CreditCorp Disburses Loans To 100,000 Nigerians In Six Months- See How To Apply

CREDICORP Disburses Loans to 100,000 Nigerians in 6 Months — See How to Apply

Barely six months after receiving its takeoff capital from the Federal Government, the () has successfully disbursed credit to over , including , as part of efforts to expand financial inclusion and improve citizens’ access to consumer loans.

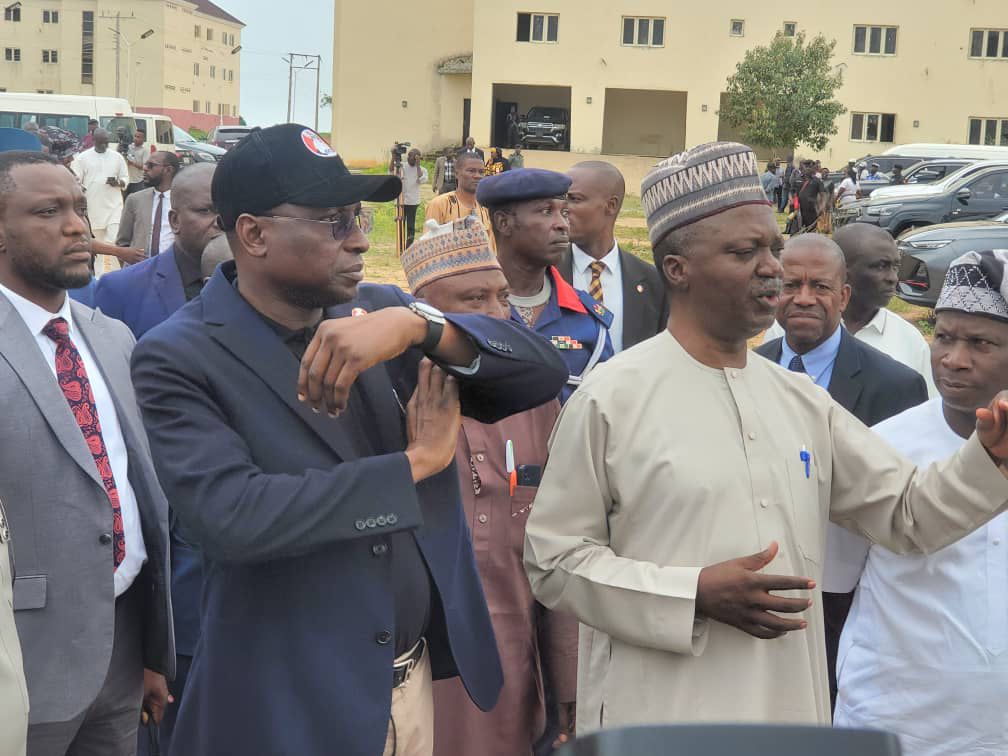

Speaking at the on Tuesday, the Chief Executive Officer of CREDICORP, , said the agency has rapidly scaled operations, partnering with 23 licensed financial institutions, with “hundreds more in the pipeline.”

“We got our funding just over six months ago. As of today, we’ve onboarded 23 financial institutions and delivered credit access to more than 100,000 people. Roughly 35,000 of these are federal and state civil servants,” Nwagba revealed to State House correspondents.

He noted that early reports from the disbursements show that many beneficiaries are using the loans for

This update is the since President Bola Ahmed Tinubu approved to implement the under his administration’s Renewed Hope agenda.

Financial analysts have lauded CREDICORP’s pace, with some calling it one of the in West Africa, especially considering the large number of beneficiaries reached in such a short time.

The agency’s mandate is to , with a long-term target of reaching and expanding consumer credit to

To apply for a CREDICORP-backed loan:

Applicants are encouraged to through the platform before applying, as CREDICORP is also building a national for long-term transparency and equity in lending.

According to Nwagba, the next phase will focus on:

-

Expanding access to

“We’re not just handing out loans. We’re building a trusted credit system that works for everyday Nigerians,” Nwagba affirmed.

CREDICORP has also committed to enhancing credit education, policy transparency, and risk guarantees for financial institutions, ensuring lenders are encouraged to serve more low-risk but previously excluded populations.