Amazon Prime Day's Record-Breaking Surge: A Roadmap for Strategic E-Commerce Investments

Albert FoxMonday, Jul 7, 2025 7:31 am ET

![]() 36min read

36min read

Amazon Prime Day 2025 shattered records, generating $23.8 billion in U.S. sales—a 28% leap from 2024—cementing its status as a pivotal event for global e-commerce. This year's four-day format, aggressive discounts, and AI-driven logistics underscored a seismic shift in consumer behavior and retail dynamics. For investors, the data reveals compelling opportunities in three areas: AI-powered retail efficiency, discount-sensitive sectors, and industries insulated from tariff volatility. Yet, risks loom large for those unprepared to navigate rising trade tensions.

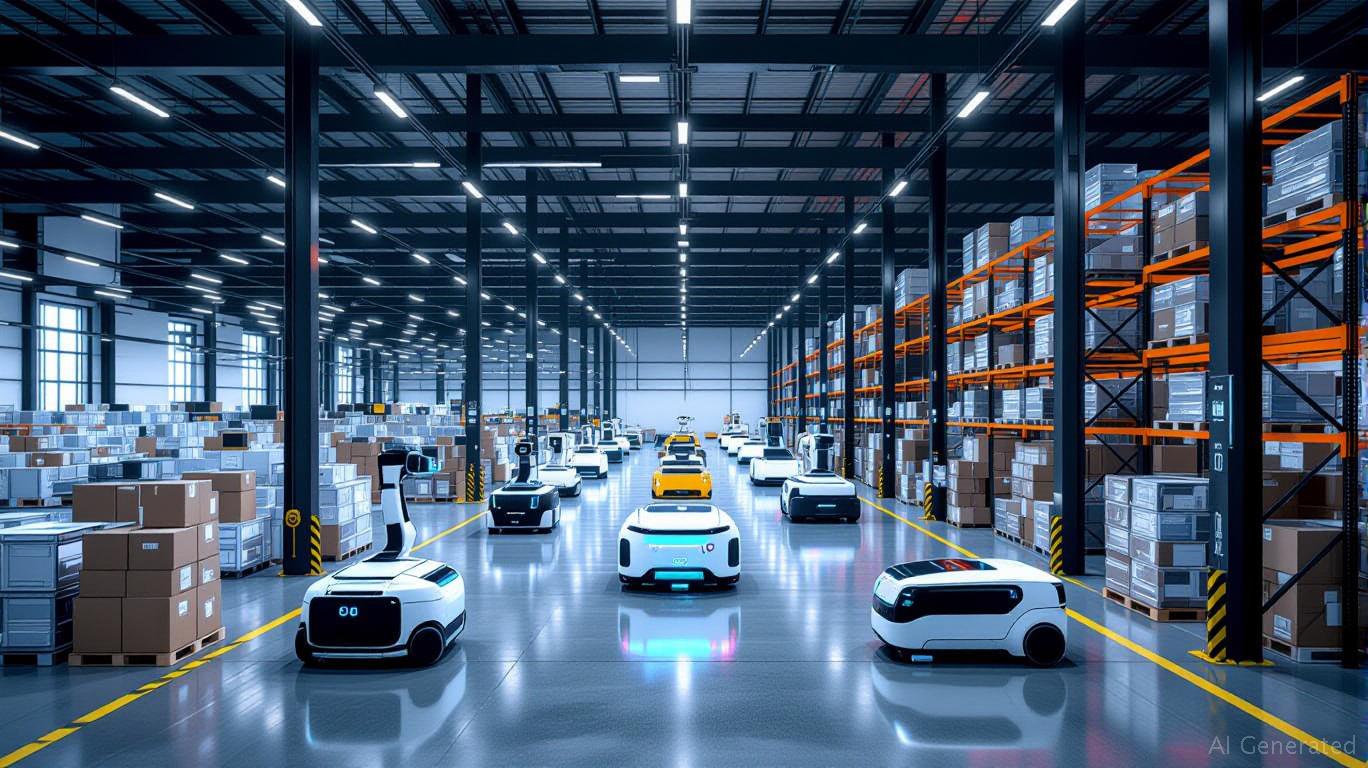

Amazon's dominance hinges on its mastery of AI, which now orchestrates everything from demand forecasting to warehouse robotics. In 2025, AI tools like and enabled personalized recommendations, while generative algorithms optimized inventory placement and delivery routes. This precision reduced costs and boosted conversion rates, particularly for impulse buys.

: Retailers and tech firms leveraging AI for supply chain optimization stand to gain. Companies like , , and are already investing heavily in AI-driven systems. Consider:

While Amazon's valuation has plateaued, its AI-led margin improvements could reignite growth. Meanwhile, integration of AI into inventory management has narrowed the gap with Amazon, making it a defensive play in this space.

Prime Day 2025 saw beauty tools, apparel, and home goods dominate sales, with discounts up to 24% driving traffic. This aligns with a broader trend: consumers increasingly prioritize affordability, even as inflation eases. The and —items with low price points but high emotional appeal—exemplify how brands thrive by blending practicality with fun.

For investors, beauty and lifestyle brands with agile pricing strategies and strong online presences are poised to win. , which owns drugstore brands like and , could capitalize here. Similarly, 's omnichannel model and loyalty programs position it to capture discount-conscious shoppers.

While Prime Day celebrated its success, underlying risks persist. Over 70% of Amazon's products originate from China, yet U.S.-China tariffs now average , with rates spiking to 30% on certain goods. These costs force sellers to either absorb losses or hike prices, squeezing margins.

: Companies reliant on Chinese imports—like electronics retailers—face margin pressure. Instead, focus on firms with diversified supply chains or regional manufacturing. (parent of Victoria's Secret and Bath & Body Works) sources 40% of products locally, mitigating tariff impacts. Similarly, 's inventory-rich model and U.S.-based suppliers make it a safer bet than import-heavy peers.

Affiliate programs drove 57% of Prime Day transactions in 2024, with platforms like and channeling traffic. In 2025, short-form video platforms (, ) and micro-influencers dominated, offering high ROI. Tools like (which allocated $10M in ad spend) amplified creator reach, proving that content quality and trust matter most.

: Back platforms enabling affiliate success. and , which dominate ad tech, benefit indirectly. Direct plays include Impact Co. (PK: IMPCT), a leading affiliate network, and Shopify (SHOP), which integrates affiliate tools for small sellers.

Prime Day 2025 is a masterclass in retail evolution, but investors must balance optimism with caution:

1. AI Leaders: Prioritize retailers like Amazon and Walmart, and tech enablers like Robotic Technologies.

2. Discount Winners: Invest in beauty/lifestyle brands with agile pricing (COTY, ULTA).

3. Tariff Shields: Favor companies with diversified supply chains (L Brands, Home Depot).

Avoid overexposure to tariff-vulnerable sectors, and monitor geopolitical risks closely. The next decade will reward those who bet on efficiency, affordability, and resilience—the pillars of e-commerce's new frontier.

The road ahead is clear: invest where technology, pricing, and supply chains meet consumer needs head-on.

_1751880097.jpeg)