China sets rates, trade war fear dissipates?

Table of Contents

Asian markets are bracing for the Peopel’s Bank of China’s (PBOC) interest rate decision, a key event that could shape investor sentiment and economic outlook for the region. The declaration arrives amidst a backdrop of global trade tensions and concerns about the inflationary impact of rising U.S. tariffs.

“A trade war between the U.S. and its major trading partners woudl be damaging for growth and markets, so you would think investors are pricing that risk into their portfolios,” remarked an analyst.

The Federal Reserve’s latest minutes highlighted concerns among officials regarding the inflationary potential of President Trump’s trade policies. Firms have indicated their intention to pass on the cost of import tariffs to consumers through price increases.

Despite escalating trade tensions, discussions between the U.S. and China have taken on a slightly more constructive tone. The World Trade Organization (WTO) reported “constructive” discussions after China condemned the tariffs imposed or threatened by President Trump, which threaten to disrupt the global trading system.

Remarkably, these escalating geopolitical risks have not substantially dampened investor sentiment.Major stock indexes, including the S&P 500, MSCI World, and benchmark European and UK indices, are hitting new highs. This resilience could be attributed to investor complacency, or a belief that President Trump’s stance is a negotiating tactic aimed at securing concessions.

While Asian markets generally face headwinds from China’s economic slowdown, a strong U.S. dollar, and high U.S.bond yields, there are glimmers of hope. As a notable example,Hong Kong-listed Chinese tech shares have shown resilience. sentiment towards China and capital flows are showing signs of improvement.

President Xi Jinping’s meeting with private sector leaders has fueled optimism about potential policy changes that could bolster China’s growth, especially in the technology sector.Bank of America’s latest fund manager survey revealed a positive shift in sentiment towards China’s macroeconomic prospects. for the first time in four months, fund managers expressed optimism about China’s outlook, signaling a potential “DeepSeek effect” autonomous of any policy stimulus.

The PBOC is expected to maintain its benchmark one- and five-year lending rates at 3.1% and 3.6%, respectively. This cautious approach reflects the central bank’s delicate balancing act between prioritizing financial stability and providing sufficient stimulus amidst escalating trade tensions.

Investors will closely monitor several key economic indicators this Thursday,including:

*

These developments will provide valuable insights into the health of the Asian economy and could influence investor sentiment in the coming days.

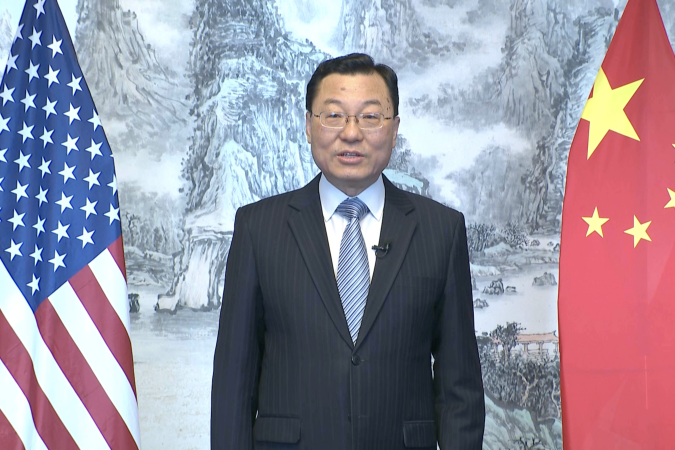

Dr. Li, with escalating trade tensions between the U.S. and its major trading partners, how do you see this impacting global growth and Asian markets?

Trade wars are never good for growth, and Asian markets are especially exposed due to their heavy reliance on exports. Investors are pricing in some of this risk,but the resilience of major indices is remarkable. Some beleive this is a negotiating tactic by President Trump, but the uncertainty is certainly weighing on markets.

Despite the tensions, discussions between the U.S. and China seem to have taken a more constructive tone. What are your thoughts on this?

It’s encouraging to see a more constructive tone,but we’ve seen these ups and downs before. Until we see concrete results, it’s wise to remain cautious. The World Trade Organization’s “constructive” discussions are a positive sign, but we need more than words to boost market confidence.

Major stock indexes are hitting new highs amidst these geopolitical risks. Is this a sign of investor complacency or something else?

It’s a mix of factors. Some investors may be complacent, but others see this as a buying opportunity. The strong U.S. economy and corporate earnings have also boosted sentiment.Though,this resilience could be tested if trade tensions escalate further or if we see a significant slowdown in the U.S. economy.

While Asian markets face headwinds,there are glimmers of hope,such as Hong Kong-listed Chinese tech shares. what’s driving this resilience?

Chinese tech companies are innovating and expanding globally, which has boosted investor confidence. Additionally, sentiment towards China and capital flows are showing signs of improvement. Though, we must remember that the broader Chinese economy is still facing headwinds from a strong U.S. dollar and high U.S. bond yields.

President xi Jinping’s meeting with private sector leaders has fueled optimism about potential policy changes. Do you share this optimism?

I do. China needs to open up its economy and encourage private sector growth to maintain long-term growth. President Xi’s meeting signals a willingness to address these issues. However, we need to see concrete policies before we can be certain of a significant shift.

The PBOC is expected to maintain its benchmark rates this week. How do you see the central bank balancing financial stability with the need for stimulus?

The PBOC is walking a tightrope. It wants to ensure financial stability while providing enough stimulus to offset the headwinds from trade tensions. maintaining rates this week would be a cautious approach, but we could see targeted measures to support specific sectors, such as infrastructure or small businesses.

Market Movers to Watch

This Thursday, investors will be watching several key indicators. Which ones do you think will have the most significant impact on Asian markets?

The China interest rate decision will be closely watched, as it provides insight into the PBOC’s thinking on economic growth. The Australia unemployment rate and South Korea producer price inflation will also be crucial, as they offer a snapshot of the health of the Asian economy.

Dr. Li, thank you for sharing your insights. Before we wrap up, what’s one thought-provoking question you’d like to leave our readers with?

Given the uncertainty around trade tensions,how do you think Asian markets would react if we saw a significant slowdown in the U.S. economy? Would the resilience we’ve seen so far hold up?