ASX slips after debt fears prompt Wall Street sell-off

Australian shares have slipped as dwindling confidence in the US economy pushes investors towards safe havens and profit-taking.

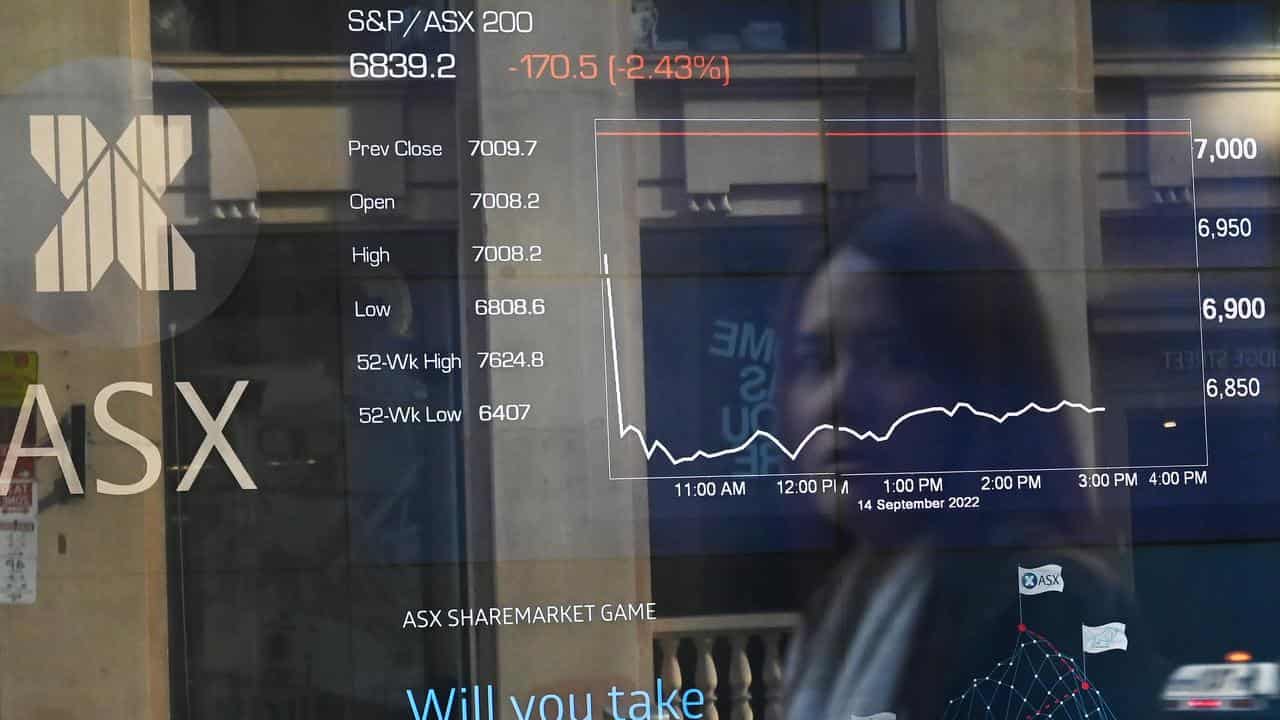

The S&P/ASX200 fell 38.8 points on Thursday, or 0.46 per cent, to 8,348, as the broader All Ordinaries gave up 41.9 points, or 0.47 per cent, to 8,570.9.

The drop followed a Wall Street sell-off overnight, after US bond yields soared on an underwhelming US Treasuries auction and as the Trump administration scrambles to pass a broad spending and tax cut bill.

"We're getting a big ratcheting-up of long-end yields, which is more or less a reflection of inflation and interest rate expectations moving higher," Capital.com market analyst Kyle Rodda told AAP.

"And without much good trade news to chase any more, it seems like the market's poised to pull back a little bit."

The Australian dollar is buying 64.49 US cents, down slightly from 64.52 US cents at Wednesday's ASX close.