AI tokens hold gains as Meta agrees to pay $15 billion for 49% stake in Scale AI

Meta Platforms Inc (NASDAQ: META) is reported to have agreed to pay $15 billion toward the acquisition of a 49% stake in the data labeling startup Scale AI. Based on reports emerging on Tuesday, Meta could strengthen its position in the artificial intelligence (AI) sector, currently dominated by other Big Tech companies, including OpenAI, Nvidia and Microsoft.

Crypto tokens that intersect AI and blockchain technology, including AIOZ Network (AIOZ) and Akash Network (AKT), are sustaining gains accrued following the breakout on Monday, underpinned by positive sentiment in the broader cryptocurrency market.

The Mark Zuckerberg-led Meta is expected to gain significant influence in the AI sector if the company finalizes a potential $15 billion deal for a 49% stake in Scale AI, a San Francisco-based company.

According to multiple reports by Baha Breaking News and Proactive, which cited two unnamed individuals familiar with the matter, the deal values Scale AI at $30 billion.

Scale AI is an American company based in San Francisco, California, that focuses on providing data labeling and model evaluation services to build applications for artificial intelligence.

Alexandr Wang, the CEO of Scale AI, is expected to assume a top role within Meta’s newly revamped AI research lab, designed with a focus on 'superintelligence,' as reported by The New York Times.

Meta is on a mission to cement its position as a leader in the AI space, building on its AI platform, which currently boasts over 1 billion monthly users. The company is expected to allocate $72 billion to AI-related expenditures, with infrastructure accounting for the lion’s share of the budget.

Meanwhile, projects in the cryptocurrency industry, advancing the intersection between artificial intelligence and blockchain technology, boast a cumulative market value of $30 billion.

Leading tokens within this niche sector include Bittensor (TAO), valued at $3.8 billion, Internet Computer (ICP) and Near Protocol (NEAR), each valued at $3.2 billion.

Akash Network, a crypto project spearheading the shift to cloud computing by leveraging the power of blockchain technology, is up over 5%, trading at around $1.41 at the time of writing.

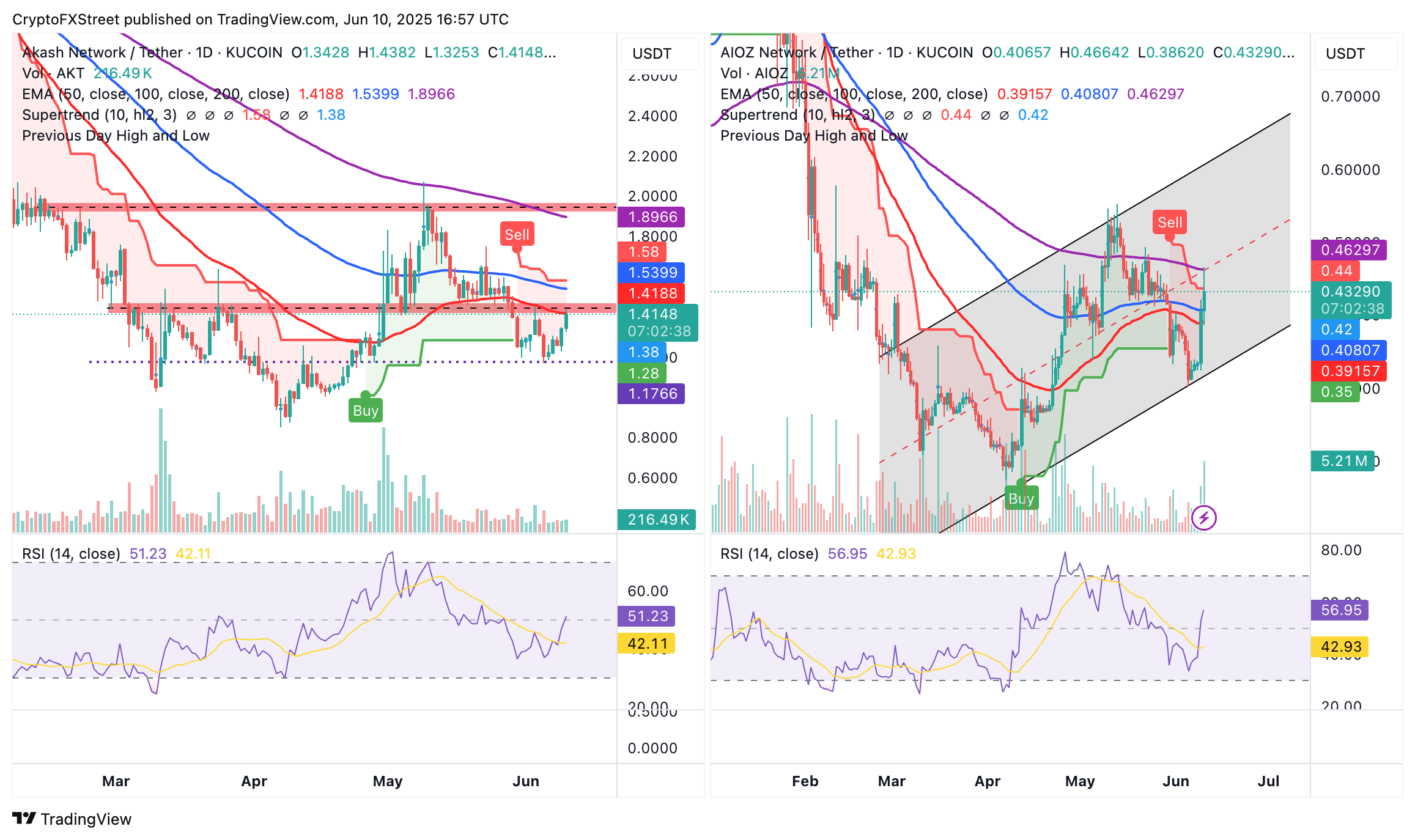

The bullish outlook, as observed in the chart below, follows a steady recovery from the support level at $1.17, which was tested on Thursday.

The Relative Strength Index (RSI) lifts above the 50 midline, solidifying the bulls’ influence on AKT. A continued RSI movement toward the overbought region would signal strong bullish momentum, increasing the probability of AKT breaking the resistance highlighted by the 50-day Exponential Moving Average (EMA), marked in red at around $1.41.

Such a move could see traders expand their bullish scope to the next key supply area at around $2.00.

AKT/USDT and AIOZ/USDT daily charts

On the other hand, AIOZ’s price sits significantly above support provided by the 100-day EMA at approximately $0.40. At the same time, it extends intraday gains of over 5% to exchange hands at $0.43 at the time of writing. The RSI underpins the bullish outlook as it ascends above the 50 neutral line, heading toward the overbought territory.

A break above the ascending channel’s middle boundary resistance and the subsequent 200-day EMA, currently holding at $0.46, would imply that the bullish structure is strengthening and increasing the chances of a breakout to the seller congestion zones at $0.60 and $0.80.

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.