BlackRock NEWS: BUIDL Fund Live on Solana and Bitcoin ETP Launch in Europe

BlackRock, the world's largest asset manager, is doubling down on its crypto strategy. In a significant move, the firm has expanded its tokenized money market fund BUIDL to the Solana blockchain, while also launching a physical Bitcoin ETP for European markets. These developments signal strong institutional confidence in blockchain infrastructure—especially Solana—and have directly contributed to a noticeable price surge in SOL.

In parallel, BlackRock unveiled the iShares Bitcoin ETP (IB1T) for European markets, allowing traditional investors to gain Bitcoin exposure via regulated exchanges like Deutsche Boerse and Euronext. Custodied by Coinbase, this Swiss-domiciled ETP adds tax efficiency and convenience.

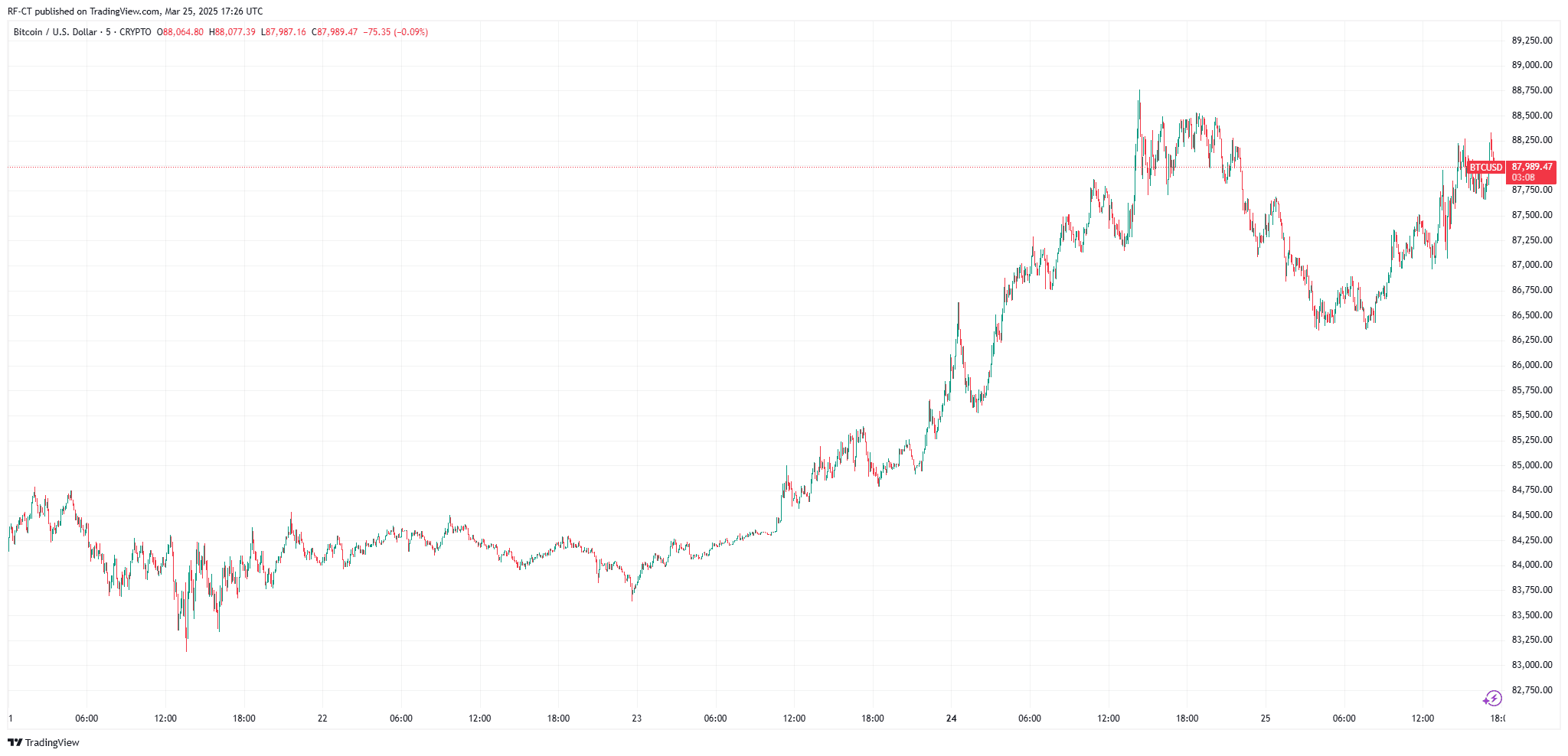

By TradingView - BTCUSD_2025-03-25 (5D)

With approximately 25 million crypto users in Europe and rising demand for regulated access, the ETP launch marks another milestone in legitimizing digital assets.

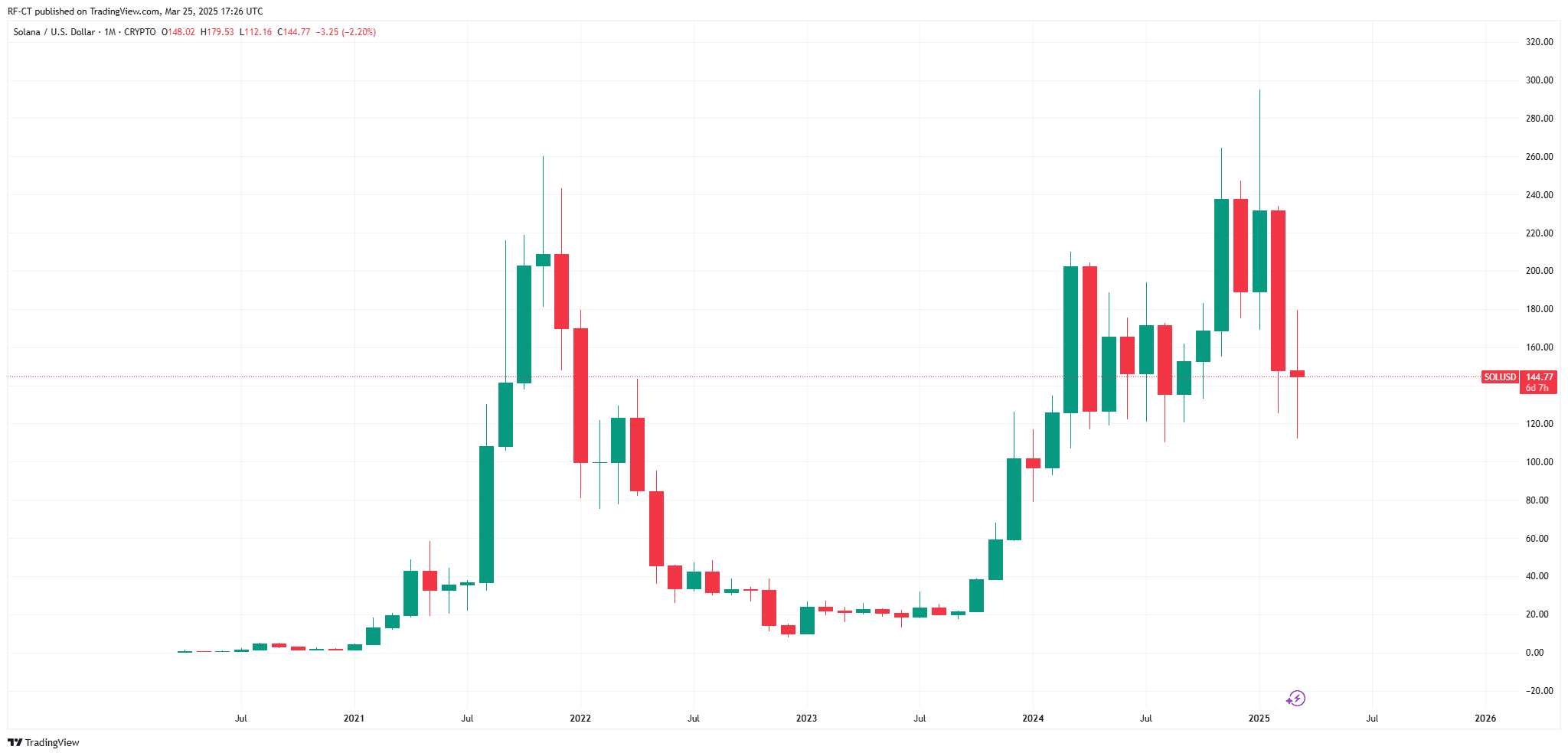

Originally launched on Ethereum in March 2024, BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) allows investors to access tokenized U.S. Treasury bills and short-term cash instruments. The expansion to Solana represents a pivotal step in integrating real-world assets (RWAs) with faster, cost-efficient blockchain infrastructure.

Carlos Domingo, CEO of Securitize (BlackRock’s partner in the initiative), emphasized that Solana’s integration supports the growing tokenized asset trend. This move validates Solana as a serious contender in the institutional finance space.

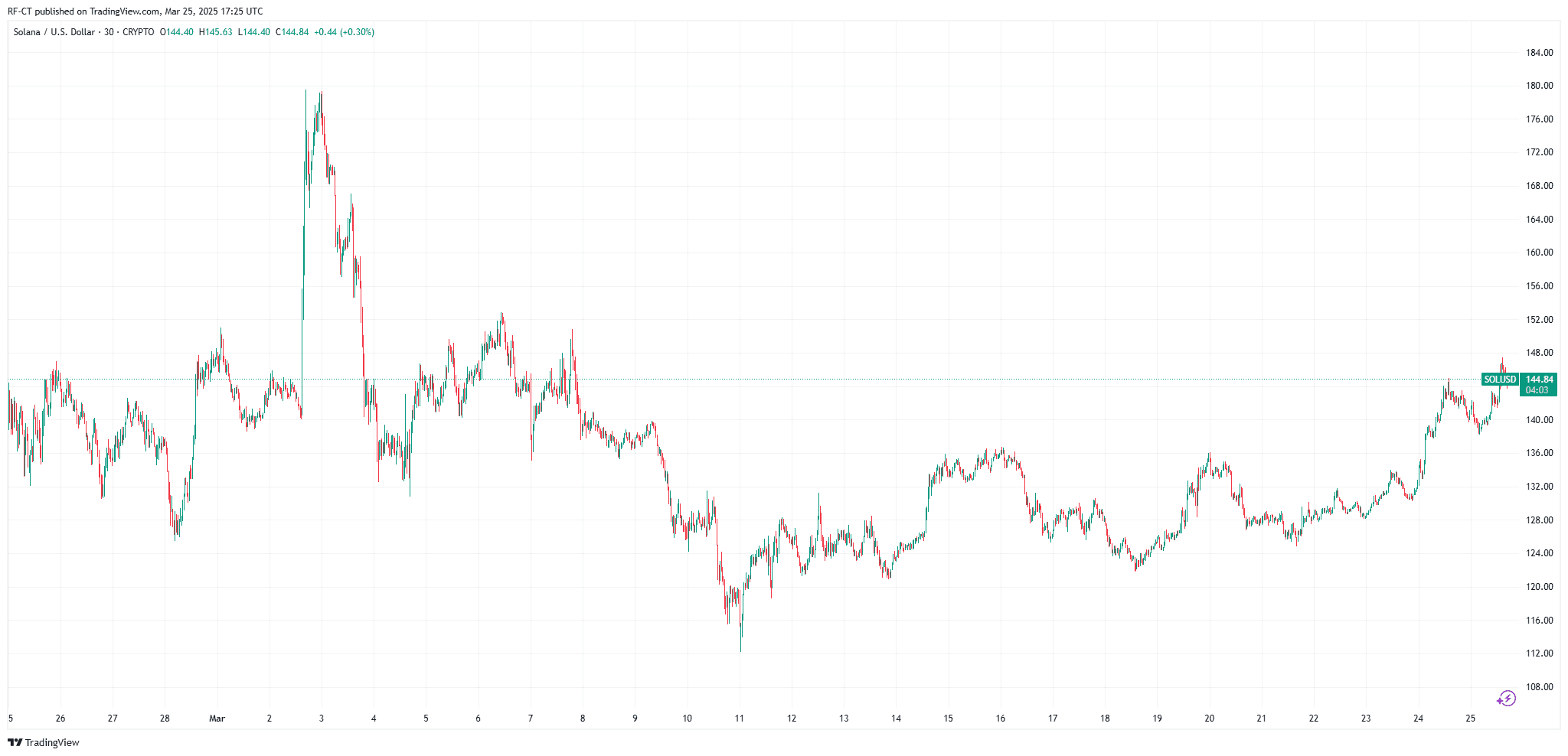

Following the BUIDL expansion news, Solana (SOL) saw a sharp uptick in price, rallying over and outperforming most top-10 cryptocurrencies. The momentum stems from:

Analysts predict continued upside potential, especially if more institutions adopt Solana for scalable asset tokenization.

Fidelity Investments has officially filed for a spot Solana (SOL) Exchange-Traded Fund (ETF) with the Chicago Board Options Exchange (CBOE). This move positions Fidelity among the first major financial institutions seeking to offer a Solana-based investment product in the U.S., pending approval from the Securities and Exchange Commission (SEC).

Fidelity, already managing spot Bitcoin and Ethereum ETFs, brings substantial institutional credibility to the application. The firm's entry into the Solana ETF space underscores the growing institutional interest in diversifying crypto asset offerings beyond Bitcoin and Ethereum.

These developments have positively impacted Solana's market performance. Following the news, SOL's price surged by 16% over the past week, reaching over $145. Market analysts anticipate that, upon official approval of the first spot SOL ETF, the asset could approach the $300 mark.

By TradingView - SOLUSD_2025-03-25 (1M)

Fidelity's initiative reflects a broader trend of traditional financial institutions embracing diverse crypto assets, signaling a maturing market and increased investor appetite for varied cryptocurrency investment vehicles.

BlackRock’s strategic moves—bringing the BUIDL fund to Solana and launching a Bitcoin ETP in Europe—underscore a major shift toward institutional crypto adoption. BlackRock's move, coupled with the Fidelity SOL ETF filing, are particularly a game-changer for Solana price. They signal trust in the blockchain’s infrastructure and catalyze bullish momentum as demand for real-world asset tokenization continues to grow.

By TradingView - SOLUSD_2025-03-25 (All)