Banks rule UPI rails; Bizongo under scanner

Happy Friday! A small group of banks quietly control most of the money received through UPI. This and more in today's ETtech Morning Dispatch.

Also in the letter:

■ Meesho files for IPO

■ ISRO tech transfer

■ Luma Fertility fundraise

Four banks bag bulk of UPI beneficiary payments

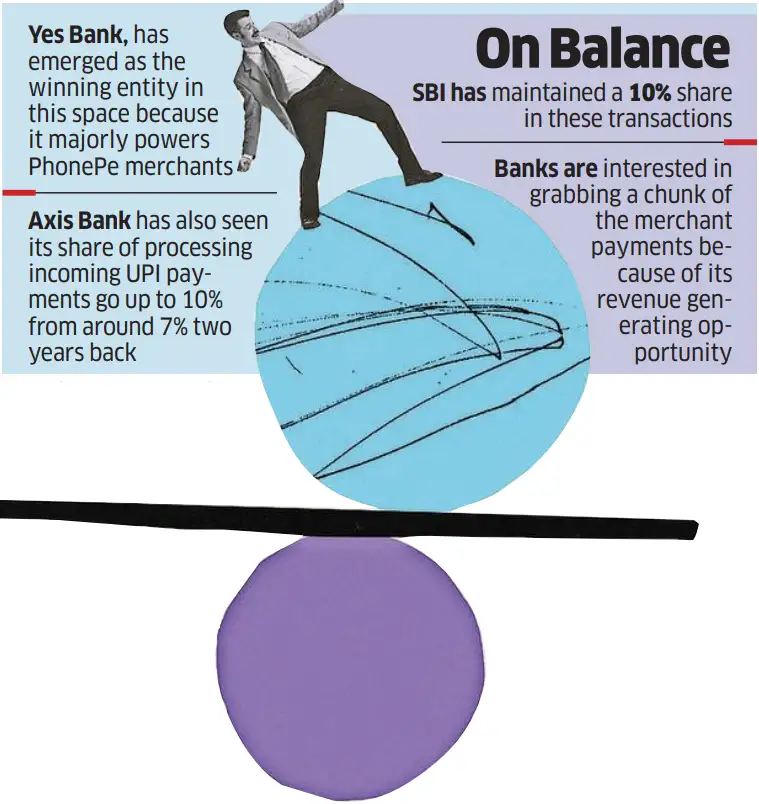

A small number of banks are quietly dominating the receiving side of the Unified Payments Interface (UPI), India's preferred retail payments system. Yes Bank leads the pack, with nearly 40% market share, mainly driven by merchant payments.

Driving the news: Yes Bank has doubled its share of payee-side UPI volumes in just two years.

Why it matters: While most conversations around UPI focus on payer-side risk and app dominance, the bank layer follows a similar pattern – only a few lenders are doing the heavy lifting behind the scenes.

Concentration risk on UPI: NPCI is considering a 30% market share cap for third-party UPI apps to reduce concentration risk. But the enforcement deadline has been pushed back by two years.

Also Read: UPI sees marginal dip in June transactions, value down 4%

BFSI's big AI turn to move the business needle for slump-hit IT firms

India's IT industry may finally get a boost, and it's coming from its oldest and biggest client – BFSI. Long the top buyer of tech services, the sector is now expected to drive growth for the $280-billion IT industry, which has been stuck in a low-growth cycle.

Purse strings: Banking, financial services and insurance (BFSI) makes up about 30% of the Indian IT sector's total revenue, going by data from Nasscom and analysts.

Muted Q1: As we reported on Thursday, Indian IT firms are bracing for a weak June quarter, weighed down by sluggish deal pipelines.

TradeCred files criminal complaint against Bizongo, alleges Rs 69 crore fund misappropriation

TradeCred has filed a criminal complaint against Bizongo, accusing the startup of misappropriating at least Rs 69 crore. The complaint, submitted to the Mumbai Police's Economic Offences Wing, names Bizongo's founders, CEO, and major investors, including Accel, B Capital, Chiratae, and IFC.

Go deeper: Despite receiving funds from invoice buyers through a controlled escrow setup, Bizongo allegedly diverted customer payments into its own bank instead of routing them through the designated escrow, in breach of contractual terms, according to TradeCred's complaint.

This, according to TradeCred, constitutes a double recovery, where Bizongo benefited from both upfront invoice financing and the final payment from customers.

Context: Bizongo has already come under scrutiny for weak financial controls, which led to senior exits and a shift away from supply chain financing. The latest dispute highlights growing concerns about governance in India's booming private credit and invoice discounting space.

In response: Bizongo, on its part, said it has been steadily paying its dues, bringing down the outstanding principal from Rs 250 crore to Rs 66 crore. It added that a settlement plan has already been shared with TradeCred.

The big picture: The case highlights how rapid growth and opaque business models in startup-led finance can leave retail investors dangerously exposed. TradeCred's move could trigger oversight of platforms offering invoice-based investment products.

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India's tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

What's next: Interested? Reach out to us at [email protected] to explore sponsorship opportunities.

Meesho files confidential prospectus for its IPO

Sanjeev Barnwal and Vidit Aatrey, founders, Meesho

Ecommerce unicorn Meesho has confidentially filed its draft red herring prospectus with Sebi for a Rs 4,250 crore ($500 million) IPO.

Driving the news: Backed by SoftBank and Prosus, Meesho recently moved its domicile from the US to India. The company reported revenue of Rs 7,615 crore for FY24, a 33% year-on-year increase, while slashing its adjusted loss by 97% to Rs 53 crore.

Tell me more: Meesho joins a growing queue of Indian tech firms gearing up to go public, including Groww, Pine Labs, and Urban Company. In FY25, the company processed 1.8 billion orders, demonstrating strong user adoption despite facing valuation markdowns.

Also Read: IPO watch: Which Indian startups are next to hit the stock market?

Zoom in: If all goes to plan, Meesho could become the first horizontal ecommerce platform to list on Indian exchanges. The IPO will be closely watched as a barometer for public investor interest in the scaled consumer businesses, ahead of Flipkart's much-anticipated listing next year.

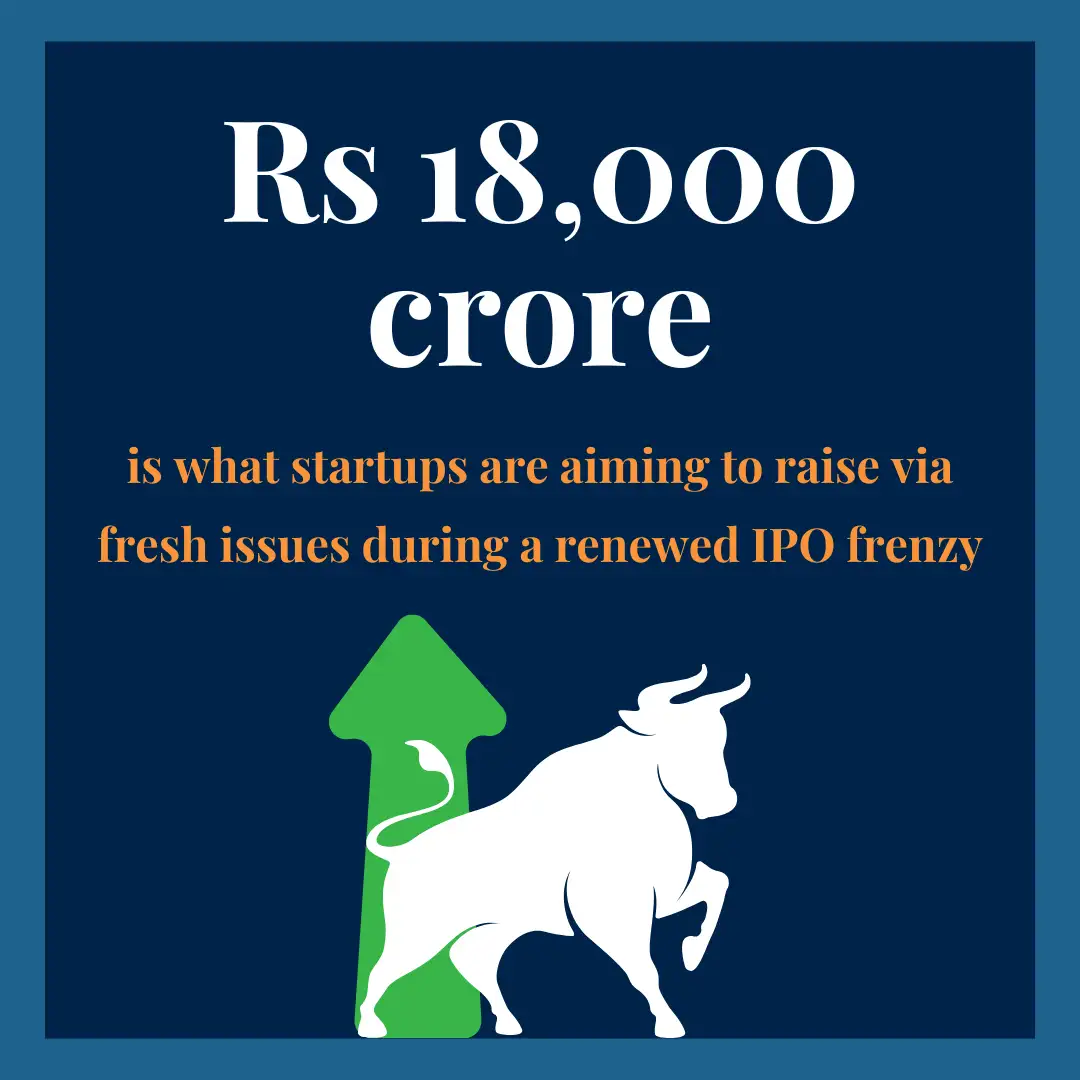

Also Read: Startups aim to raise over Rs 18,000 crore via IPOs in major D-Street push

Keeping Count

Ecommerce platform Meesho, which filed its papers for an IPO on Thursday, is targeting the largest fresh issue size among new-age companies at Rs 4,250 crore, followed by Rs 4,000 crore of edtech firm PhysicsWallah. (ET)

Other Top Stories By Our Reporters

ISRO transfers 10 key space technologies to Indian firms: Space regulator and promoter, the Indian National Space Promotion and Authorisation Centre (IN-SPACe), facilitated the transfer of technology to six companies to encourage industry participation in the space value chain.

Peak XV leads Luma Fertility seed funding round: The fertility-tech startup raised $4 million from Peak XV's Surge platform, with participation from Metropolis Healthcare chair Ameera Shah and B2V Ventures chairperson Vijay Taparia.

Global Picks We Are Reading

■ AI is eating venture capital, or at least its dollars (Axios)

■ Deerhoof did not want its music ‘funding AI battle tech’ — so it ditched Spotify (The Verge)

■ The promise and peril of digital security in the age of dictatorship (Wired)

_w=1200_h=630_pjpg.jpg?v=20230522122229)