Big Shifts: CVS Is Pulling the Plug on ACA Coverage - And 1 Million Americans Will Pay the Price

In what’s becoming an all-too-familiar pattern, CVS Health announced it will pull Aetna out of the Affordable Care Act (ACA) marketplace in 2026, leaving about a million people across 17 states searching for new health coverage — and in some cases, fighting to afford any at all.

This marks yet another retreat by a major for-profit insurer from a program designed to provide affordable health coverage to Americans who don’t get it through work. CVS made the announcement while simultaneously celebrating a 60% increase in quarterly profit and revealing a new deal to boost sales of the pricey weight-loss drug Wegovy through its pharmacy and pharmacy benefit manager (PBM) arms.

Let me repeat that: Aetna is exiting the ACA because it claims it can't make enough money on people enrolled in those plans, on the same day its parent company posted nearly in profits in just the first three months of this year.

This is the same company, by the way, that dumped hundreds of thousands of seniors and disabled people at the end of 2024 because some of them were using more medical care than Wall Street found acceptable. If this doesn’t tell you everything you need to know about who the health insurance industry is really working for, I don’t know what will.

Aetna first bailed on the ACA exchanges in 2018, then re-entered in 2022 when insurers could see more clearly how they could make significant profits on that book of business. Now, after just a few years of moderate participation, it’s heading for the exits again. CVS Health executives blamed “regulatory uncertainty” and “highly variable economic factors,” according to a statement to The Columbus Dispatch. But make no mistake—this was a cold business calculation. Uncertainties and economic variabilities are constants in the insurance game.

CVS’ CEO David Joyner told investors:

“We are disappointed by the continued underperformance from our individual exchange products … this is not a decision we made lightly.”

That’s corporate-speak for “our Wall Street friends weren’t impressed.”

Aetna’s ACA exchange business, covering roughly 1 million people, is just a sliver of CVS’ overall medical membership of 27.1 million. But even though the profits weren’t massive, the people depending on this coverage — many of them self-employed, working multiple part-time jobs, or recently uninsured — will now be thrown into chaos.

And it’s happening at a time when health insurance for many Americans hangs by a thread. Unless Congress acts in the coming months, the ACA’s enhanced tax subsidies—first implemented under the American Rescue Plan—are set to expire at the end of this year. Without them, premiums could spike by 50% to 100% depending on income and geography.

The Congressional Budget Office projects that the lapse in subsidies could leave — and now, 1 million more will be forced to find new plans as CVS/Aetna walks away.

Let’s be clear about what CVS is doing here: It’s ditching an essential safety net for millions in order to chase higher profits elsewhere—most notably, in the exploding market for GLP-1 drugs like Wegovy. On the same day it abandoned the ACA, CVS announced a new deal to give Wegovy preferred placement on its PBM formulary, displacing Eli Lilly’s Zepbound. This will help CVS dominate the obesity drug market—and rake in profits through its Caremark PBM and nearly 9,000 retail pharmacies.

It’s a powerful example of vertical integration in action. CVS owns the insurer (Aetna), the PBM (Caremark), and the pharmacy (CVS retail stores). When it walks away from lower-margin business like ACA plans and doubles down on high-dollar drug deals, we see its true priorities: selling expensive drugs, saddling individuals, families and employers with the costs, and keeping Wall Street happy.

Even worse, the decision is taking place against a troubling political backdrop. The Trump administration has already taken steps to undermine ACA infrastructure and expressed skepticism toward core public health programs. Cuts to navigator funding, changes to vaccine guidelines, and looming uncertainty around tax credits are all part of a slow-motion sabotage of the ACA. This is not to say that the ACA doesn’t have its flaws that need to be addressed. But instead of penalizing hard-working Americans and their families, lawmakers and the Trump administration should focus instead on lowering the ridiculously high out-of-pocket maximum that the ACA established (and that keeps going up every year) and fixing the medical loss ratio provision that has fueled the vertical integration in the insurance industry.

CVS executives didn’t mention politics in their earnings call. But make no mistake: this exit is happening in a climate in which subsidies that enable people to afford their premiums are in doubt. CVS is cutting and running, just as millions of Americans may need the exchanges more than ever.

CVS’s quiet reshuffling of coverage priorities seems to not just be limited to the ACA marketplace. The company is also steering employer-based plan members — people who get their insurance through work — toward CVS-owned services.

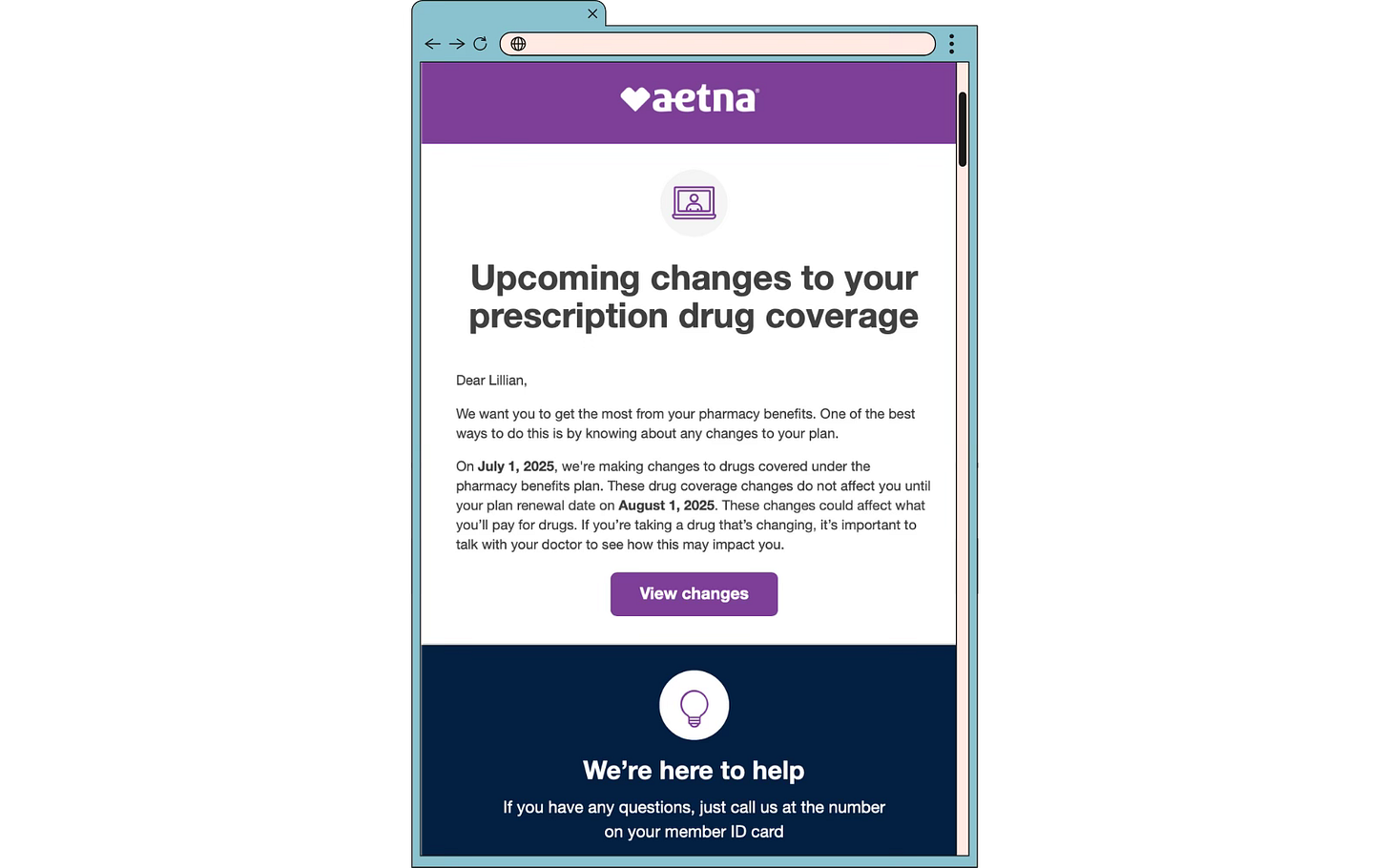

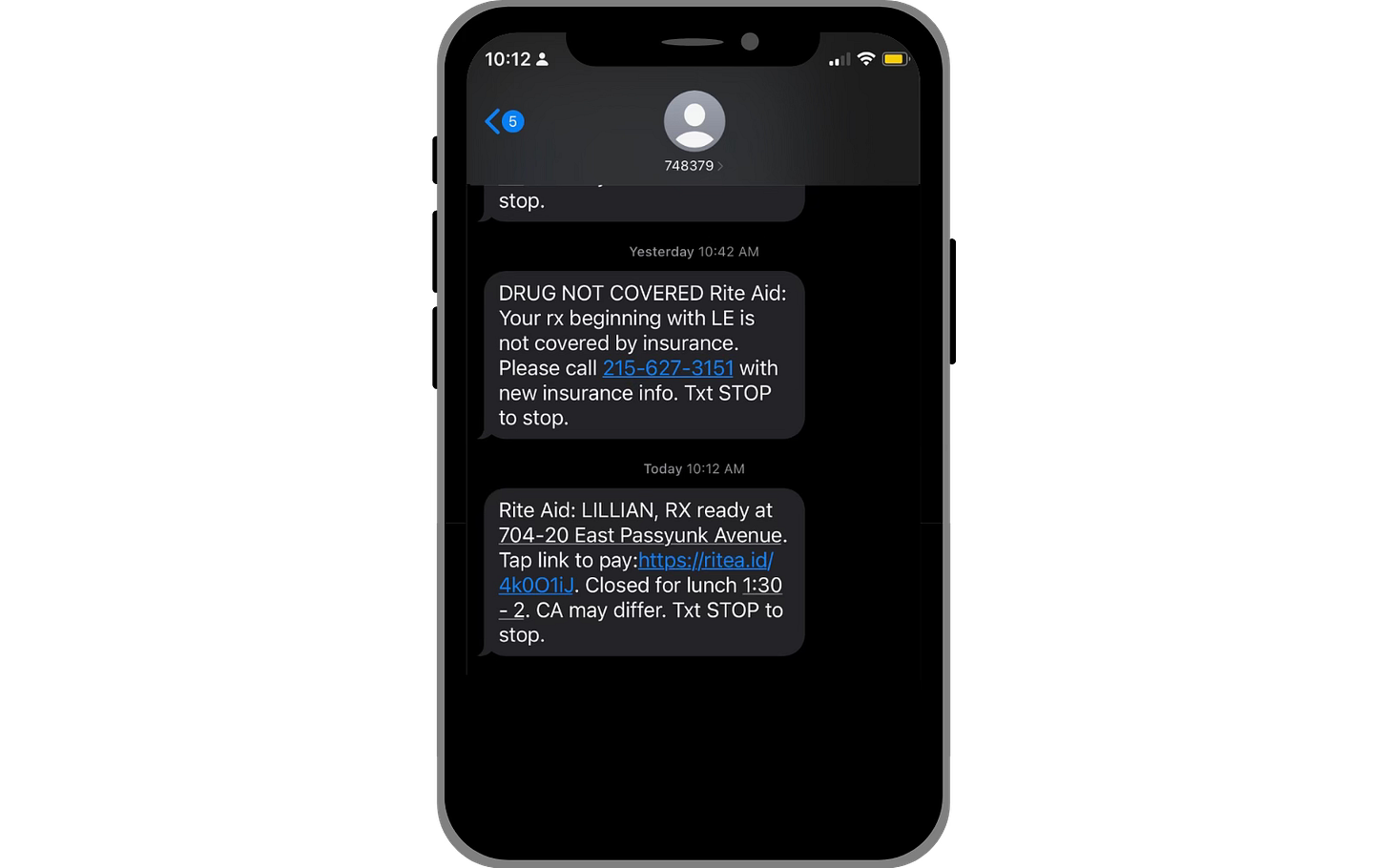

Take, for example, Lillian Hurley, a 31-year-old Philadelphia woman enrolled in an Aetna plan through her employer. She recently received a notice from Aetna informing her that, starting this summer, her medications would no longer be covered at her current pharmacy. To continue receiving coverage for her medications, she would need to switch to a CVS pharmacy – one affiliated with Aetna.

This is more than a logistical hassle. It’s a reflection of how vertically integrated health care giants like CVS/Aetna use their scale not just to dictate what care gets covered, but where and through whom you’re allowed to get it.

For Hurley — and many others — it’s a reminder that corporate consolidation isn’t just about stock prices and strategy decks. It affects people’s lives in deeply personal ways.

When insurers, PBMs, and pharmacies are all owned by the same corporation, patients lose. They lose choice, they lose control, and all too often, people lose access.

This is why transparency, accountability, and public oversight aren’t just buzzwords. CVS says it wants to be "the most trusted health care company in America." But trust is earned, not declared. You don’t earn it by pulling out of programs that help the most vulnerable. You don’t earn it by prioritizing billion-dollar deals over basic access to care.