Bitcoin Considered for Mortgage Collateral Amid Policy Shift

Key Points:

allows Bitcoin and Ethereum to be used directly as collateral. This change could significantly impact institutional demand and broaden housing market access for crypto holders.

sees cryptocurrencies like Bitcoin being considered for mortgage reserve requirements. Fannie Mae and Freddie Mac have been instructed to integrate digital assets held on regulated exchanges, with specific volatility protection measures in place.

, endorses this integration, viewing Bitcoin as a form of . Industry experts stress the transparency and liquidity of Bitcoin as ideal for such uses. As Cathie Wood notes, “Bitcoin is an insurance policy against excesses in fiscal and monetary policy” (source).

and liquidity could stabilize mortgage securities. This policy evolution aligns with past shifts in regulatory stances, paving the way for future financial integration.

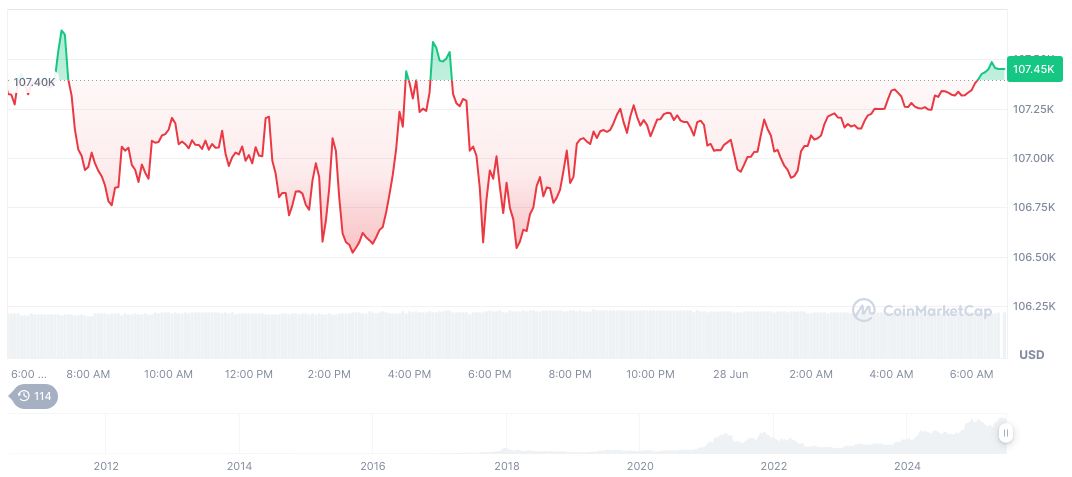

Bitcoin’s inclusion as mortgage collateral represents a historic shift from previous U.S. rules, which typically excluded crypto from federal mortgage programs. As of June 29, 2025, Bitcoin (BTC) is priced at $107,506.28, with a market cap exceeding $2.14 trillion. It dominates 64.79% of the market, whilst trading volumes have decreased by 34.19% over 24 hours, according to CoinMarketCap.

could reshape the dynamics of the housing market, allowing for greater access for crypto holders.

Experts believe that this shift could lead to increased institutional investment in real estate, potentially stabilizing the market during economic fluctuations.

: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.