Bitcoin Price Prediction: As Nasdaq, S&P 500 Hit Highs - Is BTC's 3.8% Weekly Gain a Signal for $112,000?

Bitcoin (BTC) traded around $107,343, up modestly by 0.28%, while U.S. equities soared to record highs. The S&P 500 closed at 6,173.07 and the Nasdaq Composite hit 20,273.46, bolstered by progress in U.S.–China trade talks and optimism across global risk markets.

The crypto market reacted in tandem with this bullish sentiment. Bitcoin has held above $107,000 for most of the week, gaining roughly 3.8% over the past seven days. The rally coincides with positive remarks from U.S. Commerce Secretary Howard Lutnick, who hinted at finalized trade agreements with China and ten other countries.

— Boi Agent One (@boiagentone) June 27, 2025S&P 500 hits new all-time high as Trump confirms China trade deal

Markets staged historic come

ack – tech giants leading

Commerce Secretary Lutnick confirms trade deals with 10 major partners coming imminently

Fed rate cuts still expected September despite core PCE at 2.7% pic.twitter.com/fS4r3pbaUw

While President Trump’s abrupt remarks about ending Canadian trade talks temporarily cooled market enthusiasm, equities held their gains, and so did Bitcoin. This behavior suggests that BTC is currently behaving more like a macro risk asset than a speculative outlier.

Despite the broader market rally, Bitcoin’s upward momentum faces macroeconomic headwinds. The U.S. core PCE inflation rate, the Federal Reserve’s favored gauge, climbed to 2.7% annually in May, just above the 2.6% estimate. Monthly core inflation also rose 0.2%.

Fed Chair Jerome Powell doubled down on a cautious, data-dependent approach, reiterating that rate cuts are far from guaranteed. Trump’s tariff rhetoric has further added to inflation concerns, which in turn keep the Fed hesitant.

— Fifteenmin (@Fifteenmin_news) June 27, 2025US inflation data rises slightly – consumption and income collapse

Current US economic data paints a mixed picture, especially with regard to inflation. The Fed's preferred inflation indicator – the Core PCE – was higher than expected in May. It rose by 0.2% on a monthly basis… pic.twitter.com/Se1v2NfTKV

This cautious stance has weighed on speculative risk-taking, especially in crypto markets. Even as Bitcoin maintains support above $105,000, the upside appears capped until a strong inflation cooldown or monetary pivot emerges.

Bitcoin’s recent price action indicates signs of consolidation, rather than expansion. Spot trading volumes have declined, with Glassnode reporting a decrease in daily transfer volume from $76 billion in May to $ 52 billion. Meanwhile, futures data also indicates a cooling market, on a 3-month rolling basis, and funding rates are both down.

Technically, a bullish Bitcoin price prediction is likely once it manages to break through the $108,250 resistance level. It appears to be a symmetrical triangle or bullish pennant on the 4-hour chart. The 50-EMA at $105,970 provides near-term support, while the MACD has turned flat, signaling caution.

Trade Setup:

For now, traders are advised to monitor volume and await a decisive breakout. Without a surge in participation, Bitcoin’s path to $112,000 remains a challenging uphill climb.

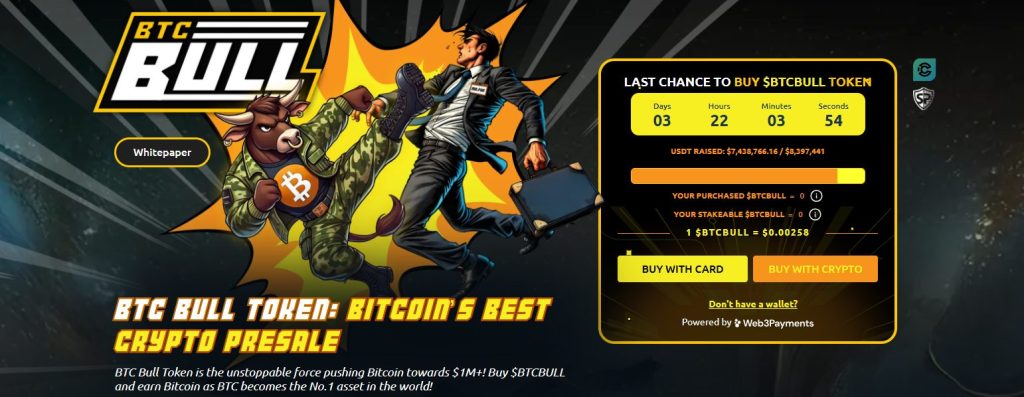

With Bitcoin trading near $105,000, investor focus is shifting toward BTC Bull Token ($BTCBULL), a rising altcoin that is nearly fully allocated during its presale. As of today, the project has raised $7,438,492.88 of its $8,397,441 target, leaving under $1 million to be raised before the token price moves to the next tier.

Currently priced at $0.00258, early buyers have a limited time to enter before the subsequent price increase takes effect.

BTCBULL ties its value directly to Bitcoin’s price through two smart systems:

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income. With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Bitcoin Price Prediction: As Nasdaq, S&P 500 Hit Highs – Is BTC’s 3.8% Weekly Gain a Signal for $112,000? appeared first on Cryptonews.