Bitcoin Bounces Back To $100K Ahead Of Donald Trump's Inauguration Day | IBTimes

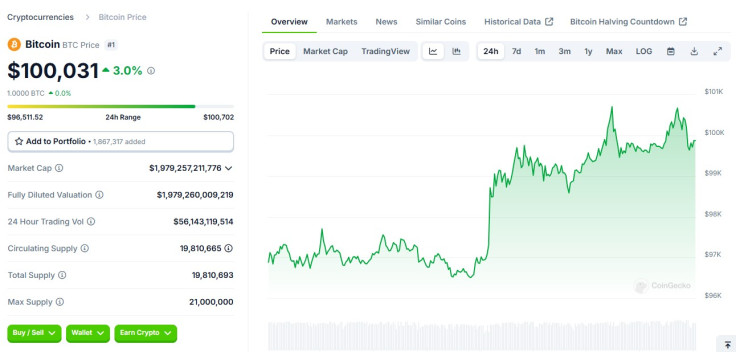

Following days of being in the red amid a broader cryptocurrency market downturn, Bitcoin returned to its throne above $100,000 Wednesday night, trading in the highs at one point.

The world's largest crypto asset by market cap was up 3% in the day and was rallying nearly 6% in the last seven days, and while there are various factors that could have played in the digital coin's surge, two recent events could have driven the price pump.

In this week's HashKey Group "Top 10 Market Predictions" for 2025 survey, nearly 50,000 crypto community members participated in a nine-day voting period to determine the most likely events that could take place this year.

A total of 50% of the respondents said they believe BTC will break $300,000 in 2025, while Ethereum (ETH) is expected to top $8,000. For the overall crypto market, half of the respondents believe the industry's market cap will hit a staggering $10 trillion.

In the past, optimistic predictions around Bitcoin's price surge were only limited to maximalists and enthusiasts, but it appears that things have shifted significantly in the past year, with a growing number of smaller holders believing that the digital currency can do more than what it has already achieved.

Aside from growing optimism around Bitcoin's potential price surge, there's also much positivity around incoming U.S. President Donald Trump's Inauguration Day on Jan. 20.

A Tuesday report revealed that Trump is expected to sign an executive order in the first few hours of his second term that would establish a crypto council. The report aligns with Trump's previous announcement of a presidential crypto council that will be led by Bo Hines.

The executive order is also expected to include an instruction for the Securities and Exchange Commission (SEC) to abandon its controversial Staff Accounting Bulletin 121 (SAB 121) that discourages American banks to hold cryptocurrencies in their balance sheets.

Trump has made multiple promises to Bitcoiners and the broader crypto space, and crypto leaders have said they will hold him accountable to those pledges.

There's also the apparent exit interview of outgoing SEC Chair Gary Gensler this week wherein he criticized all other crypto tokens beyond Bitcoin. Gensler will leave the SEC on Inauguration Day.

He said other crypto assets will ultimately end in demise if they don't prove their utility, but BTC, the world's first decentralized cryptocurrency, has the potential to morph in the future even if he still sees it as a highly speculative and volatile asset.

Bitcoin's surge obviously played good in the hands of the broader crypto market, with ETH increasing by 5%, and multiple other altcoins hitting the green or adding at least 3% in the last 24 hours.