AP

AP

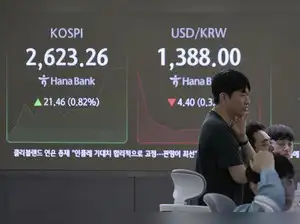

The OECD revised its U.S. growth forecast for 2025 downward to 1.6% from 2.2%, citing the impact of ongoing trade tensions and tariffs. Global growth projections were also lowered, reflecting broader concerns over international trade policies. The Nasdaq Composite rose more than 0.5% on Tuesday, driven by gains in the tech sector. Nvidia’s 3% surge was one of the main contributors, reflecting strong investor demand for semiconductor and AI-linked stocks. Overall, technology stocks led all 11 sectors in the S&P 500, making tech the day’s top-performing group.

Meanwhile, the Dow and S&P 500 showed smaller moves, as gains in tech were offset by concerns in other sectors, particularly those vulnerable to trade tensions and weak manufacturing data.

Uncertainty over U.S. trade policy continues to rattle investors. Although President Trump has paused some proposed tariffs, talks with China, Japan, and the EU appear to be stalled. Tensions remain high, with both the White House and Beijing accusing each other of violating terms of the most recent trade truce. While Trump’s team says he may speak with President Xi Jinping this week, Chinese officials haven’t confirmed any talks.In the meantime, data shows the trade war is leaving a mark. A private survey out of China indicated factory activity in May took a sharp downturn. In the U.S., factory orders fell 3.7% in April, a deeper drop than economists predicted, according to government figures. These numbers point to a slowdown in global industrial activity tied to rising tariffs and supply chain disruption.

The OECD, an international economic body, warned that global growth is slowing and blamed much of it on trade policy uncertainty. The report stated the U.S. economy is among the most at risk, given its central role in ongoing tariff disputes.The group advised governments around the world to urgently negotiate trade agreements, arguing that without resolution, investment and growth could stall further in the second half of the year. The OECD’s message added to investor concerns that major economies may underperform expectations if political gridlock continues.

Dollar General stock saw a sharp rise after the company raised its full-year guidance, saying that higher prices from tariffs are pushing more consumers toward discount stores. The retailer explained that it's seeing a clear shift in shopping behavior, with shoppers reacting to increased prices on everyday goods.As consumers look to cut costs, discount chains like Dollar General are becoming more appealing. The company’s optimistic forecast offered a rare bright spot in an otherwise uncertain retail environment.

What’s next for the U.S. economy and financial markets?

Investors are closely watching whether President Trump’s massive tax-and-spending bill, which narrowly passed the House, will survive the Senate. Any delays could add to fiscal uncertainty.Also on the radar is whether a Trump-Xi call materializes this week, which could offer hope for renewed trade negotiations. Until then, traders are likely to remain cautious, balancing solid corporate earnings from sectors like tech and discount retail against slowing economic data and geopolitical tension.

The stock market today reflected a tug of war between strong tech performance and growing economic and policy concerns. With the OECD lowering its U.S. growth forecast, investors are bracing for more volatility unless there's progress on trade talks and clearer economic signals in the coming weeks.

A1: Tech stocks like Nvidia surged, boosting Nasdaq higher than Dow and S&P 500.

Q2: What did the OECD say about U.S. economic growth?

A2: The OECD cut its U.S. growth outlook, citing trade policy and global slowdown.

Read More News on

(Catch all the US News, UK News, Canada News, International Breaking News Events, and Latest News Updates on The Economic Times.)

Download The Economic Times News App to get Daily International News Updates.