Earnings Not Telling The Story For KEPCO Plant Service & Engineering Co.,Ltd. (KRX:051600) After Shares Rise 26% - Simply Wall St News

(KRX:051600) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 37%.

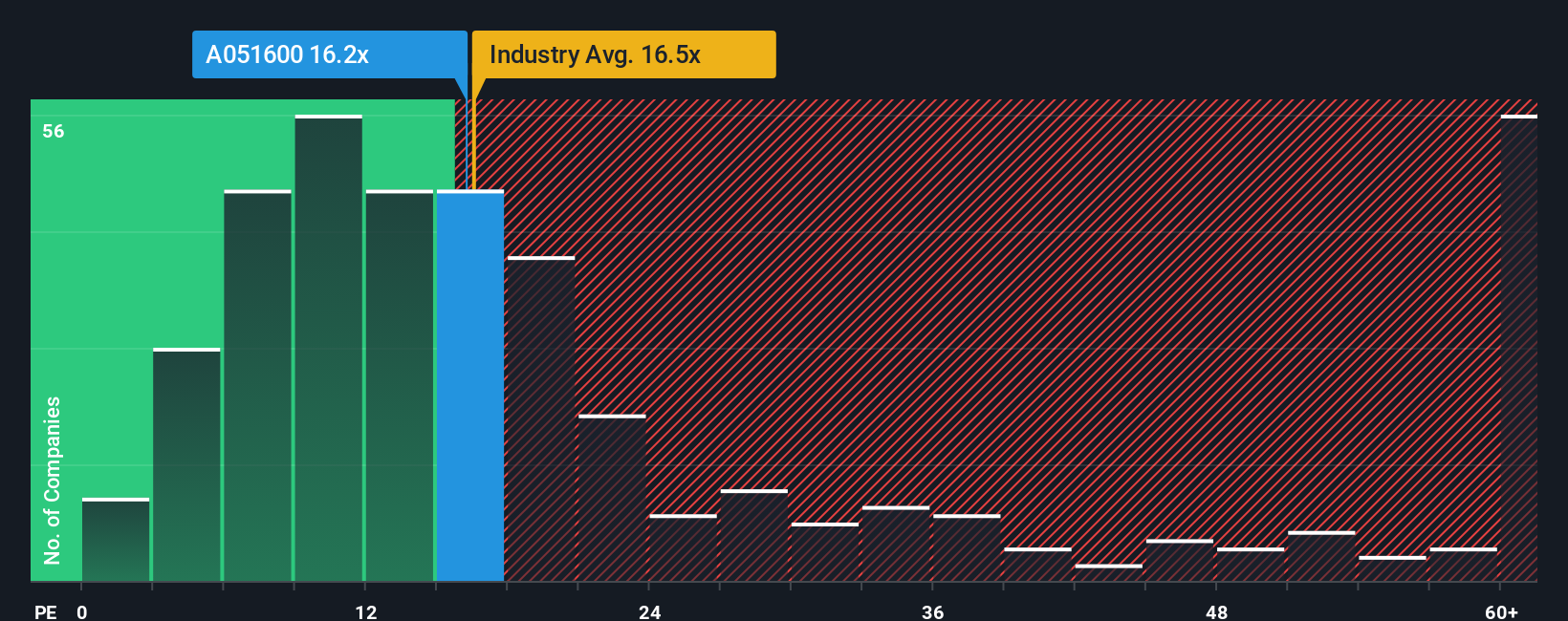

After such a large jump in price, given around half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may consider KEPCO Plant Service & EngineeringLtd as a stock to potentially avoid with its 16.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

KEPCO Plant Service & EngineeringLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for KEPCO Plant Service & EngineeringLtd

Keen to find out how analysts think KEPCO Plant Service & EngineeringLtd's future stacks up against the industry? In that case, our report is a great place to start.

The only time you'd be truly comfortable seeing a P/E as high as KEPCO Plant Service & EngineeringLtd's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 86% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 12% per annum over the next three years. That's shaping up to be materially lower than the 17% per annum growth forecast for the broader market.

With this information, we find it concerning that KEPCO Plant Service & EngineeringLtd is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

KEPCO Plant Service & EngineeringLtd's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that KEPCO Plant Service & EngineeringLtd currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found that you need to take into consideration.

If you're , why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Discover if KEPCO Plant Service & EngineeringLtd might be undervalued or overvalued with our detailed analysis, featuring

Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.