CBEX Alleged Ponzi Scheme Crash: Investors React and Loot Office

The Nigerian social media space is currently buzzing with discussions surrounding CBEX, a digital asset trading platform, following reports that the platform has allegedly crashed. Numerous Nigerians who invested in the scheme have taken to social media to express their distress, with some reportedly losing significant amounts of money. This situation has prompted reactions from various quarters, including legal experts and observers who are weighing in on the implications of the alleged crash.

Legal Perspectives on Ponzi Schemes

Popular content creator and celebrity lawyer Timi Agbaje has addressed the CBEX situation in a video, shedding light on the legal aspects of Ponzi schemes in Nigeria. Agbaje emphasized that any investment business operating in Nigeria must be registered with the Security Exchange Commission (SEC) and adhere to its regulations. He cautioned against seeking shortcuts to wealth, stating that those who attempt to defraud Nigerians through investment schemes are liable to imprisonment for at least five years, a fine of five million naira, or both, as stipulated in section 344 (E) of the Investment and Securities Act 2025. Furthermore, Agbaje asserted that promoters, influencers, and bloggers who promote Ponzi schemes leading to financial losses for Nigerians must make refunds within one month.

Domain Name Changes and Red Flags

Legit.ng's investigations have revealed that CBEX has changed its domain name several times between January 2024 and February 1, 2025. This pattern of changing domain names can be seen as a red flag, raising concerns about the platform's transparency and operational legitimacy.

Reactions and Observations

Reactions to the CBEX situation have been varied. Some Nigerians have expressed skepticism about the applicability of existing laws, citing previous instances where similar schemes occurred without legal repercussions. Others have pointed out the role of influencers and celebrities in promoting such platforms, leading to financial losses for many. One user commented that poverty and Ponzi schemes are intertwined, implying that the allure of quick wealth often overrides caution.

A Catholic Priest has also shared his observations regarding Nigerians who invested in CBEX, while other users have drawn comparisons to previous schemes like Racksterli, which were promoted by prominent figures like Davido. These comparisons highlight a recurring pattern of Nigerians falling prey to investment schemes promising high returns.

Victims Speak Out

Numerous individuals have shared their personal experiences of financial loss due to the alleged crash of the CBEX platform. One woman revealed that she lost her school fees, while another reported that she had used her business capital to trade on the platform. These accounts underscore the devastating impact of the alleged crash on individuals' lives and financial stability.

Condolences and Warnings

Amid the outcry, some individuals have offered words of encouragement and caution. One man posted a condolence message urging those who lost money to take heart and view the situation as a learning experience. He advised against making rash decisions and emphasized the importance of seeking support and avoiding suicidal thoughts. Similarly, a concerned man warned CBEX investors against making additional deposits, describing it as a ploy to extract more funds from them. He advised people to accept their losses and move on, asserting that nothing could be done to retrieve their funds.

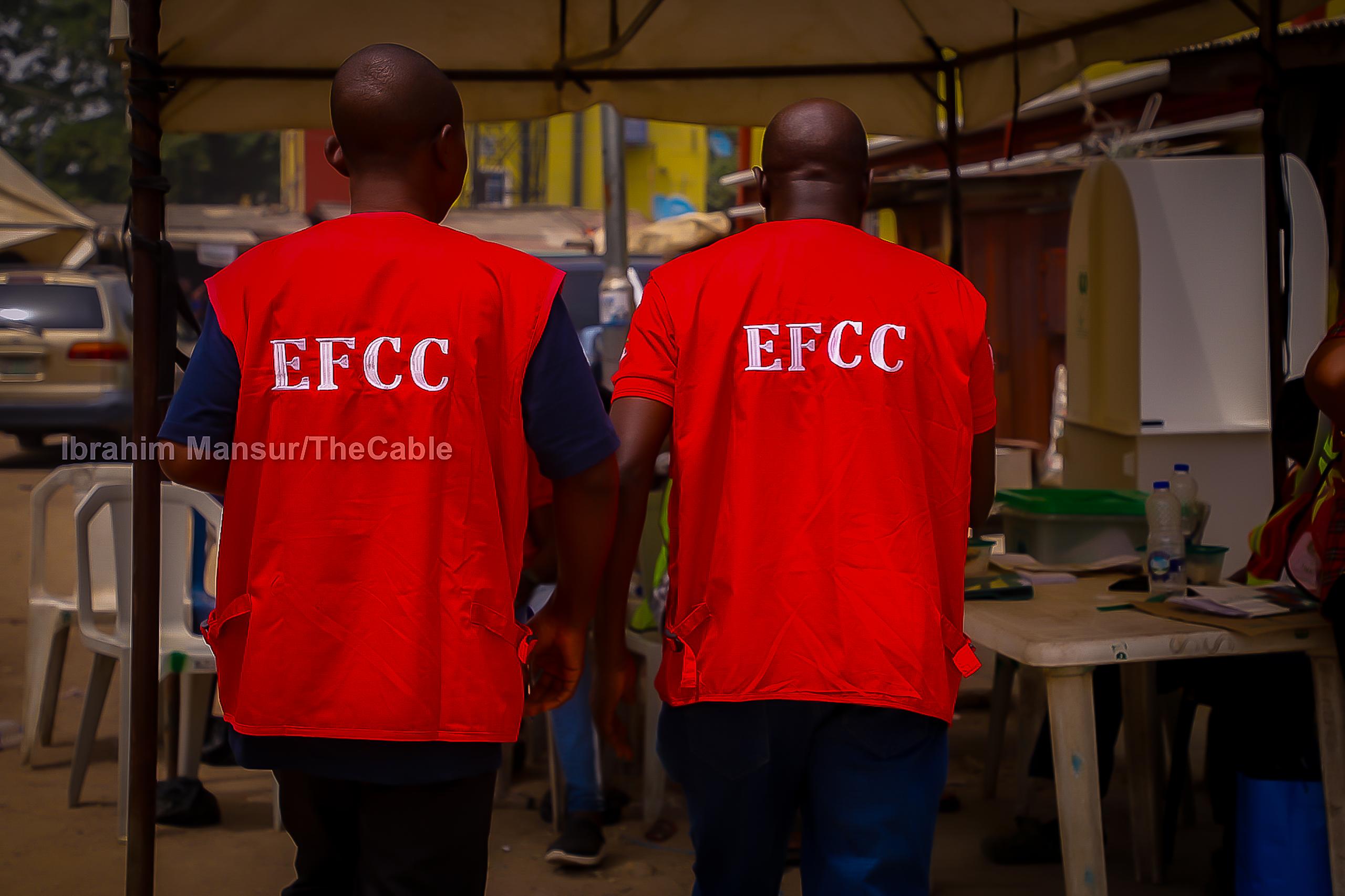

Looting and Desperation

In a display of anger and frustration, some aggrieved investors reportedly looted the office of Smart Treasure (ST Team), an arm of the CBEX crypto trading platform, in Ibadan, Oyo State. Videos circulating on social media showed individuals breaking into the premises and carting away valuables. This act of desperation underscores the level of financial distress and emotional turmoil experienced by those affected by the alleged crash.

Man Observes CBEX's Mistake

An observant individual pointed out how the management of the CBEX platform inadvertently exposed itself while trying to do damage control. According to him, CBEX mistakenly revealed that they lacked the necessary certifications to operate, suggesting that they had been operating illegally. This revelation has further fueled concerns about the platform's legitimacy and accountability.

Warnings Ignored

Former presidential aide, Bashir Ahmad, lamented that the Securities and Exchange Commission (SEC) had warned Nigerians against investing in CBEX, clarifying that the platform was not registered with the Commission. He expressed dismay that Nigerians proceeded to invest their money despite the SEC's warning, highlighting a recurring issue of regulatory warnings being ignored by those seeking quick financial gains.

Past Ponzi Schemes

A Nigerian man shared screenshots from a group chat of CBEX users, revealing that people were still investing in the platform despite the alleged crash. He drew parallels to previous Ponzi schemes, such as MMM and Racksterli, which also resulted in financial losses for many Nigerians. This pattern suggests a recurring susceptibility to investment schemes promising high returns, despite past experiences.