Blackstone (NYSE:BX) Sells Hotwire Communications To Brookfield For US$7 Billion

Blackstone (NYSE:BX) experienced a 3% decline in its share price over the last week, a move that coincides with the announcement of Brookfield Infrastructure Partners acquiring Hotwire Communications from the company. While the broader market remained flat during the same period, this transaction likely added weight to Blackstone's price movement. The sale of Hotwire potentially impacts investor perceptions regarding Blackstone’s strategic direction, yet it occurs against a backdrop of an 11% market rise in the past year. These dynamics may have influenced investor sentiment and contributed to the observed movement in Blackstone's share price.

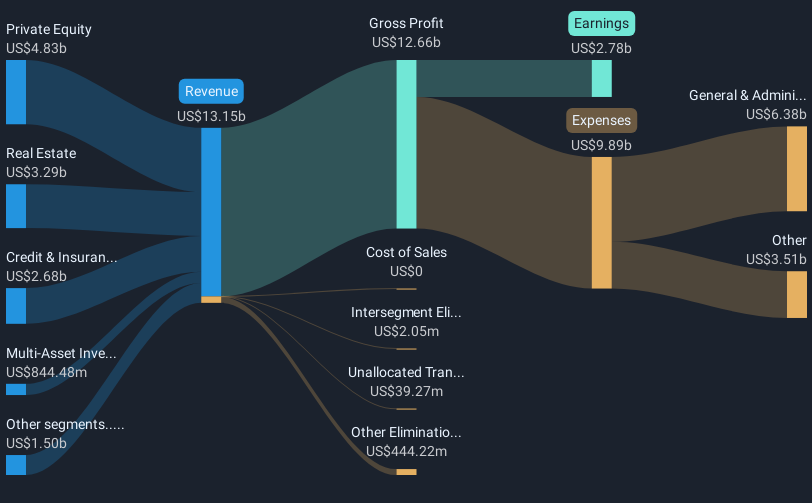

The recent sale of Hotwire Communications by Blackstone has been a focal point for investors, influencing short-term market perceptions of the company's strategic focus. This move may affect Blackstone's revenue and earnings forecasts, reflecting the company's reallocation of resources to other growth sectors such as infrastructure and private wealth. While these sectors offer potential for enhanced revenue, they introduce uncertainties with operational inefficiencies and technological shifts possibly impacting future profitability.

Over a five-year period, Blackstone shares delivered a 175.14% total return, showcasing strong performance despite recent market fluctuations. However, in the past year alone, Blackstone's performance lagged behind the US Capital Markets industry, which rose 26.4%. This short-term underperformance may be linked to challenges posed by heavy reliance on large-scale deployments and volatility in U.S. Treasury yields and inflation, which can restrain revenue growth.

Blackstone's current share price trading near the consensus price target implies a belief of fair valuation by bearish analysts, considering their revenue forecast of US$18.3 billion by 2028. The price movement of the shares, therefore, can be seen as aligning closely with these cautious analyst expectations, reflecting a conservative outlook on future earnings growth within a context of an anticipated increase in competition and market volatility. Investors should assess this landscape alongside their assumptions regarding Blackstone's potential for sustaining its growth trajectory through strategic expansions and capital deployments.

Learn about Blackstone's future growth trajectory here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring

Alternatively, email [email protected]