Canada to Roll Out Instant Interoperable Payment System

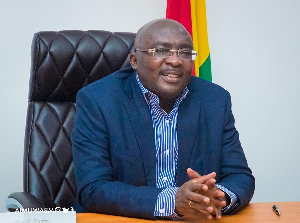

Ghana's pioneering role in establishing an innovative instant payment system, specifically mobile money interoperability, marks a significant achievement on the African continent and globally. Launched by former Vice President Dr. Mahamudu Bawumia, this system facilitates seamless transactions between all mobile money wallets and banks. Seven years later, Ghana's system remains unique in Africa and serves as a global reference point, even surpassing many developed nations.

Recently, Canada announced its plans to roll out a long-awaited instant payment system, the Real-Time Rail (RTR), after years of advocacy from Canadian fintechs. This system aims to provide the same instant and seamless payment capabilities that Ghanaians have experienced for the past seven years. While Ghana's system was a collaborative effort between GhIPSS, telecom companies, and banks, Canada's version is being developed through a partnership between Nuvei and Mastercard. Expectations are high for improved payment capabilities for businesses and individuals in Canada.

Ghana's early leadership in implementing an instant, interoperable payment system has garnered international recognition. Numerous fintech institutions consistently rank Ghana as number one in Africa and among the best globally for its effective interoperable payment infrastructure. Former Vice President Dr. Mahamudu Bawumia has also received commendation for his role in championing this transformative digital payment system.

The adoption of instant payment systems is growing worldwide as countries seek to enhance their financial systems. Ghana's mobile money interoperability set a global benchmark and is now being mirrored by Canada with its upcoming real-time rail payment system. Ghana's system allows seamless transactions among all mobile wallets and banks, placing it ahead in global financial rankings.

The journey from conceptualization to execution of instant payment systems requires strategic partnerships. Ghana's success was a result of collaboration between GhIPSS, telecom companies, and banks, while Canada's system highlights the role of public-private partnerships, such as the cooperation between Nuvei and Mastercard.

Ghana's experience with instant payments has increased efficiency within the financial sector and enhanced economic participation among underbanked populations, promoting financial inclusion. Emerging trends in financial technology include the integration of AI to predict transaction needs and blockchain to ensure systemic security, which will redefine modern banking and facilitate international transactions.

The new landscape of instant payments is fostering competition among nations to deliver faster and more secure transactions. Europe’s SEPA Instant Credit Transfer (SCT Inst) and the U.S.’s RTP 2.0 are examples of systems aimed at creating robust financial infrastructures worldwide. Cross-border instant payments are also becoming increasingly important, with global stock exchanges adopting these systems to facilitate immediate international trade and reduce settlement risks.

Instant payment systems offer benefits such as enhanced transaction speed, improved customer experience, reduced fraud, and increased financial inclusivity. Real-time payment interoperability ensures transactional freedom across different banking and financial entities without delays, fostering economic efficiency. Countries are advancing their payment infrastructures by adopting new technologies like blockchain and AI to promote real-time and secure financial transactions.