Coverage of Warren Buffett's Comments at the Berkshire Hathaway Annual Meeting

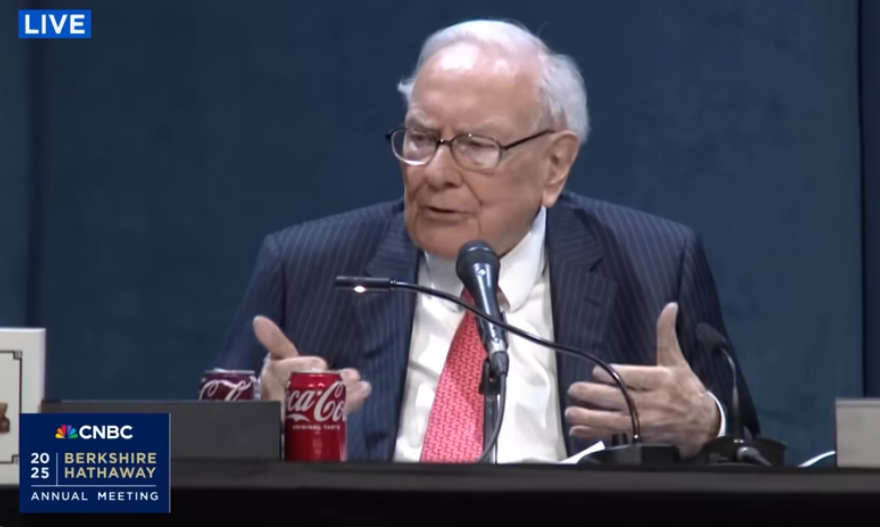

The Berkshire Hathaway annual shareholder meeting, often dubbed "Woodstock for Capitalists," took place on Saturday, drawing shareholders from around the globe to hear insights from Warren Buffett, Greg Abel, and Ajit Jain. CNBC livestreamed the event, which commenced with a pre-show at 8:30 a.m. ET. Attendees began lining up as early as 1 a.m. local time to secure the best seats at Omaha's CHI Health Center, with a traditional sprint for front-row spots occurring around 7 a.m. CT. Buffett took the stage around 8 a.m. ET.

Many attendees showcased their admiration for Buffett through their attire. Some wore shirts and hoodies featuring Buffett's likeness, reflecting the positive energy and excitement surrounding the event. One attendee, Nora Ridenour, sported a shirt inspired by Andy Warhol's art, while others wore apparel from previous Berkshire events.

The meeting occurred amidst market volatility and concerns over President Donald Trump's tariffs. Investors sought Buffett's guidance on these issues, with many economists warning of a potential recession. Buffett addressed the recent market turmoil, stating that it was normal for stock investing and not a "dramatic bear market." He noted that Berkshire Hathaway's stock had been cut in half three times during his 60 years at the helm. Investor David Samra highlighted tariffs as a key topic and expressed interest in Ajit Jain's commentary on wildfire issues affecting the energy business.

Buffett also commented on fiscal policy, expressing concern about governments making decisions that weaken currencies. He stated that the value of currency is a scary thing and that the U.S. has come close to the edge regarding reckless fiscal practices. These comments echoed concerns raised in Berkshire's annual report.

Ajit Jain discussed the impact of private equity firms on Berkshire's insurance business, admitting that they had become less competitive in that space. However, he cautioned that the higher leverage and aggressive strategies used by private equity firms could lead to problems if regulators become concerned about excessive risk-taking. Jain also lauded Geico CEO Todd Combs for significantly reducing the company's workforce and improving its telematics capabilities, leading to substantial cost savings.

In response to a question about artificial intelligence, Jain acknowledged its potential to transform the insurance industry but emphasized Berkshire's cautious approach, preferring to wait for opportunities to crystallize before investing heavily. Buffett shared advice on careers, emphasizing the importance of enjoying one's work and being discerning about who one works with. He also affirmed his confidence in the U.S. economy, despite criticisms of current trade policies.

Buffett revealed that Berkshire almost spent $10 billion recently and reiterated that the company would find opportunities to deploy its record levels of cash, likely within the next five years. He also stated that he would not be selling Berkshire's Japan stocks, regardless of future interest rate hikes by the Bank of Japan. Buffett criticized tariffs, stating that trade should not be a weapon and that the U.S. should focus on trading with the rest of the world.

He jokingly thanked Apple CEO Tim Cook for making Berkshire a lot more money than he had. Buffett also noted that Apple co-founder Steve Jobs made the right decision in choosing Cook as his successor.

Berkshire sold thousands of its 60th-anniversary books during Friday's shopping event. Buffett shared statistics from the convention, noting record attendance of 19,700 people and significant sales for See's Candies, Brooks, and Jazwares. The meeting was opened to applause, with Buffett noting it should be his biggest and best yet.

Berkshire's earnings report revealed that the company had net sold stocks for 10 consecutive quarters, leading to a record cash pile of $347 billion. The company's operating earnings declined, driven by weakness in insurance underwriting and foreign exchange losses. The report also noted that tariffs created considerable uncertainty for Berkshire's businesses.

The shopping event in Omaha featured interactive displays and merchandise from Berkshire's holding companies, including specialty Squishmallow toys. Berkshire Hathaway shares reached record highs, driven by the defensive nature of its insurance empire and its strong balance sheet. Investors were keen to hear Buffett's thoughts on tariffs, with some suggesting that they could create opportunities for Berkshire to make new investments at a discount.