Chase Sapphire Reserve $300 Travel Credit: How It Works

In the interest of full disclosure, OMAAT earns a referral bonus for anyone that’s approved through some of the below links. The information and associated card details on this page for the Capital One Venture X Rewards Credit Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer. These are the best publicly available offers (terms apply) that we have found for each product or service. Opinions expressed here are the author's alone, not those of the bank, credit card issuer, airline, hotel chain, or product manufacturer/service provider, and have not been reviewed, approved or otherwise endorsed by any of these entities. Please check out our advertiser policy for further details about our partners, and thanks for your support! The offers for the Ink Business Preferred® Credit Card, and Chase Sapphire Preferred® Card have expired. Learn more about the current offers here.

The Chase Sapphire Reserve® Card (review) and Sapphire Reserve for BusinessSM (review) are lucrative premium travel cards. There are lots of reasons to consider picking up these cards, including great rewards structures, lounge access, and more.

While both cards offer quite a few credits, there’s one credit that’s easiest to use, and which I consider to basically be good as cash. Specifically, I’m talking about the $300 annual travel credit. In this post, I want to take a closer look at how this benefit works, as it helps greatly with offsetting the $795 annual fee.

Every cardmember year, the Chase Sapphire Reserve and Sapphire Reserve Business offer a $300 travel credit.

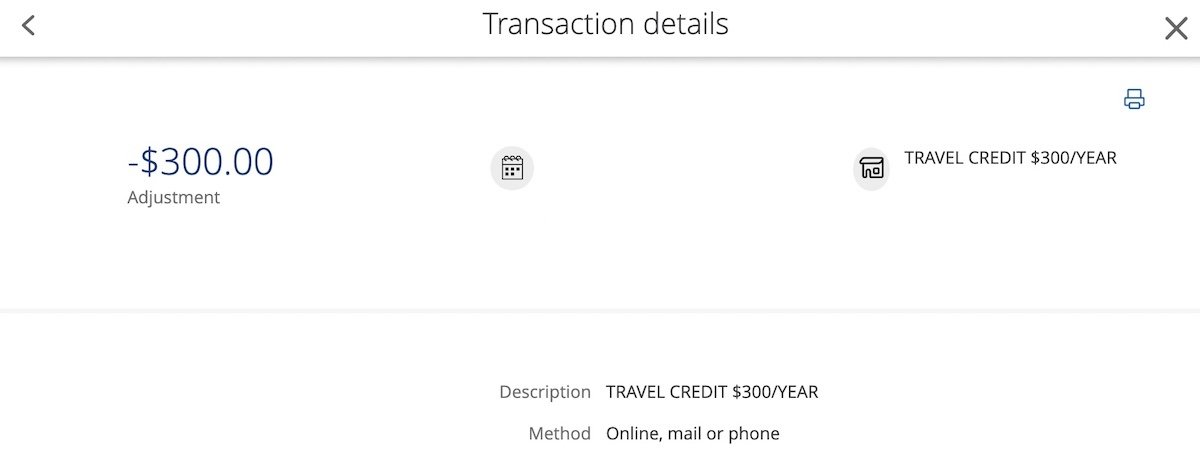

This credit is applied to purchases automatically — there’s no need to register — and you can use it over as many purchases as needed until the credit is completely used up. So that can be a single $300 purchase, 10 purchases of $30 each, etc. This comes in the form of a statement credit that posts shortly after you make your purchase.

What purchases will automatically be credited as travel? Chase defines travel as including the following purchases:

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.

As you can see, it’s not just traditional travel purchases that get reimbursed, but also things like rideshare, parking, trains, buses, and more. You can easily use the $300 credit in your day-to-day life.

As soon as you activate the Chase Sapphire Reserve or Sapphire Reserve Business, you can immediately start using the travel credit. There’s no waiting period required.

In subsequent years, your $300 travel credit is valid starting on your anniversary account date, which would be 12 monthly billing cycles after you opened the card.

The travel credit should post almost instantly after a purchase posts to your statement. So if you’re an existing cardmember, just wait for your new anniversary year, and then you should start to see the credits posting. Unlike some other credits, you typically don’t have to wait weeks for this to post, or anything like that.

When many people get the Chase Sapphire Reserve or Sapphire Reserve Business, they’re trying to reach the minimum spending requirement in order to earn the welcome bonus. How does the $300 you get reimbursed for travel play into that?

Well, the total amount you spend (minus the annual fee) counts toward the minimum spending requirement. So even if you get reimbursed $300 through the travel credit, that $300 in spending would still count toward the minimum spending requirement.

Note that if a purchase on the Chase Sapphire Reserve or Sapphire Reserve Business qualifies toward the credit, then you don’t earn points for that portion of the credit. In other words, if you spent $1,000 on travel and had $300 reimbursed, you’d only earn points on $700 worth of that purchase.

If you refund a purchase that was reimbursed, then the statement credit should similarly be reversed, and the amount should automatically be applied toward a future travel transaction. However, some report that the statement credit doesn’t get reversed, so this seems like a case of “your mileage may vary.”

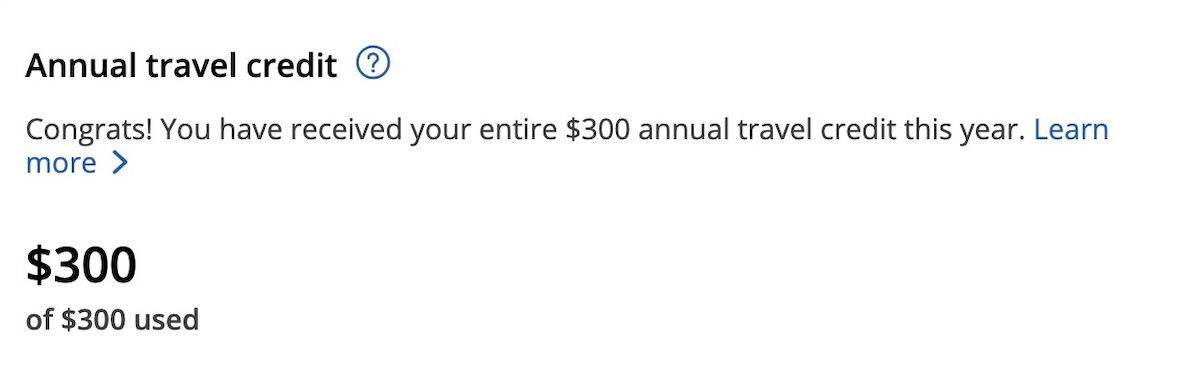

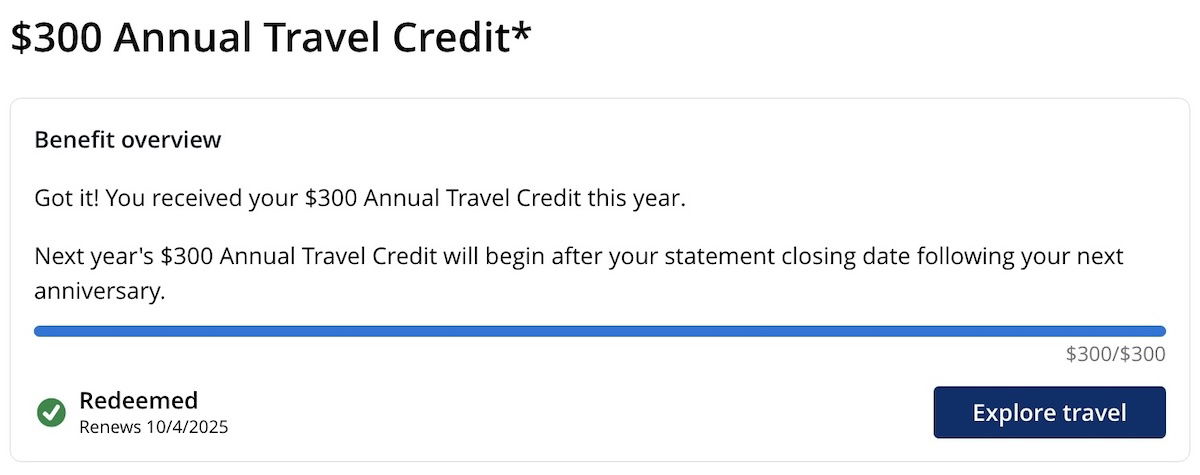

When you go to the Ultimate Rewards homepage, log into your account, and select your eligible card, you should see the card’s dashboard, with all kinds of details. If you scroll down, you should see the “Annual travel credit” section, showing how much of your credit has been used.

If you click the “Learn more” button, you’ll be brought to a page that also shows your renewal date, so that you can see when you’ll next receive a credit.

There is no published data on this, though I’d have to assume that a vast majority of people with the Chase Sapphire Reserve and Sapphire Reserve Business are fully utilizing the travel credit. That’s why I feel comfortable suggesting that for most users, it lowers the real annual “out of pocket” on the card by roughly $300.

Let me take it a step further — if you don’t use the full $300 travel credit then this card simply isn’t for you. There are better cards out there for someone who doesn’t spend at least $300 per year on taxis, rideshare, subways, trains, hotels, airlines, etc.

If the credit is so easy to use, many people probably wonder why Chase bothers having such a credit, rather than just outright lowering the annual fee but that much. I suspect there are two reasons for this:

Both The Platinum Card® from American Express (review) and The Business Platinum Card® from American Express (review) offer a variety of credits as well. One of the credits they both offer is an annual up to $200 airline fee credit (Enrollment required). There are a few things that make this credit not as good, though:

While the $200 airline fee credit is only a small part of the Amex Platinum suite of benefits, that aspect of the card is in no way competitive, in my opinion.

The Capital One Venture X Rewards Credit Card (review) and Capital One Venture X Business (review) are also lucrative premium cards, which are quite easy to justify. The cards have $395 annual fees, and offer a $300 annual travel credit. How does that credit compare?

Many people are deterred by the $795 annual fee on the Chase Sapphire Reserve and Sapphire Reserve Business. While the cards offer lots of credits that can help offset those fees, the single easiest perk to maximize is the $300 annual travel credit.

Every cardmember year, your first $300 in spending in the travel category will automatically be reimbursed. Unlike some of the other credits and benefits on these cards, this credit is super straightforward. By my math, this really lowers the “out of pocket” on the cards by $300.