Bitcoin Supply Shock Incoming: Bulls Eye $114K Next!

Bitcoin’s supply on exchanges is declining rapidly as its price moves higher. On-chain data reveals that reserves held on both exchanges and over-the-counter (OTC) desks have fallen to their lowest levels in years. Meanwhile, price trends and technical patterns indicate growing buyer momentum. With supply tightening and demand holding strong, projections for new all-time highs in 2025 are gaining traction among analysts.

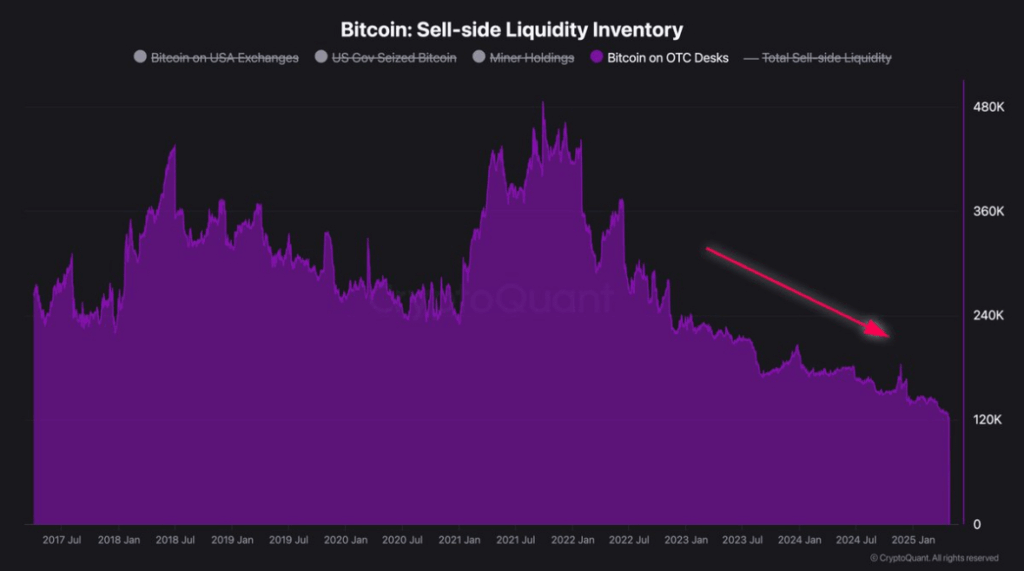

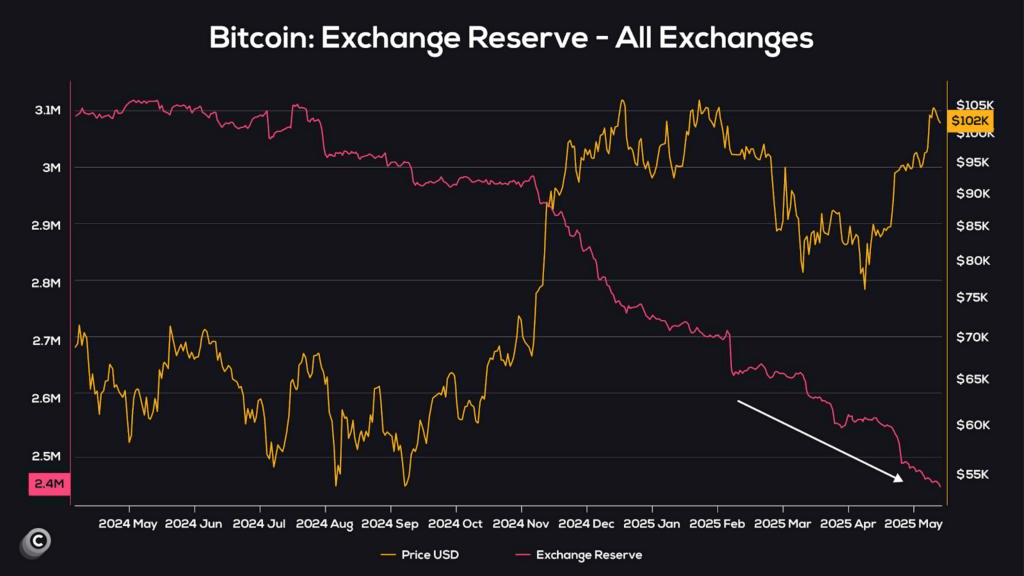

On-chain data from CryptoQuant shows a consistent decline in Bitcoin held on exchanges and OTC desks. These sources are commonly used by both retail traders and large institutions for buying or selling. According to the latest data, Bitcoin reserves have fallen below 2.4 million, down from over 3.1 million in mid-2024. OTC desk holdings have also dropped below 120,000 BTC, compared to nearly 480,000 in 2021.

A falling exchange reserve often means that fewer coins are available to sell on the market. This can occur when investors transfer Bitcoin to cold wallets, indicating long-term holding. As supply on exchanges continues to decrease, it can create pressure on price when demand increases.

According to CryptoQuant, “Sellers are disappearing. Bitcoin held on OTC desks is at levels not seen since before the 2020 bull market.” The drop in available supply has led to predictions of a new supply shock in the market.

Market analysts also watch price action patterns and trendlines supporting continued gains. A recent chart shared by analyst CryptoFaibik outlines a stair-step pattern of consolidations and breakouts. The chart shows three strong bullish continuation formations, each followed by higher price movement.

The ascending trendline seen on the chart has held since April, and the price continues to bounce above it. Each breakout has delivered gains between 10% and 13%, with the next target sitting at $114,000. This would mark a new all-time high for Bitcoin, surpassing the previous peak of around $69,000. Current price action suggests bullish momentum remains strong, with the potential for Bitcoin to move above $110,000 in the next upward move.

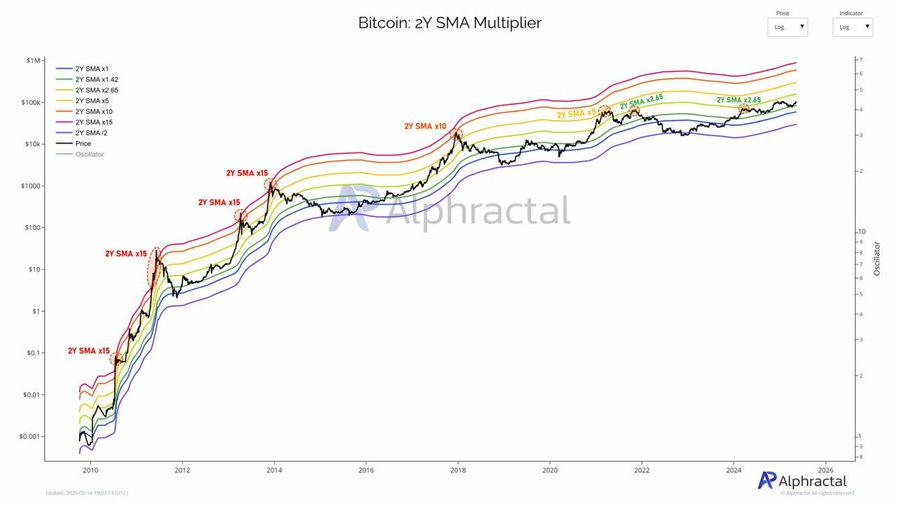

A separate model tracking Bitcoin’s 2-Year Simple Moving Average (SMA) multipliers shows how the asset’s behavior has changed over time. Earlier cycles saw peaks of 15 times the 2Y SMA, during periods of speculative trading. In 2017, Bitcoin peaked at 10× the 2Y SMA, and in 2021, the top was around 5×.

Bitcoin will likely reach its historical resistance at 2.65× band, the price at the all-time high in 2025. This area was touched in the previous bull run and signaled a peak. At the same time, analysts note that this recent trend is exhibiting greater stability. The pattern currently in place is marked by less volatile price rises and smaller drops than in previous cycles.

Bitcoin’s price has already surpassed $102,000 as of May. The rise has come alongside falling reserves, which is often viewed as a bullish indicator by analysts and traders. This relationship is shown in charts where the gold line (price) moves upward while the pink line (reserves) trends down.

Traders are interpreting the gap between price and available supply as an indication that the market is strengthening. The previous cycles were characterized by limited traders, while the latest trend is being propelled by major players like long-term investors and institutions.

The Bitcoin market appears to be maturing and becoming more stable. Stability is being slowly achieved as market participants adopt a long-term view and major players back the market.

If current supply and demand trends continue, analysts expect Bitcoin to reach between $150,000 and $250,000 by late 2025. For now, bullish traders are targeting a breakout above the key resistance level at $114,000.

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Olivia Stephanie is a FinTech enthusiast with a keen understanding of financial markets. Her passion for economics and finance has led her to explore emerging blockchain technology and cryptocurrency markets.