crisp. I know I never want to feel that way again, and what I thought was important professionally really isn’t. But I also do value financial stability, especially in America, where one illness or accident can absolutely wipe someone out financially. I’m now redefining what I want my work life and personal life to look like, and I’m asking a lot of questions about what that means for financial stability and what is worth sacrificing, because often financial stability and a balanced life seem to be at odds. I’m hoping to find a solution, and I am working to change my own perspective on money and be less anxious about it.Since submitting this entry, I found a full-time job, and I start in a couple of weeks. I’m taking a less demanding job (and a pay cut of about $25,000 from what I was making from my last job). I was very intentional about looking for a job with a particular set of responsibilities so I can have better work/life boundaries.

I had such a scarcity mindset before I left my job, and I really didn’t believe we could live on one income. But this year has shown me that we can get by on a whole lot less without feeling like we are missing out—we clearly had some breathing room that I just couldn’t see.

I’m not sure how our spending will change now that I’ve got a full-time job again. As I said earlier, I want to make sure we’re thoughtful about how we save, potentially setting aside more in liquid savings and not just focusing on retirement. We’ve always been focused on putting away money for the distant future, and not for, like, five to 10 years from now. I really want to come up with a plan for that.

Oh, I may bring back our lawn service, too, rather than mowing the lawn myself and treat myself to an occasional pedicure.

Please comment with kindness!