Daily Market Outlook - Tuesday, July 1

Image Source: Pexels

Stocks entered the second half of the year with a continuation of a record-setting rally, driven by optimism that the US economy can cope with the uncertainties stemming from President Donald Trump's tariff policies. The MSCI All Country World Index, which reached a peak on Monday, has seen gains for four consecutive days. In Asia, stock indices in Taiwan and South Korea led the way, while S&P 500 futures experienced a slight decline of 0.1% following the benchmark's best quarterly performance since December 2023. Meanwhile, the bond market improved, with yields on the 10-year Treasury note falling approximately 2 basis points to 4.21%. Wall Street's investors pushed stock prices to historic highs at the close of a robust quarter, fueled by optimism that the US is nearing concrete agreements with its primary trading partners. Expectations that the Federal Reserve will resume interest rate cuts have contributed to one of the best first halves for Treasuries in five years. Yet, the broader unpredictability surrounding Trump's tariff and fiscal policies regarding the long-term implications for the US economy is reflected in the dollar's 10.8% decline in the first half of the year, marking its worst performance for that period since 1973. Concerns about the growing deficit associated with the president's $3.3 trillion tax and spending proposal, which is currently being debated in the Senate, have further compounded these worries. Japanese markets dropped by as much as 1.2% as Trump hinted at imposing additional tariffs on Japan, leading to a stronger yen that negatively impacts exporters. This new wave of negotiations with Japan coincides with the impending July 9 deadline for increased tariffs on multiple trading partners. Trump pointed to Japan’s reluctance to accept US rice exports as a key issue. Previously, he had described the trade of automobiles between the US and Japan as inequitable and mentioned the possibility of maintaining a 25% tariff on car imports. Furthermore, a stronger yen also put pressure on Japanese stock prices, despite a marginal increase in confidence among Japan's major manufacturers in June. This unexpectedly positive sentiment might encourage Bank of Japan Governor Ueda to maintain discussions about a potential interest rate increase at the forthcoming board meeting at the month's end.

The ONS released an update on gilt holdings distribution as part of the Q1 National Accounts yesterday. Broadly, two key investor categories—namely the Bank of England (via QT/APF) and the pension fund & insurance company sector—have continued to see their ownership share in the gilt market decline (refer to chart). In contrast, overseas investors, banks, and ‘other financial institutions’ have increased their market share over the past two to three years. This shift is particularly notable as the Bank of England, during QE, and pension funds for many years, provided a consistent source of either absolutely or relatively price-insensitive demand. With the behavior of these investor groups now reversed or stagnated, the gilt market faces a new dynamic. As Governor Bailey remarked at the House of Lords Economic Affairs Committee last week, "we now have a mix of buyers who are probably more sensitive to relative yields." Consequently, the investor base has become more focused on fiscal sustainability considerations. The government’s recent concession to backbenchers ahead of today’s vote on welfare reforms highlights the constraints it faces in pursuing budgetary savings on the expenditure side. This comes at a time when having greater flexibility could help mitigate potential gilt market volatility.

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

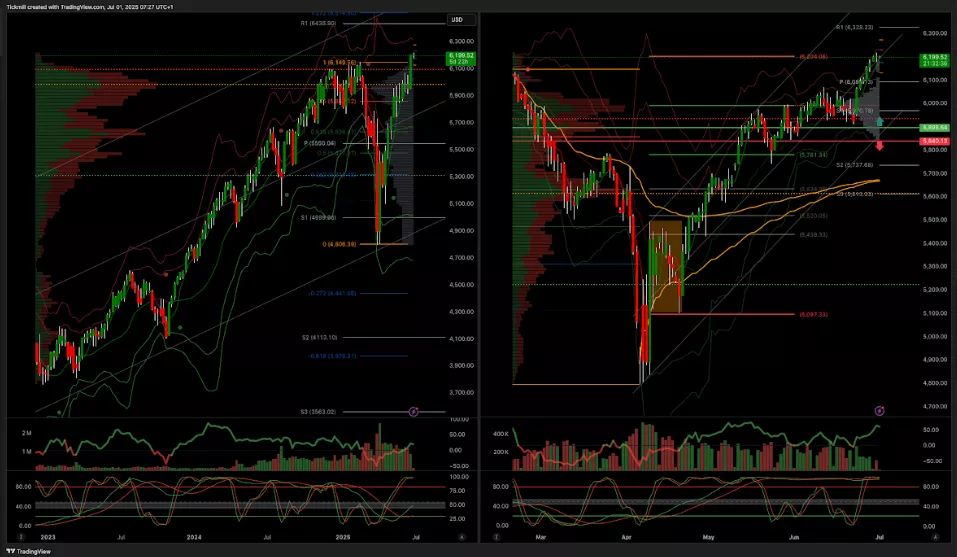

SP500 Pivot 5900

(Click on image to enlarge)

EURUSD Pivot 1.12

(Click on image to enlarge)

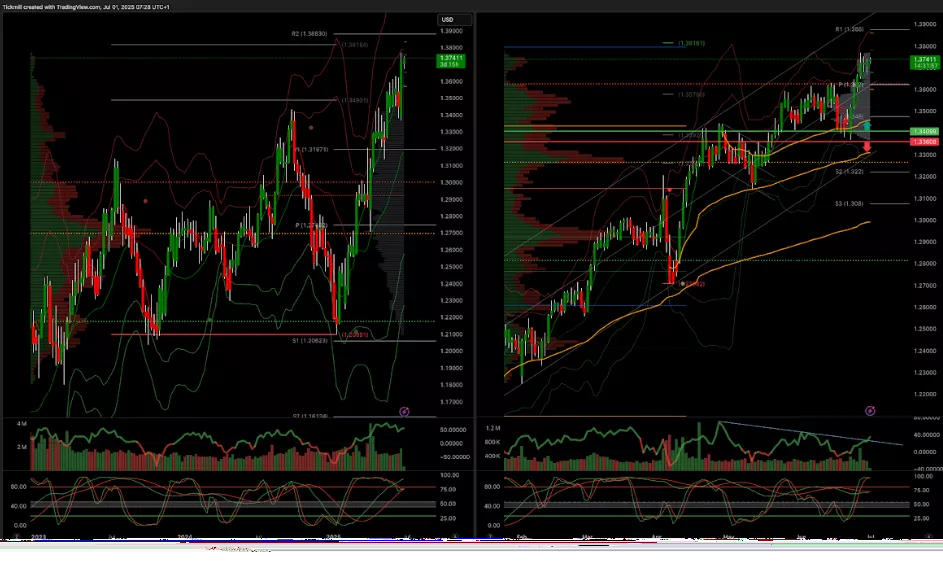

GBPUSD Pivot 1.34

(Click on image to enlarge)

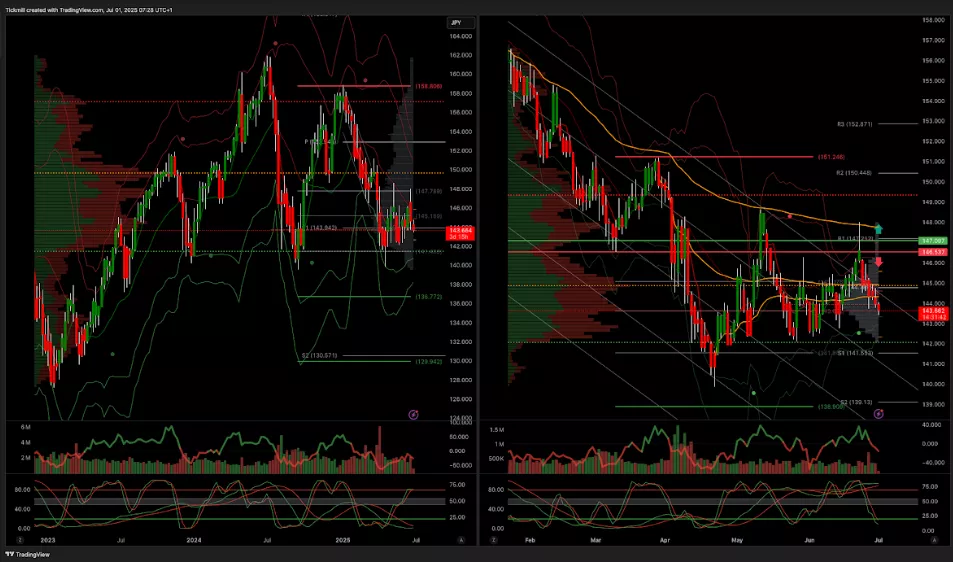

USDJPY Pivot 147

- Below 146.53 target 139

(Click on image to enlarge)

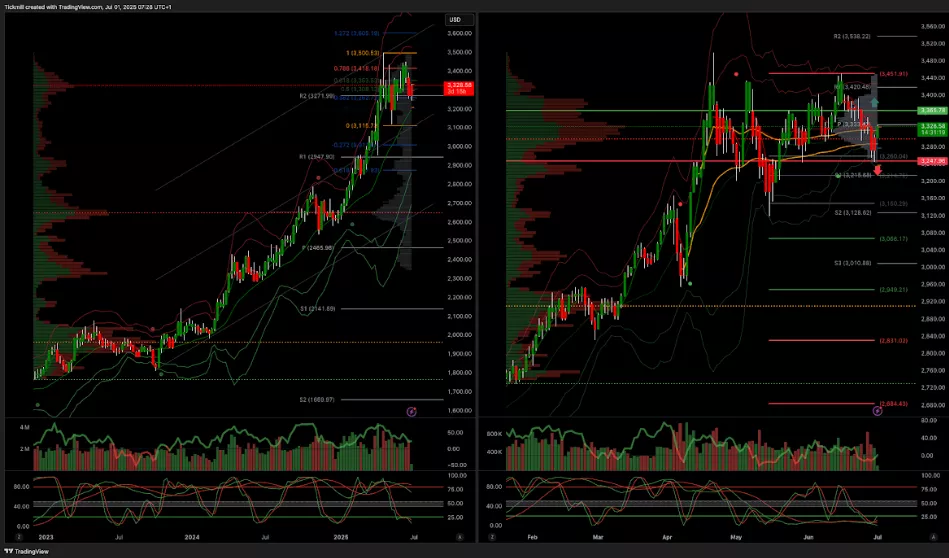

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

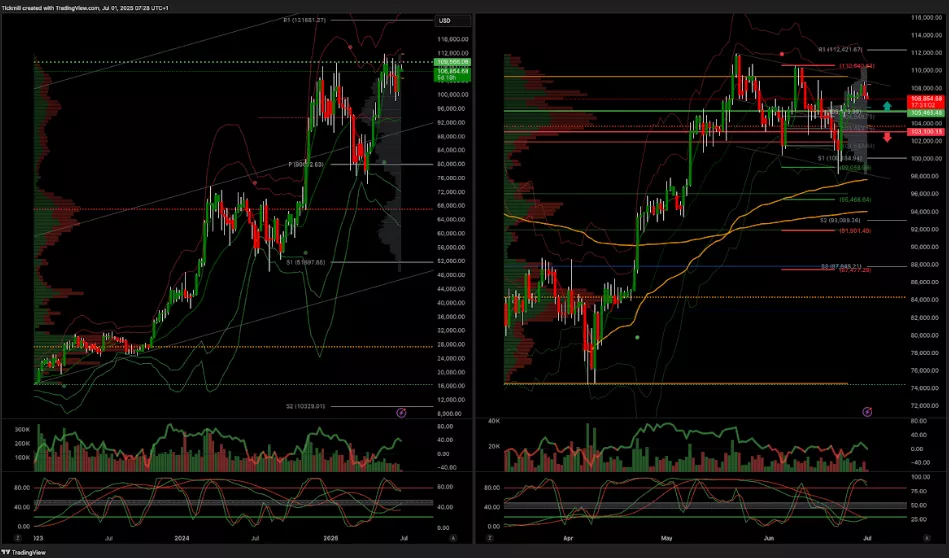

BTCUSD Pivot 105k

- Daily VWAP bearis

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

S&P 500 Weekly Action Areas & Price Targets - Monday, June 30

Daily Market Outlook - Monday, June 30

The FTSE Finish Line - Friday, June 27

:max_bytes(150000):strip_icc()/GettyImages-2217858319-e3dd36094ffa400dbee9b99e46257e39.jpg)

:max_bytes(150000):strip_icc()/INV_Powell_0724_GettyImages-2164066612-ed2f559b9a134d348820363c401b9050.jpg)