Economic Concerns: Local Borrowing and Inflation

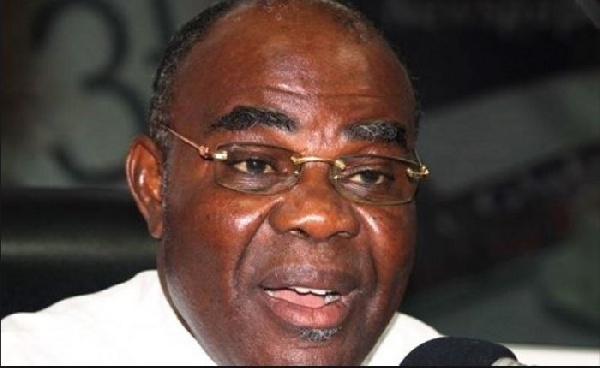

Kenya's National Treasury is shifting its borrowing strategy, opting for domestic sources to mitigate risks associated with external debt, according to Treasury Cabinet Secretary John Mbadi. This move aims to reduce the government's exposure to currency volatility, which significantly impacted debt servicing costs when the shilling weakened to Sh160 against the US dollar two years ago. As of December 2024, Kenya's public debt stood at Sh10.93 trillion, with a near-equal split between domestic (Sh5.868 trillion) and external lenders (Sh5.057 trillion). The new strategy targets a 75% domestic and 25% external borrowing ratio.

Mbadi emphasized that shrinking external support necessitates this shift. Policy changes in major economies, such as the US, signal reduced availability of cheap external loans. He highlighted the importance of strengthening domestic markets to compensate for this decline. The strengthening of the Shilling to Sh130 against the dollar has already reduced external debt by a trillion, from Sh6.089 trillion in December 2023 to Sh5.057 trillion in December 2024.

The government is also exploring increased tax revenues and prudent resource management to bridge budget deficits, while acknowledging that curbing corruption and enhancing efficiency are ongoing processes. While borrowing remains a necessity, the priority is to tap into domestic markets whenever possible.

However, past trends indicate that commercial banks often favor lending to the government through Treasury Bills and Bonds, potentially squeezing credit availability for households and businesses. This preference stems from the perceived stability of government debt compared to private sector lending.

In related economic news, a recent PwC survey reveals that Kenyan CEOs are most concerned about inflation, despite its recent drop to 3.5% in February. The survey identifies inflation as a major threat, followed by global macroeconomic conditions. In February 2023, inflation stood at 9.2%, significantly impacting the cost of living. Sixty percent of Kenyan CEOs are optimistic about global GDP growth, while 48% are cautiously confident about the local economy, which is projected to grow by 5.7%, according to the Central Bank of Kenya (CBK). However, the CBK cautions that this projection could be affected by the high cost of doing business, subdued consumer demand, and increasing geopolitical conflict.

While global inflation is expected to decline to 4.2% in 2025, 35% of Kenyan CEOs remain highly exposed to inflation in the next 12 months, compared to 27% of global CEOs. Other concerns include macroeconomic volatility (28%) and cyber threats (25%). Climate change is the least of concerns for Kenyan CEOs, with only 10% viewing it as a significant threat.

PwC's Peter Ngahu noted Kenya's digital maturity in East Africa, driven by broadband expansion, mobile money platforms, and fintech solutions. He emphasized that Kenyan CEOs are focused on innovation and adapting to evolving market conditions and that 65% of Kenyan CEOs are confident about the economic viability of their businesses over the next decade if they continue on their current path.